The Evolution of Hedge Funds

The Hedge Fund Industry Matures

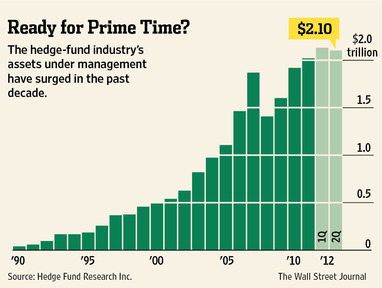

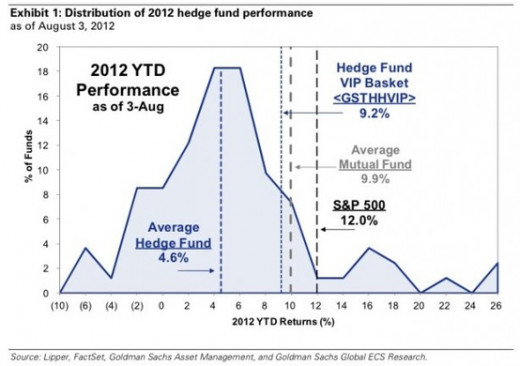

The performance and growth of the Hedge Fund industry has reached a plateau phase. Star performers still get the headlines; however this masks a drift into under-performance by the industry in general. Assets under management grew explosively from the inception of the industry until today.The Credit Crunch of 2008, exposed the inherent weaknesses in the industry and sorted out the stars from the rest. The crisis put a check on inflows until investors had time to decide who they thought the survivors and winners would be.

Money then migrated to those managers who starred during the crisis. Investors ignored the warning on all Hedge Fund brochures; which discloses that past performance is no guarantee of future performance. In the notable cases of stars like John Paulson and Louis Bacon, this disclosure was apposite. Some star managers have underperformed since then; and this under-performance has been amplified by the extra funds that they have taken in since the crisis.

The Hedge Fund universe is diverse, so it is therefore difficult to compare and contrast different managers. Comparative analysis can be done however, in relation to one important criterion; namely losses.

Warren Buffet has two rules of investing:

- Never lose money

- Never forget rule 1

The performance and growth of the Hedge Fund industry should be viewed in this context.

At inception, the Hedge Fund industry was all about Absolute Returns. Hedge Fund managers employed various strategies to create a high Absolute Return. Hedge Fund investors came from the High Net Worth Individual universe, who had the disposable income and the ability to take this kind of risk. Once this universe of investors was exhausted, the industry looked to institutional investors as the next source of funds.

Institutions have fiduciary relationships with their own investors, therefore the inherent risks in Hedge Fund investing needed to be mitigated. This mitigation came by re-inventing the Hedge Fund industry in a manner that was acceptable to fiduciary managers. Hedge Funds were presented as non-correlated assets that were less volatile than the traditional long only strategies of the institutions. The non-correlation and low volatility were achieved by the Hedge Fund taking a short position against its long position. This is when the Hedge Funds entered their Alternative Assets phase of evolution, in which the ability to short securities against long positions led to the classic Hedge Fund designation.

The creation of huge amounts of global liquidity by central banks after the dot.com Bubble and 911, allowed Hedge Funds to leverage their positions to achieve greater returns. This leverage was needed to generate returns; as a wall of institutional money was steadily pouring in, that was having a diluting impact on managers' ability to create attractive returns. Banks on Wall Street, which were at the source of this liquidity decided to use it for themselves, rather than to supply to Hedge Fund managers. Proprietary trading desks and internal Hedge Funds thus mushroomed within the banks. By the middle of the 2000's, liquidity and leverage were driving the system; and the Hedge Fund industry began leveraging securities that were created out of collateral securities. This marked the final phase of the boom leading up to the crisis of 2008.

Hedge Funds 2.0

The concept of non-correlation was exposed by the Credit Crunch. The only non-correlation was a directional bet on a bear market. Absolute return was then understood in its true form, as the manager's ability to call the direction of the market. It became apparent very quickly that the Hedge Fund industry is no better than average at calling market direction. Suddenly, institutional investors had difficulty reconciling this speculative concept with their mandates to preserve capital and grow returns.

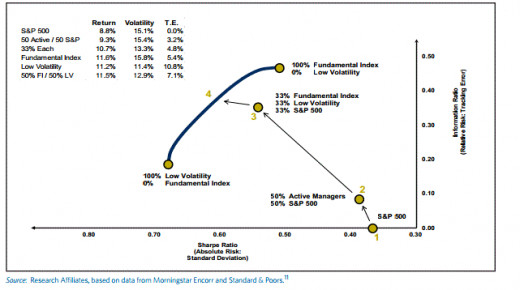

To square this circle, institutional money managers adopted the concept of Relative Performance. Applying this concept, the institution can avoid a conflict with its fiduciaries; if it can show that even though it has lost money, that it has lost less than a comparative benchmark index or other group of managers. Relative Performance has been the mendacious saving grace of the Asset Management and the Hedge Fund industry. As the graph below shows, asset managers are now in the business of trading off relative versus absolute return, to come up with a blended return that they can get their fiduciaries to swallow.

Performance is all Relative

The Holy Grail of money management is now to position one's portfolio at an optimum position on the envelope of relative versus absolute performance. By choosing a broad index and/or a large universe of fund managers, the asset manager can build in the under-performance of these companies and poor managers into a benchmark. Having created a benchmark that is biased in favour of mediocrity, the manager thus has a better chance of beating it and earning his fees.

Investors in funds should understand this moving of the goalposts and demand benchmarks that represent excellence and not mediocrity. Choosing an index of say the top one hundred companies in the S&P 500 Index each year, as the benchmark for next year, would level the playing field on equity fund managers. Choosing the performance of the best Hedge Fund managers as the high water mark for next year's crop of Hedge Fund managers would make the industry a lot more honest; and probably a lot smaller too!

Links

- Tomatoes and the Low Vol Effect - Research Affiliates - August 28, 2012

Explore an exclusive database of accounts from high- and ultra-high net worth investors.