U.S. States That Do Not Collect Income Tax

State Income Taxes Vary Widely

State Income Tax Is Only One Consideration Among Many in Choosing Where to Retire

States with No Income Tax

Only seven U.S. states do not collect individual income tax: Alaska; Florida; Nevada; South Dakota; Texas; Washington; and Wyoming. Residents of these states keep more of each paycheck since there are no state income tax deductions, and they don't waste time filling out state tax forms.

Two other U.S. states have only a limited individual income tax: Tennessee and New Hampshire. Tennessee has a 6% tax on taxable dividends and interest over $1250 per person ($2500 for joint filers). New Hampshire has a 5% tax on taxable dividends and interest over $2400 per person ($4800 for joint filers). Residents of both states need to file state tax forms, but they are simple.

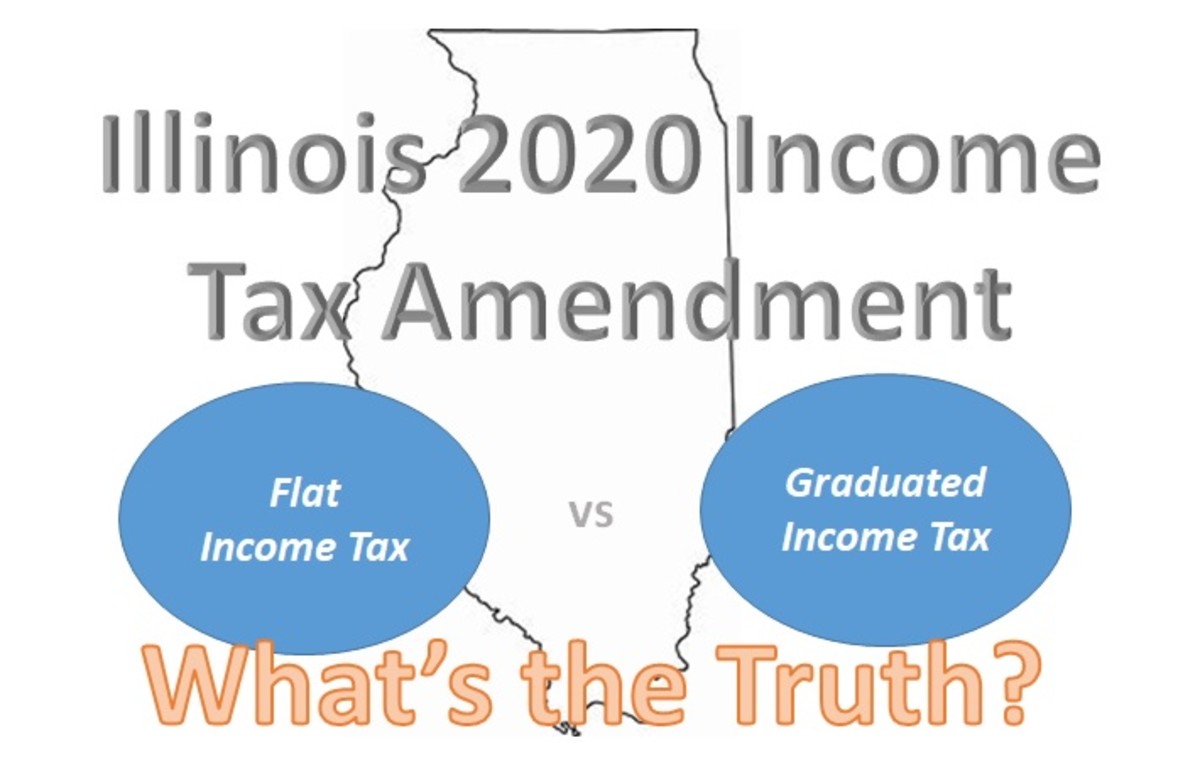

The other 43 states collect income tax on individuals. Residents of these states see state income tax deductions on each paycheck and must file state income tax returns. 36 of these states have graduated income taxes requiring people with higher incomes to pay higher tax rates than people with lower incomes. The others have flat tax rates: Colorado (4.63%); Illinois (5.0%); Indiana (3.4%); Massachusetts (5.3%); Michigan (4.25%); Pennsylvania (3.07%); and Utah (5.0%).

At first glance, it would seem that people can improve their standard of living by choosing to live in one of the nine U.S. states that impose no individual income tax or only a limited state income tax. After all, residents of these states have no money withheld from their paychecks to pay state income tax, and they don't need to waste time each year preparing state income tax forms.

In reality, it turns out many people can enjoy a higher standard of living by residing in a state with an income tax than in a state without an income tax, despite the need to pay state income taxes. There are several reasons for this seemingly odd reality.

Other State Taxes Can More than Offset State Income Tax

Some states that do not collect state individual income taxes more than make up for it with high taxes of other types, such as high property taxes, sales taxes, fuel taxes, personal property taxes, etc.

For example, while Texas is one of the seven states without a state income tax, it charges the third-highest property taxes as measured by the percentage of home value that homeowners pay in property taxes, at 1.81%. Thus, a Texas homeowner with a $500,000 house will pay an average of $9,050 per year in property taxes (and, in some Texas municipalities, much more than that). New Hampshire residents pay even a higher percentage of their home value in property taxes, at 1.86%, which is the second-highest tax rate in the nation. Only New Jersey is higher, at 1.89%.

Thus, while people who earn high incomes but are satisfied with living in inexpensive houses will be better off living in a no-income-tax state, people with low incomes but expensive housing tastes will often be better off living in a state with an income tax but lower property taxes. The latter group includes many retirees who have the means to purchase expensive houses despite low taxable income. This is why many retirees who retire to the sunshine of Florida pay more in taxes than they might think.

If a low overall state tax burden is an important factor in deciding where to live, you need to do more than simply select a state without an income tax. You should instead estimate your total state tax burden in the states you're considering, taking into account your probable taxable income, housing situation, and spending patterns.

Higher Salaries Can More than Offset State Income Tax

The top 10 states in terms of average household income for 2011 were Maryland ($70,004), Alaska ($67,825), New Jersey ($67,458), Connecticut ($65,753), Massachusetts ($62,859), New Hampshire ($62,647), Virginia ($61,882), Hawaii ($61,821), Delaware ($58,814) and California ($57,287).

Of these top 10 states, only Alaska and New Hampshire do not impose general state income taxes on individuals. The other eight states impose state income taxes, with California (top rate of 10.55%), Hawaii (11%) and New Jersey (8.97%) among the five states that have the highest individual income tax rates.

Thus, for many people, the higher salaries paid in states with a state income tax can be more than enough to offset the impact of the state income tax in comparison to states without an income tax but with lower salaries.

If your goal is to maximize your after-tax salary, you again need to do more than simply select a state without an income tax. You should instead look at the salary you could expect to receive in each state, and subtract the state income tax you'd expect to pay, to find the after-tax salary in each state.

Better State Services Can More than Offset State Income Tax

Some states survive without individual state income taxes only because they provide fewer services to their residents. For example, while New York imposes high income taxes (with a top rate of 8.97% on income over $500,000) along with high sales and property taxes, it ranks fourth among the states in spending on benefits such as education (where its average per-pupil spending of $18,618 ranks first in the nation) and Medicaid (where its average per-enrollee spending of $8,960 ranks second).

Thus, in deciding which state to live in, it is also necessary to examine the importance of state services. If you or your family rely on state services, you may be better off living in a high-tax and high-service state such as New York than in a low-tax and low-service state such as Texas. For example, if you have a child with special needs, you might prefer to live in a state such as New York.

Resources for Finding Your Perfect Place to Live

- How to Find the Perfect Place to Retire

Its easier than ever to find comprehensive information about other places. Here are 10 helpful resources to find your dream retirement destination. You can even make virtual visits.