Tax Deductions for Contributions to a Traditional IRA

Tax Deductions for Contributions to a Traditional IRA

Contributions to a traditional Individual Retirement Account (IRA) normally result in a deduction against gross income on one’s tax return. However, if a taxpayer (or one’s spouse) is covered by a retirement plan at work, at any time during the taxpayer’s tax year, their ability to deduct contributions to an IRA on their tax return may be limited or prohibited. To determine if a taxpayer is covered by a retirement plan at work one must look to the type of retirement plan offered to the taxpayer as well as the tax year of the taxpayer. Most taxpayers follow a calendar year accounting period.

Specific rules determine the tax year a taxpayer is considered covered under an employer plan. These rules vary based on whether the employer plan is a “defined contribution plan” or a “defined benefit plan.”

An employer defined contribution plan is a plan that provides for the creation of a separate account for each employee covered under the plan. Defined contribution plans list the amount the employer may contribute to the employee’s account, as well as the amount an employee may contribute. Realized benefits from the defined contribution plan stem from contributions made into the account plus any earnings growth. Defined contribution plans include 401(k), 403(b), profit sharing plans, stock bonus plans, and money purchase pension plans.

If the employee contributes money into the defined contributions plan or the employer makes allocations to the employee’s account the employee is “covered” for the tax year, so long as the contributions and/or allocations are contributed or allocated to the employee’s account for the plan year that ends with or within the employee’s tax year.

A defined benefit plan is any plan, which is not a defined contribution plan. The major difference between the defined benefits plan and the defined contributions plan has to do with the benefits, which are realizable under each plan.

A defined benefits plan details the specific benefits, which accrue to each employee. Years of service and income are the criteria normally used to determine benefits upon retirement, and the payouts are normally consistent until death. The plan administrator determines the contribution amounts required to provide the stated benefits to the employee based on years of service when the employee retires. Through a combination of contributions from the employer and employee, as well as investment growth, the administrator manages the plan to make sure a level funding of benefits are available to employees. Defined benefit plans include pension plans, annuity plans, and cash balance plans. If an employee is “eligible” to participate in an employer’s defined benefit plan for the plan year that is within the taxpayer’s tax year then they are “covered” under the plan. This is still true even if the employee refuses to participate in the plan, refuses to contribute to the plan, or did not meet any minimum service requirement to accrue a benefit for the plan year. This differs from the defined contribution plan where if no contributions or allocations to the plan are made the taxpayer is not considered covered under the plan.

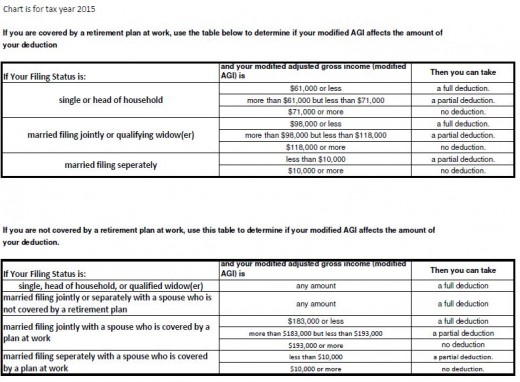

Modified Adjusted Gross income Rules: Next, depending on whether the taxpayer (and/or the taxpayer’s spouse) is considered covered under a retirement plan, one would need to see if the taxpayer had too large of a modified adjusted gross income to take a tax deduction for contributions to a traditional IRA. I have included a chart, which displays the modified adjusted gross income limits for taxpayers to take a deduction for contributions to a traditional IRA for the 2015 tax year. Please also note that while one may not be able to take a deduction for contributions to a traditional IRA, one can normally contribute to the traditional IRA even if the contribution does not get a tax deduction benefit. However, the amounts of one’s contributions to the IRA are subject to also taxable compensation rules, age, and total contribution limitations to both traditional and ROTH IRAs. IRS Publication 590-A Individual Retirement Arrangement list these limitations.

Contribution Limit Rules: In order to open and make contributions to a traditional IRA the taxpayer (or taxpayer’s spouse) must have taxable compensation for the tax year, and have not reached the age of 70 and a half by the end of the tax year. If only one spouse has taxable compensation, then the other spouse can only contribute to an traditional IRA if the file a joint return. Additionally, traditional IRA’s are “individualized” accounts. What this means is that you cannot have a joint traditional IRA account Rather each person must have an account of their own.

For purposes of making contributions to a traditional IRA taxable compensation includes wages, salaries, commissions, self-employment income, alimony and separate maintenance, and nontaxable combat pay. Please note that self-employment compensation refers to “net earnings” from your business, provided personal services are a material income producing factor, reduced by any deductions you made for contributions you made to another retirement plan of the business and less the deductible part of the self-employment taxes.

Compensation, for purposes of making a contribution to a traditional IRA, does not include dividend income, interest income, earnings and profits from property, annuity or pension income, deferred compensation, income from certain partnerships, or any amounts you exclude from income.

The amount you can contribute to a traditional IRA, for the 2015 tax year, is the smaller of the following: $5,500 ($6,500 if you are age 50 or older), or your taxable compensation for the taxable year.

Deadlines: Contributions must be made by due date of your tax filing: Contributions to a traditional IRA, for a particular tax year, can be made up to the original tax filing deadline, not including extensions. For example, if you wanted to include contributions to a traidtional IRA on your 2015 tax year return, you would need to make a contribution to the IRA by April 18, 2016 (deadline extended this year due to Emancipation Day holiday.) However, normally the deadline would be April 15th.

IRS Publication 590-A – Individual Retirement Arrangements

https://www.irs.gov/pub/irs-pdf/p590a.pdf

Conclusion: When deciding whether to contribute to a traditional IRA or not, one should look into whether they may qualify for a possible tax break. However, this should not be the only reason why someone should make such a determination. You should also estimate what your potential income situation will look like when you retire. This is because when you start taking out distributions from your traditional IRA most likely your distributions will be 100% taxable. I say most likely, because some people do make contributions to their traditional IRA for which they do not take a deduction for on their taxes. If you do not take a deduction for your contribution to your traditional IRA, then when you take a distribution out later a portion will be deemed a return of your "already" taxed contributions (where your already taxed contributions are your contributions for which you did not take a deduction for). You should also consider if you may need to dip into your traditional IRA prior to turning 59 and a half. This is because if your distributions are not a qualified distribution then you may be subject to a 10% penalty in addition to the taxes paid on your distribution.

To learn more about various areas of taxation, click the articles below:

More about tax rules:

- Mortgage Interest Deductions: Mortgage Interest Deductions are "itemized deductions" which may help you lower your taxable income, and therefore your tax liability. Mortgage Deductions are subject to several limitations.

- Gambling Loss Deductions: Gambling Loss Deductions are "itemized deductions" which may help you lower your taxable income, and therefore your tax liability. Gambling Losses may only be taken up to the amount of Gambling winnings.

- Roth IRA Contributions: Contributions to a Roth IRA do not result in tax deductible savings on one's tax return. However, Roth IRA investments have other great tax benefits later on in life, such as being able to possibly take distributions from the account (both contributions and income earnings) tax free "if" the recipient meets all of the requirements.

- Student Loan Interest Deductions: Payments of one's student loan interest may result in a tax deduction based on whether the interest is on a qualifying student loan, and the taxpayer meets certain eligibility requirements.

Do you have a traditional IRA as part of your retirement plan

Do you have a 401(k), 403(b), Pension Plan or other non traditional IRA as a retirement account?

© 2016 James