Understanding Your Credit History

Your credit history defines your credit worthiness. Most people know that having a good credit rating has many financial benefits. Unfortunately few people know how to achieve a high score.

Implications of Your Credit Rating

Every consumer benefits from a good credit score. A negative credit rating can significantly reduce the chances of getting a credit card, bank loan or even insurance. It can also dramatically lower your chances of owning or renting a home. You can even be denied employment in a company that uses credit rating as one of its acceptance criteria.

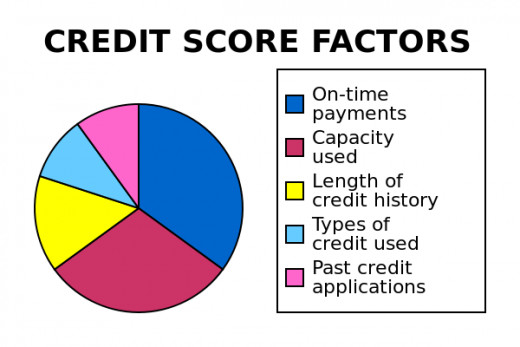

What Makes Up Your Credit Score

So What is a FICO Score?

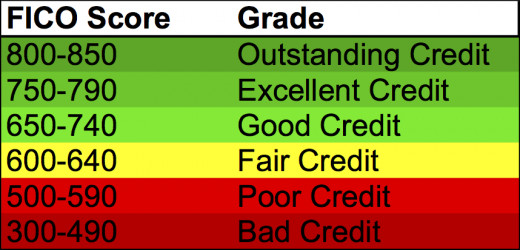

Who rates your credit worthiness? There are three consumer credit bureaus (Experian, Equifax and TransUnion) who compute your FICO (Fair Isaac Corporation) score. Each bureau has their own proprietary algorithm, which is used to create a numerical value ranging from 300 to 850 indicating your overall creditworthiness.

Your FICO score is determined by your credit history and is based on records obtained from your banks, creditors, lenders and utilities. When lenders report late payments or collection activity your FICO suffers. If you file for bankruptcy or use a debt management service, your score will likely drop. Frequent credit requests can also indicate that you may be experiencing financial distress and this can also lower your score.

Your payment history accounts for 35% of your credit score. The next major factor is debt-credit ratio at 30%. The length of time covered by a credit history makes up 15% of your score. The remaining 20% is made up by the types of credit accounts owned and hard inquiries that lenders make whenever you seek credit or loan at 10% each.

FICO Score Grades

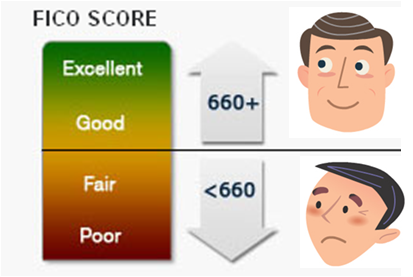

Why Your Score is So Important

Your credit history is used by banks, creditors and lenders to evaluate their exposure for lending money or giving you more credit in the form of personal loans, mortgages and credit cards. Your FICO score is one of the primary factors used to evaluate your willingness and ability to repay debts.

Staying On Top of Your Credit Score

Do You Check Your Credit Score at Least Once a Year?

Getting a Copy of Your Credit Report

Understanding your credit history allows you to better manage your personal finances. As mandated by the Fair Credit Reporting Act, you can have one credit history report annually for free. You can start by visiting the annualcreditreport.com website. Unfortunately it won't include your FICO score.

Your free credit report lists all of your credit transactions. It contains detailed account information, including payment history, credit limits, outstanding high and low balances, and any collection effort or action taken to recover overdue debts, as well any debt management and bankruptcy cases filed.

Is Your Credit Report Accurate?

The important thing to remember whenever you check your credit report is that your objective is to ensure that the information contained therein is 100% accurate especially in the area where financial accounts and payment histories are concerned. Errors are sometimes found that can adversely impact on your credit standing. You may even uncover transactions you have never placed, or payments that remain open when you have already paid them.

If you find any of these errors, be sure to contact the credit agency that released your report. There is also a good chance that the same errors had been captured by all three agencies and you will need to contact all of them.

Final Thoughs

Given how important your credit rating is to your overall financial health it's surprising how few people actively monitor their FICO scores. It's easy to mess up your credit score - making minimum credit card payments month after month, increasing your debt to income ratio, and of course fraud in the form of identity theft are all common culprits. Monitoring your credit reports is a smart move to ensure your you maintain a good to outstanding credit rating, which is a major factor in ensuring your future financial health.