Reducing Credit Card Debt Quickly

Reducing credit card debt

Many Americans are struggling with the burden of credit card debt. A recent study by value penguin concluded that about 38% of the American population is in credit card debt to some degree. Of the households that carry a balance on their credit cards, the average amount owed is over $16,000. When you consider APR interest rates range from 13%-26% possibly even higher it’s no wonder that so many Americans struggle under the weight of credit card debt. We as Americans have created a society in which the buy now pay later concept is a way of life. We get lured into these cards with cash back rewards, airline miles, or a 0% introductory APR. The problem all to often is that we use our credit cards the same way we would cash on hand, so the mindset becomes get into a bind use a credit card, want to go on vacation use a credit card, want to buy that 65inch smart TV use a credit card. The lure of small monthly payments is so much more attractive and appealing than budgeting and saving for the luxuries you want. It’s a cold hard truth I know, but frankly most Americans use credit cards the wrong way and can lead themselves down the path of financial ruin by trying to live above their means. Credit card companies love this because keeping a high balance on your cards and paying only the minimum each month means they get to continue to charge you super high interest rates and keep you in debt to them for years to come.

Pay more than the minimum

So, you find yourself in debt up to your eye balls with your credit card companies, what’s the first thing you should do? The answer is, there’s no quick fix option, the sad reality is at this point your going to have to pay your debt, pay a ton of interest, and it’s going to take time unless of course you have the cash on hand to throw at your credit card and reduce what you owe. If this isn’t possible the next best option is to pay more than your minimum each month. Let’s say for instance your minimum payment is $50, if possible you should double that and pay $100 each month. If doubling your payment seems a bit steep, then maybe $75 a month is possible. Whatever you can afford. Just pay more than the minimum. By doing this you will reduce the amount of interest you pay over the course of paying off your balance.

Create a budget

Working to pay off your credit card debt is great, but you also need to determine how you got in this situation in the first place, and then work to not repeat the same mistakes. For the majority of Americans, the credit card debt piles up because they live beyond their means. It’s so easy to fall into the trap I don’t have the money, so I’ll just put it on my credit card. This line of thinking is dangerous, and irresponsible. It leads to a vicious cycle and traps you in debt, your monthly payments go up, your income stays the same, and before you know it you have $16,000 worth of debt. So, do yourself a favor create a realistic budget based on your income and stick to it. Start with your most important bills and then work your way down to your spending money. Money you spend on frivolous or unnecessary things should only be what is left after everything is paid. If you work to reduce your spending and live within your means your Reliance on credit cards will reduce as well.

Credit cards are not for emergencies

Somewhere along the way we have all heard the myth that credit cards should be used for emergencies. This is simply not true. The only time this could be true is if your stuck somewhere and don’t have access to the money in your checking or savings account but even then, it’s wise to have to some cash on hand. Credit cards are not meant to be used in the case of a financial bind, that my friend is what your savings account is for. You should work hard to not only budget your spending but also put money aside into a savings account. You can then access this money for emergencies. Let’s say your car breaks down and repairs are going to cost $500. Many people would simply swipe the credit card and be done with it but pause for a moment and consider that adding that $500 debt to your card means you are also adding a 13-25% interest rate on top of that $500. This is money you are literally throwing away. A better solution would be to use your savings and then you can save all that interest

Credit cards are not meant for large purchases

It can seem so appealing to just swipe your card to buy that new smart tv you’ve been drooling over. Maybe you got a new card or the store you’re in offers an attractive line of credit option with an introductory 0% APR. The problem with this is unless you pay off the entire balance before the introductory rate is over then you are stuck with all of that interest being added to your balance. A better practice would be waiting and saving to purchase the tv out right. If you have to use a credit card or if the discounts and savings of using a credit card are too good to pass up, then make a plan on how and when you are going to pay it off. Another great option would be to use the card for part of the purchase and another form of payment for the rest. Or simply use the card and pay it off right away, this is a great practice to get rewards, cash back, or other perks your credit card offers.

Stay below 30% of your credit limit

Creditors like to see that you can use your line of credit responsibly. Therefore, you should aim to Stay below 30% of your limits. This will show that you are financially responsible. If you find yourself over this 30% threshold you should begin working to reduce your debt as quickly as possible. Once you are able to get your debt to a reasonable level, keep it there. Using your credit card for large purchases and then paying it off or maintaining a zero balance is not the best practice. This does little to prove your ability to maintain a line of credit. Debt is directly related to your overall credit score. No debt equals no credit, high debt equals a risk to creditors, but a high line of credit and a small debt shows financial responsibility and makes you look more attractive for loans and such.

Negotiating your debt

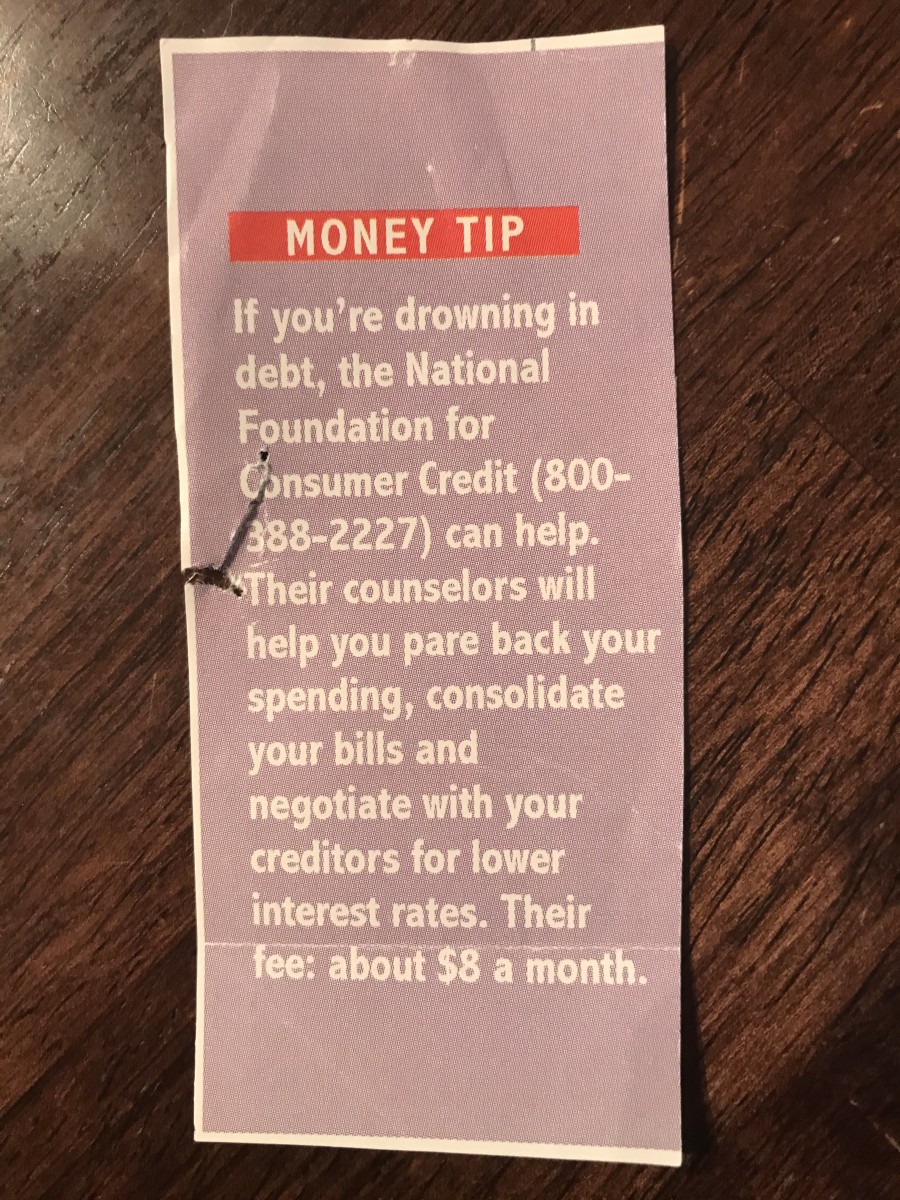

Depending on your particular set of circumstances you may find yourself in such a financial bind that making even your minimum payments is difficult. If this is the case, talk to your creditors. Do not ignore their calls, often times there may be options/ payment plans available to help you get back on track. Your debt collectors goal is to collect the debt, so they may be willing to work with you to accomplish this. Consider what you can reasonably afford to pay, and work negotiate this with your creditors and then most importantly stick to that payment arrangement.

Get a second job

I realize this option may not always be feasible, but even a temporary second job can help you pay down your debt quickly. If you can devote even a few extra hours a week there are plenty of options to help you get back on track. If your comfortable taking calls and using a computer for instance you may want to look at work from home opportunities where you can make you own schedule and work when you want to. These opportunities usually pay $9 or more per hour and can be a great source to supplement your income if your schedule is already hectic.

Debt consolidation

Consolidating your debt into one monthly payment may be a good option if you have several cards with high balances. With this option, you would have to borrow the money to pay these debts off from a bank or financial institution. Often times the interest rate with a debt consolidation loan is much lower than your cards. In addition, having one monthly payment will make things easier and you will be able to pay off your debt quicker. It is also highly possible that this monthly payment will be much lower than your current credit card payments. Shop around to get the best interest rates, loan terms, and lowest payments.

Pay off your highest interest cards first

Another option, is to pay off your highest interest card first. This will save you the most money in the long run. Continue paying at least the minimum on your other cards but throw as much of your disposable income as possible at your highest interest credit card. Do this every month until this card is paid off. Afterward, you can take the money you were throwing at this card each month and put it into to your next highest interest card, and so on until all of your cards are paid down to a reasonable or zero balance.

Discipline is key

Getting out of debt is hard. It requires a commitment and a lot of dedication. Often, to truly reduce your credit card debt you are going to have to reduce your spending, create a workable budget, and build a savings plan for the unexpected. In the long run the frivolous things in life mean nothing compared to securing a financially responsible future.