Trading Stock Options in Volatile Markets

Volatility

Of all the factors that influence the prices of options, volatility is the most neglected factor. Unfortunately, volatility is such an important factor in the price of an option that a change of one percentage of volatility has such a significant influence to the price of the option.

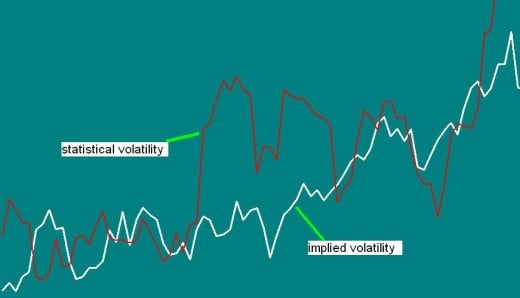

Every stock has cheap options when the volatility is low and expensive options when the volatility is high. Every stock has a range which its price can fluctuate within a defined time period. In Mathematics its called deviation and it's from it that one can derive standard deviation. This deviation is called volatility and it can be computed for every asset from past prices. This volatility is called historical volatility or statistical volatility. It is by the use of the statistical volatility that one can be able to approximate the future prices of the stock.

Stock options have volatility referred as implied volatility. This implied volatility is the volatility implied by the prices of the options of that stock.

Ideally, the volatility implied by the options should be the same as the statistical volatility of the underlying stock. But this is usually not the case. If the difference is large, it indicates the price of the options is not reflecting the actual volatility of the stock and either the options are high priced or low priced.

Calendar or Horizontal Spreads

Falling stock prices will tend to result with higher implied volatility whilst rising stock prices will tend to result in low implied volatility. This happens because falling stock prices will result in greater uncertainty in future risk and higher insurance premium against future losses. The opposite is also true in case of rising stock prices.

When the implied volatility is higher than statistical volatility, it means the options are expensive and the best thing to do is to sell short the stock options hoping that soon or latter the high implied volatility which is associated with higher prices will drop to the levels of stock statistical volatility. When the implied volatility is lower than statistical volatility, it means the options are cheap and the best thing to do is to buy long the stock options hoping that soon or latter the low implied volatility which is associated with low prices will rise to the levels of stock statistical volatility. By following this line of argument, one can buy or sell options and make a nice profit based on comparison between stock statistical volatility and options implied volatility. But this can only help you if you know the direction of the stock price.

The purchase of a stock option is very risky because a long option is wearing asset which has a limited life and the closer it get to expiration the higher it loses its value. Similarly, the sale of a naked stock option is equally very risky because it has a limited time and the risk is unlimited. But try combining a short option and a long option and the whole business of making money using options becomes a beauty.

One of the best combinational strategies of options that I like is called calendar or horizontal spreads. A calendar spread will shield you from volatility changes and time wear. In fact, you gain from differential of time wear between the sold option and the bought option. You sell an option (call or put) and at the same time you buy another option of the same type (call or put) on the same underlying asset and at the same strike price, but with a one month difference in expiration date. The two options should be out-of-the-money. If you believe the market is going up use call option, and put options if you believe the market is falling. If the options get at-the-money, close the positions. A calendar spread is one of the safest and most successful strategies a beginner trader can use.

If you have liked this article, and you would want this page to keep up and improved, you can help by purchasing some great items from Amazon by following Amazon links and widgets on this page. A free way to help would be to link back to this webpage from your web page, blog, or discussion forums.

The Author’s page is designed to help beginners and average readers make some money as an extra income to supplement what they may be earning elsewhere - details of which you can find in My Page, if you will.