How To Make The Most Of Small Business Finance

MECHANICS OF SMALL BUSINESS FINANCE

Understanding finance can help you get a small business going or keep it afloat in tough economic times.

In terms of small businesses, finance means finding the money to keep your business open.

The money that you need (or capital) can be found in several different spheres:

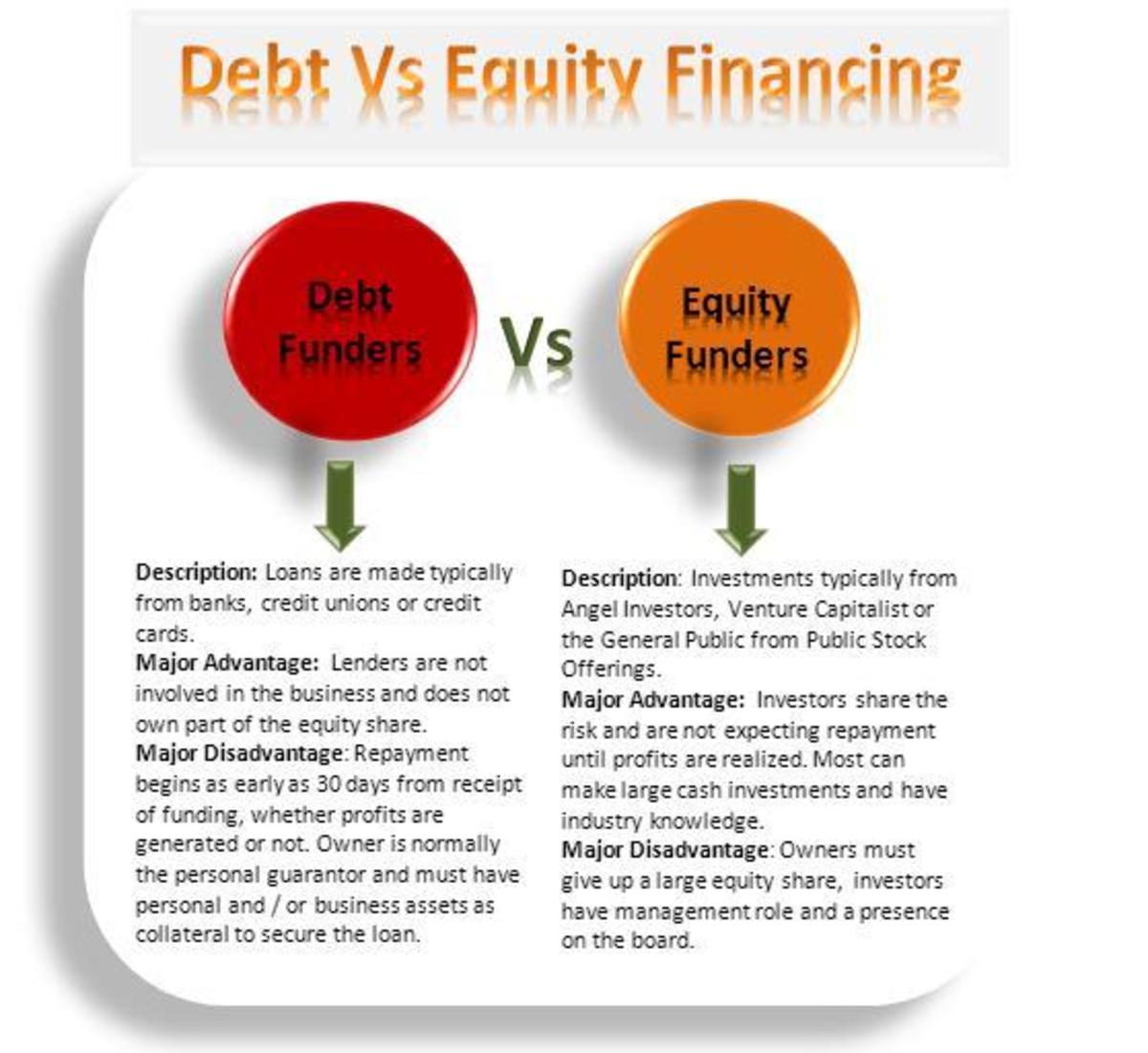

- Selling your debt or borrowing money

- Selling your equity or getting investors

- Securing loans based on the business' assets

Most every business borrows at some point in time and some businesses are in debt the entire length of the life of the business.

- Debt is part of being in business.

Loans can come from several places and varying amounts depending upon the type of business and the investment needed to get up and running or stay open for business.

- Lenders will loan you X amount of dollars with the agreement that it is to be paid back in X amount of time with X amount of interest.

UNDERSTANDING SMALL BUSINESS FINANCE

Other ways of obtaining money for your business are through credit card loans, personal loans from friends and family, establishing a line of credit with a bank or loan institution, trade credit (usually a line of credit from a supplier), or other traditional loans from banks and other lending institutions.

TIP: A business that is at least 2 years old and has a proven track record of surviving will have more chance of obtaining traditional loans. For some loans, you may have to put your house or other collateral up as a guarantee on the loan.

Most, however, will want to see that the business itself is collateral against a loan.

TIP: Companies looking for money might also look to the Small Business Administration (SBA) and their guaranteed loans program.

Personal loans from family or friends are also common sources of financing for a business and most are not based on collateral as a guarantee for the loan though some can be depending on the lenders. These loans are usually at most several thousands of dollars.

MECHANICS OF SMALL BUSINESS FINANCE

What if your business needs to find financial support.....or investors. What is an investor?

- Someone who generally has a "piece" or interest in your company.

TIP: Obtaining investors can mean that you lose some if not substantial control of your business depending on how much you depend on your investors and their terms of investment.

You most usually give up part of the worth or equity that your company has built when investors sign on. It is also relevant as to where you are in your business plan....starting up or expanding and how deep your pockets need to be filled to accomplish your goals.

The investors in your company are equity investors and can be classified several ways by the style in which they invest.

WHO ARE SMALL BUSINESS INVESTORS?

- Venture capitalists. These investors

can be individuals or companies that specialize in investing in businesses that

have the potential to give high returns on their investment. They also invest in businesses that may be

about ready to expand in a huge way onto the public scene and they stand to

make a good bit of money on their investment.

Venture capitalists by and large are interested in businesses that have shown their potential and who are already successful. They also are investors who like to bring in their own team of management to see that the business is run 'their way'.

- Angels. This is an investor who generally provides start up money to young companies or could be a wealthy friend or friend of a friend who is willing to underwrite getting an idea off the ground.

- Small Business Investment Companies (SBIC's). These are investors associated with

the SBA who provide private investment money and sometimes combine this

investment with government money. These

investors generally back companies again that have a proven track record.

SBIC's are very successful today.....boasting at least 270 SBICs nationally with $3.5 billion invested in private funds coupled with $1 billion in government funding.

- Private placements. Private placements are investors you sell shares in your company to. These are not shares sold to the public but rather select individuals. This type of investing works best for companies who have not gone public. With this type of investing, you can still retain control of your business pretty much; you can also decide how much to sell your shares for and to whom.

- Initial Public Offerings or IPOs. This type of investing is when you sell

shares in your company to the public in the form of stock in your company. However, this type of investing is under the

watchful eye of the SEC (Securities and Exchange Commission) and requires

reporting to shareholders and also to securities regulators.

The first time a company sells its shares to the public it becomes an IPO. This is the form of investing that brings in millions of dollars but it also requires the owners of the business to give up huge amounts of control.

THE ART OF CREATIVE FINANCING FOR SMALL BUSINESSES

Equipment Financing - the practice of leasing rather than buying equipment. Loans are available through banks and other traditional lenders, finance companies, equipment makers or retailers.

Financing obtained through customers or suppliers - if you have a product that is essential to their business or is for instance hard to find elsewhere or unique, or even if you are a key partner in the distribution of their goods and services, these businesses will give you loans or equity investments.

Convertible debt - a loan that can convert to equity in your business for instance if you throw the option of equity in your company into a debt situation when applying for a loan with a potential lender.

Factoring - an option where you can sell your accounts receivable to a third party (who is the factor)......and you sell them for a reduced price. When you sell your invoices you are generating income sooner than if you had to collect those invoices on your own. The factor pays you a discounted amount on the invoices and then owns them. He rather than you collects on them when due. The people who purchase a company's receivables and who are most likely candidates for "factors" are finance companies or banks

Strategic partnerships - this is when you join into a partnership with companies with like business goals or development plans. This can support an inflow of cash either way between the partners but it can also be beneficial to the longevity of both companies. An example would be a company developing a netbook and partnering with a company like Acer.

SMALL BUSINESS FINANCE 101

In short, small business finance is complicated.

But....small business finance can work when you combine the right product with the right management with the right financial approach.

Most small businesses fail because they grow too quickly and do not have the manpower to sustain them.

They also fail because they make poor choices in terms of growing too quickly without the capital to back them up.

Understanding how to manage a small business is complex but it can be quite simple really.

Take time to grow your business and try to keep it manageable as you grow.

If you need to take on investors, be aware of what will happen to the control of the business.

Investigate small business advisors to give you tips and tricks to keep your small business afloat.

Most of all, keep an eye on your bottom line and make it a habit to live by that.

The most successful small businesses are the ones that are managed well and do not expand too quickly.

TIP: Check out the videos for more concrete ideas not only on small business finance but also how to start up a new business!

More Information on Small Business Finance

- How to Find Training, Online Classes, and Small Busi...

This article has been written in response to a Hub Request for ideas and resources for receiving training and business assistance in the automobile window tinting business. Training is available from a... - Great Ideas for Employee Bonuses for Small Business

For any employee of a small business, acknowledgement for a job well done goes a long way while paying returns that endure in both tangible and intangible ways. Feeling a personal sense of accomplishment and... - Small Business Financing by ERMA

There are institutions which devote their services in assisting the Small Business solutions. Institutes such as ERMA aid in starting a small business and offering extensive selection of services, that are... - What are the New Rules of Small Business Financing?

If you plan on getting a start up financing or an equipment lease financing, you should know some of the essentials in getting an approval quickly and easily. Here are the new rules of small business... - Small Business Financing - Info

Need small business financing? There are several small business financing sources that people are just not aware of. Read on to find out your small business financing options. Check with your local... - Guide to starting your own small business

Starting your own small business requires patience and thorough planning. Use this basic guide for business planning. - Using Credit Cards to Manage Small Business Financin...

When that business wishlist begins to grow, many small business owners turn to personal cash and credit to pay the bills. However, using personal credit cards to manage small business financing needs may not...