The Seven Mindsets of the Rich

The quickest way to make a rich man poor and a poor man rich would be to switch their mindsets.

There are plenty of people out there who would disagree with that, but the fact of the matter is when a rich man loses it all, they tend to get back up and reach the top in just a few years, while when the average person wins the lottery, they usually go right back to where they were before in a couple of years. Why is this? Because the rich don’t carry the same mindset as the poor. They have different goals and motivations than what we usually think, and even more importantly they treat money differently than most. A great example of this is-

1. They don’t work for money

I know this sounds counter intuitive, but it’s a fact. If you ask the average rich person (and I’ve met quite a few surprisingly) why they work, the answer is almost never “money.” Instead they work for one of two reasons. The first is “passion.” Passion is so much more effective as a motivator than simple money, because people with passion will work on something to the best of their abilities regardless of whether or not it’s the most effective business plan. And because they work on something to the best of their ability, it usually creates the best possible product. Which as it so happens is generally the product that everyone wants.

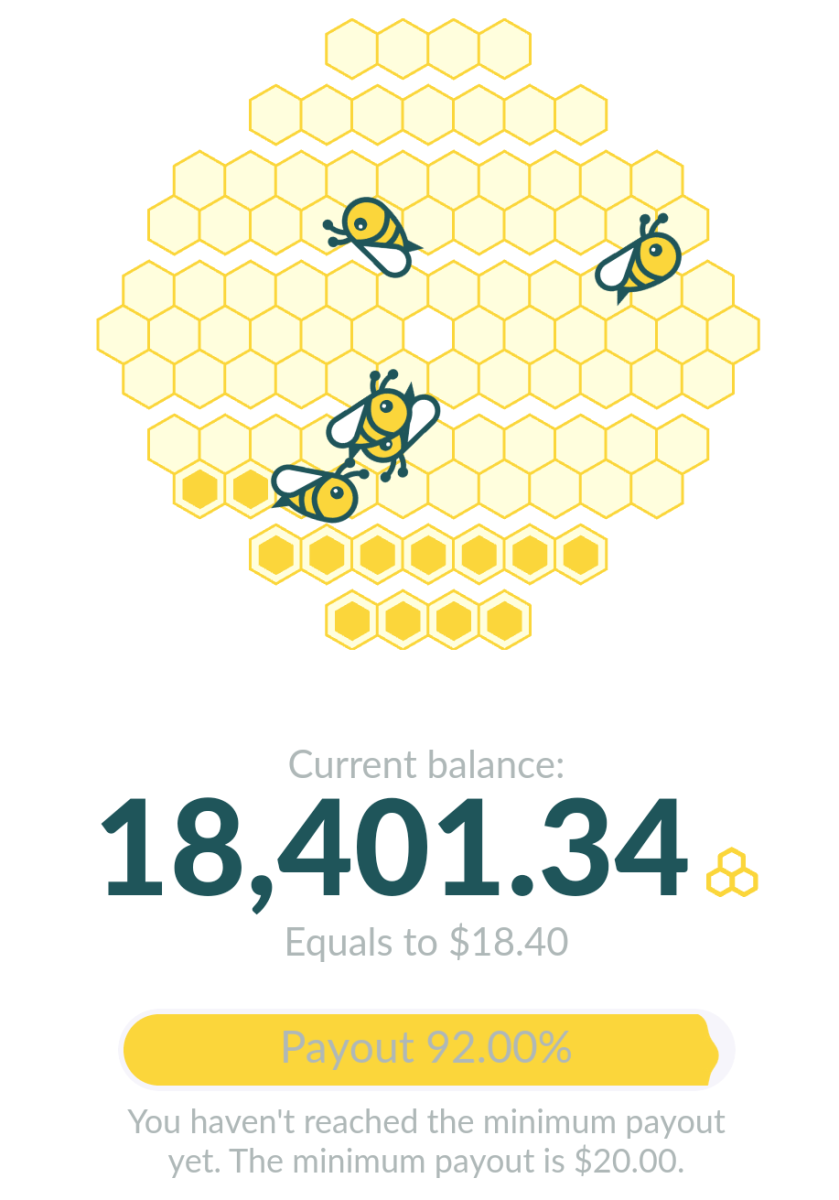

The second reason most rich people work is to generate wealth. So what’s the difference between money and wealth? To put it simply money is currency, and wealth is income. See instead of focusing their efforts on getting money directly (e.g. working for an hourly wage) they create income streams. These stream produce money constantly. This video explains the idea pretty well.

The difference is they create passive income streams so that when they aren’t working at it, they are still making money. Which when it meets the critical threshold of paying for their living expenses, means they can then focus solely on developing new sources of income. As you can see it’s a system that allows them to grow constantly, as opposed to just when they convince their boss to give them a raise. Speaking of passive income streams, I highly recommend the book Rich Dad Poor Dad, if you are trying to get ahead of the rat race. The primary focus of the book is reteaching you how to handle money so you can get ahead.

2.They don’t pay attention to the competition

Sounds odd right? What business doesn’t pay attention to their competition? A lot of them actually. When you stop spending your time focusing on what others are doing, you free up your time to focus on what your customers or business contacts really want, which is what it’s all about anyway. See the truly rich don’t care if their competition is doing something new, so long as they are doing right by their people. They also have the ability to see into what people would want if they only knew about it. For example, Henry Ford was once quoted “If I had asked people what they wanted, they would have said faster horses.” Because he had the insight to see what people would really want rather than just what they were asking for, he was able to help create one of the biggest industries of all time.

3. They work more than you think

You might think that since they are so rich they just don’t do anything anymore, but that is hardly ever the case. In fact the rich tend to work much more than the average person. The average self-made rich person once worked 40 hours week at a normal job to feed and clothe themselves just like everyone else, but they also worked 20-40 hours a week after they went home for the day in order to get ahead.

While a lot of them do slow down to some extent after they no longer have to focus on their needs, they still work almost constantly. A friend of mine who founded his own business makes a fortune off of his Amazon sales. He literally never has to work another day in his life, and he wouldn’t even feel the difference in his lifestyle (and he owns a nice house), but he continues to work 50 plus hours a week every week to grow his company. Why? Because that’s what he wants to do, not what he needs to do. 40 hours a week tends to be the minimum for these people. It’s like the book of Proverbs says

“Lazy hands make for poverty, but diligent hands bring wealth.” Proverbs 10:4

4. They don’t buy useless things

Now hold on a minute, because I can already see people complaining about this. Yes the rich do buy expensive sports cars, and mansions, and all manner of things like that. But they didn’t get to where they are by buying those things. To them that was never the goal, instead they use their money primarily to make more passive income. The only time the rich buy such extravagant things is when it doesn’t matter to them one bit. That’s right, that half a million dollar sports car they own, is usually only bought after they are at the point when they don’t even notice the difference in their lifestyle that the price tag brings.

You may not think it, but it turns out there are a great deal of wealthy people out there who would rather keep an old rust bucket that works, rather than spend money on something nice. And the reason why is simply because the cost of maintaining and purchasing a new car will decrease the amount of money they have for things which actually matter to them.

5. They make money work for them

The last point leads into this one quite well. Instead of using their money to buy nice things, the bulk of what they spend goes into making them more money. Even on a smaller scale, if you are only making fifty dollars a month more than you can live on, a rich person would take that money and put it to work. Websites like Sofi and Lendingtree allow even small investments, and though you won’t be getting very much on from the interest, it’s still something. Think about it like this 50 bucks a month times twelve months in a year is 600$, at 8% interest that would give you 48 bucks. Nearly a whole extra month’s worth of spendable income in a year. But remember the rich don’t stop there, they take that 48 bucks and reinvest the bulk of it making it grow even faster. Even at that slow of a pace you could eventually get some pretty nice returns. On top of that, you have to remember that they still own the 600 dollars, and if a better investment comes up, they can be ready to jump on board.

But this goes even further than you might think. Poor people tend to do the opposite. Credit cards, mortgages, auto loans, these are all example of things which are actually take money from you in the long run. Credit cards are obvious of coarse, but buying a new car is often considered an asset for the average person. But really it's not, a car takes money to keep maintained, and furthermore it's value almost always depreciates over time. Buying things like this may seem like a good idea, but the truth is that over time the poor acquire more and more debt, and actually lose money throughout their life because of it.

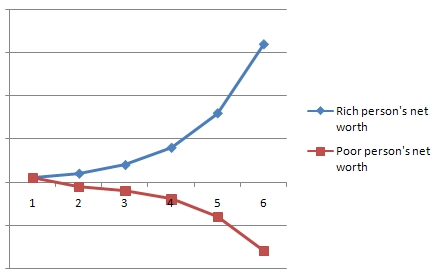

Take a look at this chart to see how this works.

As you can see the rich continue to make more and more money over time, while the poor "invest" their money into things which take more and more to maintain. The results are that if work income remains constant, the rich will continue to get richer from their investments, while the poor will continue to lose money from interest rates and maintenance costs.

6. They are extremely generous

Sure there are plenty of greedy jerks out there, but the majority of the rich are actually quite generous. It may seem counter intuitive but it’s actually a pretty good strategy.

You may be thinking “Sure if I had plenty of money I would be willing to part with some too.” But it might surprise you that most rich people tend to be generous long before they are rich. This is because one of the best ways to get anyone to work with or for you is to give them something for free. This even applies in the traditional job market.

Here’s an example, one time I responded to a job listing and set up an interview. It was a pretty coveted position, it involved getting paid to play around on social media and test an extremely fun product. Now before I went to the interview I went online, and dug through their website. I found all kinds of small mistakes and ways it could be made better. I in essence came up with a marketing strategy for a company that I hadn’t even began to work for yet.

Want to know how it turned out? Well I gave them all the information that I had during the interview and what do you know, I was their new favorite person. They didn’t even bother interviewing anyone else. I walked out the door with one of the best jobs I have ever had, and do you know why? Because I gave them something useful to them. That small gift opened a lot of doors, and the rich know that’s how things work.

Let’s take a look at books as an example. Authors always get more sales after they have given their book away for free. This is made especially true when they give away the first book in a series they wrote. Each time you give away something, people recognize that. Even the Bible agrees on this one.

“Give, and it will be given to you. A good measure, pressed down, shaken together and running over, will be poured into your lap. For with the measure you use, it will be measured to you." Luke 6:38

7. They know when to hire someone to do their job

The rich rarely work at something for too long, and this is because when they see that something is producing income, they outsource the work as soon as it’s reasonable to do so. This is one of the biggest factors in contributing to sustained income.

Anyone can work a job, but few people think to outsource their own work. The benefits of doing this are amazing though. When you hire someone else to do a job at a fraction of the price that you receive, then you have essentially created a passive income stream out of regular work. Now before you go doing this at your work you have to make sure that it’s ok with your higher-ups, and this system doesn’t typically work too well if you are paid on an hourly basis. But if you are working for commission, say for a real-estate broker, then hiring someone to drum up leads could be more than worth your while.

Take a look at this table and see if you can tell which one side is going to lead to financial freedom.

Differences Between the Rich and Poor

The Rich

| The Poor

|

|---|---|

Don't work for money

| Sell their time directly for money

|

Don't pay attention to their competition

| Waste time and effort trying to figure out what others are doing

|

Work more hours than they are told

| Work as many hours as their job tells them to

|

Don't waste money on things

| Spend most of their money on things they want or need

|

Make their money work for them

| Buy things which take money to maintain

|

Are generous

| Only give when they believe they can afford to do so

|

Hire people to do their work for them

| Try to do everything themselves

|

I think anyone can tell at this point which side of the table they want to be on. I know I do.

The silver lining about this whole situation is even if you have been living the old way, there is nothing stopping you from adopting these traits and working toward becoming successful in the future. And remember if you fall, get up again, and keep trying. There are plenty of ways to make passive income out there if you are just willing to put in the effort. You can succeed.

If you have any questions feel free to leave them in the comments, I'd be happy to answer them for you.