Suze Orman's Tips For Reducing Your Credit Card Debt

Have You Been Seduced?

Credit card companies are very good at luring people into debt - sending out cards, giving them to college students and young people in their first jobs, then gradually increasing the credit limits until they are greater than an entire month's income, so you can't possibly ever pay them off in full.

Credit cards can be as addictive as a drug - only in the case of credit cards, the pusher comes to you!

If you can't pay off your credit card debts right now, today, then you're in credit card trouble. Suze Orman.

According to bankruptcy lawyers, if your credit card debt is equal to your annual salary, you will never be able to get out of debt. You are, in essence, bankrupt.

Sneaky Ways They Charge You Extra

Do you think you have a grace period? A period of interest-free purchases before they start charging you interest?

Read the fine print.

Some companies will only do that in a month when you have carried forward a zero balance. If you don't pay off the card in full, you can kiss goodbye your interest-free purchases.

Also, some will give you the month interest free, but then retrospectively bill you for interest back to Day 1 if you don't pay the balance in full the NEXT month.

Then there are the ones who penalise you for always paying your card off, by charging you an "account keeping fee" in any month that you have a zero balance on the card.

Some will offer you a honeymoon interest rate - very low, like perhaps 5% or 6% - if you transfer a balance from another card to their card.

But then, if you charge a purchase to your card, they will bill you interest on that purchase at a very high rate.They will apply your repayments against the transferred balance, which is at the lower rate, leaving the purchase to be charged at a higher rate of interest until all the lower-rate debt is paid off.

Often, you would have been better off taking a card which charged a flat rate of interest from Day 1 than all these complicated arrangements which sound good but cost you in hidden traps and charges.

Always, always read the fine print!

Cash Advances

All the credit card companies will hit you in the back pocket big time for cash advances, because there isn't a merchant in the transcation that they can gouge for 1%, 2% or up to 4% of the money.

Check your fine print, and you will usually find that cash advances carry a higher interest rate, get paid off only after all purchases have been paid off, and often incur a fee as well as the interest charges.

Just don't do it!!

Getting Rid Of Credit Card Debt

First thing: All credit cards must be cut up!

If you are not willing to do this right now, it's a sign that you need some serious help. It means that you still don't understand the implications of having debt of this kind - and that you are still being disrespectful to yourself and to your money. Suze Orman

Check out Suze Orman's 9 Steps To Financial Freedom to understand why respect for money is so important.

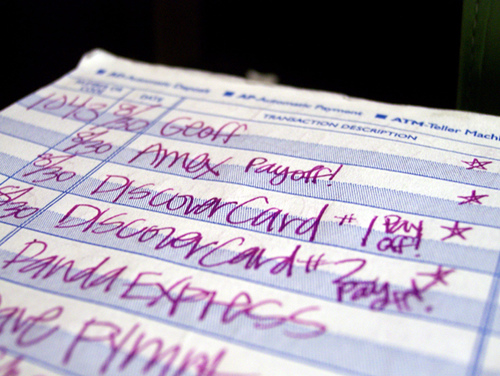

Make a complete list of everything you owe.

Figure out the largest amount you can afford to pay toward reducing credit card debt each month. For example, this might be $900.

Look at the list of everything you owe, and for each creditor list the minimum replayment, and add $10 to it. Total the list. This might come to $750.

Subtract this amount from the amount you can afford to pay. This leaves $150.

Put everything else that you can afford (the $150) into paying off the debt with the highest interest rate.

Once that debt is cleared, switch that original amount (and the minimum payment plus $10 from the debt you just cleared, which might have been $75, for example) to the debt with the next highest interest rate.

You will now be paying that next debt off at a rate of $225 per month over and above the basic minimum-plus-$10.

Borrowing Against Your Home To Pay Off Credit Cards

Sometimes, you can get a better interest rate on mortgage-backed borrowings. This makes sense ONLY if you have cut up the cards.

Otherwise, in a couple of years time you may well find have a bigger mortgage AND the credit card problem you have today is back again anyway.

In a falling real estate market, you need that equity to protect you from becoming "upside down" on your mortgage - owing more than the house is worth.

Do it if you must, but make sure the cards are GONE when you do!

Debt Free!

Nothing beats the feeling of being debt-free.

It may take months, or years, of living carefully and doing without, but the sense of accomplishment you get when you are no longer a slave to a credit card company is truly blissful!

Peace of mind is worth the discomfort of financial discipline - and before long, you will have adjusted to your new lifestyle. When the cards are paid off, instead of starting to party again, divert that monthly repayment into an investment for your long-term security.

Financial freedom is just a decision away.

Suze Orman is on Oprah this week, offering emergency financial advice to people worried about unemployment, foreclosure, or bankruptcy. If everyone would just follow her 9 Steps To Financial Freedom, such emergency advice would hardly ever be required.

But then, we all plan to get our finances in order some day, don't we? Right after we lose those extra pounds, get fit, start eating right, and be more tolerant about the Class A bitch in the office ...