The Credit Card Offers You Need to Consider

The Bank Matters

Before you select the particular type of card you will apply for, it’s good to consider which bank you would like to do business with. The bank who maintains your credit card make a major differences on the type of credit card you receive.

JP Morgan & Chase Bank, for instance, use Visa credit cards with relatively standard interest rates. That makes a huge difference for some cardholders. It is NOT Visa policy to waive all foreign transaction fees, cover trip interruption fees, or trip cancellation fees. However, the same level Visa Cards will waive foreign transaction fees when you bank with CapitalOne.

Citibank, on the other hand, mainly uses Mastercard. Mastercard features different tiers of Credit Cards (Regular, Platinum, World, World Elite). The World and World Elite cards carry perks that Visa does not, while offering global acceptance that is just as good as or better than Visa. Citi tends to keep the default card offering as a Mastercard World credit card – a much higher tier card than the Visa offering by JP Morgan and Chase.

Acceptance Matters

American Express offer some pretty awesome rewards and perks! Amongst the host of credit accounts I have are an AMEX card and a Discover card. Both happily sit in a secured location and are hardly ever used. Why?

AMEX isn’t worth it, because AMEX has very limited acceptance, even in the United States! I currently work a mid-sized company that to this day does not accept American Express, and has no intentions of adding support!

Discover has better acceptance in the States, but suffers in foreign markets. Also, the revolving category model that Discover uses for cashback rewards isn’t appealing all that great; not to mention the fact that those categories also have caps on how much reward cash you can earn back as well.

So, yeah, don't hold your breath on seeing me praise cards coming from either of those companies!

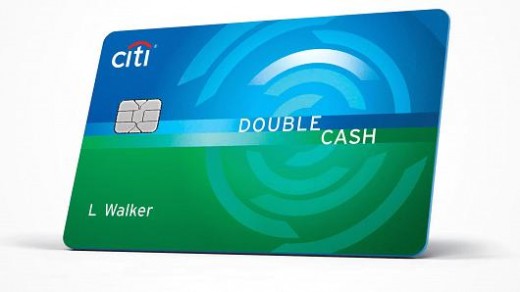

Top Cash Back Card – Citi Double Cash

Citi Double Cash Back card takes the cake. 2% cash back on all purchases - 1% for spending, 1% for paying back. This card is backed by Mastercard World benefits including 24/7 Concierge Service, Travel Accident Insurance, Trip Cancelation Protection, Worldwide Car Rental Insurance and more!

That’s impressive for a no fee card! These aren’t just eye candy benefits either. Most times you book a trip, you are offered the opportunity to purchase insure for your trip in case something happens. Whether that be the airline, hotel, third party-company, rental car company, etc., you can deny them all and rest assured Citi has you covered!

So let me reiterate: you’re being told that if you paid for the trip with this Citi Double Cash card, you are covered for interruptions (even fees for changing your flight), for medical emergencies worldwide, for any damage to your rental car, and even damages to your store-bought purchases!!

Oh and it’s not hard to get those things you need from Citi! When you use those benfits That concierge line that you get with your credit card? Yeah, just call them and they’ll do all the navigating for you and get you what you need ASAP!

This card could potentially save you an incredible amount from bothersome fees! By far, my top choice for a no-fee card.

It is worth mentioning that this card does have a foreign transaction fee of 3% unfortunately

Top Rewards Card – Citi ThankYou Preferred Card

Good rewards credit cards with no fee are scarce these days, but not to worry! Citi has your back on this one as well!

The ThankYou Preferred card offers 2 points per dollar spent at restaurants and entertainment, and a point per dollar on everything else! Oh, and points don’t expire ever, thank goodness!

ThankYou rewards can be used for almost anything – Travel, electronics, gift cards, or even simply cash back!

As a Citi World Mastercard, you’ll once again see benefits of worldwide rental car insurance, trip cancellation protection, and worldwide travel accident insurance! This card has a 24/7 concierge service as well.

Just like with the Double Cash card, the foreign transaction fee is regrettably present at 3% of each purchase.

Top Low Interest Card – Barclay Card Ring

Low interest cards cut many of the rewards benefits to produce a card with an interest rate that's worth considering if you're carrying a card balance frequently.

This card has an astonishingly low rate at 8%! To put that in perspective, you’d be hard pressed to find a personal loan rate lower than 10%, and this program beats that rate by a whopping 2%!

And here's a huge positive: there is no balance transfer fees - ever! When you need to move your balance to the ring card, do it. No 3% transfer fee, no $5 fee, just a simple no charge transfer!

In addition to no balance transfer fees, this Platinum Mastercard includes a free FICO score report, no foreign transaction fees, and a “giveback” program that allows for the cardholder to potentially earn cash back from the program.

Top Simple Card – Citi Diamond Preferred

I don’t know why anyone even considers the no frills card. There isn’t any harm in getting the points, even if you aren’t really interested in using them. But if you insist – Citi has one that is simple as pie.

If you’re getting a card because it’s simple it probably won’t matter but as a Citi World Mastercard, you’ll once again see benefits of worldwide rental car insurance, trip cancellation protection, and worldwide travel accident insurance with access to a concierge service 24/7 again.

Yes, just like the past Citi cards mentioned, there is a 3% foreign transaction fee for use outside the U.S.

The only thing that’s outstandingly special about this card that we don’t have elsewhere is the 21 month period of no interest on purchases made or balance transfers! For some people, that’s a rather strong motive to go apply for this card!

Bottom Line

You can do anything with cash back, so I’d recommend getting a cash-back card when it comes to no annual fee cards. Citi’s offerings are so absolutely irresistible on this end that I don’t really think there’s anyone else who we can toss their hat in the ring.

Yeah, I mentioned a lot of Citi cards. No, they don’t pay me for advertising. Their cards just work like they should. I’ve had many different banks I’ve worked with and no one meets Citi’s customer service level, card offerings, or personal care. All of that backed by one of the world’s biggest international banks!

There’s a million cards out there, and I want you to find the one that fits your lifestyle. Just read the terms carefully and remember: Please Charge Responsibly!