The Key To Personal Money Management

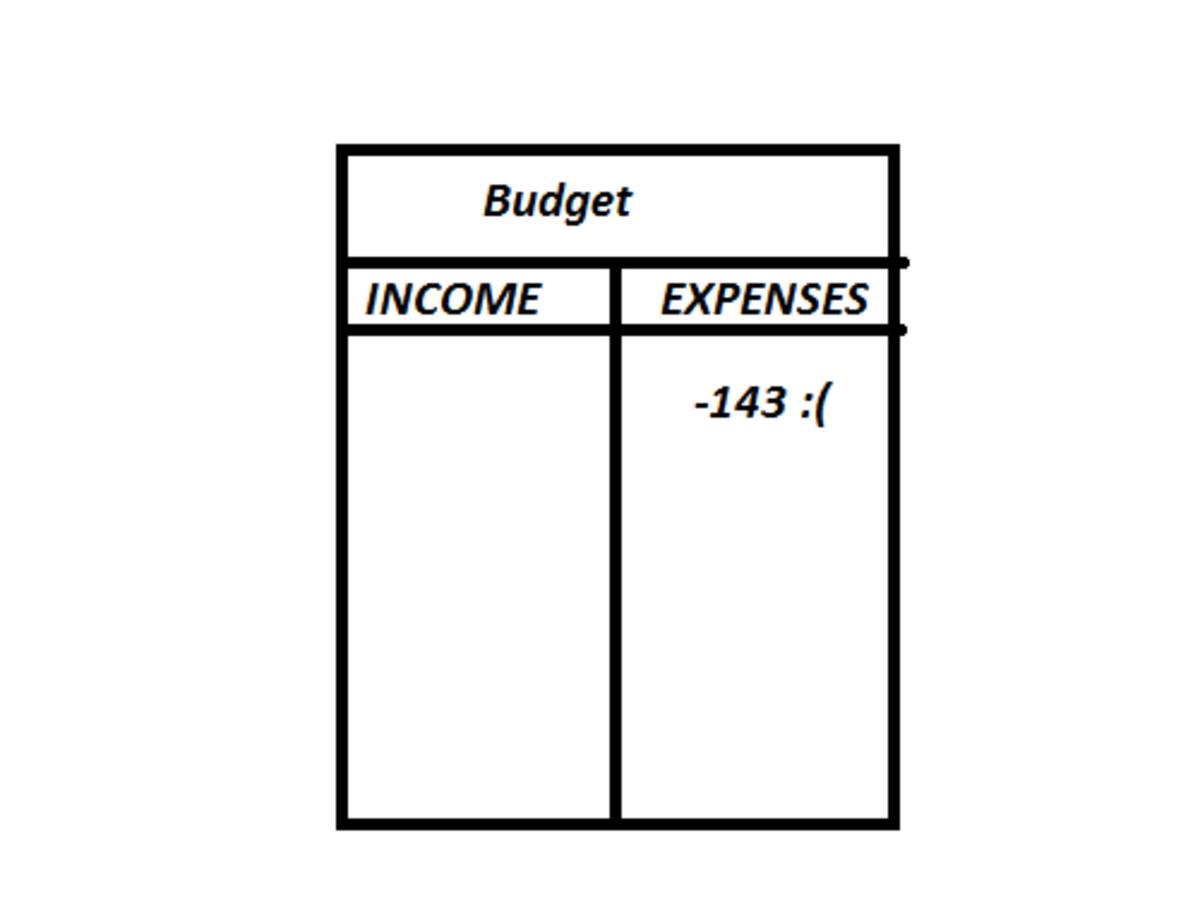

Who is your best personal money manager? YOU! No one knows your financial situation and personal needs and wants better than yourself. To manage your money, you must set up a budget. Budgeting is NOT self-denial; rather, it is simply organizing your spending to avoid waste, so that you can truly afford what you need and want. While there are websites, even software, that help you, it’s something you can easily do on your own.

First, you must have money to budget; in other words, earn income. The most common way to do this is to get a job. Other ways to earn income is to open your own business and sell products, as with a store, or promote your services, as with an auto mechanics shop. If you’re fortunate, you may have inherited property which you can rent out, or a large sum of money, from which you can live off the interest. In the latter case, BE CAREFUL not to spend the principal, because your income is based on it!

Next, you must assess your needs. Some must be met daily, such as food and transportation. Others are monthly, like housing and utilities. Last, there are the annual / biannual ones, such as auto insurance. The best thing to do is to make a list, along with the cost of each. Next, write your monthly income. If it is less than your outgo, you can search the list for areas to make cost adjustments.

A good way to break down a budget is this way; 60% of net income should go to housing, utilities, food, clothing, and insurance. Housing alone should cost no more than 25%. The remaining 40% should go to irregular expenses (such as repairs, or vacations), long term savings, retirement, and fun money; each fund should take up 10%.

How to accumulate savings? PAY YOURSELF FIRST! You can put money in a jar, placing it in a savings account once a month, or shift some money from your checking account into your savings every payday. For retirement, many companies offer 401k plans; I personally recommend a 15% deduction, since it’s pre-tax money, and you’ll barely notice it’s missing.

How much can you spend on daily expenses? Simply figure out what do you spend your money on every day, and how much. Make sure it’s a reasonable amount; if you eat out on a regular basis, it’s not necessary to have $20 lunches every day. It’s also makes more sense to brew your coffee at home, rather than driving through a stand each morning.

How should you spend available money on day-to day expenses? Writing checks helps you keep track of what you buy, and how much you spend on it, but that can get cumbersome. It’s also impractical if you eat out a lot, since many food places don’t accept checks. It’s best to allow yourself a certain amount of cash each week to spend as you need, and leave the rest in your checking account, writing checks or using your debit card for purchases.

Once you’ve worked out your personal budget, you’d be surprised at what you can afford. Since it will greatly improve your quality of life, it is well worth the effort!

© 2012 Yoleen Lucas