Down Payment for Home Mortgage Loans

Budget for Savings

A house is the typically the biggest expense made in your lifetime, and you will have to be serious about saving money if you want an adequate down payment to help get good home mortgage loans. First, you need to work out a budget if you have not already done so, and see where you can cut expenses to increase the availability of money for savings.

A 20 percent down payment on a new home loan is the ideal way to purchase a home if possible and will allow you to get a preferred interest rate, and you will not have to pay the extra fees for that 20 percent that make you house payment so expensive.

Check Credit Rating

Ideally, open a savings account just for a house down payment, so you are not tempted to use the money for another reason. If you are saving over an extended period of time, put some money into CD’s as the interest rate is not great, but it is better than a money market account. You can purchase a CD for 6 months, a year or several years.

There are many ways to cut expenses, such as eating out less often, driving as little as possible, using coupons at the grocery store and so forth. Make sure you pay off all credit card debt, as lenders are stricter now than they have been in the past.Keep your budget posted where you can see it, and that will help you stick with the program.

Get a credit report from all three credit bureaus, which is free. They are Equifax, Experian and TransUnion. Since they are in competition, each one may say something different.

You don’t want anything negative on any of these reports. Make sure any errors are corrected, and if there is some amount of money owing try to make arrangements to pay it off.

How Much House Can you Afford

Decide what size house you want to buy and in what location. You should look at some houses to get a clear idea of cost and what will fit into your budget. A mortgage payment should be no more than 30% of your net income. That would include house taxes and insurance.

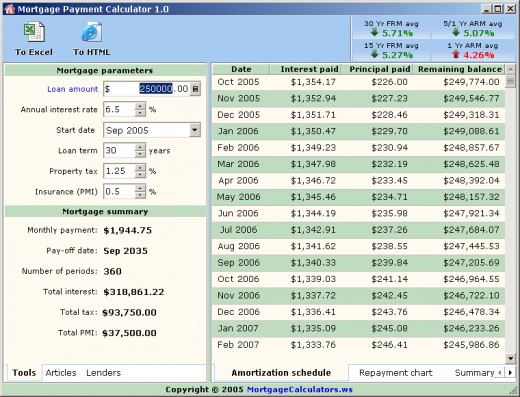

Use a mortgage calculator to figure all the expenses, payments and interest amounts. In this particular housing market it is possible to find good housing that has been foreclosed on, or some people are selling for low prices because they are desperate.

When you decide what your house will probably cost, then you need to think about how you will finance this house. Shop for the best loan rates. Sometimes it is worthwhile to borrow from your 401K if you do not have an adequate down payment.

The interest rates are low on these loans, plus the amount you borrow is set aside into a savings account and earning interest until such time you have the 401K loan paid off. There is no government penalty for borrowing money from your 401K, just for actually taking the money out of the the retirement account.

Other Helps with Down Payments

There is special financing for first time buyers where they put no money down and just pay the closing costs. There are several programs to check out. Borrowers in several locations with a wide range of incomes may get help from Fannie Mae or Freddie Mac, the government sponsored offices that buy mortgages and package them as investments.

There are several non-profit and community groups that lend buyers a helping hand. Also, check what your particular state has to offer.

If you are a first time buyer the government allows you to take $10,000 out of your 401K without penalty as a down payment.

If you are married and you are both first time buyers, you can potentially withdraw $20,000 for your down payment. This is a big decision, as you still have to think of your long-term retirement goals.

It is also possible to borrow from your 401K, which you will have to pay back in quarterly installments. The money you put into the 401K is pre-taxed, and the payback is money that you have paid taxes on, so this is a down side.

However, the money you borrow from the 401K program is placed into a type of saving account where you accumulate low interest, and the interest rate on the loan is typically low, so there is an upside. As you make payments, your money in the savings is released where you can put it back into a mutual fund or wherever you choose.

Mortgage Calculator

Methods of Finance

There are several basic ways to finance a house. The standard fixed rate mortgage can be found at banks, credit unions and mortgage companies. At this time the interest rates are considered low and ideally you should put down 20%, plus you will have closing cost unless you can get the seller to pay them for you.

You can also get a loan with 10% down, but you will be required to pay an extra monthly fee called the PMI. A variable rate loan might look attractive as the payments are low now but if the interest rate starts to climb, as it always does eventually your payments may make your house unaffordable.

An FHA mortgage requires a lower down payment of 3.5% and they are not as strict concerning credit and job history. They offer 30 or 15 year fixed rate mortgages, and adjustable rate mortgage options as well.

A VA mortgage is given to an eligible veteran, which means you have been a member of the armed services with an honorable discharge. You can get 100% financing and there are no mortgage insurance requirements. Again there are 30 and 15 year fixed loans, plus adjustable rate options.

Real Estate Tips: Buying a Home: How to Save Money to Buy a Home

In Summary

Ideally when you are ready to buy your home you will have 20% as a down payment and qualify for a 15 or 30 year fixed rate loan. The payments will never fluctuate as they might with a variable loan.

Saving money over a longer period of time may be worth the wait to buy a house. If you already own a home you are selling, you will hopefully make some money which will be at least part of your down payment.

Not everyone is able to purchase a house with this ideal scenario, which makes it so nice that there are alternatives. FHA and VA are certainly worthwhile. If you are a first time buyer this is a great time to buy a house as there are so many different programs where you can get help.

Do your homework and check into all the programs you qualify for so you can find the best fit in your situation. Even with the help, you still need to save money to buy a home as there are always unexpected expenses, such as closing costs or maybe the home needs some repair if you buy a fixer upper.

Saving money should become a habit as you will always have some back up funds for an emergency.

This content is accurate and true to the best of the author’s knowledge and is not meant to substitute for formal and individualized advice from a qualified professional.