The Only 3 Money Questions You Need to Answer

We’re bombarded with advice, advertisements, information and warnings about managing our money. How can we push past the noise and simplify the quest? Consider these three questions:

- How much money do you need?

- When do you need the money?

- How much risk are you willing to take with your money?

The questions are easy to remember, hard to answer, and the answers will change over time and with changing circumstances. The answers are unique for each individual, family and business.

Consider the key words in each question:

Need

- NEED: Do you need to spend the money, or do you want to spend the money for the product, service, experience or investment?

We need food, clothing, housing, and social interaction for our physical and emotional well-being. Within these needs, though, there are inexpensive and expensive ways of fulfillment. The choices you make depend on how you choose to allocate your time, and your ability and willingness to do tasks yourself vs. hiring others to assist or do them for you. For examples:

- You and your friends want to eat a meal together. Do you arrange for potluck at someone’s home or go to a restaurant?

- You decide to change residences. Do you look for something in “ready to move in” condition, or “the worst house in the best neighborhood” that will require renovation?

When

WHEN: This is the easiest question to answer, with two exceptions.

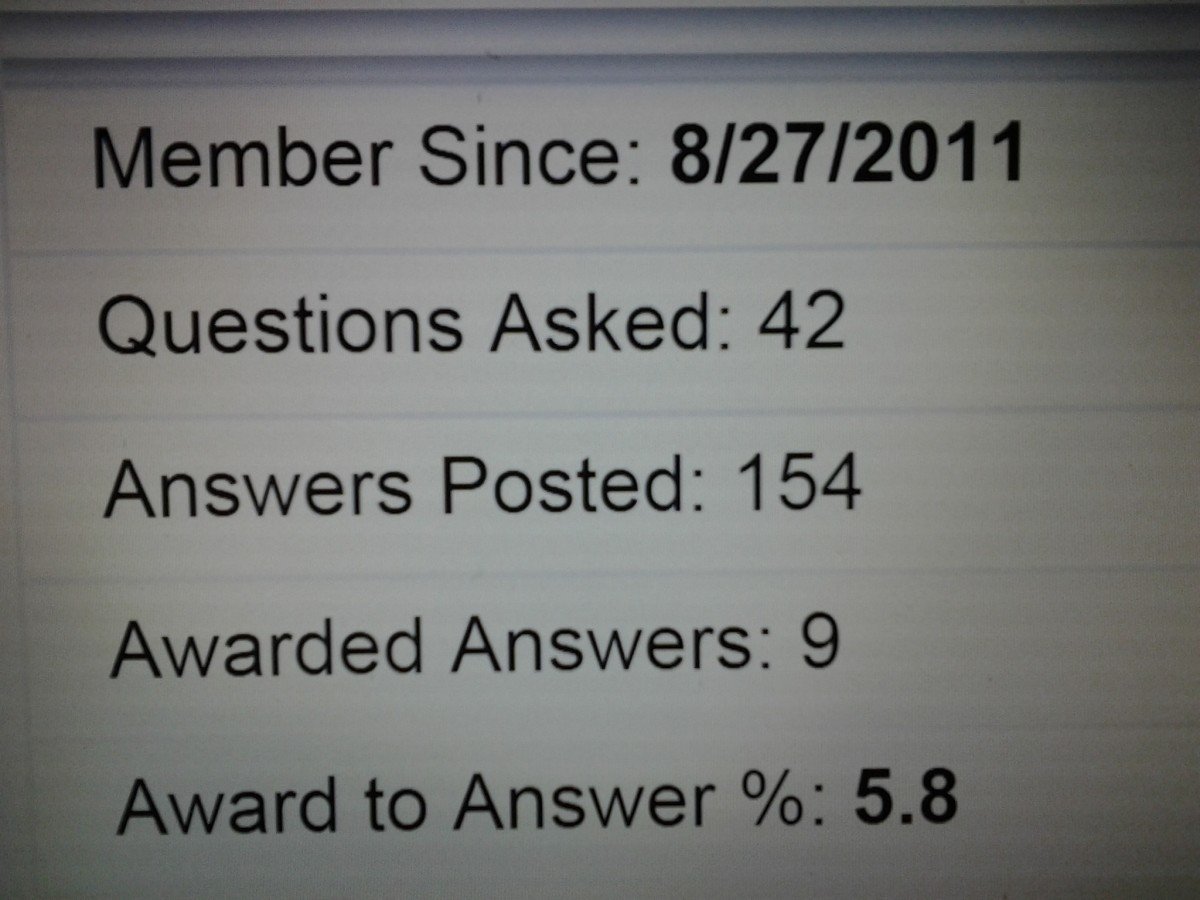

Almost all of us have monthly and other periodic bills, e.g. utilities, housing, transportation, required insurance, business payroll. The invoices and due dates arrive at predictable times and often predictable amounts. You can plan for these predictable bills and you can create and implement a system for your other monetary goals. Envelopes, jars and bank accounts can be labelled “vacation fund” or “car fund” and can help you see your savings progress.

Things do break down and need to be replaced. Cars now tend to last 150,000 to 200,000 miles with proper maintenance. Determine your current mileage and average annual mileage to figure out when you’re likely to need another car. Research the vehicle you may need at that time, and plan to save at least 20% of the estimated price between now and then for the downpayment.

You can do the same for household appliances; several websites list the average lifespan for most components in houses.

The two exceptions to the predictability of most expenses both deal with the need to save. Individuals, households and businesses all need emergency funds for unpredictable expenses and opportunities. Individuals should save for a long period when they won’t or can’t rely on consistent wages, salary or other income, a time often called “retirement”.

The key to each of these savings needs is to convert them into relatively predictable processes. Emergency savings funds should be at least six months of your average expenses, factoring in any that are paid infrequently such as taxes and insurance. Set a deadline for accumulating that amount. Set up a savings account to store the money, and if possible, use payroll or other automated direct deposit to add to that account.

“Retirement” income often comes from a variety of sources: dividends and interest from investments, rental income, capital gains from sales of investment or valuable items. But, you have to acquire these assets before any of these income options appear. That, too, means savings; however, unlike the six-month expense amount guideline for the emergency savings fund, the rule for retirement savings is “the more, the merrier”. We don’t know how long we’ll live or how long we’ll have our health. It’s tough to predict our timing or amount of our future expenses.

The solution is to start saving and investing early, and to segregate that money from all other. IRAs, 401K and 403B plans, and even annuities can help, as can careful purchases of less liquid (readily converted to cash) assets such as real estate and antiques.

Risk

RISK: You can spend money once for a product, service or experience. So your choice to spend must factor in the likelihood that you won’t need that money for another purpose, or that you believe you have or can get money for your other needs. You can change your savings and investment choices, for example from savings accounts to mutual funds to real estate and back again, and each of those choices reflects your current risk tolerance.

The answers to these three questions will change with time and circumstances. Those who recently completed their formal schooling are likely to have monthly debt and a real need to accumulate sufficient items to establish their own households, and expenses to expand their social and professional networks. A few years later, many will be raising their own families and must consider the needs of these additional household members. Starting with the Baby Boomer generation, many households are multigenerational households, caring for parents, themselves and children. At some point monetary needs will shift from buying things to using services and having experiences such as vacation travel. The amount and timing of the service expenses are unpredictable and can cause a temporary or permanent inability to increase income. Consequently, generally the older we get, the lower our risk tolerance.

Remember the 3 Questions

The three money questions remain. The tighter your current money situation, the more frequently you’ll want to think about them.

- How much money do you need?

- When do you need the money?

- How much risk are you willing to take with your money?

© 2018 Cherie Kurland