THINKING ALOUD (BusinessLaw) BUSINESS TAXES: Tax-Avoidance vs Tax-Planning

Disclaimer

The writer makes no warranty of any kind with respect to the subject matter included herein or the completeness or accuracy of this article which is merely an expression of his own opinion. The writer is not responsible for any actions (or lack thereof) taken as a result of relying on or in any way using information contained in this article and in no event shall be liable for any damages resulting from reliance on or use of this information. Without limiting the above the writer shall have no responsibility for any act or omission on his part. Readers should take specific advice from qualified professionals when dealing with specific situations.

Chén Róng’s Little English-Chinese Dictionary

-

“Every family has its own unique edition of unchantable mantra (unspoken difficulties)” = jiā jiā yǒu běn nàn niàn de jīng

-

win-win agreement = zuǒ yòu féng yuán; hù huì hù lì

-

tried-and-true = kào dé zhǔ de

-

hamming up = kuā zhāng zuò zuò

-

Doltish chauvinism = kuā zhāng de ài guó zhǔ yì

-

All & Sundry = dà jiā

-

A Taxing Time for Global Business

Writer: Chén Róng

Perception is a mixed bag -- truths, half-truths, untruths and unsubstantiated ones.

Ask anyone who does not know Sandra Ng some of the things about her. The conversation between A and B may go this way:

A: Sandra is a whore?

B: A cheerful one at her best! You see, she had the role of a prostitute in her movie “Golden Chickensss”

A: It is an X-rated movie, right? In other words, she is a porn movie star!

B: Oh, no! She is not a porn star. Sandra is a popular straitlaced Hong Kong actress. You see, her 38G-boob is not real. It is just a pair of breast prostheses she had to wear to get raucous laughter from the audience. It is all about good clean fun.

Perceived Increase in Corporate Tax Avoidance

The real world of corporate taxation may be such a mixed bag. European countries are seen investing in new technology – new mandatory electronic invoicing system for all businesses. The number of tax inspectors doubled. All these new initiatives were implemented to ensure “hard-to-tax enterprises” pay all their taxes. Is tax evasion really getting out of control suddenly?

Tax evasion, just like prostitution, is a centuries-old pursuit. Are there more tax evaders and prostitutes now than before? Perhaps. But then we have not accounted for the substantial increase in world population and business promulgation because of increased world trade. It is certainly true that some companies do try using unlawful ways to pay less tax such as using shadow workers on short-term contracts and thus avoid paying levies to reduce labour charges. Firms moving from a formal economy to an informal one is not the norm of the business world. The majority of companies are respectable ones that do not practice tax-dodging, although the authorities said they have used aggressive tax avoidance strategies and gimmicks paying peanuts in taxes. Companies probably use legal accounting tools to keep tax payments to a minimum -- using foreign cash to invest and expand international operations at a lower cost.

The root of the problem lies in the numerous concessions and incentives provided by governments to entice firms to incorporate local businesses. It is an open-door policy to welcome every Dick or Harry setting up shop in a country. When companies plan their tax strategies around these various concessions, governments suddenly realise they were giving away too much to the extent that they now run budget deficits year after year. These so-called hard-to-tax enterprises are effectively paying less than half the nominal tax rates. Workers, too, suffered as a result of such a government open-door policy. Their wages are so low that many of them may have to turn to taxpayer-funded anti-poverty programs just to get by. At the top end of the company, the CEO and fellow directors pocket millions, including stock option gains, bonuses and other performance pay. This situation is a result of a generous tax code where unlimited amounts of wage-related expense are tax deductibles. Where is the minimum wage law that should be in place to protect its workers? Probably workers, too, unknowingly accede to the concessions so that these foreign firms agree to set up local businesses. New jobs are made available. That might have been a government's intention.

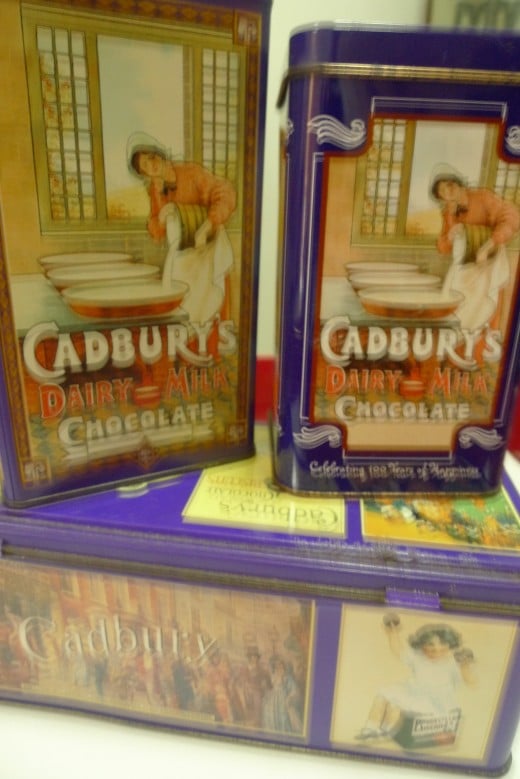

A Case Study

Let's now have Cadbury and its take-over by Kraft as a case study. The United Kingdom has been welcoming companies (especially foreign ones) by cutting tax rates -- especially on foreign-sourced finance income. The government also created fiscal incentives for companies to shift certain activities, such as research and development, to Britain. Cadbury did take advantage of conventional strategies to cut tax, borrowing heavily in high-tax countries (foreign-source finance income as encouraged by the UK tax code) while financing growth through low-tax jurisdictions such as Ireland. Now, after two decades of debt-financed expansion, the group has transformed itself as a global company, earning about ninety per cent of its profits overseas. It was reported that the chocolate maker paid an average of £6 million a year and creating 4,500 UK jobs and probably another 20,000 jobs in its supply chain. The company has exploited opportunities offered by the UK tax regime – ‘loopholes’ burrowed are fiscal incentives provided in the tax code and it is probably unfair to describe the tax planning as aggressive tax avoidance. Moreover, these loopholes are but conflicts between national and international laws, and it is hard to blame for-profits companies from adopting jurisdictions that offer their stakeholders the best deal.

The takeover by Kraft Foods USA is an inevitable event as the company had to find ways to reduce debt and expand overseas to stay in business. Yes, UK tax and UK jobs will migrate overseas but Cadbury was saddled with a mountain of debt (some £20 billion) if the merger with Kraft was passed. A fail Cadbury would mean no tax revenue and no UK job.

This is just an opinion of a non-tax consultant.

Do Not Follow Blindly

At traffic light crossings, there will always be risk takers present. They do not wait for the green man sign to light up before crossing a six-lane road. But there are blind followers who do not even take a glance at the little traffic light man before crossing. They realise their own follies only when on-coming vehicles whizzed past blasting their horns.

The writer's has this opinion on what small firms should do for tax planning. They should never use tax havens for their tax planning - havens tax authorities back-listed as notorious for tax evasion and money laundering. Big multinational companies may have good reasons to use the services of all kinds of tax havens worldwide, but small companies should not just follow them blindly. They may be placed together with those tax evaders and fraudsters and all will likely be dealt with under the same roof. Big multinational companies do have the resources to argue their way out of their difficulty; their myriad business activities can help explain their use of select tax havens are the result of underlying competitiveness and fiscal prudence. Small companies do not have such breadth and width of business activities as big multinational companies to explain and free themselves of alleged offences. Besides, small firms could not spare the time, not to mention the expenses and fines imposed on them.

There is really nothing unusual for globe-trotting small firms to register and operate holding companies in foreign countries, but there is a proviso to bear in mind. They have to show that the holding companies are not corporate façade (P O Box Company in a tax haven) to shield an artificial income allocation without economic substance. In other words, there should be legitimate work done by the holding company in areas like research and development, marketing, banking and treasury functions, intellectual property management, logistical and other services within a free trade zone, etc.

Don’t Question the Authority

Almost in every culture, family members never question the head of the household why certain things got done a certain way; nor ask for an apology from him even for seemingly obvious mistakes made. It is both politically incorrect and unthinkable. In the corporate world, companies have to know that doing business itself is a risk. There will be uncertainties in an increasingly challenging global business world. Small firms will be the hardest hit if they are ill-prepared for uncertain taxing events.

Therefore, it pays to be constantly kept aware of likely policy change; and make changes within their business systems to deal with the new state of affairs -- fewer concessions. India, at short notice, imposed a 5% tariff on iron ore pellet exports. It was an attempt to safeguard domestic supplies, and to increase tax revenue as well. MMTC - a top Indian trader - spent millions converting its newly built iron-ore export terminal to one for coal shipments. Other less-well-off traders had to throw in their towel. The same situation happened in Indonesia recently. New rules banned export shipments of ore. An export tax was imposed with immediate effect. Some people said the new rules favoured the long-standing international miners who are able to build smelters and other infrastructure. In fairness, efforts by Indonesia to win a greater share of its own mineral wealth are not a happening that is completely unforeseeable. It did not come earlier because the country needed the foreign companies to bring in capital and know-how in developing the mines during those early years. Things then were in their infancy. The latest development should not come at a surprise even with the smallest of players in the mining industry.

The truth of the matter is that countries are hard-pressed on finding ways to raise money to pay for the myriad of expenses expected of a government.

READ OTHER STORIES AT:

http://chenrong.hubpages.com

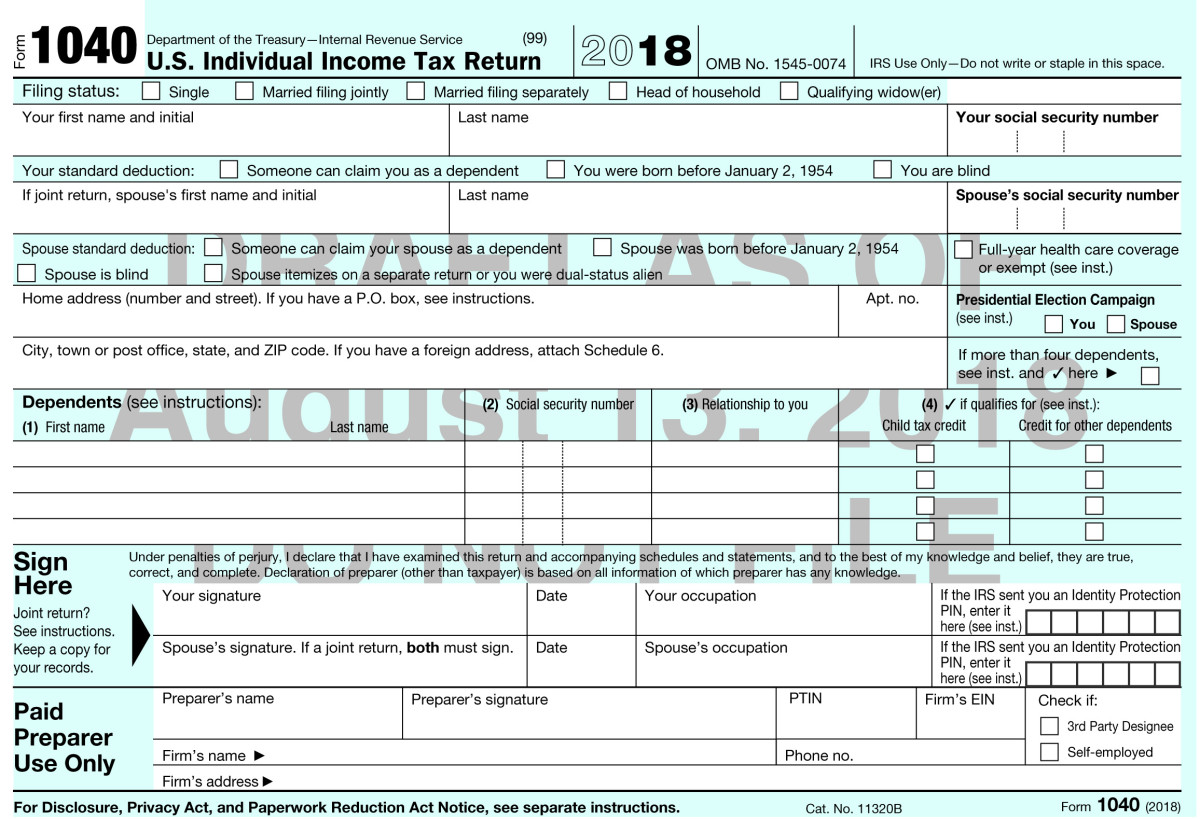

BUSINESS TAXES:

Tax Avoidance vs Tax Planning

No longer in Lockstep

WRITER: Chén Róng

Whichever way one looks at it, direct and indirect taxes remain a conundrum - a paradoxical, seemingly insoluble, and difficult problem between governments-in-debt on one side, and reluctant taxpayers on the other side of the spectrum.

- A tug-of-war

A decade ago, when Cyprus advertised itself as a place for millionaires looking for a tax-attractive place to do business, as well as park their money - no questions asked -- businesses and the wealthy came in droves. Today, when this island country decided on a one-time tax on private deposits in Cypriot banks, the wealthy hit the panic button, reminding us of mosquito fogging in many of our high rise residential buildings. On a Blue Monday morning, the moment fumigation men arrived, a swarm of mozzies would rush to seek refuge in a high-rise apartment next door; and to an adjoining one if they were again attacked by deadly fumes. Migration of mosquitoes is similar to hot money flows - flight to safety is always an immediate response to every threat to health and wealth.

What comes as most outrageous to the authorities is: like mosquitoes, the wealthy individuals and businesses take refuge just next door, near enough to come back to enjoy the good things in life offered by the abandoned home. The French media have had occasions vilified the wealthy for being unpatriotic -- crossing the border to Belgium which has no wealth tax or capital gains tax on asset sales. These elites were assisted by offshore private banking services, popularly known as inter-bank businesses. When these banks joined hands in moving money around, they unknowingly enabled the evasion of tax by some wealthy individuals; people whose tax planning was based on deliberate non-declaration of income which is a criminal offense in most countries.

Why are the loyalists shying away? People who have had heavenly good time for the past decade? The French and Cypriot governments, once upon a time put in high places, are now considered thieves who steal from their own people; skimming money from bank deposits! It seems so unfair; people should be seen extending their helping hands of friendship at a time of crisis. The country now faces a financial crisis and further bailouts seem unavoidable. It is probably taboo to talk about it --quoting the old Chinese saying: "Every family has its own unique edition of an unchantable mantra (unspoken difficulties)". France and Cyprus are not alone patching up financial holes as many European Union members too are on the heels of debt, hence an outside judgment call is unwarranted. Let us take a closer look at this tug-of-war. We will leave the wealthy individuals alone and listen to the rumblings of corporate tax-payers.

- Both Sides of the Story

- The Lockstep

In theory, tax-avoidance is understood to mean the structuring of one's affairs to reduce tax in legally permissible ways. In other words, we know what it means to say: arranging our affairs within the law, so as to minimize our tax liability. However, such a transaction would only be acceptable if it has commercial substance; it is not a sham such as the creation of a shelf company to hold certain assets to avoid paying tax. In short, the tax payer entering into the tax avoidance arrangement must be done in good faith and for bona-fide commercial reasons; and that the arrangement fell within the stated scenario under the relevant law.

For big companies, their need for a diversified portfolio will mean that tax-planning is an unavoidable necessity; and that includes routing transactions through offshore financial centers, some of which may easily be identified as tax-havens. In the course of such legitimate tax planning, the corporate tax payer may take full advantage of all eligible exemptions, deductions rebates, and etcetera; in order to shift profits offshore without violating all legal provisions. Now that many countries are at the brink of bankruptcy, goal posts are shifting with the two concepts -- tax avoidance and tax planning(different as they may be) are no longer seen walking in lockstep. Similarly, the tax administrator and corporate tax payer are both not dancing gracefully in tango double lockstep.

On the one side – the Tax Administrators

Tax-administrators are naming and shaming tax-payers: specific jurisdictions are placed under colour-listings ranging from grey to that of white. Such category adulteration has affected legitimate tax planning of the big established corporations. Since they have to be careful not to use abusive tax shelters serving no economic purposes, many rushed to position themselves away from tainted (black) to untainted (white) jurisdictions. Normally used tax planning jurisdictions such as Liechtenstein and Mauritius will see a continuous fleeing of corporations to places perceived as acceptable -- where substantive business operations are routinely carried out. Over time, the administrators are adamant to have them all painted white, figuratively speaking.

Tax-administrators are intensifying cooperation with others; by inking tax information exchange agreements to snuff out ‘Black Money’ – especially corporate bank accounts with undeclared assets. Some tax laws demanded payment retroactively on long concluded deals; fortunately, these are but rare cases.

Tax-administrators are now fine-tuning their tax systems. Some undefined concepts are:

I. Aggressive tax-avoidance strategies

II. Excessive (and inappropriate) income shifting; legal planning that involves the shifting of funds into subsidiaries in low or zero-tax havens;

III. Unwarranted tax planning

Where terms are left open to broad interpretation, it provides plenty of room for arguments by the authorities.

Tax-administrators are now saying: Corporations may not have broken existing laws through tax planning nevertheless, they are free riding on the efforts of others; and not playing a fair game in paying their fair share of tax. They are stashing away income by basing themselves in low-tax countries (such as Ireland and Bermuda) practising a new type of tax avoidance – defined as legally planning to avoid taxes. With this new normal, such corporations may fall into the same classification as the tax evaders. Tax avoidance is therefore the grey area between compliance and evasion and every individual case has to be determined on its own merits.

The crackdown continues relentlessly with audits done on another class of big tax-avoiders - or evaders – with hundreds of millions having gone uncollected through blatant violation of tax codes. These are the corporate tax-payers who declared losses from the start of operations, despite making profits; and repatriating profits disguised in the form of inter-company expense payments.

Tax-administrators are now acknowledging that their existing tax systems are full of corporate loopholes; and their entire system is ill-placed for the internet age. Companies which provide digital services should be charged VAT on all digital services provided to European Union residents, regardless of where the digital service provider is located –a death knell.

Moreover, companies are now able to use complex accounting methods to reduce tax liabilities through loopholes in different tax regimes across specific regions – loopholes the authorities themselves may have created when allowing companies to be based in member states. That was then, this is now the new normal - companies using these loopholes may be regarded as operating tax scams; practising aggressive (if not abusive) tax avoidance, although legally speaking; these tax payers have broken no laws.

It’s a New Normal!

Such lofty rhetoric stung corporate executives; and it is also potentially troubling to the business world. With the exception of the tax experts, navigating through these tax landmines can be mind-boggling for the small and medium –sized enterprises (SMEs), just as it is perplexing to the writer now sounding the warning bell.

With this confused state of affairs, sea change may turn to their shores. SMEs should sit right up in the face of what is now troubling the big boys. Are these accusations fair? Let’s hear the other side of the story.

On the other side – The Tax-payers

Tax-payers’ bills, particularly the big corporations, are aboveboard: They declare their income properly although their tax obligations can be interpreted differently by the authorities. What they do is legally shifting profits to territories where they can pay the lowest amounts; their group structure and business model enables them to use globalization as the tool in paying less tax than others. The authorities accused them of playing one country against another because countries are not cooperative enough to create an international tax system to plug all these tax loopholes

Tax-payers are facing a shortage of qualified staff and now faced with the new challenge of greater audits and scrutiny by tax administrators as business has to grow globally to be economically viable in a competitive world. Their problem seems insurmountable. Having to employ and keep capable employees for subsidiaries spreading over five or more countries, their difficulty is made more challenging if the world economic runs a prolonged downturn. Adding more staff means additional costs to the business.

Tax payers expect their tax departments to free up cash: Indirect taxes do matter in good days and all the more so in the present long drawn economic downturn. For globetrotting companies, efficient management of taxes can unlock real bottom-line savings and improving cash flow. Value Added Taxes (or Goods and Services taxes) and Customs Duties in international trade and the pursuing of repayment of overpaid import charges are important watch-keeping areas. While there exists benefits of trade facilitation (free trade zones, licensed warehouse, etc.), the flip side is: limitations imposed by cross border scrutiny to meet Customs compliance, and they vary from country to country. In tough economic times, Customs authorities have increased scrutiny of filings and compliance, particularly refunds – thus affecting cash flow; some sober complaints of wine dealers and other merchants.

Tax-payers think lowering of corporate tax is not necessarily a concession: Headline statutory corporate tax rates are on a general downtrend with nations vying strongly for international investment; but why is it not a concession? The reason: an increasing cross border mobility of labour and capital makes them difficult to tax. There is an urgent need to pursue new revenue streams - a rising trend with governments making legislative adjustments to cast a wider net over taxable income - to make up for revenue shortfalls. These new income streams are:

- Putting in place a stricter interpretation of existing laws

- Introducing transfer pricing rules

- Stepping up audits on cross border transactions through information exchanges with other countries

- Enforcing new and existing economic substance rule – imposing penalty on understatement of tax for transactions that lack economic substance – basically to nap those companies hiding behind tax shelters!

All these measures will be adding to compliance burden of the corporate tax-payers leaving them with lesser time minding their business.

Tax-payers have asset-heavy business which is also highly cyclical: Shipping is one such business. Unlike a factory, a cargo vessel does not have an obvious place of residence for tax purposes and, therefore, it is always difficult to impose shipping taxes. Except for paying an annual tonnage tax at place of registration, a shipping operation is essentially tax-free; therefore one operating in a regime that imposes high taxes would quickly put a particular company at a grave disadvantage vis-à-vis its competition. In fact, many ship-owners do not make big profits trading their ships even in a tax-free environment. The shipping kingpins, traditionally the Greek owners and now the Norwegian tycoons such as John Fredriksen, are adept at buying in the troughs and selling at peaks. Not surprisingly that when these prudent investors sell their modern tonnage and new ones still under construction, substantial capital gains were made to tie them over the cyclical downturns.

It may be true that some big businesses have aggressive tax avoidance strategies because they are duty bound to shareholders to plan their way to paying less to governments and more to them. Moreover, governments which failed to practice financial rectitude should not be bailed out by tax-payers. In fact, good times or bad, some big businesses have made contributions in creating thousands of jobs for their home countries; they contribute a lot in payroll taxes.

Tax-payers’ increasing profits may be due to operational improvements maintained over the years and not a result of aggressive tax planning; and it is the duty of a government to encourage companies to implement operational improvements to grow their business. There are start-ups whose business models require that they locate in various countries to survive the budding years. For illustration: An Asian start-up in the online gaming business – it has a start-up capital of US$2.5 million provided by Institutional investors. The company has a large user base across Southeast Asia but cross-border taxes slice off a great portion of its annual revenue. Since it has limited financial resources, the company had to repatriate earnings from these Asian subsidiaries because of the need to pay game developers promptly. But wherever it does that, these countries levy intellectual property taxes on the funds – a strain on the company’s limited cash flow. It has no choice but to reorganize its activities in these countries to minimize its tax exposure. Killing such a business is a no-win situation for all. Hamming up a robust tax audit, tax-administrators may unwittingly kill such survival stories. Tax-payers ranted: Governments should be aware of this need to balance their act.

- It takes two to dance the Tango -

Indeed, in Ballroom Tango, a weight change by one partner leads to an automatic weight change by the other. Yes, the writer is suggesting that both the corporate tax-payer and the tax administrator should perfect the art – whether in double lockstep, cross, parallel or promenade walk – to give each other greater elegance in self-expression.

- Corporate tax-payers should take a step back: tax PLANNING need not be complex.

Human nature is such a perplexity that when a tax adviser speaks of the importance of early tax planning, listeners generally will brush it aside as sales talk. In truth, for some SMEs, taxation may not be on their minds when planning business operating structures. For others, they may not want to factor in the cost of having a tax advisor, thinking they may not be in a potential tax position in the near term.

It is easy to be wise after the event. Fire fighting is hazardous work that involves a high risk of death or injury to all and sundry. In the same vein, tax planning after the event will be more costly; and it may produce undesirable results such as an unlawful outcome. Tax planning is not rocket science; it should not have to involve complex implementation of systems and ideas – it pays to shop around a little for a practical and easy tax planning before the event. If you have some time, do read the sub-hub “It Takes Two to Tango” (attached to this article) – an analogy that stresses on the importance of getting something that suits you.

- Corporate tax-payers should demonstrate social responsibility.

Businesses, both big and small, should run on ethical, socially responsible principles; and paying a fair share of tax is one such practice that should be highlighted particularly by investors of public listed entities. Firms should embrace tax transparency if they want to stay in business. Siphoning off the bulk of taxable profits from local operations to offshore shell companies in dodgiest of havens merely to shelter them from tax is a socially irresponsible act when these entities themselves have been benefited from tax-funded public services. A change to more socially acceptable practice is an inevitable outcome when the consumer public steps in threatening to boycott buying of goods and services from such companies paying no or little tax to their home countries. Why wait for such public outcry? You may have to bow to unwanted publicity by offering a voluntary tax contribution to the home country.

- Tax administrators should take a step forward in graceful non- suffocating style

Coming back to the London shipping business model as a befitting example - shipping tycoons, such as the London Greeks, have been the driving forces of a vibrant London economy. The flow over into other supporting enterprises actually creates employment to Londoners. These ship-owners operate out of London as ship agents because a non-domicile rule enables them to keep all profits earned in tax-free jurisdictions as their ships go places. It goes without saying that a tax change may force these shipping tycoons to leave London for other tax-free regimes. If the non-domicile rule is changed, it is hard to label ship-owners as ungrateful when they leave in droves.

You may blame it to free trade for inundating cross border businesses. Condemn good telecommunications, if you will that Athenians shipping tycoons can now easily talk to clients such as big oil companies in New York and London over immaculate telephone conferencing systems. It is a far cry from the days of poor and faulty communication lines. Except for harnessing an old tradition, Greek owners no longer have to locate themselves in London; and a change of tax rule will stir them out of their resting laurels. For now, countries the world over are wooing international investors by developing their infrastructures such as telecommunications and airports, Under these circumstances, playing the hard ball may end up culling the proverbial goose that provides the pot of golden eggs.

Governments should also listen to tax experts who may recommend measures that can stimulate business growth. A reasonable tax code is more than just about attractive tax rates. The system has to be efficient as well. Instead of trying to plug all tax loopholes and thus creating a very complex tax code; or using confusing adjectives (such as abusive or aggressive) in describing tax avoidance strategies – install tax rules that are simply to comply with. Business people love certainty in tax treatments; uncertainties may cause companies to locate their businesses elsewhere.

- Tax administrators should polish up their act

In a competitive business environment, governments should do more by (i) lowering corporate tax rate and (ii) design a simple and efficient tax code. Renegotiation of outdated double tax treaties on more competitive terms may be helpful to the tax system.

Singapore has done a lot in this respect; of course, Singapore’s attractiveness as a corporate location goes beyond tax to include its easy and efficient transport, a high quality of life and well-trained people. In case being finger-pointed as doltish chauvinism, let’s take a leaf from another city-state: Malta, which is located in the heart of the Mediterranean Sea, has more than a century old maritime tradition. Its favourable regulatory and tax regime is attractive to the shipping industry. Nevertheless, Malta does not rest on its laurel; so far it has entered into more than 50 double tax treaties, and a reciprocal agreement between Malta and the United States exempts shipping and air operations from income tax.

Similarly in Japan, plans are now underway to create special innovation zones in Tokyo and Osaka for industry such as aerospace; these zones come with lower taxes and special tax deductions to donations given to research and development. These measures to lower tax burden to the business community will surely bring cheers to a moribund Japanese economy. This tried-and-true strategy may be called re-targeting – a fine-grained way in nudging investors.

- New Rules for a New Era

The global tax landscape is now evolving because of an economic slowdown following a global financial crisis. Some tax policies turned inward looking – closing exemptions and loopholes in existing tax codes and greater enforcement actions against tax-avoiders – all designed to increase tax revenues to prop up their ailing economies. In addition to the increase in value-added tax, there will be new, complex and costly administrative burdens as a result of the augmented tax compliance and reporting procedures. For countries with complicated tax code, it can be outrageously daunting to figure out how much tax one has to pay.

While the big boys have tax-advisors in their employ, the small and medium-sized companies do not; and they are the ones that need advice on the changed era. There is still sufficient time to plan, budget and implement the necessary changes to their current business models, but time is running out for fast action; it is about high time they discuss with tax-advisers for win-win strategies.

Repeatedly ignoring warning-bells and flashing lights on the current tax-avoidance kerfuffle seems tantamount to corporate hara-kiri.

READ OTHER STORIES AT:

http://chenrong.hubpages.com/hub/THINKING-ALOUD

---- E N D -----

Hubpages do not support words written in the Chinese Language. Readers can get a free online English-Chinese translation from GOOGLE TRANSLATE OR TRANSLATED.net

The difference between tax avoidance and tax evasion is the thickness of a prison wall

— Lord Denis Healey