Warren Buffet’s 2 Tools of Determining a Company’s Debt to Invest In

Billionaire Warren Buffet

Learning Objective

The objective of this hub is to teach how to determine the Debt to Equity Ratio and Current Ratio of a stock using MSN money website tools so that you can determine debt level of a company you want to invest in.

Lets get started!!!!!

Say you a novice investor who wants to invest in stock market. A first question that comes to mind is; is the company worth buying? The only way to know if the company is worth is buying or not is to analyse the company or more technically “security”. Unfortunately, the answer isn’t as easy as yes or no. The correct answer is it depends. The problem is that some industries typically require more debt than others do. For these industries, a higher debt load is normal. For example, utilities often borrow large sums of money when building new power plants. It may take several years to build the plant, which means no revenue and lots of debt. For that reason, I will use the tools use by stock market guru billionaire Warren Buffet. I personally found this tools very rewarding and I write from experience to help you make informed decisions.

According to AboutMoney.com, debt is not a bad thing when used responsibly. It can help businesses grow and expand. However, misuse of debt can result in a burden that drags down a companys earnings. That is the reason why it is important for you as an investor to know the amount of debt you are dealing with.

I consider myself more of a "value investor" so the balance sheet is really the most important. Quite simply, if you can buy a company for less than the book value (assets-liabilities), you have a bargain. But of course it would be unwise to only look at this. One must know that the company is profitable and not losing tons of money, as shown on the income statements, and that enough cash is being generated to cover interest and day-to-day operating expenses (cash info is on the statement of cash flows). These are the main three statements people look at and ones I would focus on most. They are all important in accessing the value and earning potential of a company.

Key question is;

As a novice investor, did you understood the heavy financial terms or phrases I used above? I doubt you did.

Buffett became a billionaire on paper when Berkshire Hathaway began selling class A shares on May 29, 1990, when the market closed at $7,175 a share. Watch this

I'll cut the chase and get straight to the point. We will use Warren Buffet's two tools.

Tool Number one: Debt to Equity Ratio (DER)

1. Debt to Equity Ratio-The debt-to-equity ratio (D/E) is a financial ratio indicating the relative proportion of shareholders' equity and debt used to finance a company's assets

Formula: DER = Total Liabilities/Share holders Equity

Tool Number 2: Current Ratio

The ratio is mainly used to give an idea of the company's ability to pay back its short-term liabilities

Formula: Current Ratio = Current Assets/Current Liabilities

I will show you a quick way to get round the technical jargon.

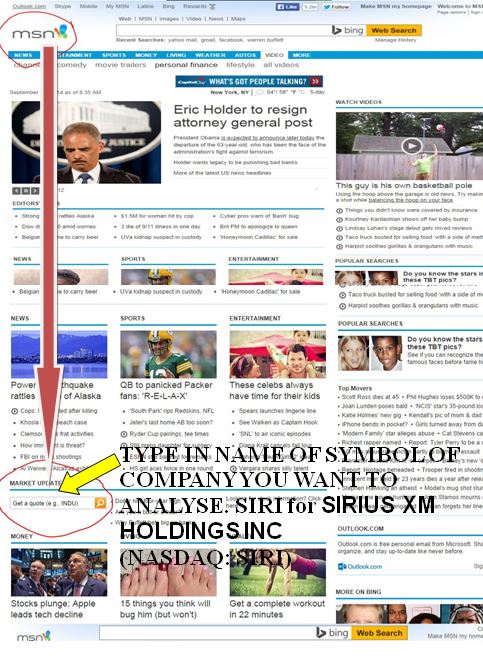

From here, I want you to go to your browser and Google up MSN.com. Note that I just chose MSN because its easier to understand and navigate around. You can also use Google or Yahoo finance. Bottom line is to use one that you understand and can use with ease.

Step 1: Google up MSN website

Step 2: Scroll down to where it says Market Update

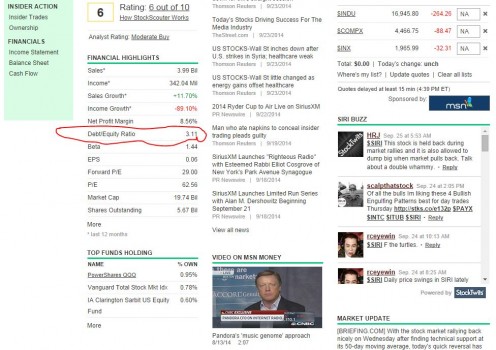

Step 3: This is what you get when you type in SIRI in the MSN stock quote section

Key Warren Buffet message

Note that Warren Buffet prefers a DER of <0.05. This means that companies whose DER is less than 0.05 means that company has low debt.

It practical sense, a DER of 0.05 means for every dollar of equity that company has, there is $0.05 cents of debt.

In our case of SIRI, the DER is $3.11. Warren Buffet will never buy the shares of this company.

Tool number 2 Current Ratio

Let me repeat this again. Current Ratio n gives us an idea on how a company will handle its debt in the next 12 months. It compares current liabilities to current assets.

Simple steps to find Current Ratio in MSN money

1. Go MSN money as shown above

2. Scroll down to Financial highlights

3. Find Balance sheet

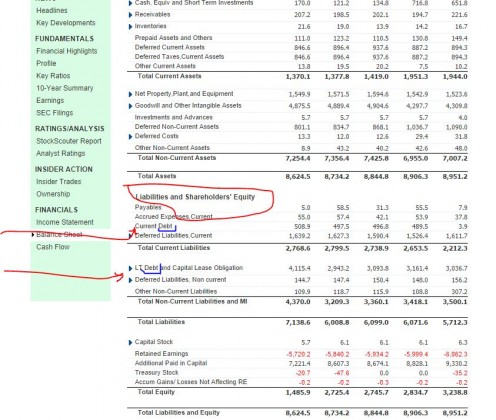

Under the Balance sheet, find where it says "Liabilities and Shareholders' Equitye". See screen shot below

Balance sheet

What you do now is to look for anything sentence under Liabilities sections that has the word DEBT attached. I have highlighted in BLUE in for you as an example.

Once you get your total, divide that figure by Total Equity given at the bottom of the balance sheet.

Key Warren Buffet message

Warren Buffet prefers stocks that have current ratio of >$1.50

What was your answer from above calculation? Is it over or below $1.50?

More Warren Buffet hubs

- Five Different Levels of Investors │ The Wealthy I...

If you want to invest and grow your wealth here, here is the hub for you. learn and master the art of investment. - Using leverage of knowledge to grow wealth

Uncover the secrets behind how the rich and powerful use simple basic everyday knowledge to amass greater wealth while majority look for complicated investment information and end up losing more. - Billionaire Warren Buffet’s 3 Stock Selection Meth...

Uncover the simple strategies Billionaire Warren Buffet uses to make billions every year.

Take a poll

Was the hub easy to understand?

Conclusion

Two key tools Warren Buffet uses to asses stocks are debt to equity ratio and current ratio. Buffet uses some complex techniques to do this. But with help of technology, I have shown you how easily you get get this calculations done instantly. There are also other key metrics Warren Buffet uses to analyse his preferred securities that we will cover in later hubs.

More hubs on wealth

- Using Leverage of your mind to grow wealth

Mind is the reason why rich become rich and poor remain poor. But how? This hub perfectly shows you HOW. - Rich Mindset Vs Poor Mindset

The rich think in a certain way that makes them rich. The poor also think in a certain way that makes them poor. - 4 Smart Steps to Build Wealth and Retire Wealthy wit...

Discover the 4 timeless steps to build wealth and retire wealthy with residential property investment. What you discover will certainly amaze you.

© 2014 Ian Hetri