How to Make Money in Stocks - A Beginner's Guide

Here are the rules and guidelines to start earning passive income from the stock market.

1. First, arrange your finances.

You shouldn't put money intended for your living expenses into the stock market. You should have gone through effective budgeting and have set up an emergency fund so you are not forced to dip into your investment. Essentially, condition your mind that the money will stay in the stock market, growing, for a very long time.

Why is this important?

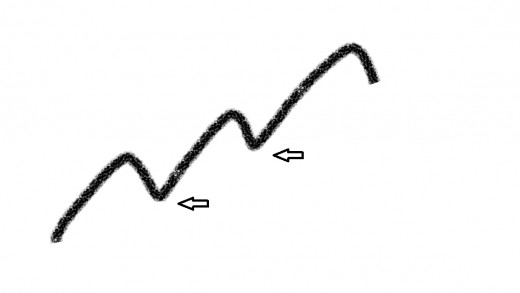

Check out the following illustration:

In the example illustration, you bought 1,000 shares of X company for $10 a share. After a year, you have an unrealized loss of $2,000 ($10-$8 multiply by 1000 shares ignoring the broker commission and other fees).

Scenario 1: You have no emergency fund and you need the money say for a house repair, you will be forced to sell at a loss, a $2,000 loss.

Scenario 2: You have planned ahead for house repair and have the budget or emergency fund for it. Seeing that there is an unrealized loss of $2,000, you just let your stock sit there and wait until it goes up. After 2 years, you see that it is selling at a market price of $12 per share. You are happy with the gain, so you sell and took your profits of $2,000.

See the difference?

Here is the definition by Investopedia:

"An unrealized loss is a loss that results from holding onto an asset after it has decreased in price, rather than selling it and realizing the loss."

2. Pick your stocks wisely.

Invest only in shares of strong, thriving companies preferably blue-chip stocks or stocks in the stock exchange index that are established businesses, have excellent earnings performance, high growth potential and will withstand bad economic conditions. Invest in companies with strong brands whose products or services you would want to buy yourself.

3. Buy them cheap

Although a stock is of a huge, established company and leader in their industry with excellent earnings record, if the stock is so expensive that there is no more room for the price to go up soon, then you couldn't expect to gain soon from buying it. So, the best option is to buy them cheap. What are the indicators that it is cheap?

a. Support and Resistance

A stock in the support level is considered cheap. Prices of stocks are like waves with low points and high points. We would want to buy in the low points which is called support level because there is so much room for the prices to increase which can give us potential gains. Be aware though that there should be no fundamental problems that caused the drop in their prices.

b. Buy Below Price

Your broker has technical people who are experts in stock markets who will do research for you. They provide Fundamental and Technical Analysis for you and recommend below what price you should buy the stocks of your choice.

4. Diversify your portfolio

Do not put all your eggs in one basket. This is a way of minimizing the risk. Do not put all your money in one stock, rather spread your money among several good stocks in different business industries.

5. Sta Claus rally and January effect

Stock prices go up during December and January. This has been the trend noticed by the historical study of stock prices. Sta Claus Rally and January Effect are used to describing December and January behavior of the stock prices, respectively when stocks are in an upward trend. You can take advantage of this and reap some profits. There is no 100% assurance because stock prices are also affected by economic conditions and news but the chances are high.

6. Ghost month

The month of August is called the ghost month in the stock market because the stock prices go down during this time. Consistent with buy low, sell high, this is a good time to go shopping for stocks when they are cheap. But still don't forget about the other factors, this is a generalization but is a useful tip when looking for a good time to buy stocks.

7. When to buy and when to sell

We want to buy at the start of an uptrend (stocks prices are going up). And sell at the start of a downtrend (stock prices begin to drop). This way we follow the rule "buy low, sell high" and reap the gains.

Know the overall market outlook and economic climate. Determine whether you are in a bull market vs bear market. According to Investopedia.com, bull market is characterized by increasing prices while a bear market is marked by falling prices and typically shrouded in pessimism.

8. Cash is king

You will be tempted to use all of your money to buy stocks you like. But what if the prices go down 30%? The prices now are cheap and it is a good opportunity to buy them cheap and wait until it goes up to sell again. But alas, your money is all tied up in the stocks you bought which you can't sell because they are priced with unrealized losses. So how do we deal with this?

a. Tranching

A strategy you can use is buying and selling in increments to deal with the uncertainties in direction of movement of prices of stocks. Truth is we don't know if the price of the stock will go down or up next week, next month or next year. So what we do is buy with half the money we allocated for that stock, if the stock goes down you can buy more. On the other hand, if the price gain goes up to say 30% and you are happy with it but we are undecided whether to sell because it may go further up, you can always sell half and take the profits, so that if it goes up we take part in the gains, or if it goes down we can buy more.

b. Peso Cost Averaging

PCA is also a very well known strategy mostly to long term investors. They buy stocks, say every quarter. In effect, it evens out the highs and lows and after holding the stock long term you will see gains as the company grows.

Edited May 8, 2020 - I will have to reassess my strategy. I would follow more my number 10 suggestion which is having a cut loss. For me, I set it at 5%. This is after what happened during the coronavirus crisis situation. I will not buy anymore in tranches when stocks are going down. Rather, I will cut loss at 5%, and buy when the stocks start to pick up again.

9. High yield dividend stock

One way to earn when all the stocks are going downhill especially during an economic downturn or crisis is through high yield dividend stocks. Cash dividends can range from 5%-15%. Not bad, isn't it?

10. Finally, cut loss strategy

Part of business is risk. So if there is some fundamental problem with the business of the stock you are holding, its prices can go down. For example, technological or legal changes that can wipe out a huge portion of the company's revenue. Painful as it may, you have to cut your losses early on before your capital gets wiped out as well. This shouldn't affect much of your portfolio if you have followed no. 4 which diversifying your portfolio. Emotionally and psychologically it would hurt but you can always win back the money you lost by investing it again in a good company stock.

I attempted trading but it is not yet for me. Buying stocks of good companies is what works for me. It gives me some peace of mind. I see price movements as opportunities rather than a scare. When they go down, good. I can buy at a cheaper price and earn more. If they go up, much better because soon I will be selling at a profit.

Happy Investing!

Do You Feel that Investing in the Stock Market is for You?

This article is accurate and true to the best of the author’s knowledge. Content is for informational or entertainment purposes only and does not substitute for personal counsel or professional advice in business, financial, legal, or technical matters.