How To Live On A Fixed Income

LIVING ON A FIXED INCOME

When people retire, one of the most difficult things to adjust to is having less money.

Moving from spending "at will" to living on a fixed income can be very frustrating.

It can be very tempting to run up credit and debt by living beyond your means.

Let's look at some ways to avoid the frustration and some concrete ways to learn to live on a fixed income.

Living on a fixed income doesn't have to be the end of the world.

If you know what you are facing and how to deal with it by simple strategies, it usually makes things easier to handle.

WAYS TO LIVE ON A FIXED INCOME

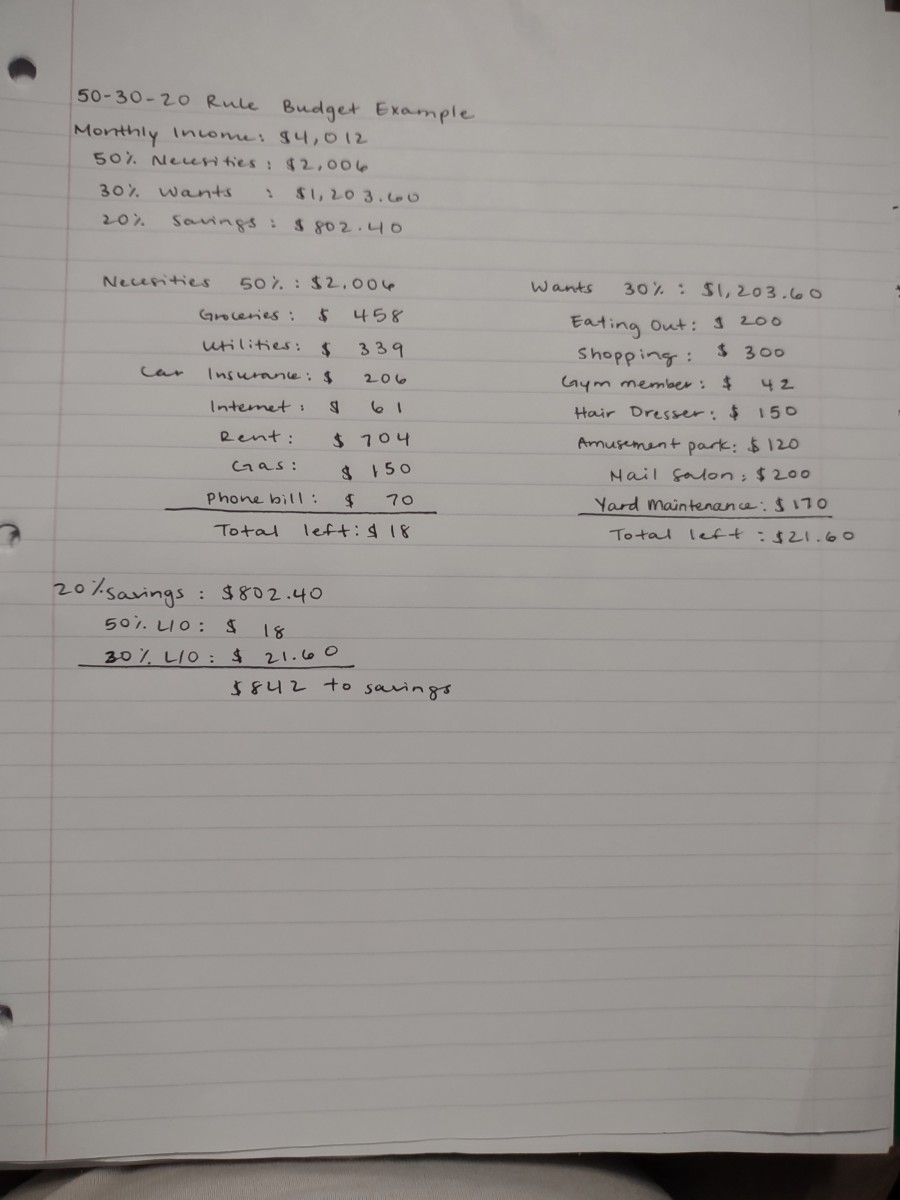

You need a financial plan......or a budget. There isn't any other way around it. You have to know how much is coming in per month and what your expenses are. Without that, you will continue to circle around the issue and possibly become more in debt. Never spend more than you are bringing in! If you do, you will increase your debt and your worries.

Plan your trips. Take advantage of your organizational skills and keep a running list of items that you need frequently or items that you need less frequently. Don't make 1-item shopping trips! You'll save on gas and time if you make a once per week trip for instance and go to multiple stores.

Play the numbers. When something goes on sale, consider buying it then and maybe let it pass other times. If you find something on sale and you can buy it and use it, stock up and save even more.

Seek out and ask for senior discounts.

There are many stores that offer senior discounts on certain days, some

all the time. Don't be shy. Find out how much you can extend your dollars

by being proud of your age! Some places

offer discounts starting at 55 but some offer them at an even lower age; some require you to be 60, and so

on. Just ask! Restaurants, movie theaters, traveling,

retail stores and more offer discounts.

Make a list of the ones you love! Consider getting a senior discount card too.

Buy on sale. I have done this for

years. I refuse to pay full price for

anything. As a senior, we especially

should not have to pay full price for a thing!

Make saving money on things a game and make sure you win it! Use

coupons and rebates to sweeten the

deal. If you really want to feel good, set aside every dollar that you

save in a separate account and see how quickly it grows. (Make sure

it's an on-line savings account backed by the FDIC and you'll get 5-6

times the interest that you would in a bricks and mortar bank)

Plan what you eat. The best way to save on food is to have a formulated plan. If you go out to eat that's fine but don't do it at the expense of throwing away food (or money). Come up with meal plans and then stick to them! Cook in larger portions and freeze if necessary so you will have variety and save money.

Learn for free. Look for free classes and activities that don't cost a cent or are relatively inexpensive. Join clubs and participate in things you have always wanted to learn or do. You'll find that there are many things you can do for free and have fun at the same time while getting to know other people.

Save your energy. Make sure you have energy efficient light bulbs and have investigated how to best save on your utility bills. These can be a huge drain on a senior budget. Make sure you have proper insulation as well and you'll cut costs. Ask your local utility companies for ways to save as a senior. Most cities have free energy assessments available through the power company. There are also many local grants that seniors can tap into to replace windows, furnaces, air conditioners, etc. Put that on your to-do list!

Work isn't all bad! Think about alternative sources of

income or even trade your services for

something you need done. If you need

help mowing or tending your yard, try to find a young person who

doesn't

charge a lot to do the job. Or maybe even find a friend who will trade

you a

service for taking care of that task for you.

Perhaps painting is a job you can perform easily while yard work

isn't......by trading you please both parties. Think about going

on-line and selling things on Craigslist. Many folks make a good little

income from it....just by picking up "free things" and refurbishing

them and reselling them! Or write on-line at hubpages!

Evaluate your medications. I'm not suggesting that anyone stop taking any medications, but here in the US, most people (especially seniors) are on a crazy amount of medication. I would suggest having your physician and/or your pharmacist analyze your medications and go over them meticulously. Are there some meds that can be cut out completely? How much do you have to pay out of pocket for them? Can some of the medications be changed to generic thus saving you major dollars? Are there alternatives that cost less? Check out the $4 prescription plans at many stores and call to see if your medications are covered. Also look into mail-order prescription refills. They can also save you big money. You won't know unless you ask your health care provider. An especially important question to ask when reviewing your medication list is "Are there meds on here I'm taking to counteract another medicine I'm taking?"....and then try to eliminate that scenario if at all possible! In many cases, there are huge savings that you can find in your medication list!

Continue saving money and paying off debt. Seniors have the same concerns usually that younger people have....having enough money to get by on and meeting your debt obligations. However, just because someone is a senior doesn't mean that you shouldn't keep padding your own pocket by putting away money in savings. Then you have money in case you need it for an emergency.....or you have it for something you need to do or want to do in the future.

Investigate the possibilities.

Do your research and find out if things like reverse mortgages,

refinancing or even moving to a retirement community are going to give

you more financial peace of mind and more security in the long run.

Nothing is ever a reality unless you check it out. If it looks too good

to be true, it might be. But then on the other hand, changes are

always good no matter what age we're at. You won't know unless you look

into every possibility out there...then make your decision based on

your life experience and decide what financially works best for you.

Living frugally or wisely doesn't mean you have to be bored or that you won’t enjoy your life. It simply means that you will get more bang for your buck and have more opportunities to do things that you couldn't before because of lack of funds or time.

How to Survive Living on a Fixed Income

In short, living on a fixed income doesn't have to be totally painful!

In fact, it can be quite entertaining if you go at it with the thought that it's more of a game than a torture.

Trying to get the most for one's money and hard work is never a bad investment.

Finding new ways to save money or make money can also be very exciting.

Sometimes when things aren't as easy, the rewards seem even greater. There are many things that we can all do to trim the fat from our financial life. Never stop analyzing and whittling away at things that you don't need!

Wishing you a well-rounded life on a fixed income. It can be done!