The IRS Installment Agreement

IRS Installment Agreement

Have you ever had an installment agreement with the IRS?

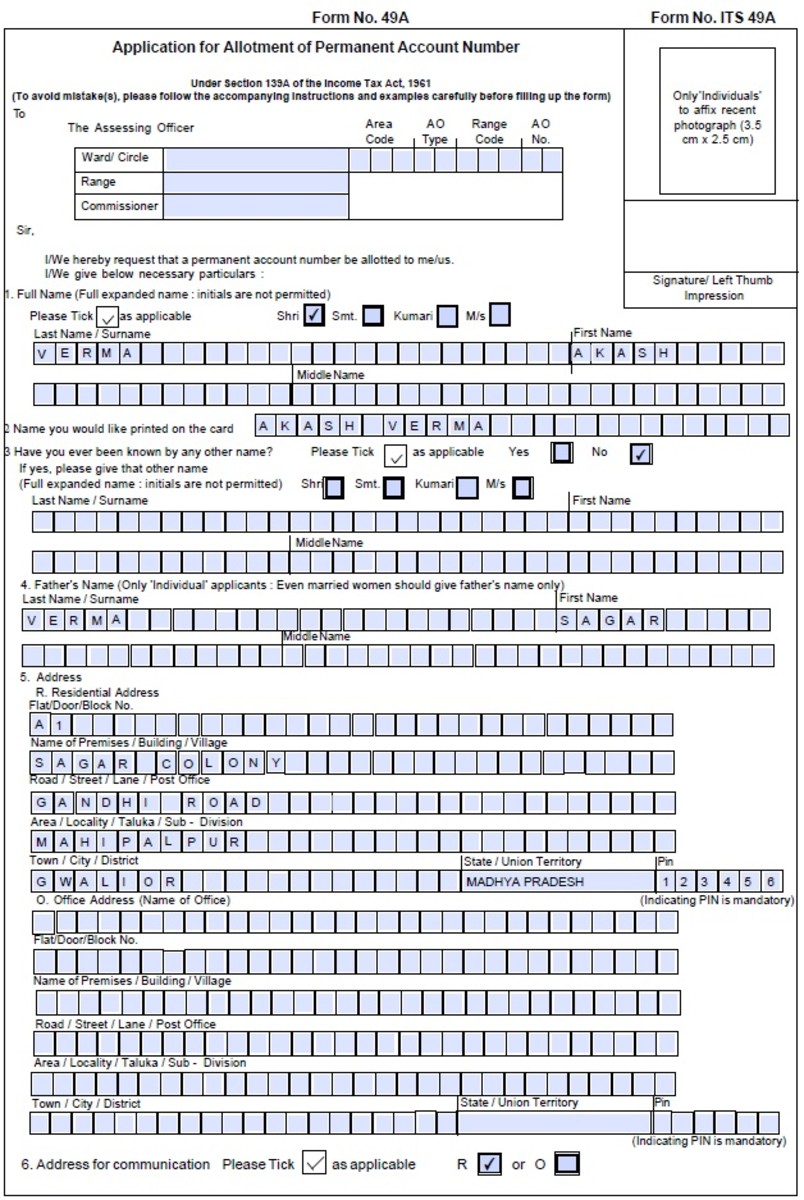

Owing the IRS is scary. What options are available when the world’s largest collection agency now has you on their receivables list? The IRS installment agreement request is the first line of defense. The IRS will be satisfied if you follow a few simple rules to handle your tax liability. Form 9465, Installment Agreement Request, can be filled out and filed with the tax return or at a later date. When the tax due in under $10,000 and the payments will retire the tax in three years or less, the IRS must accept the request. Form 9465 has fees attached to it, but can avoid filing Form 9465 and the associated fees if you pay within 120 days.

The worst thing you can do is ignore the tax due. In all cases you should file the tax return. Not filing a tax return when due is a crime. Not having the money to pay taxes due is not a crime. The IRS will become increasingly aggressive in the collection process as time goes by. In this article we will discuss how and when to file Form 9465, the minimum you can offer to pay each month, how to apply, and fees.

Amounts You Can Pay in 120 Days or Less

You can avoid the Form 9465 filing fees if you can pay in full within 120 days. Call 1-800-829-1040 to establish your request to pay in full. As a practical matter, many taxpayers do not call the IRS and instead make payments on their own until the taxes are paid in full. If no other tax liability exists, the IRS will take little or no action if payments are meaningful and paid in full within 6 or so months. This is not a guarantee. If you want assurance, you need to call the IRS at the number above and establish a request for full payment.

- 9 Best Tax Software Programs

Before you choose an online tax preparation company, review the pros and cons of each of the major players below. The advertising blitz is on for your tax preparation dollars. The best deals, however, are... - 1040.com

File your taxes online for under $20 with the software used by more tax professionals than any other. - How to Pay Taxes

Review your options when you owe the IRS.

Who Should File Form 9465?

Form 9465 is used to request an installment agreement with the IRS to pay the full amount of taxes due within 60 months. In certain circumstances, your tax liability can be extended beyond 60 months or even be for less than the full amount due. You can call the IRS at the number above to make arrangements for these specialty situations.

If you are unable to make a payment or keep making payments, the installment agreement will not work for you. The IRS will revoke an installment agreement if you miss a payment.

Your request for an installment agreement cannot be denied if the amount due is under $10,000, and:

- You filed and paid your taxes on time during the last 5 years, and

- the IRS has not determined you cannot make payments in full, and

- you agree to pay the tax in full within 3 years and comply with all tax laws while the installment agreement is in effect.

How to Apply

You can apply for an installment agreement by mailing Form 9465 to the IRS address provided in the instructions with the first monthly payment and financial disclosure (if required). Filing is also available online at www.irs.gov and by calling 1-800-829-1040.

How Much Do I Have to Pay Each Month?

It is best to pay a tax liability as soon as possible. The IRS will accept installment agreements out to 5 years and longer in certain circumstances. For amounts over $25,000 or payments that extend beyond 3 years, the IRS requires Form 933-F, Collection Information Statement. The IRS uses this information to determine how much they think you can pay.

The IRS expects you to pay disposable income each month. You arrive at this number by subtracting your necessary expenses to live from income. Your necessary expenses to live may differ from the IRS’s definition of necessary. Generally, food, rent, clothing, utilities, medical, and certain payments like a mortgage or auto loan, are considered necessary.

Fees

The IRS will request a fee once an installment agreement is accepted. The fee is $105 for payments by:

- Check

- Money order

- Credit card, or

- Payroll deduction

The fee is $52 for payments made by automatic electronic funds withdrawal.

The fee can be reduced to $43 if your income is below 250% of the poverty level by filing Form 13844. The table below lists the income limits to qualify for a reduced fee.

Reduced User Fee Income Guidelines

Size of Family Unit

| 48 Contiguous States & DC

| Alaska

| Hawai

|

|---|---|---|---|

1

| $27,075

| $33,825

| $31,150

|

2

| $36,425

| $45,525

| $41,900

|

3

| $45,775

| $57,225

| $52,650

|

4

| $55,125

| $68,925

| $63,400

|

5

| $64,475

| $80,625

| $74,150

|

6

| $73,825

| $92,325

| $84,900

|

7

| $83,175

| $104,025

| $95,650

|

8

| $92,525

| $115,725

| $106,400

|

For each additional person, add

| $9,350

| $11,700

| $10,750

|

Follow the simple steps in this article to keep current on a past tax liability. The IRS installment agreement request is the best way to manage a tax bill and reduce stress. Bookmark and link this page for future reference. I encourage you to comment your experiences with the IRS below.