The United States National Debt

Key Terms to Know

- Debt Ceiling--> the debt ceiling is basically the absolute limit of how much debt the United States can take on before declaring bankruptcy. The debt ceiling can be changed if a bill goes through Congress.

- nominal dollars--> nominal dollars are the value of the dollar bills without inflation being incorporated.

- real dollars--> real dollars are the value of the dollar bills with inflation incorporated.

- Gross Domestic Product (GDP)--> the GDP is the amount of all the goods and services produced with the United States. Basically, the GDP calculates all the 'wants' of the average person.

- Consumer Price Index (CPI)--> measures the ratio of what we consume to the cost of living. The CPI basically measures our 'needs,' like foods.

- per-capita--> a term meaning per person. If the total debt is x, then the debt per-capita (or per person) is x divided by the amount of people involved

- external debt--> the total public and private debt owed to non-residents of the United States. These foreign debts are paid through the country's currency, goods, and services.

- Currency vs. Money--> These are actually different from each other, but would take hours to explain. Currency is the act of circulating while money is what is actually being circulated. That is extremely simplified, so be careful.

- Federal Reserve Note (FRN)--> a federal reserve note is a bill.

- Deficit Spending--> Deficit spending is spending more than you have.

- Fiscal Year (FY)--> a fiscal year is any calendar year in which at the end of it a government agency determines its financial status

- Income Redistribution--> Basically the government takes the money you gave it from taxes, etc. and gives it to another person or group of persons. A prime example is a bailout.

- America's Total Debt-->all of U.S debt (federal and state governments, private sector, the whole sha-bang).

- Inflation--> a substantial rise in the value of a money that is directly related to the amount of money created and circulated. Results in the loss of currency

What is the Federal Reserve?

The Federal Reserve, much to people's thoughts, is actually privately owned, but mostly government operated. Created in 1913, it was always a highly debated topic on whether or not it should be kept up and running. The Federal Reserve also has no actual 'reserve'. There is no gold or substantial money deposits located there. About 70% of the people of the U.S.'s debt is 'inside' the Federal Reserve

How the government has no money

The governmenttechnically has no money. Therefore, it actually takes other people's money and uses it. Your money is spend through Appropriations Bills. These bills are passed by the Senate and approved by the President with a signature. What the government does is take your money, through taxes and expenses, borrows more, and spends it all. Makes perfect sense, right? This whole article won't make any sense, which sums up the financial sector of the United States Government.

How deficit spending works

The best way to explain it is through example. Lets say your total income is 10,000 dollars a month, and spend just that a month, creating no debt. You lose your job, somehow, for three months, but still continue to spend $10,000 a month. When things finally return to normal, you are 30 grand in the hole, and decide to take out a loan. You pay off the loan each month, but still spend $10,000 (as in money you do not have), driving you deeper into debt. Soon you need to take out another loan for your over-expenses, but simultaneously your interest rate on the 'getting fired for three months' loan skyrockets because you stopped paying for it. Eventually your excessive spending is way too much compared to how much revenue you generate, and you find yourself unable to even pay off the interest rates on your loans. The interest rateshave built to an un-payable level. Congratulations, you have experienced what the government experiences every day!

Each year since 1969, the government has been spending more than it earns; the U.S. Treasury Department borrows money to finance Congress' needs. The government's interest on their debt is so high it cannot find lenders to pay it back! This is partcially why Certificates of Deposits and other bonds have such terribly low interest rates: the government can't afford to pay such high rates anymore.

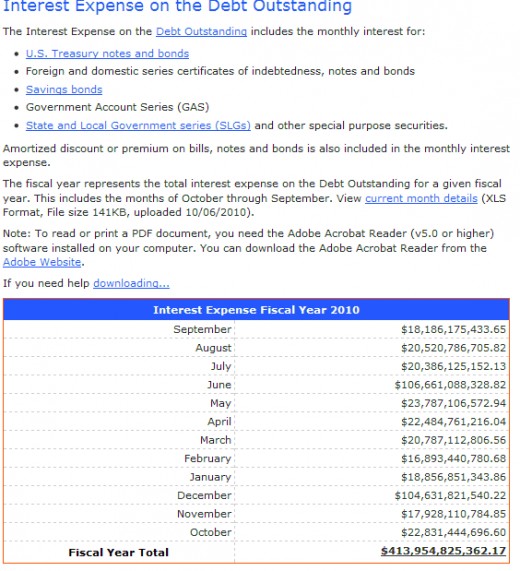

In the 2010 Fiscal Year the United States racked up $414 billion in interest rate debt only!The total debt accumulated rounded off to $1.57 trillion. This means interest rate deficit accounted for about 30% of the total deficit.

Social Security

Social Security, much to people's unknowledge, is not part of the federal budget. The Social Security has its separate account with its own income source. Its source of income is from "payroll taxes" and its revenue is not counted toward the total revenue of the U.S. Treasury. President Clinton proposed that the Social Security actually had a surplus, which was completely false. As of August 2010, they have been deficit spending. Because of this, your payroll taxes are virtually a waste of money.

Why does the gov't exist again?

According to the United States Constitution, the government has two purposes:

1) to provide citizens with the freedom of choice

2) to protect those freedoms from foreigners and domestics

The government actually steps out of these promises. If you pay taxes, that money is literally stolen from you and spent by the government. In theory, the government has no money, and is able to create money out of thin air. We are taxed to control out incomes and mindset with money. The 2008 bailouts are a perfect example. The government literally told the printing companies to print more money. For every dollar that is printed, one dollar of debt is added to the 14 trillion.

National Debt Interest Dilemma

Everyone pays interest on the National Debt through taxes or other government funding. Some people actually own a portion of this debt through savings bonds or any type of government bond. Since you own a portion of the debt, some of the interest generated goes to you, but you are also a taxpayer. This means you also pay taxes, which are used to paying off the National Debt interest (which is now impossible to ever pay off). So, you pay to fight a debt whose interest earns you money! I am not stating any opinions, just giving you the truth!

The Gold Standard

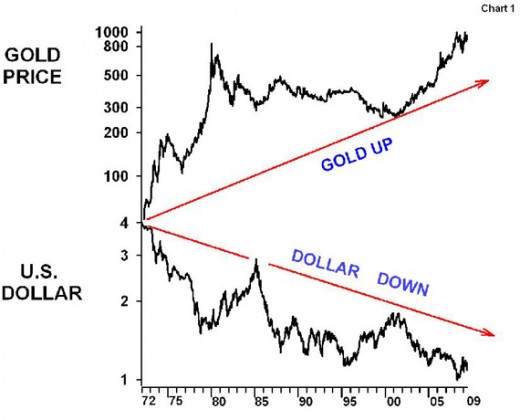

Before President Nixon took the United States off the gold standard in 1972, gold was a fixed $35 dollars per ounce. Gold was the one thing keeping the U.S. from extreme debt fluctuations. It also backed our U.S. currency, instead of trusting the government's 'word'.

When Nixon took us off the Gold Standard (another great move by Nixon; hes on a roll), gold prices skyrocketed and the value of the dollar dropped like a rock. Today, trillions of ounces of gold are needed to pay off our $14.1 trillion of debt!

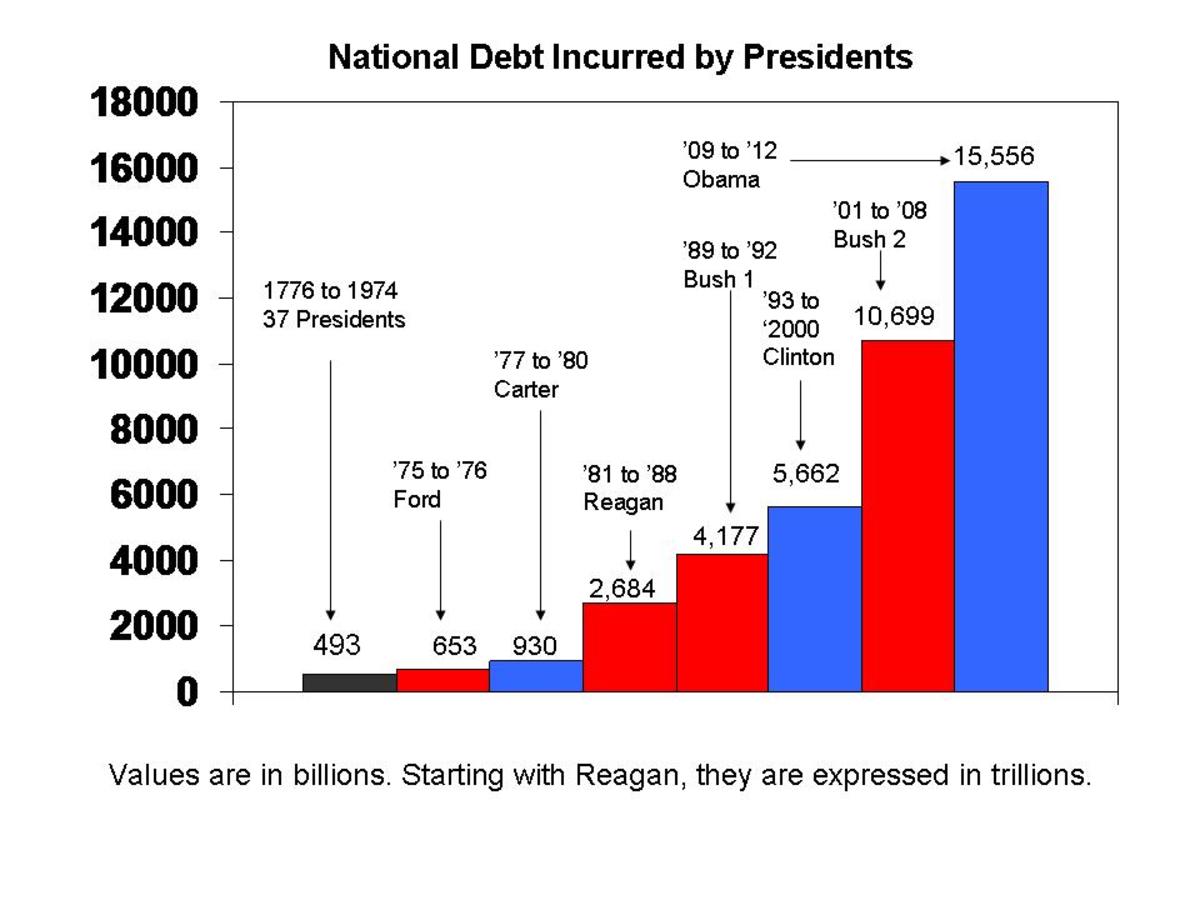

Current Statistics: Check Captions

CDs, T-Bills, and others

These things, as you know, actually produce you money. By lending money to the government, rendering it untouchable for the period of time you lent it, the government pays you back the total amount plus interest. Sounds groovy right? Wrong. The interest rates are so low, it is not hardly worth it at all unless you drop high five figures or even six figures. For instance, if you drop 2,000 dollars on a three month bond, you earn .15% interest. After three months, you have just made a whopping 3 dollars! You're better off holding a tin can in the subway for three months.

Foreign Debt

Foreign Debt, or external debt, is actually not as much of a problem as people think. Don't get me wrong, it is a problem, but not life-threatening. The external debt, related to percentage of GDP, is 98.4%, totaling a scary $45,302 per-capita.

Foreign Debt isn't a problem because of the way the United States is able to pay it off. The United States uses the foreign country's currency to pay them off, which enables trust and future loans. About 80% of the U.S.'s debt is owed to itself (so to speak). The other 20% is payable through foreign currency. This means the declining value of the dollar will increase interest rates on this debt, rendering the external debt also un-payable. These nations enjoy loaning the United States money, because they are being paid back their own currency, which is worth something!