Successful Options Trading for Beginners

DIY Wall Street

I love Wall Street! I guess that sounds odd, given the fall of the market last year, and the continued uncertainty of our economy. I inherited this love from my mother. She has always took control of her own investments. Years ago she actually won a local "Stock Market Investment" contest in her home town. She beat out many investment professionals with her portfolio picks.

As you probably know from my other hubs, I am not rich. I do enjoy investing though, and would much rather invest my $100 in the stock market, then just put it in the bank. The great thing about investing today is that it is truly "DIY", and anyone can do it. The internet abounds with trading sites, and most do not even require a large investment to start. I appreciate the fact that in the USA, an average person like me, has the right to choose my own investments.

This hub is not about regular buying and selling of stocks though, I will save that for another hub. Today, I want to write about profits that can be made with stock OPTIONS.

What is An Option?

Buying an "Option" is not the same as buying the underlying stock associated with it. When you buy an "Option" you are not buying the stock itself. What you are buying is a contract stating that you have the "right to buy" the stock associated with it for a set price.

An "Option" then can really be compared to the old "I owe you" note, or the coupon you might buy from your teenager, giving him $20.00 now for a car wash and wax, at a later date. Your car might be dirtier next week, the price of car wax might have gone up, and he might complain that he is too busy. None the less, he owes you the car wash and wax, and you have the signed coupon to collect. Your "wash and wax" coupon is now actually worth $25.00, and you can surrender your coupon to collect.

Option Call or Option Put

There are two different kinds of options for you to buy. You could also be a seller of the options, but if you were, you would not be a beginner, and probably wouldn't be reading this hub.

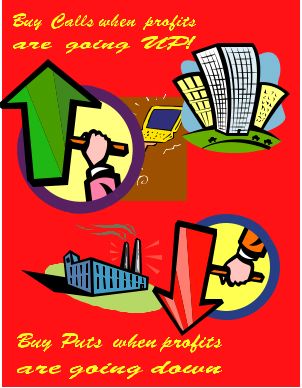

Option Calls are contracts that you buy hoping that the value of the stock will go UP.

Option Puts are contracts that you buy hoping that the value of the stock will go DOWN.

In my opinion, it is easier to start with trading "Calls", and then move on later to trading "Puts".

With either one, you only have a specified time for your option to reach it's goal. This goal is called the "Strike price."

Strike Price

The "Strike Price" is the price that you think your stock will meet and exceed before the contract expires, and becomes worthless. When you buy your option contracts, you will not just be buying a contract on one share of stock. Option contracts are sold in lots of "100". So if you buy one contract, you will be buying options on 100 shares of the stock. If you buy 5 option contracts, you will be buying options on 500 shares of the stock, and so on. Remember you do not own the stock, just the option to buy it at the strike price.

You might be thinking, why not just buy the stock then? Well, you might be looking at a stock that is out of your price range to buy. Think Apple Computer (AAPL) which is usually in the $700 range. Say this stock dropped on a bad day in the market. You would love to buy some because you feel sure it will go up in value by a lot from news you have read. You don't have the money to buy the stock though. What you can do is buy 2 option contracts (200 shares) at a strike price that you feel sure the stock will exceed in the very near future. Your option contract will increase in value as the stock value increases. You can then sell your option contract at a profit. Or, when the contract is "In The Money" (ITM) you have the right to buy your stock at the strike price, say $710, even if the stock is up to say $730 in value.

You also have to pay your broker a fee to buy and sell, so always read the fine print before you buy.

Choosing the Best Stock Option

The most difficult task in buying options is finding the best value in a stock option. Remember, the option contract itself is not worth anything. So you have to really do your homework before buying anything. Read the financial news daily. I like CNBC, and Jim Cramer's "Mad Money" show. If there is a company you are interested in, go to their website, and look at what that stock has done over the last year.

Remember, that just because a stock itself is valuable, the option contract might not be valuable. If a company's stock always hovers around the same price, say $50 a share, it would not be a good bet to buy an option on because next month it would probably still be worth $50 a share. You only want to buy a "option call" on a stock that you feel is going to jump up in value. In the same way you would buy an "option put" on a stock that you feel is going to go down in value very quickly.

cnbc.com

- Stock Market News, Business News, Financial, Earnings, World Market News and Information - CNBC

Find the latest stock market news, information & headlines. Get up to date business news as well as stock market, financial & earnings news online. View world markets streaming charts & video; find stock tickers and quotes on the official