Time Value of Money: How Real Estate Investors Gauge It

Anyone who has purchased a tank of gasoline lately has surely experienced the effect of time value of money, yet few understand what it is and how it works.

Real estate investors might be the exception because they commonly look to determine a rental property’s future financial performance in terms of today’s dollars (or purchasing power) rather than in tomorrow’s dollars so they typically are more acquainted with the notion of time value

For those less acquainted: Time value of money is a concept derived from the fact that the purchasing power of money does not remain static and over time will change value. Inflation rate provides a good example.

According to the Consumer Price Index the rate of inflation rose 10.8 percent over the past five years. As a result, $5,000 spent for goods and services in 2007 would require an expenditure of approximately $5,542 for those same goods and services in 2012. What happened? The effect of time has decreased the value of money (or more specifically) decreased the purchasing power of that money over time.

Okay, now let’s consider it from a real estate investor’s point of view.

Say in 2007 the investor was forecasting a rental property’s cash flow to be $5,000 in the year 2012. We can see from the data above how inflation will reduce the value of money forecast essentially by providing less purchasing power to the investor when the money is collected despite the fact that the property performs as predicted.

A series of cash flows forecast over multiple years intensifies the situation.

Say, for example, the investor anticipates collecting a cash flow of $5,000 each year for five consecutive years starting in 2007. To illustrate, I’ve listed below the actual inflation rates published by the Consumer Price Index for those years along with the amount required to sustain the same purchasing power as in 2007:

- 2007-2008, 3.8%, $5,192

- 2007-2009, 3.5%, $5,174

- 2007-2010, 5.2%, $5,258

- 2007-2011, 8.5%, $5,424

- 2007-2012, 10.8%, $5,542

Why is this important?

Because without inflation the investor would collect the total $25,000 cash flows with no loss in his or her purchasing power because tomorrow’s money is worth the same as today’s money. But as you can see (due to inflation) the investor is required to spend a total of $26,590 to maintain the same worth those cash flows had in 2007 when the rental property was purchased. In other words, based upon this assumption tomorrow’s money is worth $1,590 less than today’s money.

Okay, let’s change gears.

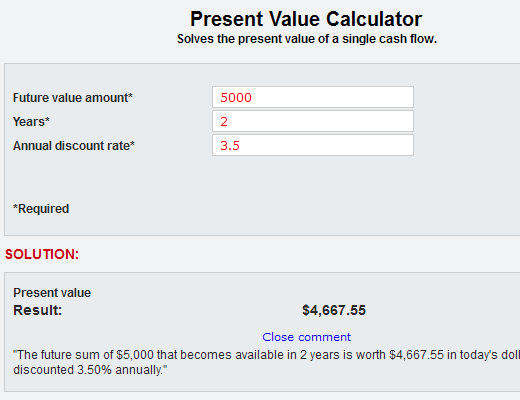

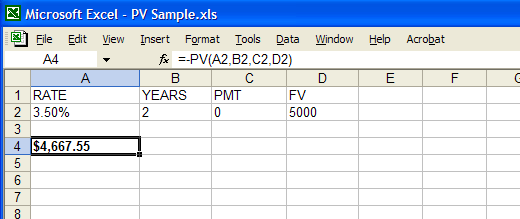

Let’s take those series of cash flows at the specified future time they become available and derive what their present value (or worth) would have been in 2007. We will do this by taking each of the future cash flows of $5,000 and then discount (the mathematical procedure for determining present value) back that lump sum amount at the inflation rate according to the time scheduled for collection.

- $5,000 in one year discounted at 3.8%, $4,817

- $5,000 in two years discounted at 3.5%, $4,668

- $5,000 in three years discounted at 5.2%, $4,295

- $5,000 in four years discounted at 8.5%, $3,608

- $5,000 in five years discounted at 10.8%, $2,994

Sample (for 2 years)

Now let’s do the math.

When the real estate investor was evaluating the rental property’s future financial performance back in 2007 the total amount of cash flow projected over five years totaled $25,000. But due to the time value of money the present value (worth) of those dollars (in 2007) was actually $20,582.

What does this eroding value of money over time mean to the investor?

For one, he or she will obtain lower rates of return than might have been originally anticipated. Take the return on investment, for instance, using an initial cash investment of $500,000. At a cash flow of $25,000 the return on investment is 5.0% (25,000 / 500,000), whereas at $20,582 the return is just 4.12%.

So there can be a huge disparity between the real estate investor’s returns projected at the time of purchase and the actual rate of return that results over time.

Consequently, the ability to measure for time value of money and solve for changes is crucial for real estate investing. Consider the disappointment had an investment decision been made to purchase a rental property on the grounds the investor would obtain a 5.0% rate of return when in fact (due to no other cause but the principal of time value of money) that the investor’s yield works out to 4.12% (?).

Of course, our example is looking backward so we don’t have to guess at the rates of inflation for each series of cash flows and therefore can compute the return on the investment rather effectively.

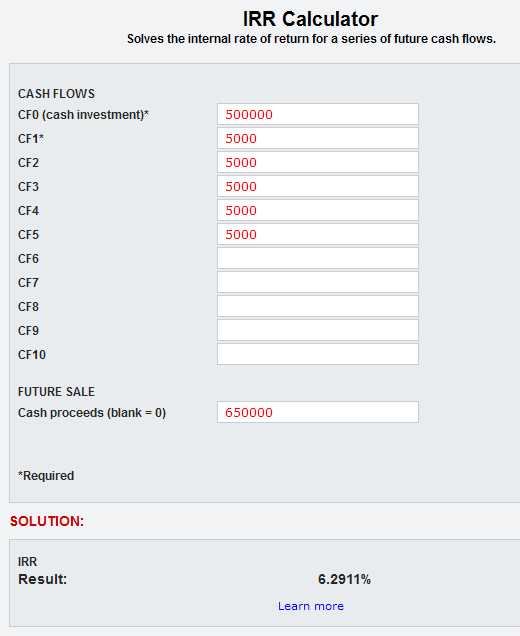

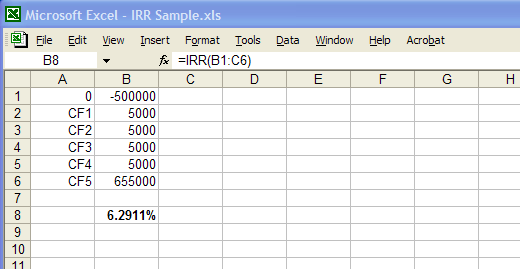

But investors aren’t given that advantage during investment decisions. So real estate investors look to elements that consider the present value (PV) of future income streams such as internal rate of return (IRR) to tell them what yield he or she might expect for their investment.

Internal rate of return works this way.

It reveals the interest rate the investor will receive for an investment consisting of payments (cash flows) that occur at regular periods. To illustrate, we’ll assume an initial cash investment of $500,000, five consecutive annual cash flows of $5,000 plus cash proceeds of $650,000 resulting from a sale in the fifth year. The internal rate of return is 6.29%.

Sample

About the Author

James Kobzeff is a real estate professional and the owner/developer of ProAPOD - leading real estate investment software solutions since 2000. Create cash flow, rates of return, and profitability analysis on rental property at your fingertips in minutes!

ProAPOD also provides iCalculator - an online real estate calculator that enables you to learn dozens of real estate definitions and formulas as you calculate. You save 64%. Learn more at real estate calculator

Other Articles

- How To Calculate Cash on Cash Return | The Method And Formula!

The formula and calculation for cash on cash return. Insights in how to use it in your next real estate analysis. - The Present Value of a Future Cash Flow - Why Understanding Present Value is Crucial To Any Real Est

Learn the difference between present value and future value and why these time value of money concepts are crucial to your cash flow analysis of investment real estate. - The Annual Property Operating Data (APOD): Why Real Estate Investors Use It and How to Construct!

Learn about the APOD. Why it's a popular real estate investing report and how to construct one. - 5 Questions Investors Should Ask and Answer About a Rental Property That Can Save Their Nest Egg!

Five legitimate questions a prudent investor should ask and answer before making any investment in rental property. It could save you your - How Risk Analysis is Used to Make Better Real Estate Investing Decisions

What risk analysis is, and why investors use it in a real estate analysis to help determine an investment decision. Illustration provided.