Tips for Managing Multiple Bank Accounts

Why Should Anyone Need Multiple Bank Accounts?

Managing your bank accounts and thus your personal finances effectively is firstly about striking the correct balance in the number and type of accounts which you operate. If you only have one account but a great many financial commitments and therefore transactions passing through it, you may very easily become confused in terms of which funds are required for what purpose. On the other hand, if you attempt to use a separate bank account for every minute aspect of your personal finances, you can very easily lose track in a different respect and misappropriate funds between accounts. This page is designed to look at the reasons for operating multiple bank accounts, which type of accounts you should have and how to manage them effectively.

Top Tips for Managing a Checking/Current Account

Money Transmission Bank Accounts

Often referred to as checking accounts, or current accounts, money transmission accounts are those which most people use to manage their every day personal finances. Money transmission accounts allow ATM withdrawals, direct debits and frequently debit card transactions.

There is much to be said for operating two money transmission bank accounts. The primary account - in to which a salary would be likely to be paid - is used for cash withdrawals and expenses which vary from day to day, week to week, or month to month. The secondary account should be used to pay fixed or semi-fixed direct debit payments. These latter expenses would include a mortgage, car loan payment, or even sports' or other leisure club fees. A standing order should be set up to transfer money from the primary account to the secondary account a day or two after salary credit is made each month.

The benefit of using two money transmission accounts in this way is principally that funds left in the primary account will generally be able to be classed as disposable income. This reduces significantly the chances of inadvertently withdrawing money which is supposed to cover the automated payment of a major bill. It remains important, however, to review the amount transferred between the two accounts whenever a monthly payment amount alters and to ensure that the secondary account always contains sufficient funds.

Savings Accounts

Savings accounts come in many different forms and are designed both for short and long term savings purposes. Some afford instant access to the funds, some require notice or the acceptance of an interest penalty in order to make a withdrawal, while others afford tax breaks or similar benefits. It is important to know the precise features of a savings account before committing funds to it and for which of these particular purposes it is designed.

Those with short and long term savings plans are for this reason better operating at least two savings accounts. Savings which are perhaps intended for any emergency expense which crops up such as car or home repairs are better maintained in an instant access account. Savings which are designed for retirement, a distant family wedding, or any other expense for which withdrawal notice can comfortably be given, are best maintained in a restricted access account, where the credit interest paid is likely to be significantly higher.

It is important in this respect to avoid appropriating too much to a restricted access account as penalties for making unexpected withdrawals can quickly offset the benefits.

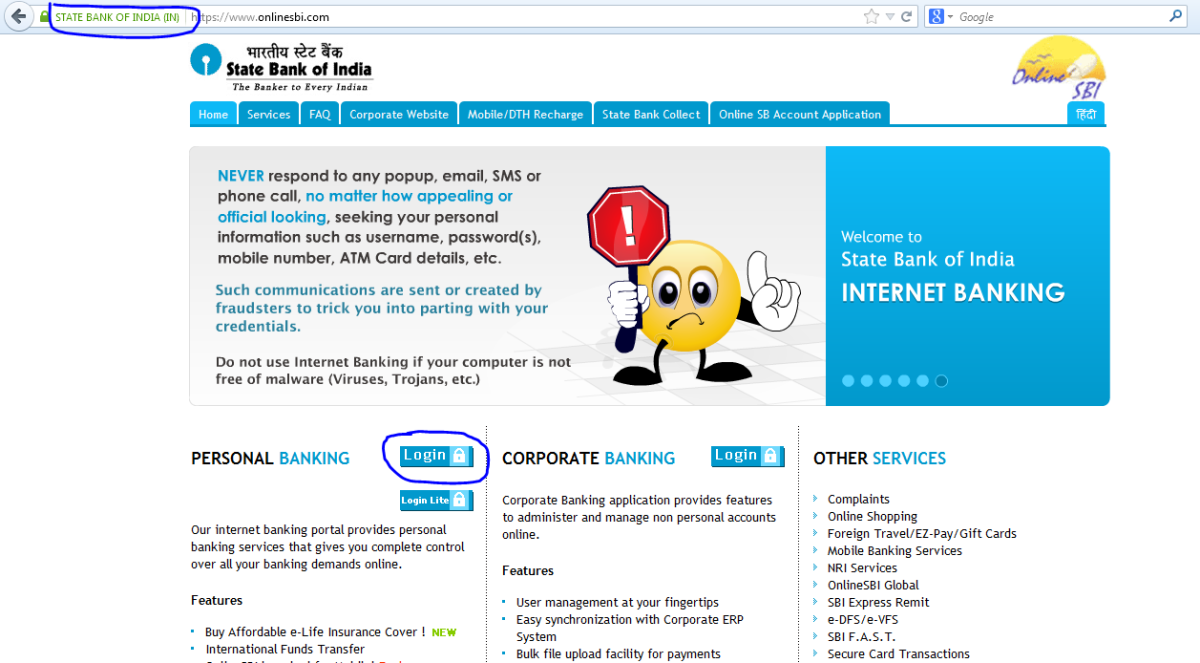

Safe Online Banking Tips

- Good security practices for online banking

The innovation of online banking and the convenience it affords has proven to be a revelation and almost a God send for millions of people the world over... - Twelve Tips To Keep You Safe Online!

If you dont take precautions online, then your money may be at risk. These twelve tips show you how to stay safe when surfing and shopping. - Top Ten Tips for Safe Online Banking | fearlessweb

When selecting a bank, be it traditional or online, there are several things you should check to ensure that your money will be safe. Yet, online banking - Tips For Safe Online Banking

The world is going online. Every day, it seems like another service that we're used to experiencing every day has an online equivalent and it is far improved - FDIC: Safe Internet Banking

As use of the Internet continues to expand, more banks and thrifts are using the Web to offer products and services or otherwise enhance communications with consumers.

Online Banking and Internet Security

There can be little doubt that online banking is the most efficient way in modern times of managing bank accounts and personal finances. Banking online allows enquiries to be made or transactions to be performed at any convenient time of the day or night. It is unfortunate, therefore, that online banking receives such negative press in many quarters and many people are thus dissuaded from using it as a result. Although it can not be denied that the hacking of bank accounts online does occur, the frequency of such occurrences in relation to the number of online banking transactions performed every day are minuscule and there are a number of steps which can be taken to reduce the likelihood of falling victim to such a crime even further.

- Read the tips and advice section on your bank's website prior to signing up for online banking

- Choose a password and security details which could not be easily guessed by anyone. Try to go for a mixture of letters (upper and lowercase) and numbers

- If using a shared computer to perform banking transactions, be sure to sign out fully when finished. Never select the, "Remember me on this computer," or other similar option

- Sign in to your account regularly and report any suspicious activity to your bank without delay

- Change your password and security details fairly regularly

- Never disclose your security details, even to a member of bank staff, and particularly never in reply to any e-mail. E-mails purporting to be from a bank requesting security details is known as, "Phishing," and is one of the most common ways for unscrupulous individuals to gain unauthorised access

- Make sure your firewall, anti-virus and associated packages are active and up to date at all times

The links to the right afford lots more useful and important information about staying safe and secure online.

Name your Online Bank Accounts!

It may sound like a strange tip but naming your online bank accounts - where your bank affords this option - is an excellent way of avoiding careless mistakes when transferring funds. If you have a few bank accounts, remembering which account number relates to which account is unlikely to be easy. This could conceivably mean that money destined for one account is accidentally posted to another. Naming your accounts will all but eliminate this risk and allow you to see at a glance which account is which.

The table below illustrates how this can be achieved in greater detail and note that the names should be relevant and functional, rather than along the lines of, "Fred, Ted and George..."

Account Name

| Account Function

|

|---|---|

Every Day

| Salary credit, Day to day expenses

|

Bill Pay

| Direct debit payments such as mortgages and loans

|

Short term savings

| Emergency money or short term requirements

|

Long term savings

| Funds geared towards longer term plans or commitments

|

Multiple Bank Account Management In Brief

- Take some time to define precisely how many bank accounts you do or do not need with regard to your own personal financial circumstances

- Use automated transfer facilities between your accounts and to pay external bills wherever possible

- Check your bank accounts regularly and ensure you keep on top of which funds are being held in each account

- Practice safe online banking at all times and keep your software up to date

An Important Word about Personal and Business Bank Accounts

Owners of small businesses in particular may very well have their personal and business accounts with the same bank. This will allow them to transfer money between the two where required.

It is important to remember, though, that money should not be transferred indiscriminately between personal and business bank accounts, however convenient it may be, as this can lead to accounting difficulties and possible taxation issues. A clear, simple, explicable audit trail must always exist in the instances of such transfers between bank accounts.

Do you Have any Bank Account Management Tips you would Like to Share?

Thank you for your visit to this page and I hope that you found it to be of some practical use. Any feedback you have, or tips you would like to share with regards to the management of multiple bank accounts, may be left in the space below.