HOME INSURANCE COVERAGE | What to Look for in a Home Insurance Policy

HOME INSURANCE COVERAGE

Home Insurance Coverage explained. Find info & resources for homeowner insurance protection & risks for flooding, earthquakes, water leaks & pet liability.

-----------------------------------------------

Home insurance coverage for most Americans represents protection for their most valuable financial asset. Your home, your personal piece of planet earth, can only be protected with insurance. If 'your home is your castle,' then your home insurance policy is the moat.

One of the most substantial risks to your home comes with the evening weather report. Since 1980, more than 120 major weather disasters have struck America, causing more than $300 billion in damage claims. Most home owners found that their insurance policies left them unprotected from financial ruin. If a natural disaster strikes your home, you are still responsible for the repayment of your mortgage, whether or not your house is still standing.

The basic home insurance coverage is riddled with loopholes that protect the insurance company, not your home nor your financial future. Like all businesses, insurance companies are in the market to make money, not to lose money. The basic, bare-bones homeowners insurance coverage protects against the catastrophic events that are the least likely to happen.

For instance, if a car slams into your house, if sparks from your chimney start a fire on your roof or if your home is robbed, you will probably be covered for your loss. However, 90% of all natural disasters in the U.S involve flooding, yet no basic home insurance coverage protects your home against this risk. Not one! Your risk of having your home damaged by flooding is four times that of the risk of damage by fire.

FLOOD INSURANCE

The most costly natural disaster in U.S. history was the 2005 Hurricane Katrina, which inflicted $46 billion in damages. Most people whose homes and lives were devastated in Katrina were without flood insurance. The financial loss of the uninsured, to this day, cannot even be estimated.

The Federal Emergency Management Agency (FEMA) publishes maps which show geographical areas of America that lie within high risk areas for flooding. Most mortgage companies require homes in these areas to carry flood insurance with their home insurance coverage as a requirement of obtaining a mortgage. However, FEMA states that "Everyone lives a flood zone."

Flooding isn't something that just happens in coastal regions or near lakes and rivers. Heavy rain storms send their damage on all parts of the country.

In October, 2000, two small towns 90 miles west of Phoenix, Arizona, fell victim to a rainstorm that dumped 1.2 inches of rain in two days. This part of Arizona normally receives about one-half inch of rain for the entire month of October. Because it is a desert region and could not absorb the rainfall, flash floods wiped out 200 homes and businesses. Some streets and houses were soaking in four feet of water and mud. As residents were cleaning the mud from their homes, another massive rainfall flooded the valley a week later. Not one homeowner had home insurance coverage for flooding!

THE COST OF FLOOD INSURANCE

The cost of the average flood insurance policy is about $600 per year, $50 per month. This is a small price to pay to protect your home and its contents against a total loss. Remember, if you lose your home to a flood, you will still have to pay off the mortgage!

Do you have flood insurance for your home?

HOME INSURANCE COVERAGE FOR WATER AND SEWER LEAKS

While most home insurance coverage extends to fire damage caused by faulty electrical wiring, damages that occur from water leaks or sewer problems are not covered. Some of the largest insurance claims are caused by water and sewer backups. You need to add this protection to your home insurance coverage. This added coverage typically costs less than $5 a month.

A sewer backup can wreak havoc on your home and belongings. The costs of cleanup, literally disinfecting your home and its contents, can run into the thousands of dollars – not to mention the cost of replacing carpeting and furnishings.

A slow leak from a water pipe can cause insidious damage to your home, not just from the water but also from mold than can begin to grow undetected inside walls or underneath carpeting. In fact, damage claims from mold have risen so dramatically in the past decade that some insurance companies have stopped writing policies in some states because of the high risk. This should be a warning that you absolutely need to add this coverage to your home insurance coverage.

HOME INSURANCE COVERAGE FOR LIABILITY

The basic home insurance coverage will come with liability protection if someone is injured in your house or on your property. However, the standard policy has a low threshold, usually $200,000 to $300,000. But you live in the 21st century where million dollar lawsuits are filed every day against homeowners.

The best home insurance coverage for liability is secured with an 'umbrella liability policy.' This will not only protect your liability as a homeowner, but also as a parent. As a parent, you are responsible for the actions of your minor children, even when you don't know what they're doing. The child who throws a baseball through a window probably didn't mean to cause a concussion or serious brain damage, but it could happen. However close your friendship is with your neighbors, it's doubtful that you will have an amicable relationship with their lawyers.

Injury or nuisance caused by your pets is not covered under basic home insurance. If you own a dog, consider that dog bites result in about 25% of all liability claims. The Centers for Disease Control and Prevention reports that more than 4.5 million Americans are bitten by dogs every year.

Basic home insurance coverage for liability will not cover your liability for you dog. If you want to keep a dog, increase your home insurance coverage for liability. The average insurance claim for a dog injury is $16,600.

HOME INSURANCE COVERAGE FOR EARTHQUAKES

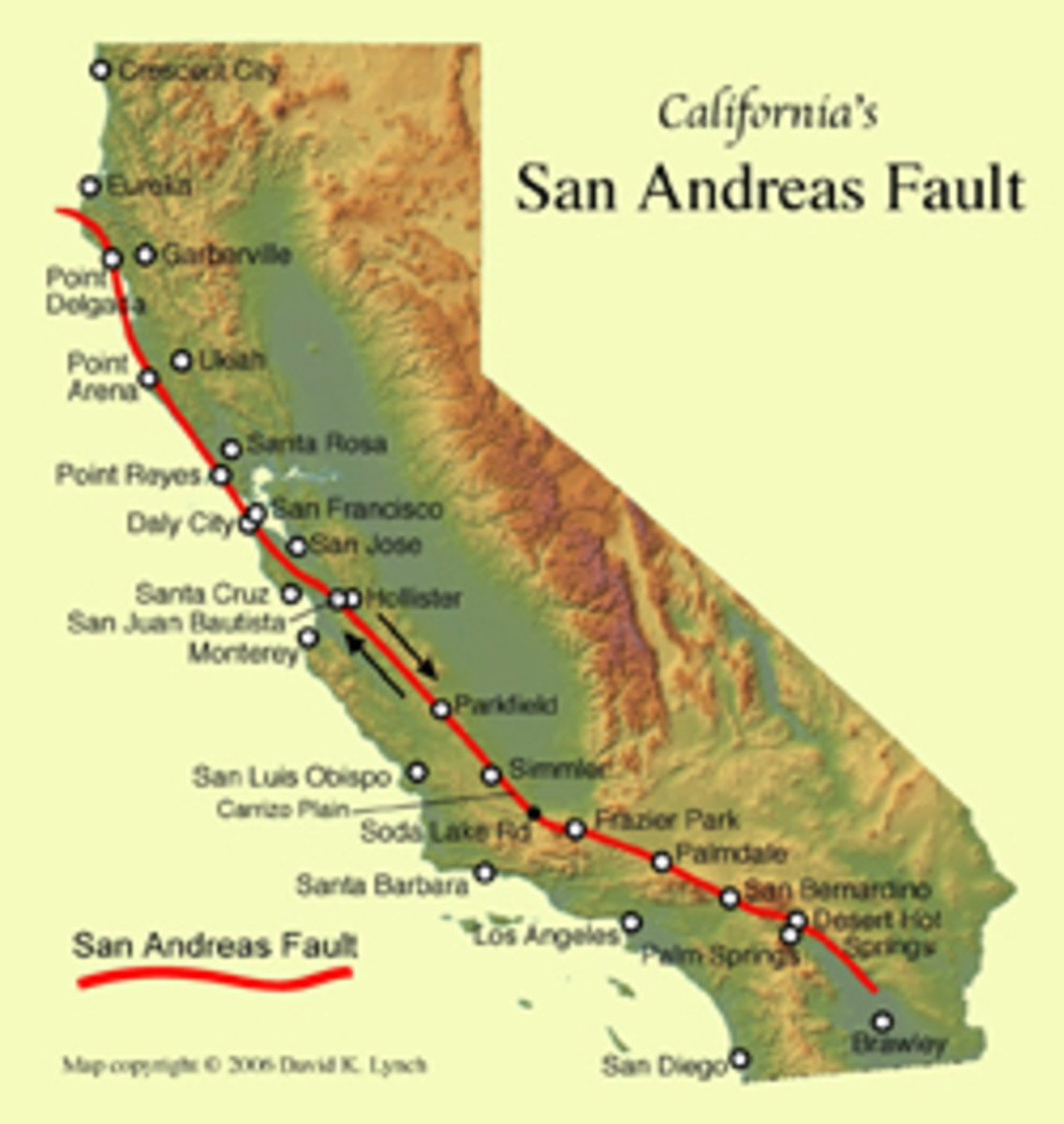

It should go without saying that if you live in an area prone to earthquakes that you need home insurance coverage for earthquakes. What seems like the obvious insurance plan is not reflected by California homeowner insurance statistics.

According to the Insurance Information Network of California (INC), only 17% of Californians are covered by earthquake insurance. When the Northridge quake struck in 1994, 72% of Californians were without home insurance coverage for earthquakes, according to the California Earthquake Authority (CEA).

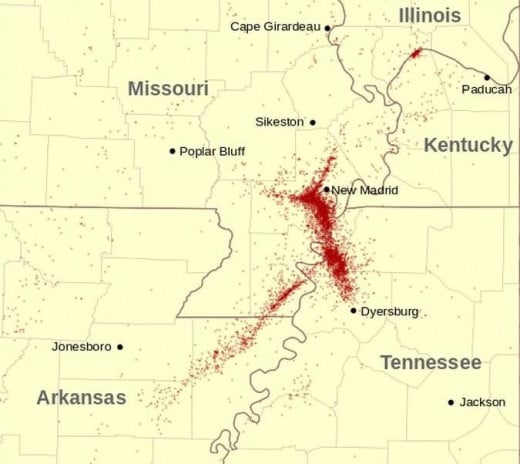

And it is not just the western coast of America that is at risk. The largest quake ever to hit the U.S. struck through the heartland of American and permanently altered the course of the Mississippi River. Three 8.0 earthquakes hit the Mississippi Valley region in the winter of 1811-12, accompanied by thousands of aftershocks.

The epicenter was near New Madrid, Missouri, and homes within a 250-mile radius of this town were destroyed or severely damaged. The shock waves from this quake rang church bells 1,000 miles away in Boston, Massachusetts, and could be felt as far away as Quebec, Canada. Hills disappeared, low-lying areas became lakes, and islands in the Mississippi River disappeared. Scientists estimate that a major quake occurring in this area within the next 35 years is a 90% certainty.

In August, 2011, a 5.8 quake rattled Mineral, Virginia. Virginia? On November 6, 2011, a 5.6 earthquake shook Oklahoma. Oklahoma? There is no place on planet earth that is immune to earthquakes. Adding earthquake insurance to your home insurance coverage costs about $500 - $700 a year. If you take a high deductible, assuming more of the risk yourself, you'll pay about half of that amount.

According to the U.S. Geological Survey, 90% of Americans live in an area of seismic activity. Having extra home insurance coverage protects your home, its contents, your lifestyle and your financial future. Can you afford to be without earthquake insurance?

Do you have earthquake insurance?

HOME INSURANCE COVERAGE RESOURCES

Learn more about flood insurance from The Federal Emergency Management Agency (FEMA).

See this week's seismic activity in the U.S.

--------------------------------------------------------------------------------------------------------

Want to earn money working online? Join the Writer Fox Writers Den.

Connect with Writer Fox™ on Google+.

Protected by Copyscape

Text and images are protected by Copyscape.

Share. Don't Copy.

Copyright © 2013 Writer Fox™. All Rights Reserved

Unless otherwise stated, all other images are via שועל ספר; used with permission.