Target REDcard Review

Best Store Card

There's only one store card worth keeping in your wallet. It's the Target REDcard debit card.

Most Store Cards are a Bad Deal

Cash-register transactions often include a sales pitch: "Would you like to get 10% off today's purchase by opening a new store credit card?" While this pitch can be tempting--especially for large purchases--its usually best to say "no" since most store-branded cards are a bad deal.

The disadvantages of most store-branded credit cards include:

- High Interest Rates: The average store-branded credit card carries an interest rate of 24% for everyone, regardless of credit scores. The average rate for regular credit cards is only 15%.

- Limited Use: Most store-branded credit cards can only be used in that store. Unless you shop at the store frequently, the card doesn't merit taking up valuable space in your wallet.

- Credit Score Hit: Simply applying for the store credit card can harm your credit score. Your score may take another hit since having too many credit cards is a negative scoring factor.

- Few Benefits: Store credit cards offer few benefits compared to regular credit cards, and don't usually include reward programs, extended warranties or price / purchase protection.

Given the disadvantages of store credit cards, its best to avoid them except for stores you shop at frequently that offer generous discounts to their credit card holders.

The Target REDcard Debit Card is a Good Deal

The Target REDcard debit card offers enough perks to merit space in your wallet.

(Target also offers a REDcard credit card. But it suffers from most of the disadvantages of other store-branded cards, so this article focuses on the REDcard debit card.)

The Target REDcard debit card offers a number of valuable perks, including:

- 5% Discount. This is an immediate discount taken directly at the cash register. It applies to almost all purchases, including sale and clearance items. This discount can be combined with coupons. There are a few exclusions (e.g., prescriptions, gift cards, previous purchases).

- Free Shipping. REDcard customers get free shipping from Target.com, along with the 5% discount. This is similar to Amazon Prime except it's free, but there's no guarantee of two-day shipping. Online purchases can be returned to physical stores, so returns are easy and free.

- 30 Extra Days for Returns. Customers who make purchases using their REDcard get 30 extra days to make returns (beyond Target's normal return policy for each item purchased). This perk does not apply to Target Mobile purchases, or non-returnable items.

- Extra Savings for Prescriptions. While the 5% discount does not apply to prescriptions, customers purchasing five prescriptions from Target's pharmacy get an extra 5% discount for a day of shopping. This extra 5% discount is in addition to the regular 5% discount.

- Donations to Your Local School. Target will donate 1% of your REDcard purchases to the K-12 school of your choice. It takes only a minute or two to designate your favorite school once you've signed up for Target's REDcard Online Management.

- Cash Back. You can request up to $40 cash back when shopping at a Target store. This cash, along with your purchase price, is debited from your linked checking account.

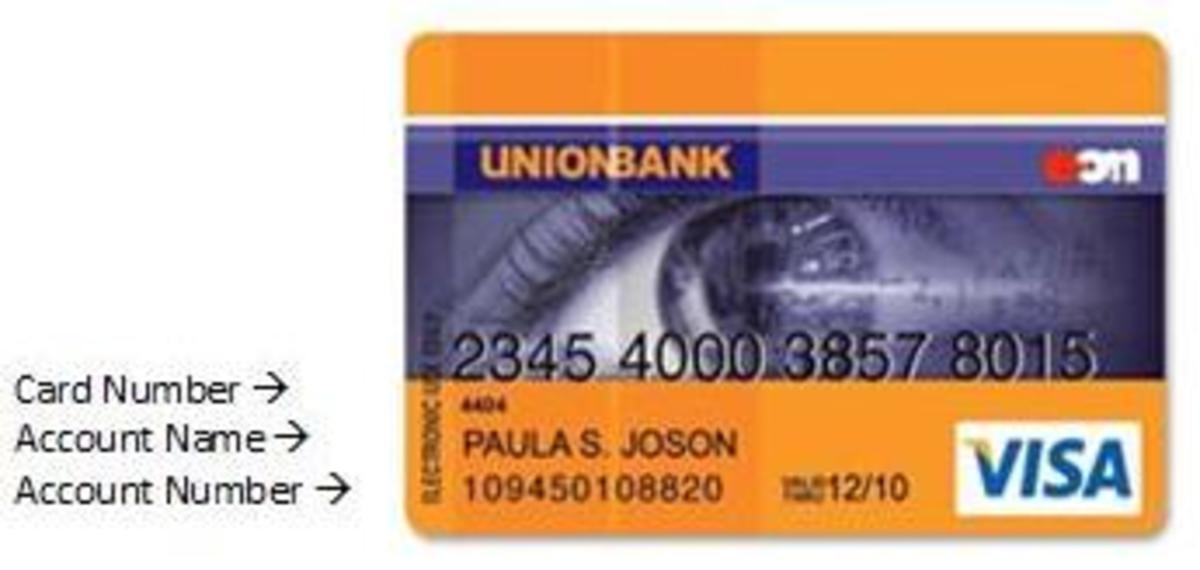

Applying for the REDcard debit card is a simple process that can be done at a store or online. A voided check is needed at the store. Any charges are debited from your linked checking account.

There's no fee for using the REDcard debit card. The only fees are returned payment fees.

Drawbacks of Target REDcard Debit Card

The Target REDcard debit card is a consumer-friendly way of paying for purchases at Target. It does have several drawbacks, all of which seem reasonable:

- No Credit. The debit card version of the REDcard does not offer credit (although, as noted above, Target also offers a REDcard credit card). This "drawback" can also be thought of as an advantage since customers are unable to accrue debt.

- No Target Mobile. The REDcard does not provide a discount at Target Mobile.

- Limited Use. The REDcard can only be used at Target and its online store.

- Does Not Build Credit. The REDcard debit card is not a credit card, and so its users can not build their credit history using it. On the other hand, it can't hurt their credit score either.

- Risk of Insufficient Funds. Since purchases made using the REDcard debit card are debited from the user's checking account, the user must remember to record these purchases on their checking account balance. It'd be relatively easy to forget to write a Target purchase into a checkbook register, and then make another purchase which overdraws that account.

Other Frugal Living Articles

- 10 Ways to Save at Starbucks

Will your Starbucks addiction kill your budget? Or, can you savor your caffeine fix while saving money? Luckily, you can enjoy the Starbucks experience by saving money in 10 ways.

- How to Reduce Food Waste to Save $100 a Month

The average family of four wastes 25% of its purchased food. In monetary terms, this family throws away $1,365 to $2,275 worth of food annually. Thus, the average family can save $100 a month (or more) by wasting less food.

- CVS Extra Care Bucks vs. Walgreens Register Rewards

You can save by buying drugs, medical supplies and personal care products at national drugstore chains. They can even be free if you use the stores' incentive coupons. CVS handily beats Walgreens in this battle of pharmacy giants.