Retirement made easy: Asset allocation

Getting the right mix of assets in your investment portfolio is probably the most important step you can make towards maximising your returns and ensuring a comfortable retirement . The reason is that the mix of assets you choose (usually known as asset allocation) often has a bigger impact on the returns you can earn than does picking the right stocks or funds. And getting the mix right may give you what many call the only free lunch in investing, higher returns and lower risk, because of diversification.

A mix of assets to spread the risk

Asset diversification

The real reason we want to think a lot about asset allocation is because we want a mix of assets that will perform differently at different times in the economic cycle. If, for example, we put all of our money into a single stock then it might do very, very well or very, very badly. The chances of one stock doubling or tripling over a short space of time are not that remote. So too are the chances of a stock falling by half or more.

If we simply wanted to maximise our chances of high returns we could treat investing like gambling in a casino. Instead of picking a number we could pick a single stock and hope to make a lot of money or perhaps end up with no money. But most of us treat investing as a sober business aimed at preserving our existing wealth as much as it is about trying to create new wealth. So we don't want to gamble it all away. That leads us to want to spread our risk. If for instance, we bet on the red or black of a roulette table we would now have only a 50% chance of losing our bet and if it paid off would only double our money. This is less risky than just betting on a single number, but is still not really a sensible investment strategy. So what we do is spread our bets even more.

Typically the first step of this is to own many stocks. The odds of them all doubling at once are much reduced, but so too are the odds of them all going bankrupt at once. The easiest way to do this is to buy an index fund, which is a low cost way of owning all of the stocks in a particular index. Since we are thinking of spreading our bets at this stage, we want a broad index fund.

Owning bonds

Owning lots of stocks is less risky than only owning a few, but even this has more risk than most investors want. Stock indexes also rise and fall in great leaps and swings. During the turmoil of 2008 and 2009 it was not uncommon for a major stock index to rise or fall by 9% in a day. That may be exciting if you are a gambler, but if, like most of us, you are trying to save enough for a comfortable retirement, then that sort of volatility won't let you sleep at night.

It is for this reason that most people will add bonds to their portfolio. The reason is that bonds usually move about by less than stocks. And bonds issued by the governments of rich and creditworthy nations such as Germany, the United States or Great Britain will also often rise in times of economic uncertainty, just when stocks are falling. This allows them to provide an element of insurance to a portfolio.

The downside of holding bonds on their own though is that they usually deliver lower returns than stocks and they are also vulnerable to periods of high inflation or rising interest rates. A typical portfolio split of 60% stocks and 40% bonds would, however, have performed considerably better than one made up only of stocks or only of bonds over most reasonably long periods (10 years or more) over the past century.

When adding bonds to a portfolio the simplest way again is to use a cheap index fund such as an exchange traded fund (ETF). One also needs to look carefully at the sorts of bonds one owns. Many investors buy bonds issued by companies (corporate bonds) because these pay higher rates of interest (called a higher spread) than government bonds. The trouble is, however, that they are riskier than government bonds and don't provide all of the benefits of diversification that government bonds do. When stock markets fall, often the prices of corporate bonds will too. Even so, one should be careful of making hard and fast rules since the price you pay for an asset matters a lot. Corporate bonds fell to very low valuations in early 2009 and delivered spectular returns over the rest of the year.

Two books on asset allocation by the master

Real estate and other assets

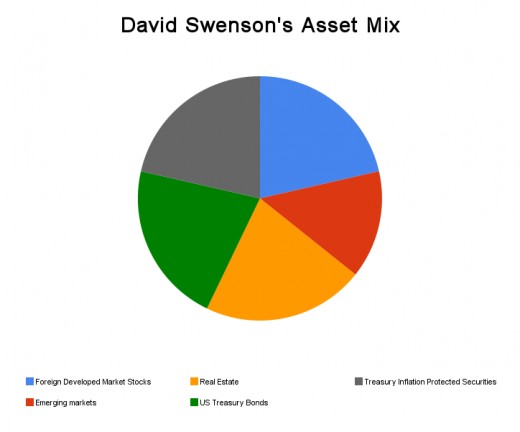

Experts such as David Swenson, who runs the endowment fund at Yale, suggest holding additional assets including real estate and inflation protected bonds. Both are aimed at further spreading the risk and holding a wide range of different assets that will perform differently in different economic circumstances.

Real estate securities, for instance, provide protection against inflation (the price of the buildings they own will go up) and also deliver higher returns than bonds would. Inflation protected bonds are also insurance against the value of your savings falling as prices rise over time. One could also add other groups to this mix such as stocks in emerging markets, which are countries and economies that are growing far faster than those in the rich world, or stocks in other countries in the rich world.

Getting the exact mix right is an art more than a science. Some people use a rule of thumb which is to subtract their age from 100 and invest that in stocks with the remainder in bonds (so a 30-year-old would have 70% stocks and 30% bonds, whereas an 80-year-old would have jsut 20% in stocks and 80% in bonds). The rule may be simple but it makes a great starting point since it takes into account the fact that our tolerance for risk changes over time. A 30-year-old may not mind a 50% fall in the value of their savings if they expect to make it up through superior investment returns over the next 40 years. But someone who is nearing retirement or already living off their savings would not want to see a big fall in the value of their investments.

Yet before adopting a mechanical approach one should also examine the rest of one's circumstances. If you own a home and have a large mortgage, for instance, then you may be quite well protected against inflation already and would want to cut back on real estate securities and inflation-protected bonds in your portfolio. If on the other hand, you are deeply concerned about inflation and financial turmoil you may consider investing in

gold (although I wouldn't recommend doing so myself). If you own annuities then you might also consider what impact they have on your diversification and ability to take risk with the rest of your portfolio. Asset allocation should ultimately be closely tailored to your own circumstances and getting it right requires a good deal of careful consideration.

Great lecture by David Swensen on Asset Allocation

Further reading on asset allocation

- The Bogle eBlog

A blog by John Bogle, the legendary founder of Vanguard investments. - Revisiting the debate over Yale\'s investing guru, David Swensen - BusinessWeek

Back in mid-March, I came across a link to an interview with David Swensen, chief investment officer for Yale Universitys endowment and author of the 2005 book Unconventional Success: A Fundamental Approach to Personal Investment. Swensen has a pheno