How to Invest in Farmland: The Information That You'll Need

Farmland Will Be Needed Forever

Land Can be a Solid Investment If You Purchase Wisely

Investing in Farmland isn't the same as speculation. This article deals with investing -- a longer term commitment. The investment goal is to generate continuous rent income plus a good gain on your investment when it's later sold.

Safety First...

The big attraction for farmland is it's maximum safety for the investor. Land won't suddenly disappear as a stock might and it can't be outsourced overseas.

So it's a no-brainer -- grab some land, right? Well, maybe...first we watch out for a hidden landmine or two that could turn your surefire cash cow into financial disaster.The good news is that the common booby-traps can be identified and dealt with ... if a bit of research is done.

Inflation Adjusted Historical Land Values

Good Investment Land Looks Like This

Hawaiian Taro Fields

What To Look For...

Your farmland must be rented out if it's going to produce ongoing income, so when you look at land, consider if it will look attractive to potential lessees. Desirable land, from the renter's viewpoint, should be cleared, fairly level, fertile and mostly stone free. Wet areas are troublesome, especially if they are legally designated as "wetlands" since you can't do much with it except pay taxes on it. Low, wet areas are most visible in early Spring.

Check with local Ag Extension agents and scout the area yourself to see how much farming and what types of farming are done in the area. You want to see a lot of agricultural activity so you'll have a lot of farmers looking for land to lease. Most crop farmers are always looking for more land to rent, so a wheat or corn growing area is a good bet.

In a rapidly urbanizing location, renters for farmland will be fewer than in farm country. Rental rates will be lower and taxes will be higher.

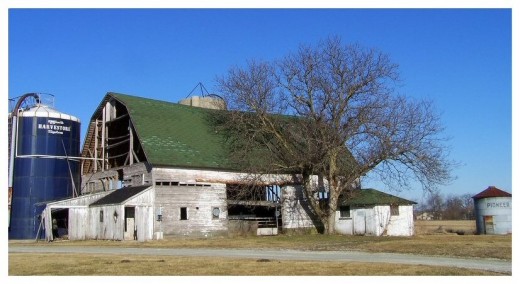

Old Farming Facilities Are a Headache

Check the Details, Then Check Again

Avoid property having any deed restrictions that will diminish it's value. If the development rights have been sold or donated, then the land is restricted to farming only and will probably be more difficult to sell in the future. If the mineral rights are not included, who owns them?

Attractive vs. Attractive Nuisance...

- Old buildings, barns, houses, ponds, manure lagoons, etc., are probably more of a liability than an enhancement for the investor. Check out the insurance implications.

- Will you will be legally responsible to maintain perimeter fences or frontage roadsides?

- Will this land be taxed as farmland or regular real estate acreage?

- Keep in mind that the landowner normally installs and maintains field drainage and provides for irrigation, if that's needed.

As soon as you have found a property with potential, it's time to "lawyer up" and get all legal questions addressed before going any further.

A Few Final Points

Here's a few items you should check out at the appropriate stage of the purchase:

- Check out the EPA list of superfund sites at http://www.epa.gov/superfund/sites/

- Check with the local Town Clerk's office for tax assessment information and check the selling price of any recent land transactions.

- Google the land's address to look for news about the property, including any lawsuits, dump sites, flooding, nuisance complaints, actions of Eminent Domain, criminal activity or inheritance disputes.

- Walk the land yourself and look for evidence of use by recreational vehicles, logging activity, or if there has been equipment transiting the property. Are there legal rights of way that you don't know about?

- If the land is currently under lease, ask the current owner what the terms are.

- Call a property insurance company that insures farms and ask about their policy regarding any structures or special conditions that exist on your potential purchase property. In recent years they have become much more picky about what they'll insure.

Land isn't an investment for everyone ... it's more of a commitment than owning stocks or bonds. It can be a rock solid anchor to your portfolio -- it'll certainly be the most interesting portion. And, as some old timer said, "They ain't making any more of it."