Registering With The Internal Revenue Service From Abroad

Why Register?

If you are in the United States, the reasons for registering with the Internal Revenue Service are fairly obvious. By law you have to do it, and you can go to prison if you do not. There are more subtle inducements. For instance anyone who pays you money is required to have your IRS taxpayer number, and in default must withhold money from your payment which they then pay to the IRS. The fact of the payment alerts the IRS to your existence, then the employer will be required to provide such information as it has about you to help the IRS to trace you.

The IRS has no sense of humour about your using names like D. Duck, M. Mouse, or B.H. Obama to evade paying your fair share of tax.

Never Volunteer!

As I do not live in the USA, why would I wish to register with the Internal Revenue Service? The answer is in the withholding tax. If you earn money on Hubpages, that is money earned in the USA. Hubpages neatly sidesteps involvement in my tax affairs by never touching my money. For 40% of the time Hubpages earns money from Adsens for my hubs, and 60% of the time I earn money from my hubs. Adsens will withhold 30% from my earnings when they pay me.

To prevent Adsens deducting tax I first have to register with the IRS on a W7 form, and then notify Adsens on a W8 BEN form that I am choosing to benefit under the double taxation agreement between the USA and the UK. Then Adsens will not deduct any money. Adsens will notify the IRS of payments to me, who will inform Her Majesty's Revenue and Customs, who will check my British tax declaration to check I have declared my foreign earnings.

Given that I have not yet come close to receiving a cheque from Adsens, why am I bothering? For the paltry amounts involved, avoiding or deferring a little tax it is not worth the trouble.

Riches will come!

Although I do not expect to receive much money from Adsens, I also have hopes of earning some money from Amazon linked hubs. In the more immediate future I expect to publish two books this year through createspace.com .

If I simply buy the books from createspace and market them myself, there are no US earnings. However, if a buyer buys from createspace or Amazon or the Google online publishing venture, there are US earnings. So I need to prepare my W8 BEN form and serve it on the payers before they start withholding tax.

The Process

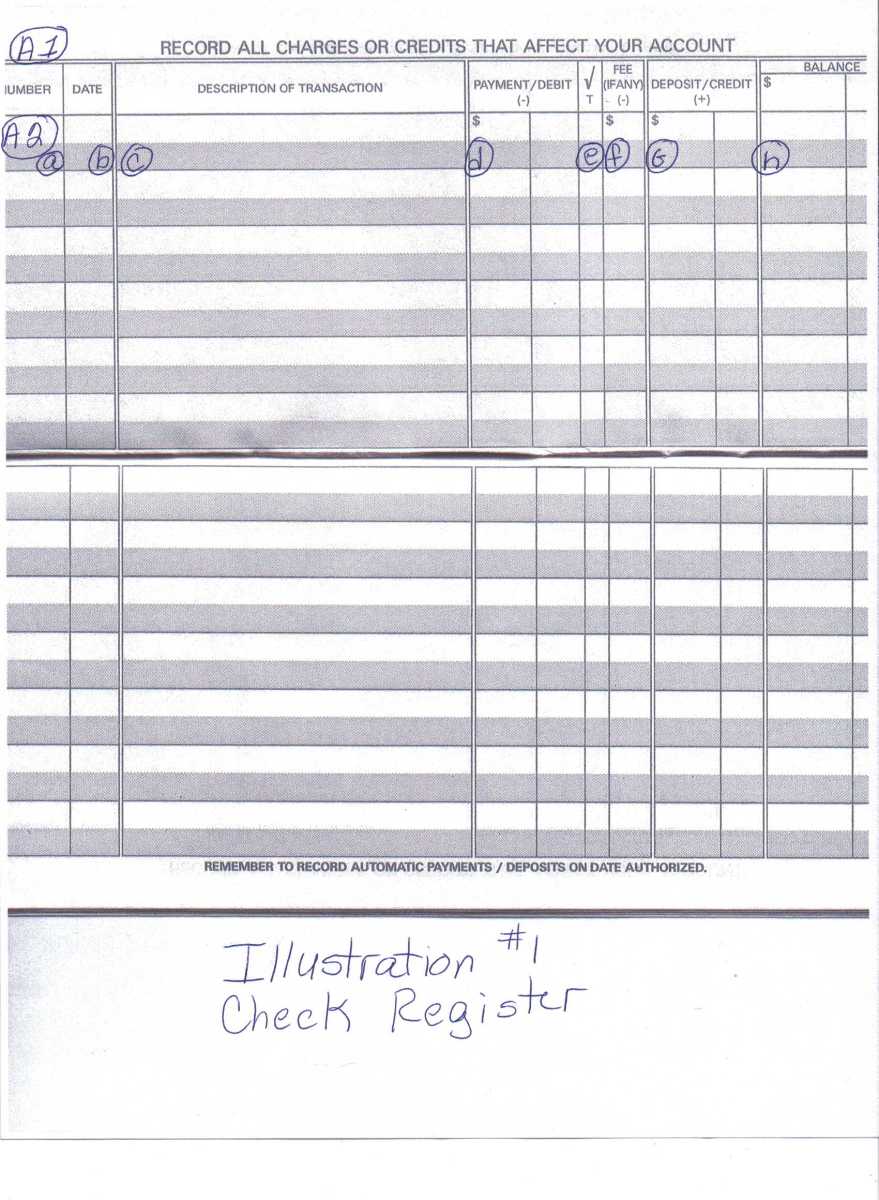

The process starts with downloading the W7 form from the IRS website. That bit is pretty easy. Completing the form is fairly straightforward - if you are a mind reader. You tick boxes "a" and "h", and after "other (see instructions)" you write "Exception 1 (D) Royalties".

The treaty article number is "12".

You are expected to produce identification. The practical problem is that my nearest IRS office is at the American Embassy in London. I could have had a copy passport "notarised" but that is pretty expensive. It was almost cheaper to go to London in person. In discussion with my better half we decided we would make a holiday of it.

We had to choose the right days because one information source says the IRS office is open to walk-in customers between 10 and 12 only, 4 days a week, and another says it is open longer hours but only 3 days a week. If you cannot get through on the telephone, email them and they reply within 3 weeks.

In London

We booked into a London hotel, and booked to see a musical about the American musician Woodie Guthrie called "Woody Sez", and a play by Sheridan called "The Rivals" which was first performed in 1775. Both were excellent. We spent a day at the British Museum and a day at the Royal Botanical Gardens at Kew.

The American Embassy at Grosvenor Square has fairly tight security, but it is reasonably relaxed, with Brits used where the suicide bombers are likely to be first discovered. There is a queue for Immigration and another for American Citizen Services. I joined the ACS queue and got through to the IRS office.

There was a touch of humour at the IRS office with a framed copy of a letter

"Dear IRS,

Please cancel my subscription.

I do not want to pay any more."

This brings a smile to almost anyone's face. The young American at the counter was pleasant and intelligent. He looked through my W7 form, and asked for my letter from the US payer. I was surprised.. He showed me this part on the instructions

" 1(d) A signed letter or document from the withholding agent, on official letterhead, showing your name and evidencing that an ITIN is required to make deductions to you during the current tax year that are subject to IRS information reporting or federal tax withholding."

I said that I had come down from Yorkshire for this, and indicated that I was less than pleased with createspace. He said that he gets about a dozen a week like me from createspace.

To save me coming to London again he took a copy of my passport and certified it, and gave me 30 days to lodge the W7 form, certified copy passport , and a letter from createspace. He said he could accept a scanned copy letter or fax provided it was on the createspace letterhead and had a signature.

What next?

Next up is to contact createspace and obtain a letter to lodge.

Then serve my W8 BEN form on my payers starting with createspace.

Createspace are quick

Createspace provuided the letter by email within 3 days. I accidently deleted the letter before printing it so they provided another. The envelope goes off to the US Embassy today, and they will send everything to the USA. I have been told the process will take in the order of 3 months. Once I have a taxpayer number I can complete my W8 BEN form and start serving it.

I am now Registered!

On 16 June received my Regstraton document from the Internal Revenue Servce. Now to send off W8 forms!

By The Same Author

- MARKETING MY BOOK

This article is of course about the marketing for my book. I hope you will gain ideas and insights to help you with marketing your book. If you have insights or suggestions to give, please please use the... - Updating (2012) "Marketing My Book"

How Charles Got on with the first edition and what is currently happening with the seconfd edition. - How To Be Careful With Money

ideas for debt reduction, credit cards, saving money, and earning money. Deals with coming together as a family. How to tell the neighbours. - THE GOOGLE BOOK SETTLEMENT -THEFT OR GIFT?

As an author who will publish a textbook later this year, I was incensed when I realised that Google intend to take my book and to sell copies without my permission. I had written in my chapter on intellectual...