Keep Track Of Your Money by Balancing Your Checkbook

The Application of simple math

In today's world, anyone with a checking account should know how to balance their own checkbook. Simple application of basic math skills is all it takes to complete this task. I will note that all it takes is just one transposed number to throw your checkbook out of order. Precise recording of each transaction is extremely important if you want a perfect outcome.

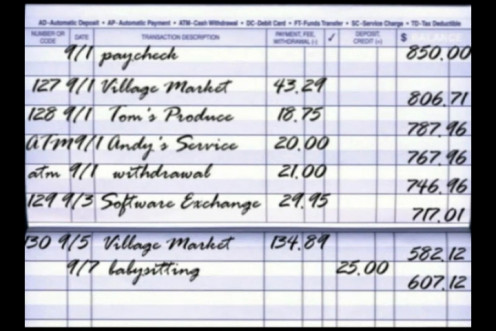

Step one: When you make any transaction, whether is it a withdrawal from an ATM, automatic debits or a store purchase, you must keep your receipts so that you can record the amounts into your checkbook when you get home. After recording each entry, be sure to add or subtract the amount from your balance.

Step two: From the receipts that you have, record each transaction correctly on the debit side of your checkbook register as shown on your receipts. Also, remember that any withdrawals, automatic debits and checks that you have written should be recorded in your register as well. Again, make sure to subtract the amount from your balance.

Step three: Any automatic credits and deposits that you make should be recorded on the credit side of your register. Again, be sure to add this amount to your balance. If you have an interest bearing checking account, you will have to add the interest to the balance of your account.

Step four: When you get your monthly checking account statement, you should reconcile your checkbook entries to your statement line by line. Every line on your statement should match the entries in your checkbook register. If not, then go back and re-check your transactions for both your register and statement to find possible errors. I will also note that there is a tendency to double record some entries out of forgetfulness or being lazy to write down what you have spent in a day.

Step five: Once you have reconciled your statement to your checkbook register, they should balance to the same amount. Again, if they did not balance, go back and re-check your math.

There are times when anyone can be overdrawn on their account. This is a costly mistake that can add up to a huge dollar amount. NSF charges and other fees can quickly add to your negative balance and can range from $25.00 and up depending upon the financial institution. To keep from incurring bank fees, you have to make sure that you deposit funds into your account as soon as possible. So it pays to stay on top of keeping an immaculate checking account balance.

This simple application of basic addition and subtraction to balance your checkbook should hopefully be an easy process for you. This will help you to see where your money is going. In starting your financial journey, balancing your checkbook is one of the necessary tools in getting off to a good start in handling your finances.

The Balancing of a Checkbook in Progress