Top 10 signs that you will never get rich

After initial months or years of working and sweating, you successfully landed a satisfactory job with a salary that could pay your bills and help you live quite comfortably, and you thought to yourself that your life had finally begun. However, some years or even a decade later, you look back and suddenly realize that you are still not much richer than you were before. Whether you like it or not, it is very likely that you have fallen into the middle income trap. You should become even more alarmed if you show more than one of these following 10 signs:

Are you in the middle-income level?

You do not learn anything new from your current job

After a long time working for the same company or doing the same type of job, you probably have learned all its tricks, tips and shortcuts, and you can complete your task reasonably well without having to give much thought to it. You might have been appointed to some middle-level managing position according to the company’s promotion scheme without much trouble. To train new employees, you can rely on solely on your personal experience, and never need to do any research or prepare much in advance: you have perfected your presentation since you have done it for dozens of times. If all of these things apply to you, the good news is congratulation, you have become sort of an expert in your field, but the bad news is you probably have not learned anything new for quite some time and have fallen from the peak of the learning curve. If you are not aware that the world outside is changing at a frantic pace and that you are falling behind by not moving forward, your complacency can trap you forever within your current income level.

You feel insecure towards newcomers / young graduates

One symptom that people who have stumbled into the middle-income trap show is that they fear changes. Newcomers and young graduates represent changes and they bring a new set of skills, personalities, and perspectives into your current game. Consequently, whether you would like to admit it or not, they make you feel vulnerable since they are as fresh as the morning dew and you are as old as the hills. While a certain amount of insecurity is helpful in motivating you to improve yourselves and become more competitive, most of the time, it results in negative reactions such as hostility, work conflicts and resentment. Unfortunately, for the old timers, in this battle, you are often at a disadvantage, and for the organization as a whole, this situation impedes work performance and reduces productivity.

You are not entirely satisfied with your job but you are scared of leaving

Although not everyone is fortunate enough to make a living out of their passions, it is still not normal or beneficial to keep working for a job that no longer inspires you or makes you care about. When you stop caring about your work, you stop improving your knowledge and skills, or introducing innovation. For young workers, once they are bored of their jobs, they quit and move on to find a new position that can help them exploit their full potentials and prosper. Nevertheless, for seasoned employees, instead of changing and improving the situation (remember that they are afraid of change), they settle for safety and security. You need passion to succeed and the fear of leaving the mediocrity to pursue excellence is really what confines middle-incomers to their perpetual fates.

You turn your back on your past passions and belief

Denying your earlier dreams and faith is another sign that you have come to terms with your present state and started to deny who you truly are. You might have dreamt of becoming an influential social entrepreneur, a high-qualified doctor, a prominent politician or a respected scientist; however, now you just want to focus on selling your next product, completing your routine work schedule or meeting with the next client. It is not that there is anything wrong with your current life; it is just that if you ignore your passion and the true calling of your heart, you can gradually lose sense of your own identity, then conform to the normality and live like that for the rest of your life.

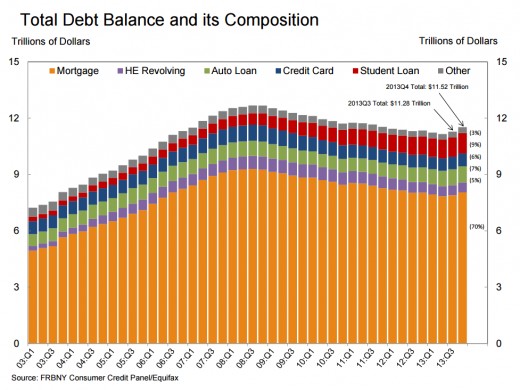

You have too much debt and obligations

On the federal level, in 2014, the US’s public debt as a percentage of GDP reached 102.1%[1]; on households’ level, households’ debt as a percentage of disposable income was 113%[2]. The average U.S. household carried about USD 15,762 in credit card debt and USD 130,922 of debt in total[3]. Most of American households’ debt went into mortgages (accounting for more than 70% of total debt balance), followed by student loan, and auto loan. While it is inevitable to have debts, and some kinds of debts such as student debts and mortgages are even considered good debts, debts come with responsibilities and need to be paid with real income. Therefore, debts do reduce your job mobility and make it harder for you to leave and find a better job since you depend more on your monthly paycheck to meet your debt obligations.

You have no investment

According to a survey of about 2,000 randomly-chosen individuals by Get Rich Slowly, 40% of the respondents reveal that they do not invest even a cent in anything[4]. Unfortunately, if your paycheck is your only source of income, you are very likely to be trapped in the middle-income league. The most popular how-to-become-rich advice states that you can never become rich by working for someone else because when you do so, you are helping someone else to accumulate their assets, not yours. Having more than one streams of income by investing not only encourages you to save more but also gives you another plan to fall back on. There are many investment channels that you can explore nowadays such as buying stocks, real-estate or gold, starting your own businesses or investing in a capital fund and having an expert manage your money for you, etc. If after taking into account all of your expenditures and savings for emergency, you do not have much left, or you are a risk-averse person, you can invest your time and skills in other activities that can generate side income such as blogging, selling handmade items, taking photos, and so on.

You don’t invest in yourself

If you do not invest in yourself, you certainly miss out on the best chance to bring you out of the middle-income trap. Investing in yourself clearly does not mean over-indulging yourself with extravagant spending on brand clothing, luxurious cars or a huge mansion: these spendings only lead to higher debts, which further lock you in your middle-income trap. Investing in yourself means constantly broadening your knowledge, brushing up and learn new skills, keeping yourself abreast of current trends, growing your network, or in short, adding more value to yourself so you become more sellable. If you do not equip yourself with appropriate tools, you will not be able to grasp the opportunity at the most critical moments.

You have no network

Relationships are the catalyst for success, and networking enables you to expand and build-up those meaningful and enduring relationships. For people who desire to get out of the middle-income zone by finding a better job or starting a new venture, having the right network is particularly important. If you know the right people, they can not only motivate you to reach for new horizons but also provide you with financial support, connections, reference and valuable advice. If you have no network, it can be very hard to start and manage everything on your own. What’s more, if you are surrounded by a network of successful people in various fields, you can be inspired to follow their path and thrive just like them.

You are easily discouraged

Stepping out of your comfort zone and giving up your familiar routine way of living to embark on a new adventure remain a very big but very personal decision. You cannot expect everyone to understand your choice, and more often than not, people, sometimes including your close family and best friends, will try to dissuade you from what they consider irrational. If you are easily influenced by other people’s opinions, you can never come close to living the life that you wish for. Subsequently, you will succumb to the crowd and keep staying with the middle-income crowd, the biggest and hardest to get away from one.

You have no financial goals

Having no financial goal also affects your ability to find your way to break into the high-income league. Like everything else in life, you need a goal and a clear roadmap to guide you to where you want to be in short-term, middle-term and long-term. Without a clear financial goal, many people just keep spending around like they just live for today and only stop when the credit card bills arrive. To develop a personal financial plan, you can sit down and consult with your partners, or even hire experts to assist you with calculating your current net worth, income and expenditure, deciding your professional, lifestyle and retirement goals, evaluating your options and creating an action plan to achieve your goals. If you over accomplish and reach your action plan milestones faster than planned, you can raise your target, revise your plan and dream bigger.

How to get rich

Reference

[1] https://research.stlouisfed.org/fred2/series/GFDEGDQ188S

[2] https://data.oecd.org/hha/household-debt.htm

[3] https://www.nerdwallet.com/blog/credit-card-data/average-credit-card-debt-household/

[4] http://www.businessinsider.com/an-astounding-number-of-americans-arent-investing-a-cent-2014-12