Do You Trust Retirement Calculators?

- Retirement Savings Calculator on Kiplinger.com

Kiplinger.com is a business forecasting service that offers fiscally conservative advice for individuals in all stages of life. This calculator includes factors like how your funds will be invested during retirement. - Retirement Savings Calculators on The Motley Fool

Motley Fool, a popular online investment advice service offers these detailed retirement calculators while they dish out their own brand of foolish advice.

Yay, We're On Pace to Retire...Or Not!

Retirement calculators are like weather predictions in Texas: if you wait five minutes, the results will change. Today I was checking my husband's modest retirement savings account, which was the numero uno reason he took his new job. He is 43 and the retirement clock is ticking.

If you are a student of retirement planning and personal finance, then you've already heard that if you're 22 and you save $6,000 dollars, you don't have anything to worry about, because by the time you're 65, you'll be sitting on a nice pile of cash--at least a million in your favorite currency. That's sound advice and I wish I were 22 again, but like all the other poor schleps in their 30's, life happened, and here I am, trying to figure out if I'm going to be able to retire when I'm 65, or 68, or 71.

Life happens. And while I am thankful that things are improving lately, the last 10 years before that were a little messy, so our retirement portfolio is a on the...lean side.

Today I was checking our new retirement plan using the retirement planning calculator from the investment site where we keep our funds, and good news! We are on track! The retirement calculator said, after I entered all of my numbers, including the money we are saving to make up for NOT doing it in our 20s, that if we use their calculations for Social Security and the probable investment income from our other accounts, we will be able to retire before my husband's 69th birthday. And fortunately for us, our children will all be out of the house by then, too, (I hope)!

Well, I was on a roll and feeling pretty good about that. I don't have to go to the corner store and buy lottery tickets anymore. And while it might be necessary for me to get a part-time job somewhere that is friendly to older folks, that won't be too bad either. I won't want to be cooped up in the house anyway. So what gives?

I went to a second web site and plugged the exact same numbers into THEIR retirement calculator, just to see what would happen, and got some very different news. "In a bad economy," their calculator warned, "you will experience a shortfall of funds by the time you are 75." Wha...? Huh?

Use their figures to calculate social security? Sure. But don't expect much. It won't be enough. To make up the shortfall we can save an extra $1500.00 a month, and please be sure to deposit those funds into the investment company's special advisor account, because our investment strategy is too risky!

How do the Retirement Calculators Compare?

So are we on pace to retire on our current income, or not? Both of the retirement calculators I used asked for essentially the same information. How much income does my partner and I earn each year? How much are we saving monthly? How much do we already have tucked away in retirement accounts?

But retirement calculator number two felt a little bit like a thinly-veiled excuse to find out where I was REALLY keeping my money, so the investment company could convince me to convert, roll-over, and play dead. Oops, not what I meant to say. It also asked me to project my anticipated inheritances. Great Aunt Matilda. Not dead yet. But she should be by 2026. Hmmn, let's fiddle with the numbers and see what would happen if she passes in 2024. A little morbid. And besides, I saw no indication that they took my predictions into account.

So what did I learn from this? I realized that not all retirement calculators are created equally.

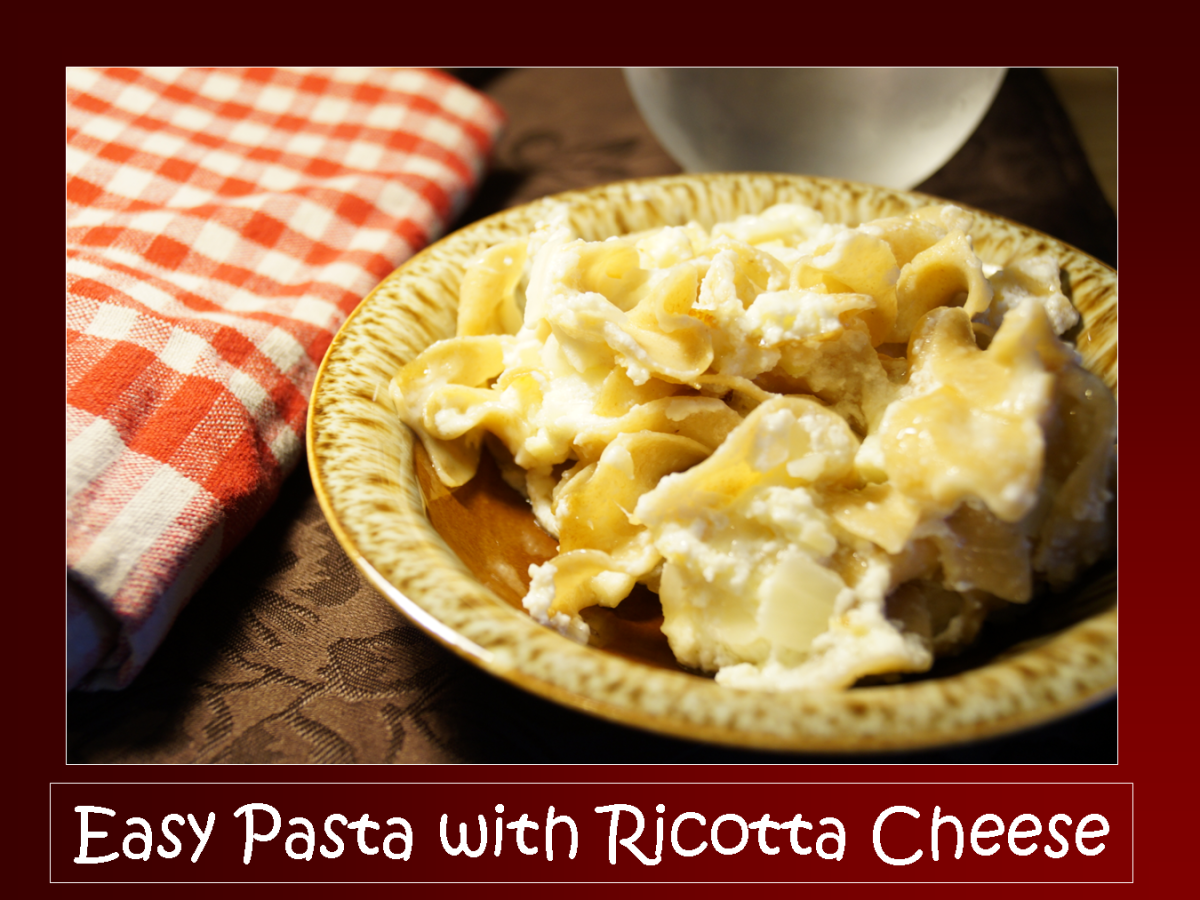

I don't really want to hear that the glass is almost empty from the company that is housing my retirement nest egg. But I don't want to hear the glass is almost full if it really isn't, either. I'm pretty darn lucky to have a glass at all, and I want reassurances that I'm doing the right thing, and that my eating macaroni and cheese several times a month is going to help me keep putting it on the table well into my 90s.

If you are using your investment company's retirement calculator, get a second and even a third opinion. And learn as much as you can about the different type of retirement investments available to you, including the differences between traditional and Roth IRAs, 401Ks, and employee matching programs.

Since They're Going to Depress You Anyway...

I think trying to save for retirement in today's economic environment takes a little bit of creativity and sense of humor. To that end, I suggest that retirement calculators steer clear of telling people how soon they will be completely broke, and instead, give advice measured by boxes of macaroni and cheese.

The Macaroni and Cheese Retirement Calculator Inputs

- Years to Retirement: ___________

- Amount in 401K: _______________

- Amount you Plan to Save Monthly: ____________

- Number of hungry people you will be responsible for feeding: ________

The Macaroni and Cheese Retirement Calculator's Results

The Macaroni and Cheese Retirement Calculator estimates that you will be able to afford 34 boxes of macaroni and cheese each month to feed 2 hungry mouths in your family after you retire at age 65. However, if you take a part time job at a fast food restaurant, you will probably be able to eat your meals free, thus enabling you to continue buying 34 boxes of macaroni and cheese until you reach age 82, at which time you will no longer be able to digest it anyway.

If you increase your withholding by $100 a month, you will be able to buy 10 more boxes of macaroni and cheese a month, which has an indefinite shelf life, and is rich in fortified vitamins and comes in Spiderman shapes.