Regulating Bitcoin

Pt.1

- Introduction

Bitcoin is said to be more revolutionary than the invention of the Internet, having the ability to democratize international finance. Trying to explain what Bitcoin is can be somewhat difficult. In short, Bitcoin is a globally decentralized virtual currency that is backed by mathematics. One of the major difficulties facing Bitcoin’s future is how governments are choosing to regulate and tax it. Despite it being universally accepted, it is regulated and taxed differently across the globe.

- Objective

Explaining Bitcoin isn’t easy, but it’s important to understand because it has the capability of changing how money works. Some believe that it will be the money of the future. One of the reasons for its creation was to provide an alternative to the banking crisis.[1]Bitcoin is a single technology that is built on top of the Internet, and its value cannot be manipulated by any central authority.[2]It isn’t backed by gold like some currencies. Instead it’s backed by the laws of mathematics.[3]The purpose of this paper is not only to explain what bitcoin is and why the United States government has yet to fully regulate it, but also to explore what other countries have done to regulate it, and explain why a uniform regulation across the globe should be set.

- History

In October 2008, someone using the pseudonym of Satoshi Nakamoto posted a message to an obscure internet mailing list saying, “I’ve been working on a new electronic cash system that is fully peer to peer, with no trusted party.”[4]His message contained a link to a paper titled “Bitcoin: A Peer-to-Peer Electronic Cash System.”[5]Satoshi’s paper proposed a network that could handle financial transactions without the need of a central authority. The platform described in his paper used peer-to-peer networking, proof of work, and public key cryptography.[6]

Computer scientists had been experimenting with these technologies for years to create digital currency, but Satoshi found a way to combine them like no one had ever done before.[7]Cryptographers and Programmers across the globe collaborated with Satoshi and developed what is now Bitcoin.[8]With Bitcoin, people can send any amount of money anonymously to anyone, anywhere in the world.[9]Developers programmed the system so that only 21 million bitcoins will ever be in existence.[10]

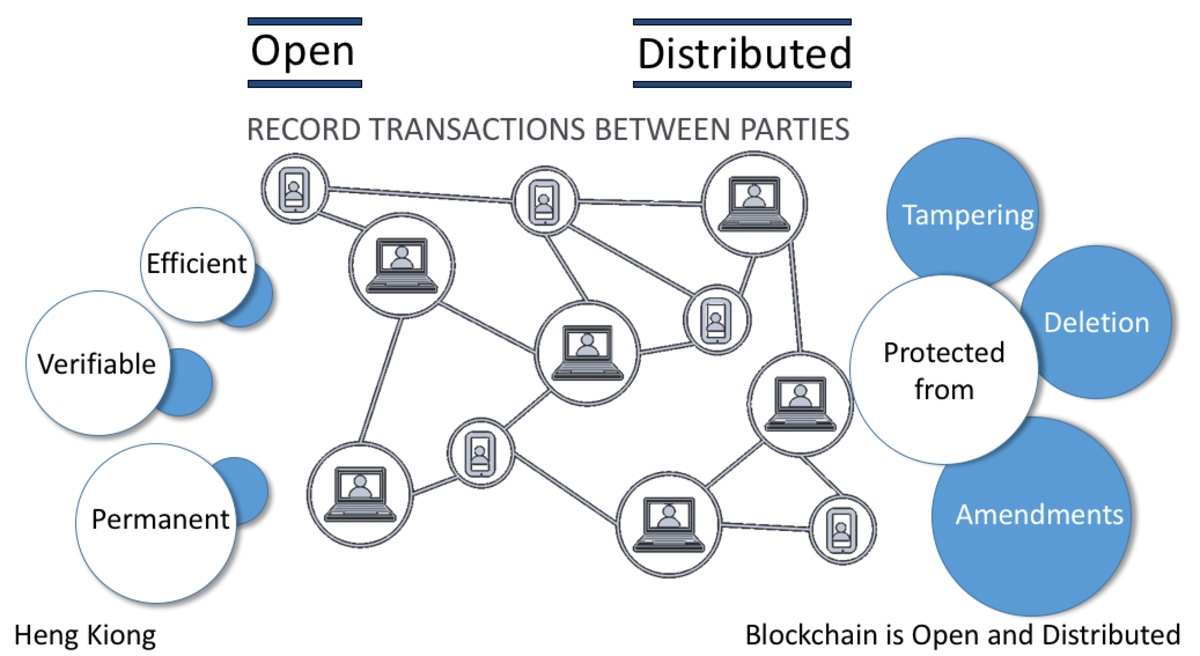

Whenever someone spends bitcoins, the transaction is broadcasted to the entire network.[11]Once it is verified in the network, the transaction is recorded in a public ledger dubbed the “blockchain.”[12]The blockchain contains a record of every Bitcoin transaction that has occurred since the system began. [13]The blockchain is maintained and shared on the network, so that everyone in the network is responsible for keeping the books.[14]

It is this peer-to-peer system that replaces the need for a central authority. Instead of having a bank or central authority to distribute and record the currency, the peer-to-peer network maintains transactions, and brings currency into existence through a process called mining.[15]Bitcoin miners are specially crafted computers that are capable of verifying and recording transactions in the blockchain.[16]As a reward for their bookkeeping, a transaction fee is provided to the miners for their work.[17]This is how bitcoins come into existence. Over time, the mining reward decreases due to the predictable supply that’s governed by scarcity.[18]

Bitcoin owners have an account number that is represented by a long stream of numbers (e.g. 1HB5XMLmzFVj8ALj6mfBsbifRoD4miY36v).[19]This is where each users’ bitcoins are stored. Anytime someone sends or receives bitcoins they are sent to the user’s address.[20]Because the addresses are long and difficult to remember, many people use a phone to scan a Q.R. (Quick Response) Code.[21]Bitcoins are capable of being broken down to eight decimal places, so that any amount of money can be represented.[22]With the use of Q.R. Code technology, ATM’s have been created to help with the ease of buying and transferring bitcoins.[23]

Bitcoins are held, and sent to and from the addresses. Addresses and a “private key” for each address are stored in a “wallet.”[24]The private key operates as a password that allows the user to have access to bitcoins held at that address, as well a complete transaction history for each address.[25]Essentially, whoever has the private key, has complete dominion and control over the bitcoins at that address. [26]

As of late, Coinbase has become most popular exchange in the United States, and makes it easy to turn fiat (dollars) into bitcoin. It provides sophisticated security measures against theft or loss which wasn’t’ available at the inception of Bitcoin. In 2016, Coinbase introduced the Shift Card, which is a Visa debit card that allows users in most of the fifty (50) states and territories in the U.S. to spend Bitcoin everywhere Visa is accepted.[27]The Shift Card allows users to make a purchase by debiting the equivalent value of bitcoin from the consumer’s Coinbase bitcoin wallet.[28]

In addition to having a debit card, users also have the option to using a Bitcoin ATM. Using a ATM is more expensive than online transactions because the infrastructure costs are higher. A consumer can use the bitcoin to buy or sell Bitcoins, and can turn Bitcoin into fiat (dollars, euros, etc..). The Bitcoin ATM’s are basically money transmitting tools, which requires them to be under the authority of Financial Crimes Enforcement Network (FinCEN), and the Know Your Client (KYC), and Anti-Money Laundering (AML) regulations.

The first exchange rate was published in October 2009, listing the value to be 1,309 bitcoins at $1.[29]Early bitcoins were inexpensive and traded in 2010 for fractions of a cent.[30]The first Bitcoin transaction for a tangible good occurred in the Spring of 2010.[31]A man named Lazlo, who lived in Florida, offered 10,000 bitcoins to anyone who would buy him a pizza. A man in London accepted and placed a long distance call to Papa John’s, ordering him two large pizzas.[32]

The momentum for Bitcoin continued and by November of 2010, 4 million bitcoins had been mined and the exchange price jumped to 50 cents per Bitcoin.[33]Since its inception, Bitcoin’s value has been volatile, ranging from less than $2 per Bitcoin to more than $1,200 per Bitcoin.[34]As of February 2016, there were approximately 15.2 million (or 72% of all bitcoins) in circulation. Roughly 25 new bitcoins are mined every 10 minutes. Bitcoins, referred to as “convertible” virtual currency, have the ability to be exchanged into U.S. dollars, Euros, and other real or virtual currencies.[35]

In late 2010, a Tokyo-based exchange named Mt. Gox was one of the first to enter the market and handle the majority of Bitcoin trading. The exchange allowed users to transfer bitcoins directly into their accounts at Mt. Gox or wire fiat currency (government-issued money, like dollars and euros) to Mizuho Bank, which would deposit the money into a bank account it held on behalf of Mt. Gox.[36]Mizuho Bank, headquartered in Tokyo, earned service fees from processing the wire deposits.[37]In order for users to withdraw fiat currency, users would make a request through their Mt. Gox account.[38]The request was sent along with the user’s banking details to Mizuho, who would in turn transfer the requested amount to the user’s bank.[39]

In early 2013, Mizuho, concerned about a United States investigation into money laundering on Mt. Gox, attempted to end its relationship with Mt. Gox.[40]In addition to fears of litigation, CEO Mark Karpeles, had been exploiting security vulnerabilities and was stealing bitcoins belonging to Mt. Gox users from as early as 2011.[41]In mid-2013, Mizuho refused to process Mt. Gox wire transfers and would no longer process any international wire withdrawals for its users.[42]In late February 2014, the Mt. Gox’s website became inaccessible and it filed for bankruptcy reporting that in addition to $27 million in cash, 850,000 bitcoins, worth $450 million had disappeared or been stolen by hackers. There is no evidence to support a hack, but this is reportedly the largest bitcoin heist ever reported. There have since been companies that offer storage insurance against bitcoin loss (e.g. Coinbase).

- Scope and Magnitude of Problem

The rise in bitcoin generated several issues that weren’t imagined by its creators. There were bugs in the code and the software needed to be updated to keep up with demand. There were security breaches on the individual user level that left people’s “wallets” exposed to hackers. One of the biggest unforeseen problems was that Bitcoin would inadvertently facilitate illicit marketplaces that would sell drugs, weapons, and other illegal services. Bitcoin may also have become a mechanism for financing terrorism because it has the power to be sent instantly anywhere in the world, nearly for free, and without any intermediaries to freeze the funds.[43]

A Bitcoin transaction by itself, without additional technology (like Tor or i2p) doesn’t fully hide a user’s identity.[44]These transactions can be traced to a user’s IP address, making the identity of the user more transparent than if they had used cash. [45]As mentioned above Bitcoins must be used in tandem with the internet. What we call the internet (or web) is really just the surface. Beneath that is a hidden internet, completely separate from the surface web.[46]

Ian Clarke created a software based on his thesis project at Edinburgh University in 1999 titled “A Distributed Decentralized Information Storage and Retrieval System.” Freenet, as it would come to be called, became a revolutionary way for people to chat online, read or set up websites, or share files with almost complete anonymity.[47]The term “deep web” and “dark web” came about in 2009 when the search terminology was discussed together with illegal activities taking place on the Freenet darknet.[48]

Similar to Bitcoin, the deep web is a system that has no central servers and is not subject to the control of any one individual or organization.[49]I2p and Tor are similar systems. Although their initial purpose was to allow users a way to communicate pseudonymously and securely to promote free speech, the deep web has been used to facilitate large-scale criminal activity, including but not limited to, illicit drug dealing, child-pornography, and human trafficking.[50]

Anyone intent on using Bitcoin to launder money overseas, can purchase them from individual dealers, trusted miners, or can purchase their own mining hardware to turn “dirty money” into Bitcoins.[51]Because Bitcoin is an unregulated form of online currency that circumvents the traditional banking system, it has been an ideal placeholder for terrorist assets and a way for terrorists to exchange money.[52]The Treasury Department estimates that ISIS makes between $468 million and $520 million annually, with $4.7 million and $15.6 million held in virtual currency accounts.[53]

These two technologies (deep web and Bitcoin) have made it difficult for governments to provide safety guidelines and oversight. Because these technologies reach across the globe, regulation has been especially difficult. Bitcoin’s growth has outpaced the creation of laws to regulate its use.[54]The legal status of Bitcoin differs considerably from country to country and is still indeterminate or altering in many of them.[55]While some countries have unequivocally allowed its use and trade, others have prohibited or limited it.[56]Likewise, various governments have classified bitcoins differently.[57]

- Regulating Bitcoin

- Policy Advancement

The United States’ first response was a publication in 2010 from the FinCEN warning against the use of Bitcoin for money laundering and funding terrorist.[58]FinCEN considers the transmission of bitcoins into U.S. currency to be the “transmission of currency,” and requires business who do this to register as a money service business. Once registered as a money service business, they must abide by certain guidelines including gathering the identity of those engaged in the transaction, maintaining these records for five years, and reporting suspicious activity.

In 2015, the U.S. announced that the U.S. Treasury classified Bitcoin as a convertible decentralized virtual currency.[59]That same year the U.S. Government of Accountability Office (GAO) recommended that the Internal Revenue Service (IRS) formulate tax guidance for Bitcoin businesses.[60]The IRS responded with guidance that explained that virtual currency is treated as property for federal taxation purposes and that “an individual who mines virtual currency as a trade or business is subject to self-employment tax.”[61]It further stated that taxpayers that receive virtual currency, as payment for goods or services must include the fair market value of the currency when computing gross income.[62]Additionally, if property received in exchange for virtual currency exceeds the taxpayer’s adjusted basis of the virtual currency, the taxpayer has a taxable gain.[63]

States in the U.S. have since decided to adopt their own regulation. New York was the first to adopt a BitLicense, which aims to regulate virtual currencies by regulating commercial operators (i.e. wallet providers) as if they are normal financial operators or money transmitters.[64]This license requires operators to comply with AML, KYC, and money transmission laws and regulations.[65]New Hampshire has adopted similar legislation, treating Bitcoin sellers as money transmitters.[66]California has attempted to pass legislation, but it must await a second reading by its state senate.[67]

Throughout 2016, the Uniform Law Commission (ULC) (a nonprofit) has been working to draft legislation with the purpose of harmonizing state laws by focusing on the regulation of Bitcoin and other digital currencies.[68]The ULC’s drafting committee last met in October, 2016 and may be prepared to vote as early as August, 2017.[69]Each states’ regulators and legislatures would have to adopt the ULC’s proposal before any of the provisions could be enforced.[70]

Even though the United States started out as the leader in Bitcoin regulation, it has now fallen behind other jurisdictions.[71]Significant time has passed since the IRS first confirmed that it would oversee and tax digital currency transactions.[72]The Inspector General’s report stated that the IRS has failed to provide adequate information to help taxpayers comply with their tax obligations, and failed to respond to the proposals and questions made through public comment.[73]As a result, “until a comprehensive virtual currency tax strategy is developed, the IRS is open to the risk that undetected noncompliance of virtual currency taxable transactions will result in an increase in the Tax Gap.”[74]

- Why Regulation Has Stalled?

There are few reasons to speculate why Regulation in the United States has failed to progress. One theory is that the power of non-decision is at play and it exists because the elite prefer non-regulation and money and mobilization they have make it difficult for opposition to change the status quo. The license regulation that a few of the states have adopted require a $100,000 money transmitter bond which is designed to protect consumers and the state from money transmitters who unlawfully withhold, misuse, or otherwise seize the funds under their control.[75]Because the wealthy are highly mobilized, it is likely that are opposed to regulation and are willing to push against policy changes that threaten their interests, except those that raise the barrier to entry.

Another plausible explanation for lack of regulation is problem definition. Disputes about how to regulate bitcoin can be based on its perceived social significance, meaning, implications, and urgency.[76]Like with any emerging technology, it’s not yet fully understood, presenting regulators with significant challenges.[77]Regulators have to be able to fully understand blockchain technology, in general in order to appreciate the impact it has on competition, innovation, and regulation.[78]

- Who is Affected or Cares about Bitcoin Regulation?

The people who are most likely to be affected by government regulation “are the ones already engaged in legal business activities and ventures –that is, those paving the way for an innovative and competitive financial future, and one with global reach.” Those people who are already engaged include consumers, miners, exchange companies, and companies that accept Bitcoin payment like Target, Home Depot, Sears, Apple, PayPal, and Subway to name a few. States and governments have an interest in Bitcoin to regulate against theft and fraud, and to tax certain Bitcoin transactions.

Bitcoin, being a decentralized currency, operates independently of any central bank or government, and people can exchange value on a peer-to-peer basis, without the approval of any financial intermediary.[79]Because of this, Bitcoin “does not reside in any given regulation, and can therefore be constructed to be agnostic to any jurisdictional rules.”[80]Since there is no central regulatory authority, it has the potential to affect almost anyone.[81]People can operate the network anonymously, which opens the door to criminal activities, tax-evasion, and money-laundering.[82]

- Strategy for U.S Government Recognition

- Which level of government should address the problem?

Because of Bitcoins ability to reach all citizens, the United States federal government should be take the initiative for creating a uniform regulation. It has the power to do so, but it is possible that it is waiting to see what other countries will do before procuring any hard and fast rules. The United States has the influence and the power, unlike many other nations, to actually pull together a untied global regulation. In order to do so, it will need to observe the actions taken in other countries to compile an agreeable solution across the globe.

This might occur through diffusion of innovation. Diffusion of Innovations is a theory that tries to explain why, how, and at what rate new ideas and polices spread. Diffusion is the process by which innovation is communicated among participants over time. Political Scientist have created and implemented several mechanisms to prove and gain empirical evidence of its existence. By using diffusion of innovation, Congress can explore what other countries across the globe are doing to regulate and tax bitcoin and can come up with a globally accepted solution

- What is the Solution?

Bitcoin is an emerging technology that hasn’t yet disclosed its full potential. One of the many challenges involved in fully taxing and regulating Bitcoin is that no standardized set of regulations across the globe exists. Conflicts endure as to whether it is commodity or currency, and this adds to the difficulty of regulation. Regulatory measures will need to focus on price stabilization, security, and position for Bitcoin (currency versus commodity) in order to create adequate oversight for disruptive transaction processes. More importantly, cooperation across the globe with associated governing bodies is necessary to create a regulatory resolution for the use and trade of Bitcoin.

Australia classifies Bitcoin as property and has released tax guidelines for individuals and business.[83]Because Bitcoin is not classified as money or foreign currency, its supply is not “financial supply” that would be taxed under the goods and services tax (GST).[84]It is however, an asset for capital gains tax (CGT) purposes.[85]Record keeping is mandated and consumers must retain the date, amount, purpose, and identity of the other party for all transactions.[86]For those who are not carrying on a business or enterprise, there is no income tax or GST implications, but if bitcoins are used to purchase goods or services for personal use or consumption, any capital gain or loss is disregarded provided that the cost is $10,000 or less.[87]

If receiving bitcoins for goods and services are provided as part of a business, records of the transactions are to be kept in value of Australian dollars and are included in ordinary income.[88]The value of the Australian dollars is the fair market value, which can be obtained from a reputable Bitcoin exchange. A business may be charged GST when receiving Bitcoin in return for goods and services, and if the supply of those goods and services are a taxable supply, the business will be able to claim input tax credits on the GST charged on those transactions.[89]Also, when carrying on a business and business items are purchased (including trading stock) with Bitcoin, there is a deduction allowed based on the arm’s length value of the item obtained.[90]

The European Union (EU) has not passed any specific legislation indicating that Bitcoin is accepted as currency.[91]The European Central Bank classifies Bitcoin, like the U.S,. as a convertible decentralized virtual currency.[92]According to its traditional financial sector, regulation is inapplicable to Bitcoin because it falls out of both the Electronic Money Directive and Payment Services Directive due to its non-traditional financial actors.[93]

The European Banking Authority has advised banks not to deal in virtual currencies until regulation is in place. It also advised Bitcoin users against using the non-regulated currency, warning that they are at risk of losing their money and may be liable for taxes when using virtual currencies.[94]Although no explicit directives to tax consumers has been specified, the European Court of Justice has ruled that Bitcoin transactions are exempt from the consumption tax because those transactions are to be treated as a means of payment.[95]

China, much like the EU, forbids financial firms like banks from holding or trading bitcoins.[96]According to the central bank’s website, the People’s Bank of China declared that financial institutions and payment companies are not allowed to buy, sell, or insure the virtual currency or any bitcoin-linked products.[97]It is perfectly legal for private parties to hold and trade bitcoins, but authorities have warned that they will be closely watching the local usage of Bitcoin, as wells as, its development overseas.[98]

There is little information about the regulation and taxation of Bitcoin in every continent. Despite there being no current regulation explicitly prohibiting the use and trade in each continent as a whole, some of the countries within have promulgated their own directives. [99]Bangladesh, Bolivia, Croatia, Ecuador, Kyrgyzstan, Russia, and Thailand have unequivocally outlawed the use of Bitcoin.[100]In countries like Argentina, Belgium, Chile, Colombia, Czech Republic, Cyprus, Denmark, Estonia, Finland, Greece, Iceland, India, Indonesia, Ireland, Italy, Jordan, Lebanon, Lithuania, Luxembourg, Malaysia, Malta, New Zealand, Netherlands, Nicaragua, Norway, Pakistan, Philippines, Poland, Portugal, Romania, Singapore, Slovakia, Slovenia, South Korea, Spain, Switzerland, Turkey, United Kingdom, and Vietnam, bitcoins are not considered legal currency.[101]Many of them have released official statements regarding its use, but there are no specific regulations pertaining to Bitcoin use in these countries.[102]It can be assumed that in the above-mentioned countries, Bitcoins may be used and traded by private parties.[103]

- What are Costs/Benefits, Advantages/Disadvantages of the Proposed Solution

Too little regulation has the possibility of leaving digital currency vulnerable to criminality, which will directly affect consumers and the economy.[104]Too much regulation poses the risk of “stifling innovation and driving away potential digital currency based businesses.”[105]Another challenge, is how to enforce sanctions when regulations are breached.[106]Consumer protection measures that have been introduced by the licensing requirements in the U.S., without a global agreed upon regulation, may drive businesses overseas to evade regulation.[107]The license promotes Bitcoin through protected practice, but it simultaneously raises the barrier to entry and stifles its innovative potential.[108]

Because the future of Bitcoin and its potential problems are unknown, it is hard to measure whether or not the currently regulating governments are providing adequate oversight. Bitcoin is difficult to regulate because governing bodies are unable to conclude whether it is a commodity or currency. Its price fluctuates, so converting it to fair market value has proven difficult for those attempting to comply with the reporting requirements that some countries demand. If there were a consensus as to how to value Bitcoin, and whether or not it is deemed a currency or commodity then it would be easier for there to be a globally accepted regulation. Until Bitcoin can be treated universally in the same manner across the globe, there will be discrepancies in oversight and regulation.

- Conclusion

- Usefulness and Limitations

The regulating issues of Bitcoin boils down to its existence as a “value medium and how it fits in which current anti-money laundering, know your consumer, commodities and cash laws.”[109]Bitcoin continues to grow in popularity worldwide, and with a reported 1.3 billion bitcoin users in 2015, 4.7 million are estimated to be users by the end of 2017.[110]If the use of Bitcoin is to ever be widely accepted and trusted, the regulation surrounding them must be clear.[111]Regulation in the U.S. currently involves the IRS, who defines cryptocurrencies for tax purposes, and the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC), which oversee their use in trade.[112]The IRS treats Bitcoin as property and the SEC treats it as fiat currency.[113]

Bitcoin and its application has the potential to “change how people spend money, transforming global markets in ways that are currently unimaginable.”[114]For now the use of Bitcoin will continue to be limited mainly because of regulatory questions “at every level of the government in the United States and elsewhere.”[115]The lawmakers and court systems can best regulate Bitcoin once they agree on what cryptocurrencies are and discover a way to limit criminal use while simultaneously allowing it to develop legally within the free market so that it can confer its benefits on citizens across the globe.[116]

- Recommendations for Future Research

Due to the difficulties of effectively regulating digital currencies, research into the field is encouraged because there are considerable challenges to overcome before Bitcoin can become an integral part of the mainstream economy.[117]I expect that developing nations, with unpredictable currency might experiment with the use of Bitcoin. Following the plan of regulation in these countries and others will help develop the direction in which regulation should go. For now, many countries will adopt the “wait and see” approach.

[1]The Rise and Rise of Bitcoin, Dir. Nicholas Mross, 2014. Film.

[2]Id.

[3]Id.

[4]Id.

[5]S. Nakamoto, Bitcoin: A Peer-to-Peer Electronic Cash System, 2009, 2016 www.bitcoin.org/bitcoin.pdf

[6]The Rise and Rise of Bitcoin

[7]Id.

[8]Id.

[9]Id.

[10]Id.

[11]Id.

[12]Id.

[13]Id.

[14]Id.

[15]Id.

[16]Id.

[17]Id.

[18]Id.

[19]Id.

[20]Id.

[22]Id.

[23]Id.

[24]Sec. & Exch. Comm'n v. Shavers, No. 4:13-CV-416, 2014 WL 4652121, at *1 (E.D. Tex. Sept. 18, 2014).

[25]Id.

[26]Id.

[27]https://support.coinbase.com/customer/en/portal/articles/2228646-the-shift-card

[28]Id.

[29]The Rise and Rise of Bitcoin

[30]Id.

[31]Id.

[32]Id.

[33]Id.

[34]Id.

[35]Notice, 2014-16 I.R.B. 938 (2014).

[36]Greene v. Mizuho Bank, Ltd.,No. 14 C 1437, 2016 WL 946921, at *2 (N.D. Ill. Mar. 14, 2016)

[37]Id.

[38]Id.

[39]Id.

[40]Id.

[41]Id.

[42]Id.

[43]Jonathan Chester, How Questions About Terrorism Challenge Bitcoin Startups, Forbes, (Dec. 14, 2015, 11:06 AM),http://www.forbes.com/sites/jonathanchester/2015/12/14/is-bitcoin-the-currency-of-terrorism/#3d5b03675e7c

[44]Id.

[45]Id.

[46]Id.

[47]Andy Beckett, The Dark Side of the Internet, The Guardian, (Nov. 25, 2009, 7:05 PM), https://www.theguardian.com/technology/2009/nov/26/dark-side-internet-freenet

[48]Id.

[49]Id.

[50]Id.

[51]Deschappel, Ariel, Why Regulating Bitcoin Won’t Work, CoinDesk, http://www.coindesk.com/why-regulating-bitcoin-will-not-work/

[52]Id.

[53]Id.

[54]Benjamin W. Akins, Jennifer L. Chapman, Jason M. Gordon, A Whole New World: Income Tax Considerations of the Bitcoin Economy, 12 Pitt. Tax Rev. 25 (2014).

[55]Id.

[56]Id.

[57]Id.

[58]Id.

[59]Notice, 2014-16 I.R.B. 938 (2014).

[60]US Government Accountability Office (May 2013). Virtual Economies and Currencies: Additional IRS Guidance Could Reduce Tax Compliance Risks. GAO Report GAO-13-516. Report to the Committee on Finance, U.S. Senate.

[61]Notice. 2014-16 I.R.B. 938 (2014).

[62]Id.

[63]Id.

[64]De Fillippi, Primavera, We Must Regulate Bitcoin. Problem Is, We Don’t Understand It, (Mar. 1, 2106), WIRED, https://www.wired.com/2016/03/must-understand-bitcoin-regulate/

[65]Id.

[66]Lance, Vince, State Regulation Changes the Game for Bitcoin Sellers in New Hampshire, CoinDesk, http://www.coindesk.com/state-regulation-changes-the-game-for-bitcoin-in-new-hampshire/

[67]Coleman, Lester, California Lawmaker Shelves Bitcoin Legislation, CCN, https://www.cryptocoinsnews.com/california-lawmaker-shelves-bitcoin-legislation/

[68]Olsson, Alexander, Bitcoin Week in Review –November 11, 2016, (Nov. 17, 2016). Perkins Cole, LLP. https://www.virtualcurrencyreport.com

[69]Id.

[70]Id.

[71]Torpey, Kyle, The United States Is Falling Behind in Bitcoin Regulation, (Apr. 25, 2016). BTC Media, https://bitcoinmagazine.com/articles/the-united-states-is-falling-behind-in-bitcoin-regulation-1461604211

[72]Id.

[73]Id.

[74]Id.

[75]Lance, Vic, State Regulation

[76]Rochefort, David; Cobb, Roger, The Politics of Problem Definition: Shaping the Policy Agenda. 1994. Lawrence, KS: University of Kansas Press.

[77]De Fillipi, Primavera, We Must Regulate.

[78]Id.

[79]De Fillipi, Primavera, We Must Regulate.

[80]Id.

[81]Id.

[82]Id.

[83]Tax Treatment of Crypto-currencies in Australia—Specifically Bitcoin, (Aug. 20, 2014). Australian Taxation Office (ATO). https://www.ato.gov.au/General/Gen/Tax-treatment-of-crypto-currencies-in-Australia---specifically-bitcoin/

[84]Id.

[85]Id.

[86]Id.

[87]Id.

[88]Id.

[89]Id.

[90]Id.

[91]Regulation of Bitcoin in Selected Jurisdictions, loc.gov. The Library of Congress, Global legal Research Center 2014.

[92]European Central Bank (October 2012). Virtual Currency Schemes, Frankfurt am Main: European Central Bank.

[93]Id.

[94]Press Release, European Banking Authority, EBA Warns Consumers on Virtual Currencies(Dec. 13, 2013), http://www.eba.europa.eu/-/eba-warns-consumers-on-virtual-currencies

[95]Stephanie Bodini, Amy Thomson, EU’s Top Court Rules that Bitcoin Exchange Is Tax-Free, (Oct. 22, 2015), BloombergBusiness. Bloomberg. http://www.bloomberg.com/news/articles/2015-10-22/bitcoin-virtual-currency-exchange-is-tax-free-eu-court-says-ig21wzcd.

[96]China Bans Financial Companies From Bitcoin Transactions, (Dec. 5, 2013), Bloomberg, http://www.bloomberg.com/news/articles/2013-12-05/china-s-pboc-bans-financial-companies-from-bitcoin-transactions.

[97]Id.

[98]Id.

[99]Regulation of Bitcoin in Selected Jurisdictions, loc.gov. The Library of Congress, Global legal Research Center 2014.

[100]Id.

[101]Id.

[102]Id.

[103]Id.

[104]Shillito, Matthew; Stokes, Rob. Governments Want to Regulate Bitcoin –Is That Even Possible?, (Mar. 26, 2015), The Conversation, http://theconversation.com/governments-want-to-regulate-bitcoin-is-that-even-possible-39266.

[105]Id.

[106]Id.

[107]Id.

[108]Hackett, Rupert, Is Regulation Even Relevant to Bitcoin?,(May 7, 2015), Bitcoin Bull, https://www.bitcoinbulls.net/is-regulation-relevant-to-bitcoin.html

[109]OConnell, Justin, The Future of Blockchain Regulations. (Mar. 26, 2016). CCN, https://www.cryptocoinsnews.com/future-blockchain-regulations/

[110]Gotschall, Mary, TheFuture of Bitcoins, (Jan. 15, 2016), VOA News, http://learningenglish.voanews.com/a/the-future-of-bitcoins/3137339.html

[111]Analysis, The Arduous Task of Regulating Bitcoin, (Aug. 3, 2016), Stratfor, https://www.stratfor.com/analysis/arduous-task-regulating-bitcoin

[112]Id.

[113]Id.

[114]Id.

[115]Id.

[116]Id.

[117]Shillito, Matthew; Stokes, Rob. Governments Want.

This article is accurate and true to the best of the author’s knowledge. Content is for informational or entertainment purposes only and does not substitute for personal counsel or professional advice in business, financial, legal, or technical matters.

© 2019 Rob Borrow