Roth IRA Basics

What You Need to Know About Roth IRAs

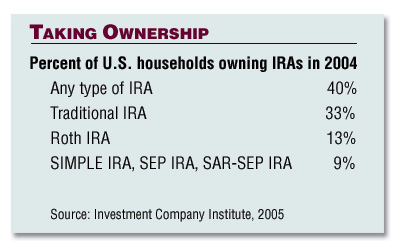

Because the Roth IRA has been deemed by most retirees as the most efficient individual retirement account, more and more people are beginning to realize the great benefits and profit potential this plan can grant them in their retirement years. But before you open your own Roth IRA, it is very important that you gain knowledge of the Roth IRA basics that can provide you essential information about this advantageous retirement account.

The Roth IRA is mandated by the tax law of the United States, whereas its name came from the late Senator William Roth of Delaware, the chief legislative sponsor of this retirement investing option. The Roth retirement account was recognized by the Public Law 105-34, commonly known as the Taxpayer Relief Act of 1997. The best Roth IRA advice and most common types of assets that you can invest in through a Roth IRA are mutual funds, common stocks, certificates of deposit, derivatives, notes, securities and even the real estate.

Outline of the Roth IRA Basics

The Roth IRA basics outline the specific requirements and filing status’ prerequisites as directed by the Internal Revenue Service (IRS) that will determine if you are eligible to open a Roth IRA. The most acknowledged benefit of a Roth plan is its distinct tax structure. There are limitations on the contributions you can make each year, wherein you are only allowed to add funds to your account smaller than your modified adjusted gross income (MAGI) or compensation. As for 2009, contributors are only permitted to contribute not more than $5,000. Contributors who are fifty years of age or more than fifty years of age are allowed to make additional contributions up to $1,000, referred as catch up contributions.

Do you know how to open a Roth IRA? You will only become eligible to open a Roth account if you fall under the income limits. If your filing status is single filer, you qualify for full contribution if your salary is up to $105,000 and up to $105,000 to $120,000 for partial contribution. As a joint filer, your compensation must be up to $166,000 for full contribution and up to $166,000 to $176,000 for partial contribution. For married filing separately, income should be up to $0 for full contribution and up to $0 to $10,000 for partial contribution.

Traditional IRA and the Roth IRA

There are significant differences between the Roth vs Traditional IRA. Learning about these will help you decide what particular individual retirement plan suits your needs for your retirement. The tax for Traditional IRA are tax-deductible, Roth IRA on the other hand are made up of contributions that are not tax-deductible. Due to this, all withdrawals or distributions that you will carry out in the future are commonly tax-free, though there are specific stipulations that govern this privilege. You can only enjoy a tax-free withdrawal if your account has been open and active at least five years for principal distributions and your age is at least 59 ½ years if you want to withdraw growth portion above principal value.

If you learn about the Roth IRA basics you will recognize that it has fewer Roth IRA limitations, withdrawal restrictions, regulations and requirements. Moreover, the transactions within your Roth IRA, which may incorporate dividends, interest and capital gains, will not incur current tax liability under the tax law.