What Caused the Financial Market's Meltdown?

Back to 1929

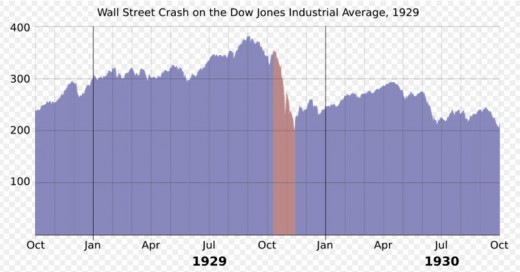

In order to understand the root cause of the financial meltdown, you have to get in the way back machine and go all the way back to the Wall Street Crash of 1929. It is now known that one of the major factors that created the crash and the ensuing Great Depression was that commercial banks could act as investment companies and investment companies could act as commercial banks. What does this mean? It means that commercial banks could invest in the stock and bond markets and investment companies could loan money to people for house mortgages.

Glass-Stegal Act

The Glass-Stegal Act was passed in 1933 and it put a stop to the commercial bank and investment company rulings. All was well until 1980 when Reagan removed the limit on saving and loan companies as to how much they could loan for mortgages. There was a 100K, limit, but thanks to Reagan that was removed and the sky was the limit. Everybody was leveraging houses and finally, the whole thing came crashing down, like a house of cards. It was known as the savings and loan debacle of the 80’s.

Gramm-Leach-Bliley

In 1999, Clinton, under duress from congress and bank lobbyists, passed the Grahm-Leach-Bliley Act, which allowed banks to be investment companies and investment companies to be banks. This was done so that everybody could buy a house. The banks and investment companies developed all kinds of exotic instruments that would allow people to buy houses and mitigate the risk for the lenders.

Enter FNMA and Freddie Mac

FNMA (Federal National Mortgage Association) and Freddie Mac (Federal Home Loan Mortgage Corporation) were allowed to develop sub-prime mortgage which allowed people to get a very low interest rate mortgage initially, but after a certain period, it would increase tremendously. You did not have to even qualify for the loan or show that you had any income at all. They would fake the documents for qualification.These loans were then pooled together and sold to investors as mortgage backed securities.

Credit Default Swap

Derivatives and Credit Default Swaps

Derivatives were the next step. If I bet on the point spread of a football game that is a derivative, it is derived from the game, itself. If an investor wanted to bet on a security going up in value or down in value, they would take out a derivative.

To further mitigate the risk, there are rating agencies that rate the investments as high risk, medium risk, and low risk. A credit default swap is an insurance that insures the investor in case the investment goes bad and is based on the amount of risk in it. The rating agencies were rating toxic assets as AAA ratings, when they were really junk bonds. By the way, last year, this was a 60 billion dollar market world wide. This is one of the causes of the European Financel Market Meltdown. Iceland was the first to go and then Greece. Be sure to view the video full size by double clicking on it.

The Crisis of Credit

House of Cards

So now we have everybody in the market, home buyers are buying houses, the investment companies are making great gains and everybody is happy. What happens next? The loans reset to the next interest rate. Now people can’t afford those homes, so they walk away from them. The insurance companies like AIG can’t cover their loses and everything comes tumbling down like a house of cards. The loans that are not covered become toxic assets. Here is an animated video that shows how the crisis unfolded. Be sure to double click on it to view it at full screen

Enter TARP

Under the Bush Administration, the TARP (Toxic Assets Recovery Program) is announced. It’s a 700 billion dollar program to bail out the financial markets. Hank Paulson, Secretary of the Treasury, wants the money without any conditions. But the people who made great money for banks and savings and loans have to get their bonuses. So they get paid. Paul Krugman, Nobel Prize winner in economics, said: "Wall Street has socialized its risk and privatized its gains." In the mean time the economy is going down the tubes. Companies that used to get short term loans from the banks to run their business can no longer get them. So they close their doors. Other companies have to layoff people.

Where are we Today?

Obama has pushed for regulation of the markets, to bring back the Glass-Stegal act. The banks don’t want it and pay lobbyists big money to block it. Nothing has been done to regulate them. They are still playing in the unregulated derivative market and will not loan money to anybody, because they can make more money playing in these markets.

How would you like to drive on a street where there were no lanes, no stop signs no signals and no police? It would be chaotic, dangerous, and risky. That’s where we are today in the financial markets. That's why I wanted to share this with everybody, so that we can understand what really happened and what needs to be done to prevent it from happening again.

For additional reading, you may want to read my hub on What does the Federal Reserve do?

New Flash 7/26/12

Sandy Weill, former CEO of CitiGroup, who was instrumental in having Glass-Stegal repealed wants to go back to the way things were when Glass-Stegal was law. Here is the link.

http://www.huffingtonpost.com/2012/07/25/sandy-weill-cnbc-break-up-big-banks_n_1701274.html