Ten Tips for Lowering your Car Insurance

Driving is a luxury. A convenient, quick, sometimes fun luxury. It is not, in many cases, a necessity of life. Consequently, drivers have to pay a lot - sometimes a heck of a lot - to drive their cars. Gas, maintenance, upgrades, the occasional air freshener, all of these things add up to a big pile of cash each year. Throw in insurance and low- to middle-income earners may strugge to keep their car on the road.

But fear not. Car insurance is a variable thing, subject to change, and the premiums you pay to insure your vehicle can drop if you know what you're doing. Below are ten ways you can potentially decrease your car insurance. They won't work for everyone, but just about every driver on the road today can probably take advantage of at least a few of these tips to pull some of the strain off their bank account.

Increase your deductible

Insurance represents the assumption of risk, and your insurance company wants to know that you're happy to absorb some of the cost in the event of an accident. This shouldering comes in the form of the deductible, the amount of money you'll pay out to repair damage before your insurance kicks in and covers the rest. The higher the deductible, the happier your company will be to cover your car - and the less you'll have to pay on your premiums.

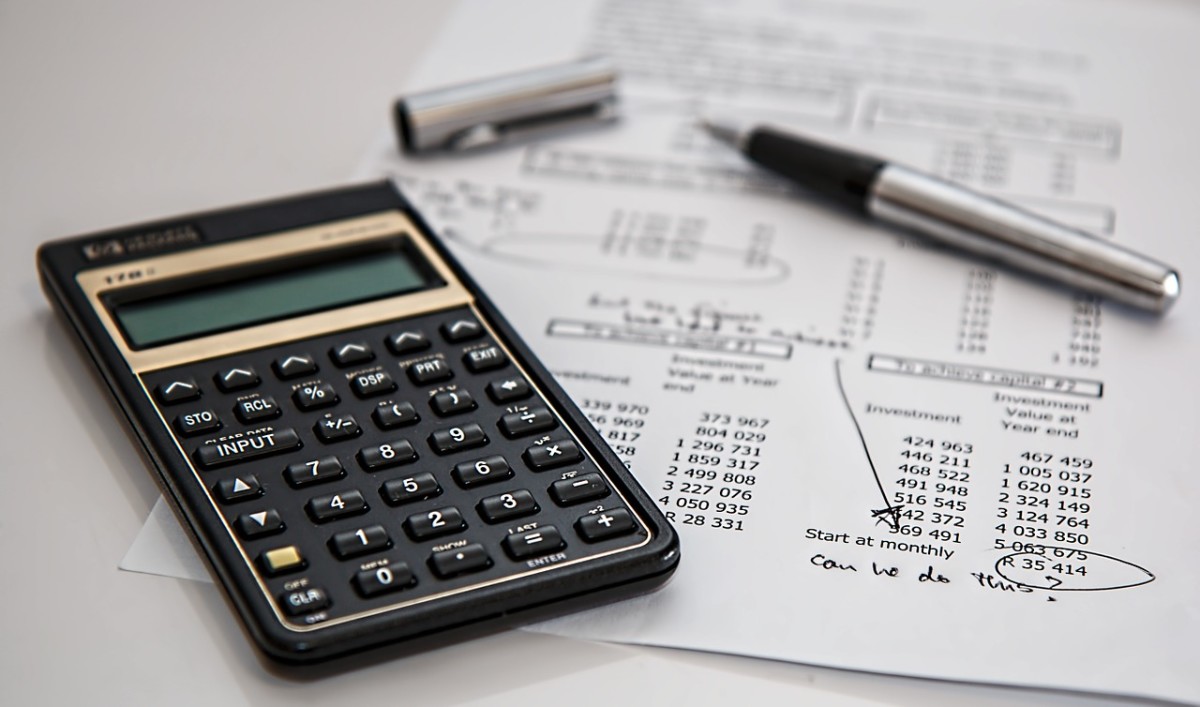

Pay premiums in a lump sum

Every company on the planet wants their cash upfront, and insurance companies are no exception. Consequently, you will pay less on your insurance premiums, regardless of the type of insurance, if you pay your premiums annually. Divide the premium into monthly installments and you'll wind up paying extra processing and credit fees, potentially amounting to hundreds more dollars on top of the original amount. Yikes.

Is this for everyone? Probably not. Premiums are pricey beasts, and most working low-income working families won't have the money to make an annual payment. It's also not advisable if you're considering a switch from one company to another, as you've locked yourself in for another year with an annual payment. Still, if you can scratch together enough cash for a lump sum and don't anticipate a change, you'll be saving a fair amount of money.

Compare rates

Different insurance companies offer different policy pricing. Some may not specialize in auto insurance, for example, or they may not cater willingly to certain parts of the country. Some may offer deals on types of insurance you simply don't need. Some companies - shock! - are just plain better than others. It always pays to shop around and compare several companies at a time to find a plan that's well-priced for you. You may also discover temporary deals by shopping around that you could miss if you focused only on one company.

That said, don't necessarily go with the cheapest company. Not all insurance companies are equal in service and reliability. Once you have an insurance company in mind, determine that it has a valid license to offer insurance coverage, and look for reviews of the service provided. Make sure you read the fine print before signing any contracts, as well - you want to know every detail of a plan before you jump in.

Only purchase insurance you'll need

Typically, your state or province will require you to have some form of liability insurance as a minimum. Liability insurance covers costs related to car accidents that are deemed to be your own fault, namely to property, other cars, or people somehow involved in the accident. By law, you are required to have at least liability insurance. (Check insurance laws for your district to ensure that you don't need more. The law changes depending on where you live.)

There are, of course, more forms of car insurance than just liability insurance. Collision insurance, for example, will cover the costs associated with repairing your own vehicle. Comprehensive insurance covers a variety of other contingencies, such as weather damage or a collision with a large animal, that may damage your vehicle. Gap insurance covers the remaining payments on a vehicle that has not yet been paid off. You don't need all of these forms of insurance, and some of them simply won't apply to your situation. Ignore the ones that are not applicable...

... though do so only after a great deal of research, both into your own lifestyle and your surroundings. Comprehensive insurance might not matter that much to a city dweller, but to someone who lives in the country? Hm. This article covers a few different types of car insurance available, and what each entails.

Maintain a clean driving record

This should be a no-brainer, but it's very important. Insurance companies deal with risk every day, and they try to mitigate risk by assessing your personal habits. In the case of drivers, this means looking at your driving record for previous infractions. The more red marks there are on your driving record, the higher your premiums will rise. Drivers with a bad enough record may not be able to sign up with some insurance companies in the first place.

Don't fall into this pit if you intend to drive a car, or at least want the option to drive, for the rest of your life. Follow the rules of the road, don't speed, and drive as safely as you can. Not getting into accidents period is ideal, since many insurance companies offer 'accident forgiveness' that essentially provides lower premium calculations to drivers who haven't been in an accident. (Though it's not as fantastic as the name implies.)

And to prove that you're playing by the rules...

Look for a company that will monitor your driving

Though it's not a completely widespread practice just yet, some insurance companies offer devices that will monitor your driving habits and send the data back for analysis. How fast you drive, how hard you brake or turn, and how closely you toe the speed limit (or if you go over it regularly), all of it goes back to the insurance company. In exchange, you may get a discount to your premium.

Sound overly obtrusive? Put a positive spin on it. Think of these telematics doohickeys as a mechanical driving instructor. You're more likely to avoid slipping into bad habits if you know someone's always watching.

Move

Imagine driving down a straight country road. What kind of perils are you likely to weather? The occasional car, yes, a blind turn here and there, perhaps some uneven terrain. For the most part, depending on where you are, a rather smooth, safe ride.

Now imagine driving in the city. You have to contend with hundreds of fellow drivers, unpredictable pedestrians, constant strings of stop lights, the odd bike... mayhem, in other words. Distractions by the bucketful. The chances of an accident shoot right up with the number of distractions.

Insurance companies take your location into account when assigning you a premium. The riskier the area where you're driving, the more you'll have to pay. Urban dwellers will virtually always have to pay more to insure their cars than rural or even suburban dwellers. Even living in different parts of the country (whatever country that may be) can have an effect on your premium. Moving somewhere else may not be a practical option for most drivers, but it is still an option.

Protect and maintain your car

Safe driving does not necessarily guarantee a safe car. Things can still go wrong even when you're not behind the wheel. Perhaps you get rear-ended while someone else is parking, or your car is stolen off of the street, or a window is smashed by an errant baseball. You could simply forget to apply the parking brake one day and send the car rolling down the road. It happens, and premiums take your car's location, condition, and safety precautions into account.

The solution? Take care of your car. Make sure it's maintained on a regular basis, and, when possible, store it in a garage or secured parking lot. Some form of approved security system, particularly in bad neighbourhoods, is also recommended. All of the above can, depending on the insurance company, lower your premiums by a fair margin.

Take driving courses

Did you go to an accredited driving school before you got your license? Have you taken a defensive driving course? Are you knowledgeable in car repair and maintenance? You may be eligible for lower premiums. Many insurance companies look favourably on drivers who take driving seriously, as these drivers are less likely to get into crashes thanks to a greater amount of situational know-how and comfort behind the wheel. This is especially handy for younger drivers just getting their licenses, as insurance premiums are appreciably higher depending on your age.

Drive safe

This last one is just common sense. Accidents happen, yes, but they're much less likely to happen if you're focused on your driving. Stick to your lane, mind the speed limit, don't drive too fast or too low, keep your eyes on your mirrors, and minimize your distractions. Do all this and you may never need your insurance, which, despite all the hooplah involved in choosing the right kind, is exactly the situation you want.

![ESSENTIAL Car Auto Insurance Registration BLACK Document Wallet Holders 2 Pack - [BUNDLE, 2pcs] - Automobile, Motorcycle, Truck, Trailer Vinyl ID Holder & Visor Storage - Strong Closure On Each -](https://m.media-amazon.com/images/I/51PiHjso5ZL._SL160_.jpg)