The Warning Signs that Tell You It’s Time to Change Banks

The credit squeeze that started in August 2007 has ravaged more 542 banks in its wake. These banks have closed their doors, leaving customers searching for a new safe place to keep their money.

Since most people have gotten past stashing cash in a mattress, it’s important to be alert to what’s happening where you bank. There are warning signs that tell you your bank may be on the brink of disaster, you just have to know what to look for.

Warning Signs

Gladys Reed, market president of BankUnited, says to look for changes in the reasons you went to that bank in the first place: “Is it closing branches? Can you still reach someone to help you with questions or issues? Is the bank still helping existing customers with their financial needs, including loans?”

If you’re into numbers crunching, you can use the Federal Deposit Insurance Corporation’s Institution Directory to look up details on how much your bank has on deposit and what its total assets are. The directory provides data concerning deposits from prior years. If you compare your bank’s current deposits to previous years, you’ll see how much it has been impacted by the current economic slump. You may also want to compare banks in your geographic location to see how large their market share is to get some sense as to which banks are healthy and which ones may be circling the drain.

Of course, analyzing issues like liquidity and growth strategy to pick the best positioned banks may be difficult for the average consumer, says Gladys: “Even the experts have not done very well at assessing the strengths and weaknesses of various banks.” So you may want to stick to key attributes that affect you personally: Are the branches convenient? Is there an online banking function that meets your needs? Do you have a personal banking contact that you trust? Gladys added, “In these times, all banks have their challenges, but to some degree it is the ‘old fashioned’ themes of convenience, customer service, and trust that resonate with consumers.”

And don’t be fooled into believing that smaller banks are protected from catastrophe.

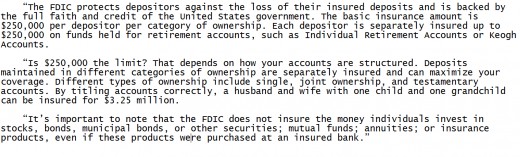

Gladys says, “For the average consumer, a smaller bank isn’t necessarily more or less safe, as long as it is FDIC insured. A consumer can have up to $250,000 in interest bearing accounts in a bank and not have to worry about it — that money is insured. And new FDIC rules protect all non-interest bearing accounts, of any size.”

FDIC Protection

And while we’re on the subject of the FDIC, how much protection does it really provide? Here’s what Gladys had to say about that

Government Bail-Out Money?

But what if your bank is in line to get some of the government bail out money; is it time to pull out your cash and head for the exit? Not necessarily, says Gladys, “Nearly every bank has some exposure to non-performing loans. Some will apply for government bailout money, and some will seek other funding, but that in itself is no reason to panic. In fact, you can take some comfort in the fact that the federal government is making sure that banks are there for you.”

What You Should Do

If you’re worried about whether or not your bank may be the next FDIC casualty statistic, it pays to do a check of the items Gladys mentioned. Remember keep it simple and personal. If your bank isn’t providing the services you need, it probably means that they’re losing financial ground. That should be your signal it’s time to start bank shopping.