- HubPages»

- Personal Finance»

- Tax & Taxes»

- Income Tax

Tax Amnesty Scheme 2018 Pakistan - Last Chance for the Taxpayers to Declare Undisclosed Wealth and Income

Pay Tax at Lowest Rate in the World

Voluntary Declaration of Domestic Assets Act, 2018

The Government of Pakistan has announced Tax Amnesty Scheme 2018 for the citizens of Pakistan to declare their income and assets which were earlier not offered for tax. The Scheme is announced under the two Acts; namely;

- Voluntary Declaration of Domestic Assets Act, 2018

- Foreign Assets (Declaration and Repatriation) Act, 2018

This article explains the features of Voluntary Declaration of Domestic Assets Ordinance, 2018 only as under:

- This scheme is for all the citizens of Islamic Republic of Pakistan except those holding any public office as mentioned in section 2(d) of the Act for the last ten years.

- All the individual, associations of persons (A.O.P.s) and private or public companies are eligible to declared their undeclared/undisclosed income or assets held in Pakistan.

- The scheme does not cover the cases where proceedings are pending in any court of law in respect of the undisclosed income or domestic assets. The term court of law has also been defined in section 2(1)(b) the Act as:

(b) ―court of law means an Appellate Tribunal, a High Court or Supreme Court of Pakistan;

This means that if the appeal or reference is filed by the taxpayer, he will have to withdraw his case from the court of law first and then he will be eligible for the scheme. Secondly, the person can avail this tax amnesty scheme even after issuance of show cause notice or even after passing of order by an Inland Revenue Officer.

This scheme covers all the assets held in Pakistan by Pakistani nationals.

How to file Declaration under the Amnesty Scheme?

Every individual, AOP or company, which is intending to avail the benefits of the scheme has to fill in a simple declaration of two pages mentioning the details of their movable and immovable properties held in Pakistan.

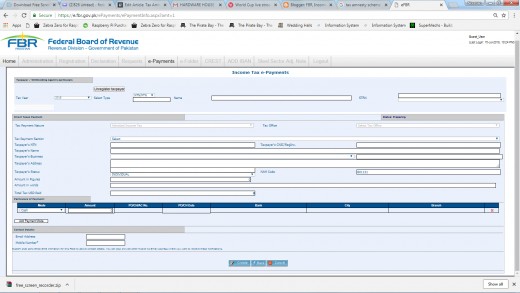

This form should be submitted online available at

IRIS login

Salient Features of the Scheme 2018

No manual from is to be submitted. There is no option available for uploading the submitted form after signatures, as some of my friends have asked that someone has told them that after submission of Form, a print out of the same should be obtained and a copy of the same should be uploaded on IRIS. For ease, the relevant section 5 of the Act is reproduced as under:

(4) The declaration of undisclosed income and domestic assets shall be made in the manner as set out in Form A of the Schedule to this Act, electronically on Federal Board of Revenue’s web portal and shall be valid only if it is accompanied by the evidence of payment of tax. The person declaring undisclosed income or wealth may be required to provide additional item-wise details of such income and assets while filing declaration on Federal Board of Revenue’s web portal.

In order to fill in the form, you first have to obtain your login in IRIS.

The method of obtaining IRIS username, password and pin code is provided in my article:

Things to do before filing your Declaration under the Scheme

Before filing your form, you may need to sort out all your assets which have been acquired from the income on which tax has not been paid. This scheme also valid for those assets, which, though have been declared in the wealth statement, but the taxpayer did not have sufficient funds to purchase the same.

In fact, the Pakistan has an undocumented economy coupled with the fact that only survey conducted by the FBR was way back in 2001. This survey was conducted with the help of Army, as a result of which it revealed that certain amount of properties were purchased out of the income not offered for tax. For example, if a person is the owner of Rs.10,000,000 but declaring income of Rs.8,00,000 per year, the Department is fully justified to assume that the property was purchased out of the income which was not offered for taxation.

So, in 2001 an Amnesty was announced which was the most successful amnesty scheme in the history of Pakistan. Thereafter, the government policies regarding taxation were quite relaxed. The taxpayers having income of Rs.1,00,000 or less were not required to file wealth statement. There was no mechanism for audit. However, in tax year 2015, again the tax law was changed and every taxpayer was legally obliged to file wealth statement irrespective of quantum of income he earned.

So from tax year 2015 onward every taxpayer has to file tax returns along with wealth statements. The wealth statements of most of the taxpayers had no consonance with the income declared by them in last fifteen years. As per general perception, the tax authorities cannot probe the investments made in the preceding six years.

So, as a result of negligence on the part of the Tax Department for almost last fifteen years there were assets of billions of rupees which were purchased by the taxpayers having no explainable sources. Now the matter of fact is that the corruption in tax department is at its peak and on the other hand there are also culprits in the profession of tax advisory. Due to this, both the taxpayers and government of Pakistan were the losers and tax officials and tax advisers were getting benefits of the loopholes in the Tax Laws in Pakistan. I have been told that the representatives of some of Japanese car manufacturing company visited Pakistan and asked their Tax Consultants why in Pakistan every year appeal has to be filed while no appeal is filed in Tax Department of Japan by the same company since its inception. This shows the complication of tax laws in Pakistan. The discretionary powers of the Taxation Officers has caused bad name for the Department. F.B.R. has to initiate measures to minimize the discretionary powers of the Taxation Officers, simplify the tax laws and facilitate taxpayers on professional basis. For documented economy, government has to encourage incorporation of companies and joint ventures. At present, the tax rates for company are on much higher side.

So the people in order to avoid the discourteous attitude of the Department prefer not to get themselves registered with FBR. In the total population of 220.00 millions, only 1.4 millions are registered taxpayers out of which half of the taxpayers are salaried persons or those whose tax is deducted at source. This means only there are 700,000 taxpayers in the population of 220.00 million which ratio is just 0.318% of the total population.

Benefits of the Amnesty Scheme announced by the Federal Board of Revenue

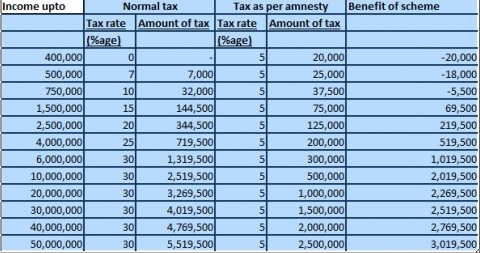

In Pakistan the tax rates rages from 5% to 30% whereas in order to avail amnesty against Pakistani assets, one has to pay just tax @ 5%. An analysis of tax payable on the basis of normal tax rates vis-à-vis tax payable on the basis of Tax Amnesty Scheme 2018 is as under:

A comparative analysis of normal tax rates and tax rates offered in Tax Amnesty Scheme 2018

A simple example of law tax rates

In addition to that the tax laws in Pakistan says that if a person conceals his income/wealth, he has to pay 100% of tax that was sought to be evaded. This means that if a person has to concealed an income of Rs.6,000,000, he has to pay income tax of Rs.1,319,500 and equal penalty which means that he has to pay a tax of Rs.2,639,000/-.

Besides, low rate of tax as per Amnesty Scheme you will be provided guarantee by Government of Pakistan that you will not be asked regarding sources from which the assets were acquired. This means that after paying tax under Tax Amnesty Scheme you will life a hustle free live so far as your tax matters are concerned.

What if one has undisclosed income/wealth but still does not availed the Amnesty?

Now all the data is converted on your Computerized National Identity Card (C.N.I.C.) which is the primary key of all the information that is generated as a result of:

i. Purchase of vehicle

ii. Purchase of immovable properties e.g. house, shop, plot, flat etc.

iii. Your bank transactions

iv. Your investments in bonds and stock exchanges.

You cannot hide your money from F.B.R. The F.B.R. has excess to all the data. For example, all the information regarding purchase of vehicle is provided by the Excise Department to F.B.R. on weekly basis and officials of F.B.R issue notices to the purchasers. This exercise will be accelerated after the date of expiry of Tax Amnesty Scheme 2018.

So be hurry and avail the benefits of this golden opportunity.

What kind of properties can be declared in the Tax Amnesty Scheme 2018?

One can declare any sort of property. The only condition is that it should not be acquired through any illegal means e.g. corruption or crime. It may consists of movable and immovable properties in Pakistan e.g. plot, house, shop, plazas, bank balances, cash etc.

How to pay tax under Tax Amnesty Scheme 2018?

Fill in the simple form, get the print of the same and deposit it in any National Bank Branch or State Bank of Pakistan

How to fill in the form of Declaration?

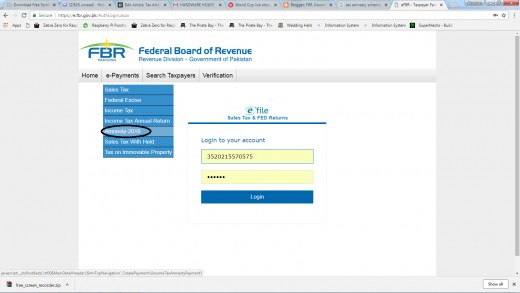

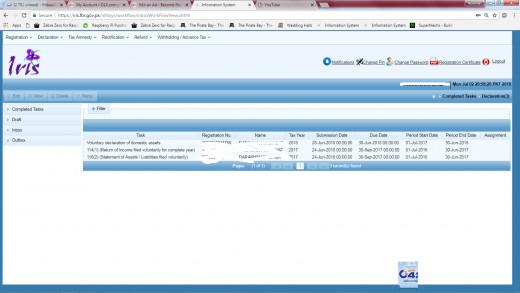

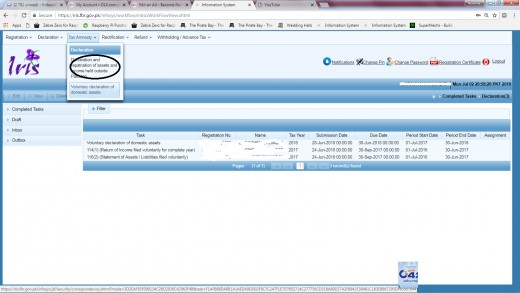

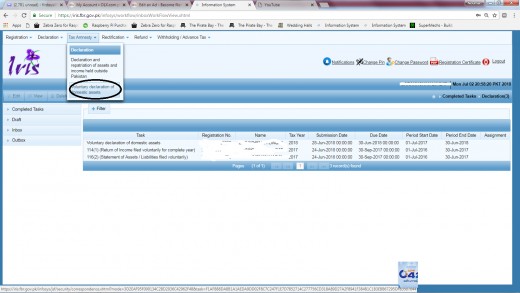

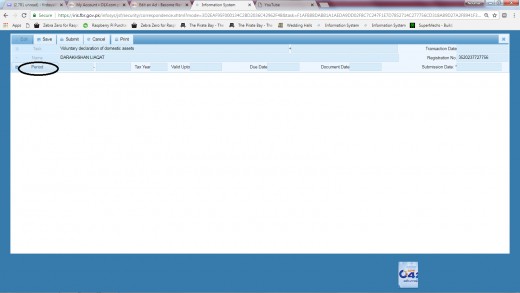

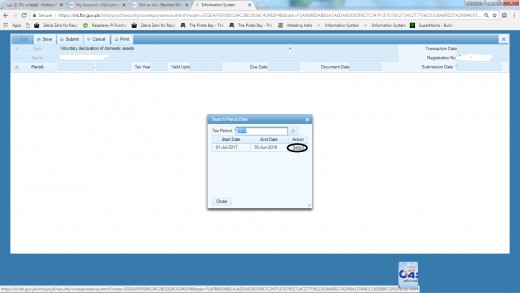

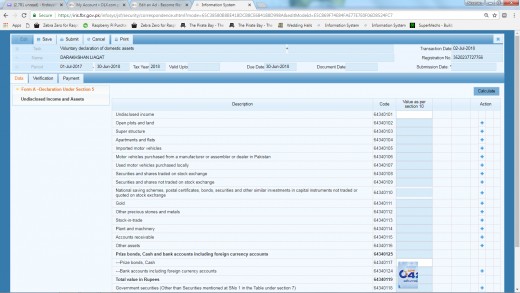

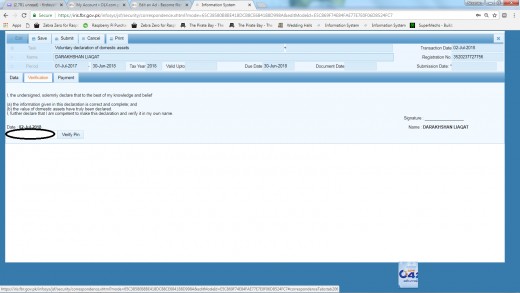

For this you have to login to IRIS. Procedure of logging in has also been explained my blog. After logging in following screen will appear:

Logging in to IRIS

IRIS1

AMNESTY-1

AMNESTY-2

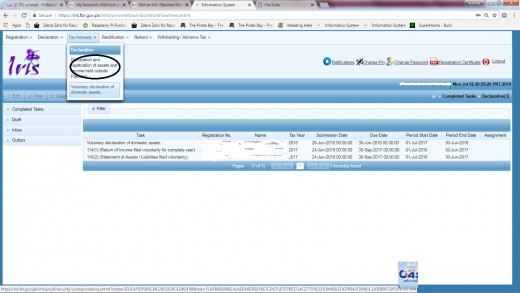

AMNESTY4

AMNESTY4

AMNESTY-5

AMNESTY-6

How to calculate the value of your properties for Tax Amnesty Scheme 2018?

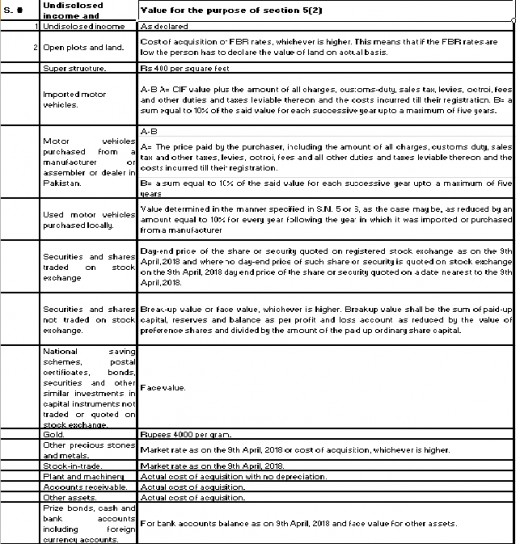

The valuation of the assets intended to declared under tax amnesty scheme 2018 is provided in section 10 of the Act as under:

Rate of properties to be calculated as under: