The Three Types of "Financial Planning"

Financial Planner Compensation Models

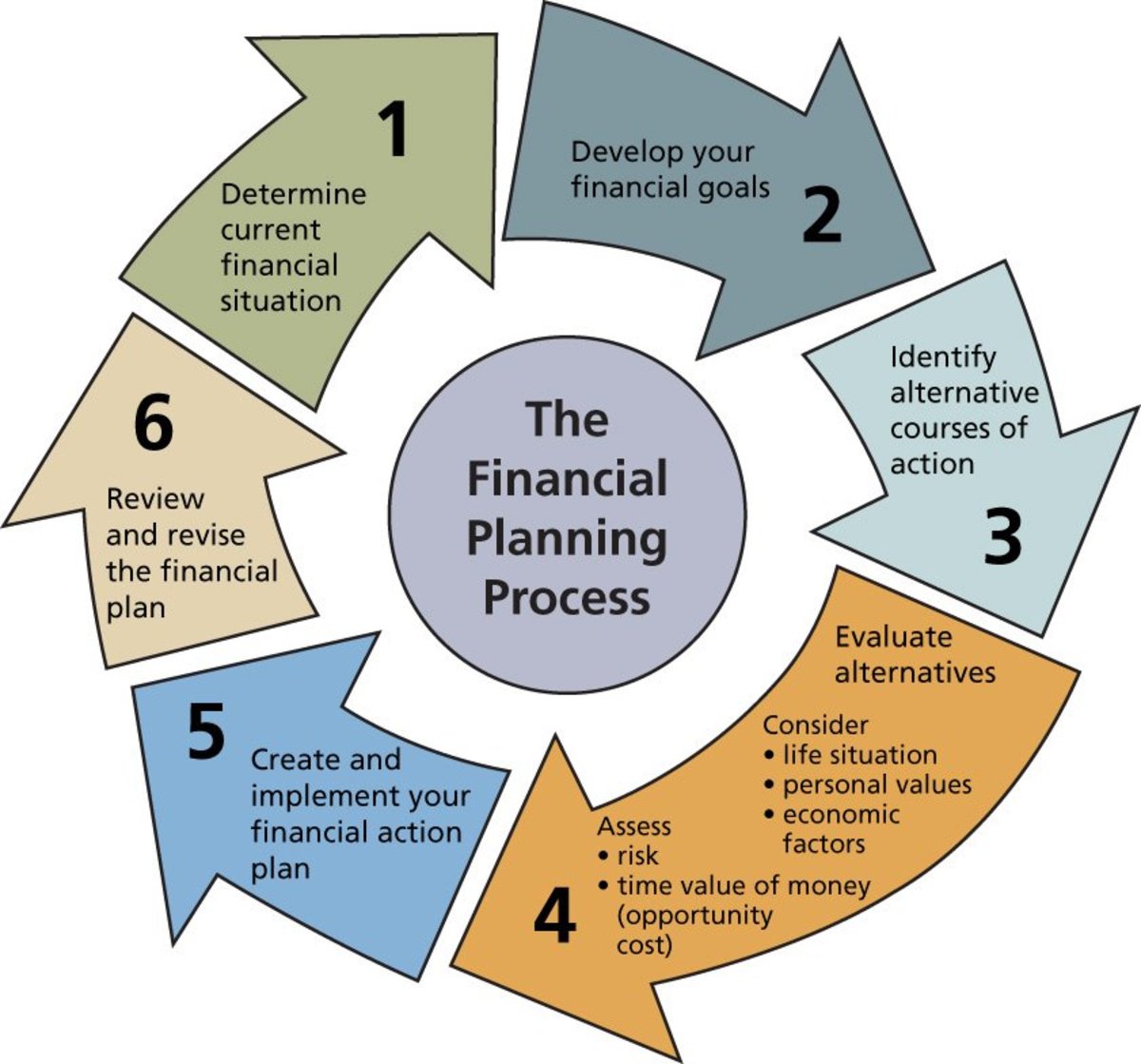

The financial planning field is a mess! It's hard to tell who the best type of person is to help you with your money. How is a regular Joe/Jane supposed to find a professional to help them improve their money skills? Also Americans are not very good with money as a rule. We like to spend, take on debt, and not save for our future self. We're not taught this subject in school, and most people don't like to talk about it in general. There's a lot of shame and pride attached to the subject of money. Let's face it, we all could use some help in this area. Since everything is denominated in money it's an important thing to get right. Having a competent and objective financial planner on your team is definitely an asset in life. Among the money experts in society there are three basic compensation models: commissions, assets under management, and fees.

The first compensation model is commissions. This used to be the most common model by far and is still pretty big. This is when you go to a financial advisor, they do a plan for free, and then make their money selling you financial products such as annuities and permanent life insurance. For the most part I don't think annuities and permanent life insurance are very good products for most consumers. I'm sure there are good advisors under this model, but it has to be difficult for the planner if no one needs or wants your products. We all deserve to be paid for the work we do however. This model could more properly be called financial product sales. The financial planning in this model is an afterthought. Sales are where the bread is buttered.

The second compensation model is assets under management or AUM. The more money that's gathered the more money that's made for the advisor. This is where the financial advisor gathers as much money as possible and charges a percentage of assets under management such as 1% every year whether the investor gains or loses money. For someone who has no money or is just starting out they won't fit into this system. They don't have anything to manage. This model is all about people who are already wealthy. Nothing wrong with that, but that doesn't apply to most of us. Financial planning is a part of this model as well, but it's usually offered as a free or low cost service secondary to managing the person's money. I think most people would be well served to be their own asset manager and buy several index funds for diversification and manage them themselves. This would cut way down on the fees paid leaving more money in the customer's pocket to compound for future wealth.

The third model is paying an hourly, flat, or retainer fee. This is the direction I hope the industry goes. Accountants and lawyers normally charge this way as do other professionals. An hourly fee is charged by the hour for services rendered. If you only need a little help this model might work well for you. The flat fee is agreed upon in advance, and no matter how long the task takes the planner the price is known beforehand. No surprises. A retainer fee is charged usually either monthly or yearly. This is another regular bill for the client to pay so the service needs to be justified. My favorite two of these are the hourly and flat fees. I believe the fee model is where the consumer is best served. Nothing is perfect though, and the problem is the fees can be expensive. A lot of Americans don't have $500 saved for an emergency. How can they possibly afford a several thousand dollar financial planning fee?

Getting objective, independent, and affordable financial advice is no easy task. It is however a worthwhile task to pursue for each of us because having money gives you more freedom in life. Besides the different types of financial planners mentioned above there are also financial coaches/counselors who work for non-profit agencies that could meet someone's needs for financial advice. Also some employers have financial help as en employee benefit through their benefits programs offered. A lot of research can be done on your own too just reading online and books. Here's to sound financial advice becoming more available to the masses.

Images

This article is accurate and true to the best of the author’s knowledge. Content is for informational or entertainment purposes only and does not substitute for personal counsel or professional advice in business, financial, legal, or technical matters.

© 2019 Blair Williamson ChFC®