Retirement Planning for Self Employed Freelancers with the ROTH IRA

How to Start Investing with a ROTH IRA

If you’re like most freelancers, when it comes to finances and investing, you fall into one of two categories:

1. You ignore it and feel guilty.

2. You obsess over every little detail and get overwhelmed with all the choices and things you don’t know.

Both of these produce the same result… nothing.

So let’s look at some ways to boil down all the excess information away from ‘investing.’

Investing is Not Just for Rich People

Most freelancers don’t have a 401K or retirement plan set up for them, like your friends with a more traditional job might. You might think “I can’t afford to invest” when the truth is that you can’t afford NOT to invest, even if it’s just a small amount. What is important is starting and getting yourself in the mental-framework that it is important.

Investing is NOT buying single stocks

Would You Rather be Sexy or Rich?

If I could give my much-younger-self advice it would be two things, one: don’t part your hair on the side like that, and two: start a ROTH IRA as soon as possible! But the truth is that a ROTH-IRA is incredibly not sexy. We like to romanticize investing as trading individual stocks, watching the tickers- buy low, sell high! It sounds exciting but that is not how long-term wealth is created for the common person.

The unsexy answer is that you make regular contributions to an investment account, which automatically buys a mixture of bonds, stocks, index funds, etc. that meet your personal risk tolerance. Then you forget about it for the next 30 years or so while you get rich.

That’s it. No balloons fall from the ceiling. No giant paper checks. Nothing. It’s all possible from the magic of compound interest.

What the Heck is an IRA?

An IRA or Individual Retirement Account is a type of investment account you can open and make regular contributions to up to a certain amount per year (in 2015 it is $5,500). It is managed by an investment firm where they take your money and buy a mixture of stocks, bonds, index funds and other investments for you based on how much risk you can tolerate (more risky=higher rate of return.) There are 2 types of IRA’s, Traditional and ROTH. The basic difference is how they are treated for tax purposes . With a traditional IRA, you can deduct your contributions from your income tax (you are then investing pre-taxed money) and you pay the taxes when you withdraw money at retirement. ROTH IRA’s, however, you contribute “after tax money” (you can’t deduct what you contribute) but when you withdraw at retirement it is tax-free. Without getting into any more details than that, this article focuses on the ROTH IRA because of its attractiveness and benefits to younger people.

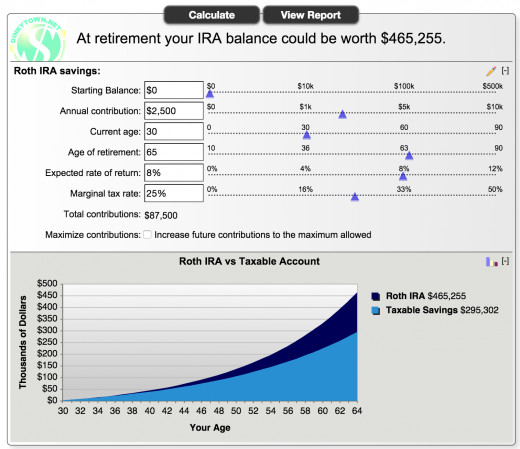

Head over to Dinkytown and check out their retirement calculators, like this one for the ROTH IRA.

It’s fun to play with the numbers and see how much you would have at retirement, right? It’s more fun if you’re in your 20’s and you think “wow I should get started right now! Look how much I’ll have, woohoo!” It’s less fun if you’re in your 40’s or above and think “I wish I would have known about this and started in my 20’s!” But you know when the best time to get started is? Now.

Some funds, like T. Rowe Price, have a minimum initial investment of $1K, but waive it when you set up an automatic monthly contribution of at least $50.

I use and recommend T.Rowe Price. Here is a page that can provide a lot more information on IRA’s. There is a LOT of terminology and details surrounding IRA’s and investing in general (load vs. no-load, target dates, etc.), and that’s why a lot of people get so intimidated by all the information and choices that they never get started. Don’t be paralyzed by all the choices.

It’s more important that you just get started, if you pick the wrong fund or wrong account type, you can change it later.

Still not convinced? Let’s look at a hypothetical scenario. This is for a 30 year old person that hasn’t saved a dollar in their life. They contribute $2500/year (or about $208/month) to a ROTH IRA for 35 years. It assumes an 8% rate of return (it is worthwhile to note that from January 1970 through to Dec. 2014, the average annual compounded rate of return for the S&P 500®, including reinvestment of dividends, was approximately 10.7% (source: www.standardandpoors.com).

ROTH IRA Table

Projected Retirement Savings

So over 35 years, if this person put $2500/year under their mattress or in a no-interest checking account, they would have contributed $87,500. Not bad, right?

But if they put that $87.5K in a ROTH IRA, they get to withdraw $465,255 TAX FREE DOLLARS.

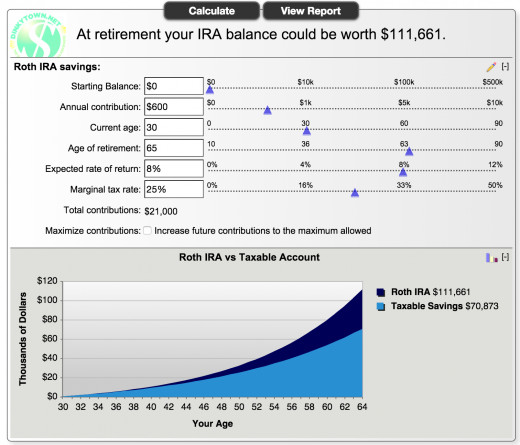

$200 a month might be more than you can save right now, and that’s ok. Don’t be discouraged!

Let’s do it again, with the same 30 year old person that can only save $50/month ($600/year).

This person, contributing only $21,000 over 35 years, could withdraw $111,661 tax-free dollars at retirement.

That’s the power of compound interest.

More Help for Freelancers

- Smart Modern Freelancer -

SMF helps the professional freelancer with all topics related to professional development, finances, retirement, personal development and professional advancement

Disclaimer:

Note: As always, you should seek the advice of a professional financial planner before making any decisions about your finances or investing. The author offers this information based only on personal experience. Results presented here are typical, but not without risk. Investing has inherent risk. Could we have another terrible recession in the US like 2007-2009? It’s possible. But this is a long term strategy, not get rich quick. If the market values go down, they will go back up in time.

What separates you from the sea of other freelancers in the world is that you’re reading this article to the end because you are serious. You take action. You control your own future. Don’t put investing for your future on your to-do list for some other time, there is no better time than now.

Do you have anything to add or an IRA investment type/strategy that’s working for you? Share it in the comments below.