How to Invest in Preferred Stocks | Inside Tips (Part III of a Series)

This article is the third is a series I have written on preferred stock investing. The first installment covered the terms you need to know to navigate this arena. The second explained the risks and rewards, and how to start investing in these issues. The following article will give you inside information that I have gained through my experience buying and selling these stocks for years.

Most of these things you could learn over time, but I will give you a head start. It is imperative to know the ins and outs if you want to be successful. There is definitely a learning curve, but once you acquire working knowledge of how things work you will wonder why you haven't considered this type of investment before.

Other Articles In This Series

- The Hidden Investment- Preferred Stocks (Part I of a Series)

Mutual Funds, bonds, money markets, ETF's, CD's... Most take advantage of these assets in their retirement accounts. I would suggest one other category that gets little to no press- preferred stocks. - Preferred Stock Tutorial (Part II Of A Series)

Preferred Stock investing is a rare occurrence for the individual investor. This article is the second in a series which details why one should not ignore this type of asset.

Call Date vs Maturity Date

A call date is the day a company has the right to redeem all their shares at face value, usually $25. This date is meant to protect the company. It gives them the option to buy back their shares in the event interest rates have fallen enough that they could finance the debt more cheaply. Note that they do not have to redeem the shares on this day and if beneficial could let the issue run to maturity, or forever if they did not specify a maturity date.

A maturity date is the day a company MUST redeem the shares. This date works to protect the investor. You know that the face value of the shares will be paid out on a specific date so you can plan accordingly. So in the event you want to gain a certain return on your money and will leave it to maturity, you don't have to worry about share price fluctuations because you know exactly what you will be paid in the future.

Remember that not all Preferred Stocks have a maturity date. Usually these issues will have a call date though, which puts the power into the company's hands. Having a good understanding on these dates is essential in forming a strategy for investing as we go along.

What rate do you to expect on your financial investments over time?

The Gold Preferreds

I have a category of preferred stocks that I like to call the "Gold" Issues. These are stocks of companies that fit a certain set of criteria.

- They are cumulative, meaning if a dividend payment is missed the company has to make it up in the future.

- They have a solid rating from Moodys and S&P. I personally consider anything a B or over to be in this category

- The issue pays at least 6%

- They have a maturity date within a timeframe suitable to my needs. For me personally it is within the next 20 years, but this may differ depending on your situation.

The reasoning goes like this. As far as them being cumulative, I think that speaks for itself. If the company has the right to defer a dividend payment for as long as they like and not compensate me in arrears at some point that issue is not worth my time. Rarely if ever have I purchased a non-cumulative issue for any period of time.

The company must have a solid rating with S&P or Moodys, which means that a third party has looked at their financials and will stake their reputation on their estimate of that business' financial standing. This helps to protect me from a company that may go under and cause me a loss in principal.

As far as the interest rate, the 6% is the least I am willing to accept for my money. It gives me a balance of a decent return with a low level of risk. Your risk tolerance may be less or more depending on your personal taste.

Which brings us to the most important part of the gold classification- the maturity date. Past articles have alerted you to the fact a rise in interest rates will cause a drop in preferred stock prices. This is because safer investments become more attractive as they start to pay more. If you hold a preferred stock and the Federal Reserve decides to raise rates, you will see the share price drop.

Imagine if you bought a $25 face value share which paid you 8% interest. Then inflation hits and interest rates move up sharply. You look at your statement and see that this issue is now only worth $21 a share. You have lost 16%!!! This of course is only an "on-paper" loss if you plan to keep it to maturity. Why? Because on the maturity date you will get the face value back, which is $25.

You continue to get 8% back on your money until that point. Not a bad profit. What you will find though is that other investors also subscribe to this reasoning so if the price drops too low they will buy the shares in force to take advantage of this situation. Because of that the price will not fluctuate as much as other issues with no maturity date.

Changing Yields

Q: If the stated dividend rate on a preferred stock is 8%, what rate will you receive?

- 8%

- below 8%

- above 8%

- any of the above

Now, you are probably thinking this is a dumb question. If a stock promises 7% it will pay 7%- right? Actually, the answer is #4, any of the above. How can that be you ask? It all depends on what you paid for the issue.

If a preferred stock is issued at $25 and it pays an interest rate of 8%, that rate is based on you buying this issue for exactly $25. It pays $2. per share per year, with the calculation being $25 X 8% (.08)= $2. If interest rates are low as they are currently you may pay a premium to get the higher rate on your investment. Let's say you buy the shares at $26. In that case the rate would be $2 (face interest) divided by $26, which is 7.69%. On the other end, lets say interest rates rise and the share price drops to $23. In that case you would earn $2 divided by $23, which would be 8.69%.

The fact that the yield rises or falls depending on market price helps to make preferred stocks a viable option in most any market condition. Low interest rates? Preferred stocks pay higher rates than safer investments. High interest rates? Preferred stocks drop in price but for those who pick them up at lower prices they will get a higher yield than safer investments.

The price you pay...

So you are scanning your watch lists and see that a preferred stock issue that you want has dipped in price. You go to your brokerage account and put in an order only to find that the ask price is quite a bit higher. Why is this the case?

Generally if you want to aquire a common stock and see the latest quoted price, you will be able to purchase it for that amount or a cent more. That is not always the case with Preferreds. These issues are usually thinly traded and it will not always be possible to find a seller willing to part with their issues at the going market price.

Is this a bad thing? Not necessarily. This dynamic will also sometimes work in your favor. I highly recommend using limit orders to build your portfolio. A limit order allows you to name the price you will purchase a stock for. The order is only fulfilled if you are able to purchase at that price. Otherwise the sale will not complete. U.sing this strategy allows you to passively purchase an issue for only want you want to pay.

On the flip side, you will also at times be able to sell your issues for higher than market value by placing a sell limit order. Name your price and wait for someone who will agree to pay it. This is of course not for the buy and sell investor, but as I will detail in a later article, there are different strategies.

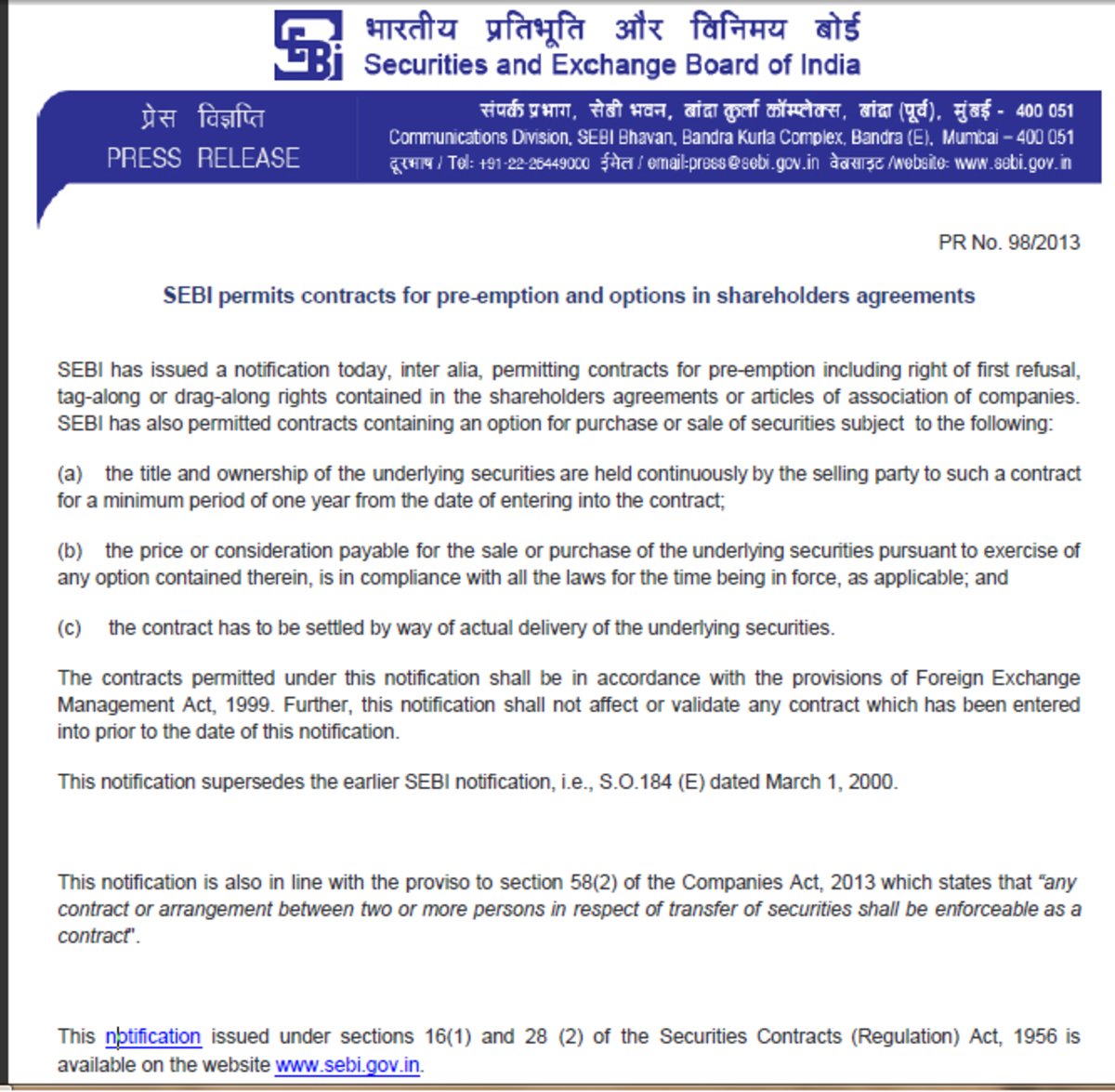

Post Properties Series A Preferred Stock Ticker

Website

| Ticker Symbol

|

|---|---|

Wall Steet Journal

| PPS.PA

|

Yahoo! Finance

| PPS-PA

|

Nasdaq.com

| PPS.PRA

|

Wells Fargo

| PPS.A

|

Google Finance

| PPS-A

|

One stock, multiple symbols

So you are interested in purchasing a preferred stock and you try to look up a quote for it. The only problem is when you enter the symbol you are not able to find it. The reason? Different sites have different formats for preferred stocks. I have personally seen at least five different formats and I am sure there are more out there.

Unlike regular stocks, there was never an agreed upon standard for Preferred Stock symbols. It seems ridiculous that each site can determine their own method, but that is what it has evolved to be and it is doubtful it will change anytime soon.

Luckily, the first characters of the issue that signify the company are the same everywhere. Most stock sites will have the auto-populate feature where it will give you options on issues that start with those characters. I recommend using this feature to initially figure out what nomenclature a site uses.

Reading this article has hopefully taken months off the time it would take you to navigate the world of preferred stocks. I would encourage anyone who is seriously interested in investing in this type of asset to take more time to understand it more fully before jumping in. For many you will find this to be beneficial to your long term financial health.