Tax Credits And Deductions For Going Green

GOING GREEN CAN NET YOU TAX CREDITS AND TAX DEDUCTIONS

Tax time is just around the corner again. But did you know there are many tax credits and tax deductions that people can take when it comes to their taxes many people don’t even know exist?

Learning about the various ways going green can save you money (whether you’re a business or an individual) is worth your time.

You may have made purchases or made home improvements or business improvements that can save you tax dollars!

Or if you’re planning on doing home or business improvements, buying equipment in the future, or just making routine purchases, the items that you buy may qualify for green tax deductions or green tax credits!

Let’s check out what’s available and the difference between tax credits and tax deductions.

TAX DEDUCTIONS VERSUS TAX CREDITS

Apples and oranges. The difference between tax deductions and tax credits is like comparing apples and oranges. Tax credits are by far the best tax advantages you can get. These are dollar for dollar right-off-the-top of your tax liability deductions. For instance, if you have a $100 tax credit for something, you skim off $100 from your tax liability. A $100 tax deduction on the other hand may only net you $10 off your tax liability. Again, tax credits are better than tax deductions.....but any money you save on your tax bill is money back in your pocket.

ELECTRIC CAR TAX DEDUCTIONS AND TAX CREDITS

Go electric. Many people think that the rebates or tax credits on hybrid vehicles are over but in fact they’re not. Two new cars came out in late 2010 which are eligible as well. You just have to check to confirm if the hybrid you’re interested in buying or bought is an eligible hybrid. There are several. Hybrid cars will earn you a tax credit of up to $7,500 depending on the car. The 2010 Ford hybrids like the Fusion are eligible as is the Chevy Volt or the Nissan Leaf. Check at Alliance to Save Energy on their web page for Vehicle Tax Credits for information on which vehicles qualify in what year.

ALTERNATIVE TRANSPORTATION TAX-FREE MONEY

Pedal to the metal. For putting your pedal (bike) to the metal, participating employers can give you a $20 per month as a tax-free fringe benefit.....just for biking to work. They can also offer you up to $230 in reimbursement for taking public transportation to work such as trains, buses, van pools, or subways. These are employer based programs so your employer must participate but a great way to go green!

SOLAR TAX CREDITS AND DEDUCTIONS

Here comes the sun. People are afraid that the high cost of installing solar panels isn’t worth the tax credit that they could obtain but the truth is, prices are coming down the more popular they become. Also, the tax credit for solar energy isn’t just about installing solar panels. There are things like solar-powered water heaters than can earn you a tax credit (dollar for dollar) of 30% of the purchase price while saving you money every month for years to come. These solar tax credits are available to individuals and to businesses alike. You can also buy solar radiators and solar shower products.

WIND ENERGY GREEN DEDUCTIONS AND CREDITS

You are the wind beneath my wings. Like solar power conversion, people are a little afraid of thinking about installing a windmill on their property whether it’s business or residential. However, installing just one will earn you a tax credit of 30% also based on the cost of the windmill installed. You can also sell excess wind energy to your local power company in many instances for more of a savings and money in your pocket! (The cost of an average windmill is $40,000 but you would get 30% of that back in tax credit costs right off the top of your liability). Installing a windmill can be a big tax credit for you but it can also give green energy benefits to a whole community!

RECYCLING AND REPURPOSING GREEN TAX DEDUCTIONS

Everything is new again. Recycling is an energy efficient tool and is part of going green. Recycling products into new products costs money though. Reuse or repurposing as it is called on the other hand is becoming more and more popular as not only an energy saving method but also as a better use of our resources. Consider donating quality clothing, appliances, furniture, even computer equipment to the Salvation Army or Goodwill. You need to get a receipt but this is a form of tax deduction where you get fair market value for whatever you donate. Depending on how much you donate, it adds up. Also, it does the environment good to reuse and repurpose rather than recycle!

GEOTHERMAL HEATING TAX CREDITS AND DEDUCTIONS

Turn up the heat. Installing geothermal heat pumps will net you a 30% tax credit of the cost of the system. You will also qualify for the same tax credit for installing energy efficient air conditioning systems or replacing them.

ROOFING GREEN TAX DEDUCTIONS AND TAX CREDITS

Roof over your head. There are tax credits available for energy efficient roofs....whether new or replacements. Roofs that reflect the sun or trap it depending upon the climate and the season are green ways of using natural resources to offset the high cost of providing energy to millions of homes for heating and cooling.

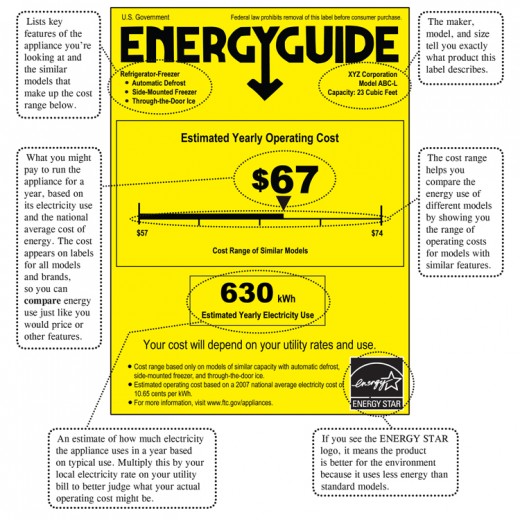

EFFICIENCY-RATED PRODUCTS GREEN TAX DEDUCTIONS AND CREDITS

Efficiency counts.

Consider the appliances that you purchase and you'll be eligible for

tax credits of from $50 up to $350......just by buying energy-efficient

appliances. This is also true on

purchases of new electronic equipment or even office equipment. Even replacing your light bulbs with

energy-efficient fluorescent bulbs or installing energy-efficient ceiling fans

can net you tax credit or tax deduction dollars.

Did You Also Know.......

- Building a green home can save you money. The contractor can make out in terms of tax credits and the home builder can as well.

- Businesses going green can likewise be eligible for many tax credits. Just by replacing light bulbs with energy efficient bulbs, you can save a bundle and get a tax credit or deduction.

- Individual states have their own going green incentives so always check with them to see what offers or credits are available.

- Improving insulation and replacing windows can also earn you tax credits or deductions.

- Having an energy assessment by your local power company can clue you in to what is available locally and nationally in terms of energy-efficient tax credits and deductions. There are even rebates available and for businesses, there are grants and loans for going green.

Tax Credits and Tax Deductions for Going Green

In short, there are many ways that you can get tax deductions for going green and many that you can get tax credits for.

When going green, sometimes the initial expense seems prohibitive but when you look at the bigger picture, in terms of conserving the world’s resources and making it an environmentally more friendly place in the long run, isn’t it worth it?

Also, take into consideration that though the initial outlay might seem steep in terms of cost, in all circumstances where people switch to greener ways of life, it ultimately saves you money over time and big bucks! It’s like investing in a money-making or money-saving system.

Whatever ways you can go greener in your own life, please do so. The planet needs your cooperation!

If you have more green tips or how to save on your taxes by going green, please add to the quality of my hub and leave an enlightening comment below!

Learn More About Green Tax Credits and Deductions

Visit:

- IRS.gov

- Energystar.gov

- USA.gov

- CPA's and accounts can give you up to date information on all tax credits and deductions available for you to take year by year

More Informative Hubs on Green Tax Credits and Deductions

- Don't Miss Out on Your Energy Tax Credit

Income taxes for middle class and affluent Americans are at an all time high and going up. But, there are still some ways to reduce your taxes, if you take the time to look. One of the best ways to save money... - Solar Energy Tax Credits

Solar energy is one of the best alternative energy available today. And the benefits we can get from it dont just end with clean, unlimited and free energy. Using solar application such as Photovoltaic... - Energy Tax Credits 2011

How do I apply for energy tax credits for 2011? Many taxpayers are asking this question because some of the federal energy tax credits are due to expire. Please keep in mind the technical rules that apply to... - Federal Home Insulation Energy Tax Credit 2010, 2011

Did you happen to install home insulation last year? You may be interested in learning more about the federal home insulation energy tax credit. If you have made your home more efficient, you might be able to... - Federal Energy Tax Credits for 2010, 2011

You may be eligible for a federal tax credit if you purchase an energy efficient product or renewable energy system for your home. If you are familiar with the ENERGY STAR products dont think they all... - The Energy Tax Credit: Is it Worth It?

The US Government's Energy Star Program reports that the typical American household spends approximately $1,300 per year on home... - Energy Tax Credits - Energy Efficiency

This seems to be the Government's Best Kept Secret these days. - Reducing your Energy Expenses with Tax Credits, Inc...

Whether you are building a new home or making home improvements, its a great time to take advantage of tax credits, rebates and incentives for a greener, more energy efficiency home. Since the passing of... - Get Tax Credits For Energy Efficiency

Author: Esmeralda Redfield It was already possible to get money (in the form of a tax credit) from the government when you made energy saving improvements to your home (like solar panels, geothermal heat... - 5 Fuel Efficient Cars to Maximize Your Clunker Tax C...

A lot of people have been doing research on this new law recently signed by President Obama. Under the CARS Act, you can get a tax credit up to $4500 towards the purchase of a new more fuel efficient car. ... - Tax Credits - Energy Star, Energy Efficiency Tax Cre...

Sometimes you have to spend money to save money, even if it seems counterintuitive. In todays economy, it may be difficult, but after reading this hub you may be more willing and motivated to save for one...