The Balance of Debt vs Wealth

A new perspective on wealth

I want to pass on a profound new perspective I have come to on how wealth is generated. This new perspective goes to the heart of how our economy operates, and it is good news for everybody.

In the past I viewed the economy as a tool of the wealthy, putting more and more money into the hands of those that already have to much, and that this is how the economy was designed, however that is not true. The economy builds wealth for those who know how the game is played and each and everyone has the opportunity to get ahead. The trick is to understand how the mechanism works and to take advantage of its benefits while avoiding its pitfalls.

I came to this new perspective when I heard an age old principle with fresh ears, and my new perspective makes me supremely optimistic about the future.

The principle I am talking about is:

SPEND LESS THAN YOU EARN

Why spending less is so powerful

It sounds simple right, maybe even a little let down after the build up I gave it, however stick with me because there is more depth to this simple statement than I ever realised. Of course at its basic level it is easy to understand that to build wealth of course you can't possibly spend more than your earn, otherwise you would simply become increasingly broke. So Why, and How, did this simple adage change my perspective about the economy and wealth? Well to answer that we need a little perspective, and the magic comes down to the power of compound interest.

The magic of investing is that once you place a sum of money into an investment each year you will be payed a percentage of that money back, each month, quarter or year depending on the investment. The effect is compounded when each subsequent month, quarter or year you are payed interest on your initial investment PLUS the funds you were payed in the previous month, quarter or year. Each year the effect of the compounding becomes greater and greater.

Compounding debt

So let's link this back to spending less than you earn. If you do the opposite and spend more than you earn the result is debt. Debt as with investments is also compounded, because your debt is another persons investment, and your debt will cost you big time. Take the most common form of debt formed from spending more than your earn, credit card debt. In today's market every dollar of debt accumulated on a credit card will cost you $1.17 to pay back after one year based on the Australian average credit card rate of 16.58%. You may not think this cost is so bad, buy now pay later and enjoy whatever has taken your fancy for a year before you repay your loan. However this is not the true cost of your debt, because if you are spending more than you earn you won't be able to pay that money back with a years time frame.

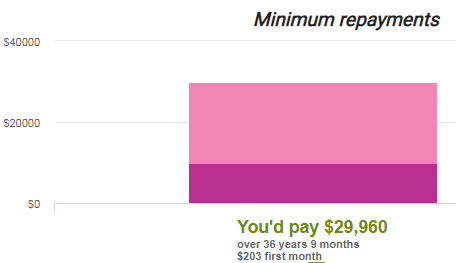

Imagine you had accumulated a debt of $10,000 and instead of paying it back the next year, instead you make the minimum repayments of 2% of the credit card balance until the credit card is repaid. How much would that $10,000 cost you? The answer is $29,960 paid back over a mammoth 39 years. Overall your $10,000 loan cost you nearly 3 times what you paid in the for the item in the first place, a full $19,960 more than the item/items purchased.

Have a look at how this is visually represented below, the light pink shows the amount it cost you to borrow the $10,000 on a credit card and it dwarfs the dark pink portion representing the original balance!

Compounding investments

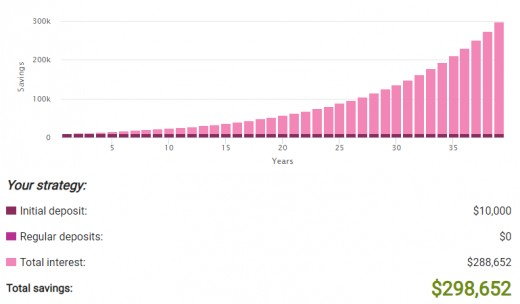

There is good news however! If you spend less than you earn, and invest what remains, the economy puts your investment to work, generating wealth beyond what you might be to imagine. The balance of debt to wealth is heavily skewed toward wealth in our world today. Ask yourself, if I had invested $10,000 how much do I think that money would be worth today? 3 times your investment, like your debt costs you? 6 times your investment, twice what the debt costs you? What about 9 times your investment, 3 times what your debt costs you?

No, your investment is worth much more to you in 39 years than that, in fact it is worth 10 TIMES as much as your debt costs you. By the power of compound interest a $10,000 deposit in the Share Market, which over the last 30 years in Australia has returned an average annual return of 9.1%, without making any additional payments would become $298,652! Almost 30 times the amount that was initially deposited.

See the graph below, that light pink portion representing your interest earned by year 39 makes the initial deposit look like a blip in the ocean.

That is the amazing thing about the balance of debt vs wealth, is that it is tilted heavily in favour of wealth. That's where the new perspective comes in, because if you spend less that you earn every dollar used wisely is so much more effective at building wealth for you than leading you into debt.

So what should you do about this, the answer is simple.

Step 1. Figure out how to spend less than you earn

Step 2. Pay off your debt

Step 3. Invest your remaining funds

There is endless information out there about how to invest, in my example I have used the Australian share market, however you can also invest in Government Bonds, Real Estate, Corporate Bonds and so much more, the options are endless.

So go and read, get some professional advice and start building your wealth today!

This article is accurate and true to the best of the author’s knowledge. Content is for informational or entertainment purposes only and does not substitute for personal counsel or professional advice in business, financial, legal, or technical matters.