Saving Money by Comparing Lifetime Cost

Introduction

You will find a lot of personal finance sites explaining you how to save money by choosing cheaper options, or to cut corners in your financial life. They might tell you to live smaller, cheaper and accept a small bit of suffering for a larger pay day in the end. A way to get out of debt, finance your dream, or be independent of income.

I am not one of these people, and while I do espouse the virtues of a smaller, humbler life, I believe that it's not the price of what we buy that defines if we grow or shrink our wealth, but by how we choose the things we buy.

Cheaper can often mean that you lose money. Expensive often means becoming wealthier. Sounds counterintuitive? Let's find out!

Item

| Price

| Functional life

|

|---|---|---|

Shirt 1

| $10

| 3 months

|

Shirt 2

| $50

| 18 months

|

Shirt 3

| $100

| 24 months

|

Shirts For All Seasons

Look at the table above, which lists a number of shirts. They are all functionally identical, except for their quality (expressed as how long they will last) and their price. If you don't have a lot of money, you will be tempted to buy the first shirt - 10 dollars, that's a steal right?

But if you think of its lifespan, you will find that it only lasts 3 months, so it would cost you about 3.33 dollars per month. In two years, you'd have to replace your shirts 8 times, costing you 80 dollars.

Shirt 2 is a lot more expense, 50 dollars - but it lasts 18 months. That's 2.77 dollars per month, or about 67 dollars worth of shirt in 2 years. You'd replace it once and then have shirt left over at the end of the year!

The last shirt is 100 dollars and lasts 24 months - 4.16 dollars per month, 100 per 2 years.

When you look at functional lifespan, you will see that Shirt 2 is clearly the most economical choice. If you choose a cheap shirt, you will actually spend more money than someone buying a more expensive shirt.

This is the basic idea of spending money wisely, but there's more to it than that.

Functional Financial Strategy

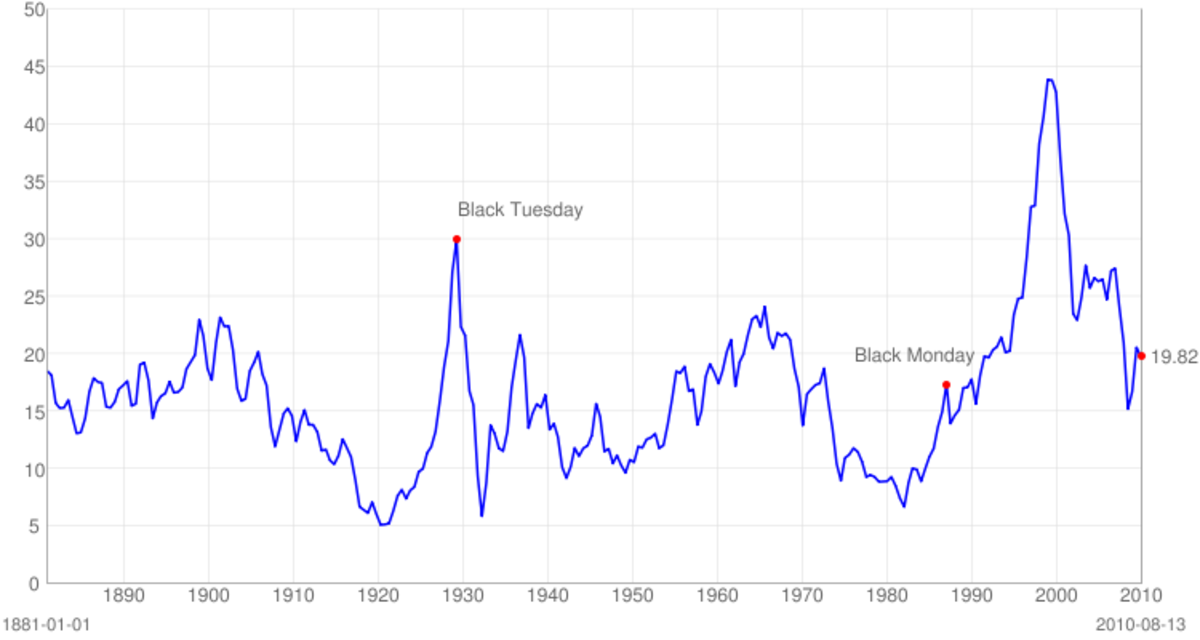

No matter why you are trying to save money, you need to have a clear goal. This goal could be to eliminate your debts, finance a dream or save up for your retirement. When setting this goal, you have to be very clear about its value (how much do you need) and future changes (inflation for example, which causes money to be less valuable over time). The longer-term your goal, the more you need to take future financial risks into account.

Once you have a clear budgetable goal, you want to start saving up for it in a way that is separate from your regular spending, such as a savings account. That way the money is "invisible" to you, and you won't be tempted to use it.

You will still need a visual reminder of your progress towards your goal however. This gives you a sense of purpose, reminds you of your goals, and keeps you motivated as you creep towards achieving it.

You could maintain a tally in a spreadsheet, or an app. However, there is nothing wrong with a low-tech solution like a spending log in a journal, or a sheet of paper on the wall where you visually represent the progress made. Simply search for "visual savings goal" and you will find quite a few printables that might fit your style. This is a great way for teaching kids about saving too!

Saving by knowing something's real cost is dependent on you knowing what you need, and buying items that are fit to your purpose.

Selecting Fit To Purpose Purchases

Longevity is one important factor in choosing the right product, and it becomes more important the longer an item lasts, or the more it costs. What you need may not be what you want.

We as Humans are greedy at times, and we like having nice things. A large TV, fast PC, spending real money in games or buying movies we never watch. Often this is the result of not spending enough time thinking about a purchase, and not be often with ourselves.

When you're going to buy a substantial purchase (a device or appliance, clothes, a car) always make a list for yourself separating out what you Need versus what you Want.

Don't ignore your Wants, it's fine to have a little wish in there. But the first directive on buying things should be what you need. This does not mean that you can't take emotion or philosophy into account. If you strongly feel you want to contribute to a better environment with an electric car (even if it's more expensive to purchase) then that's a valid argument.

By comparing Needs first, you will be able to keep yourself from falling into a trap where you buy an item which satisfies you, but which lacks something you actually needed! Being honest beforehand can save a lot of money. Let's look at a real-life example for an electric car...

Case Study - An Electric Car

Say that I want to save the environment and buy an electric car. I have already made a conscious choice for electric, eliminating a large amount of cars from my pick list.

I then need to look at how I use my car - do I drive long distances, or just to the grocery store? Do I transport large items? Does my country have features such as cold weather or hilly terrain that would put extra demands on the car?

These things are Needs - if I don't fulfill them, I might not be able to use my car, or it might be too expensive for its purpose. If you only drive to the grocery store and back, it would be a waste of money to go for a model that can drive 500 kilometers without recharging (unless that' how far the store is, no judging). A car that loses its battery charge in cold weather is near-useless in a country where winter temperatures hit -20 degrees celsius.

Then come the "Want" items: what color and look do I like? What kind of interior, electronics or features? Can I live without those? Sure! But part of the fun and enjoyment of the car comes from these things, and it would be wrong to exclude them from this decision.

There is a third category, in between, which I call "Convenience". If there is a brand dealer and garage nearby, it would make it much easier to get it serviced and repaired. If I have good experiences with a particular brand of car, I might weight that into my decision.

After all that, I separate out the Needs, Wants and Conveniences, as below:

Needs

| Wants

| Convenience

|

|---|---|---|

Electric

| Rearview Camera

| Garage nearby

|

Long-distance

| Storage space

| Fast charging

|

Cold weather proof

|

Note that "Wants" often come as extras on a car, and a salesman might want to have you buy them as part of the purchasing process. Make sure to decide beforehand what you will or won't buy.

Weighing The Options

As you can see in the example above, some people might consider storage space a Need. For me it's a Want. This prevents me from buying a big car if I don't really need it, but I am making an allowance that it could be a bigger car.

All the Needs must be met, so that disqualified a lot of vehicles. When it comes to making a choice, balance off the Conveniences against the Wants, and find whichever model gives you the most of them.

Usually this will boil down to between one and three models, where you can make test drives and see if you like how it drives, how it looks, and so on. But you can be sure that the choices you've made will suit you, because you've made a strong and decisive decision beforehand on what you needed.

Don't Deny Yourself Nice Things

A common caveat with this strategy is that sometimes people become very utilitarian and deny themselves anything that's fun or nice to have because they only look at the use value of items.

So it's important to realize that hobbies, games and movies, going out and holidays all serve important roles in keeping you sane, happy and de-stressed. So consider them an investment in your mental health, if you must.

Remember to always give yourself some "free to spend" budget which you can use to do whatever you want, whether it's buying something nice to decorate the home, materials for a hobby or to go out with friends.

Total Lifetime Cost

Home appliances like ovens, washers and dryers are particularly important to analyze, because not only will their economic lifespan be longer, their electricity usage is a big budget item.

Higher-priced items often have a better energy rating, meaning that they will consume less electricity over time.

First, when you need to buy a new appliance like a washer, sort out those that fulfill your minimum requirements, like load size and sizing requirements.

Each appliance has a wattage, which represents energy consumed. Multiply that number by the number of hours you expect to use the device. Then multiply by 30.000 to find how much KwH your appliance will use per month. This you can then multiply by the going electricity rate per KwH to determine your appliance's monthly cost.

This should give you a good idea which appliance will give value for money, but if you want a total comparison, multiply the monthly cost by 120 (12 months x 10 years) to find 10 years worth of usage. Add this to the purchase price.

I would suggest putting this calculating in a spreadsheet so you can add the wattage of each device and find a quick result for each. Purchase Price plus Use Cost over 10 years should give a good estimate allowing you to eliminate the devices that cost much more than the others.

For those that remain, their total costs should be comparable, within a small margin of each other. Among those, decide based on features you want, which brand you trust, which company has good customer service, or how well it has been reviewed.

Summary

Select purchases based on your Needs before your Wants.

Look at their total cost over their lifetime, then compare them.

When in doubt, always look at the end goal and decide if it's worth delaying it a bit for the Want or Convenience you are looking for.

This article is accurate and true to the best of the author’s knowledge. Content is for informational or entertainment purposes only and does not substitute for personal counsel or professional advice in business, financial, legal, or technical matters.

© 2018 Lolcrow