Three Key Questions on Investing

Introduction

Investing for your future is your first priority. You can’t rely on your spouse, your kids, your extended famly or your government. What are the top 3 questions to answer before you get started?

- Nov. 2018

First Question - What rate of return should I aim for?

When it comes to investing, the rate of return is key. It varies depending on risk factor. If you want to be perfectly safe, you put your money in a bank and it pays very low interest. It is safe and you can never loose your principle. However, the rate of return is also very low...perhpas less than 0.1% in today’s environment.

If you invest in the stock market, depending what stocks you buy, you can expect very high rate of return or you can loose it all. The rate of return generally follow the risk. The higher the risk, the higher the return. The safer the investment, the lower the return.

To answer the question I posed, what rate of return should you aim for? The answer is 4 percent above the inflation rate. Therefore, this answer is not a fixed quantity. The reason is very simple. When investing for the future, we cannot control the price of goods. If the prices rise for whatever reason, you need to adjust your income to help pay for those goods.

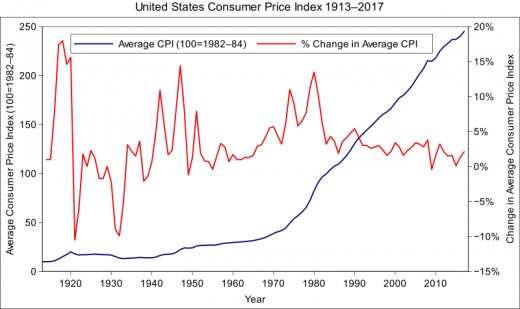

The inflation rate or the CPI is tracked by our government. It is an index that estimate the approximate rise in prices from year to year. It is an average based on an assortment of items in a basket. These are common things you need to live, such as foods, energy and housing, and consumer products.

In fact, our social security benefits are adjusted to the CPI as well. When the inflation rate rises, we need to adjust our income to compensate.

Why 4%? I chose 4% to estimate how much you will need to live off your nest egg. For example, if you saved a million dollars, and you need to spend $50K per year, you will run out of money in about 20 years. If you retired at age 65, you will be broke by age 85.

If you invested that $1 million dollars, and you got a 4% return a year, you will be ahead by 40K each year and when you withdraw 50K you are only down 10K. This will allow your money to last almost indefinitely.

Historical CPI

Second Question - Where Should I invest My Money?

The answer is Equities. Equities includes stocks, bonds, mutual funds index funds and ETF... Do not invest in bank saving accounts or annuities or insurance schemes...

Why only equities? It is the only investment that can generate the returns you will need over a long period of time say 30-40 years.

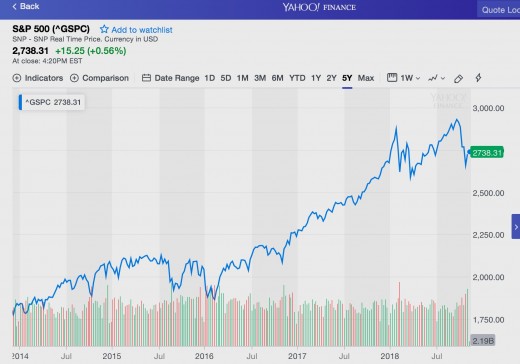

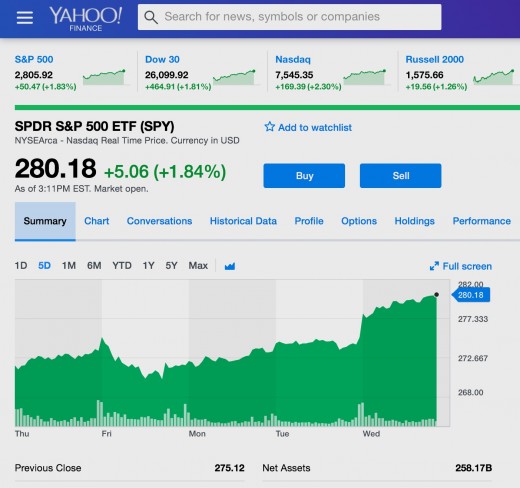

My simple suggestion is SPY. It is an index fund that tracks the top 500 companies.

Plot of S&P for the Last 5 Years

Third Question - How Should I Invest?

The last question is how to go about this. Here is what you can do.

1. Start an online broker account like Etrade or Firstrade.

2. Transfer your money into the account as Cash Account.

3. Buy SPY using dollar cost averaging over a period of 1-3 months.

For example, if you have $50K to start...

On week one, Monday, you buy approx. $10K of SPY shares, rounded off to the nearest 10 shares.

On week two, Monday, you buy the next $10K of SPY...

Continue each week until all the 50K is spent with any left over kept in cash.

By doing this, you insure you are buying SPY at an average amount rather than catching it at a high or a low.

Summary

This simple investment strategy will get you started on your way. You should monitor your investment periodically to see how you are doing. My advice is once a month, check your balance. Track your progress and see how much your nest egg is growing. Every year, compute the rate of return for that year. It is very simple.

(Year End Balance) - (Beginning balance) divided by (Beginning balance) x 100.

This is the Rate of Return for that year. Repeat this for every year...

Also, go the the BLS site and look up the yearly CPI.

See how you are doing each year. If you are getting 4% or more above the CPI, you are doing great. If any given year, you either lost or are below the 4%, you are not keeping on target. If a few years in a row of losses, revisit the strategy.

SPY Bump Post Election

Stock Market Volitility

Recent weeks have seen the stock market going up and down like a yoyo. Most down compared to a year ago. This volatility can be unnerving to novice investors. They panic and want to bail out. That is exactly the wrong move.

The simple strategy is BUY LOW, SELL HIGH.

That is how you make money. In these turbulent times, stay put. You have a long term perspective and short term gyrations should have no effect. Investing for your future should be a life long activity. As long as you follow the basic rules, you can’t be too far off. Those who try to time the market, or are greedy tends to loose in the long haul.

© 2018 Jack Lee