- HubPages»

- Personal Finance»

- Tax & Taxes»

- Tax Advice

6 Ways to pay less tax (without having to bed your tax collector)

Best ways to pay less tax

Tax issues are confusing and not something most of us like to think about in our spare time. To be honest, you would have to be pretty bored to be thinking about it at the weekend. However, the other day I read that some people pay more tax than they need to. I am hoping I am one of them so I can reduce my tax payments for the year to come.

Ordinarily the words “financial planning” will bring me out in a rash but more and more people are trying to convince me that pensions and tax efficient savings plans can bring huge benefits to my overall finances. So I am having a glance at the issue and trying to understand just how donating money to a charity or having a savings account can save me money in the long term.

Best ways to pay less tax

So far I have discovered that among the hundreds of ways to dodge the taxman, the most efficient, legal and easy to implement ways to pay less tax are:

Use your personal allowance.

Everyone has a personal allowance. Are you like me and have no idea what that means? Well, your personal allowance is the income you are allowed to earn before tax and National insurance payments.

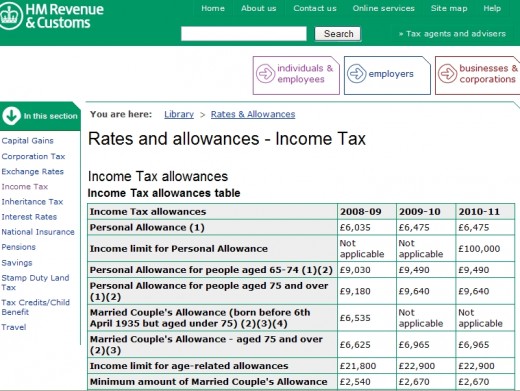

Currently in the UK your personal allowance is £6475 per year whether you are employed or self employed. After that amount you need to pay 20% tax on your earnings and if you are lucky enough to earn more than £37400 a year you have to pay 40% tax on your earnings.

If you are not sure about your tax band contact your local tax office.

Tax Rates and allowances in the UK

2. Confirm your age.

Confirm your age. This is something I would personally not

like to count on. I’d rather stay

young and pay more tax than lose my sex appeal and pay less tax. Who said youth is not expensive? Anyway, for those of you who are not

scared of wrinkles, once you reach 65 you should get a higher tax-free

allowance of £9490 per year depending on your income. I guess the government is thoughtful

enough to allow you extra tax-free income to spend on botox, facelifts and

Viagra.

3. Give more away.

Give more away. You don’t pay tax on money you donate to

charity. Just remember to get your

donation properly processed to qualify for a tax reduction. I wonder if posing for a nude calendar or

if buying all the sexy firemen calendars count towards a tax reduction.

Tax codes

- HM Revenue & Customs: Tax codes - the basics

"A tax code is used by your employer or pension provider to calculate the amount of tax to deduct from your pay or pension. If you have the wrong tax code you could end up paying too much or too little tax."

4. Check your tax code.

The combination of numbers and letters

that form your tax code indicate how much tax your employer should deduct

from your pay. If your employer

made a mistake you could be paying too much tax so it is worth checking

your tax code yourself to make sure you are paying the right amount. To understand your tax code click here

5. Get more from your savings.

If you are lucky enough to have any savings make sure you are not paying tax on your savings account unless you have to. If your income is under the tax threshold you should ask your bank for a form R85 to get tax free interest paid on your savings. You might be able to buy a fish supper and Irn Bru with your tax free interest savings.

6. Claim for business expenses.

If you are self employed

make sure you are claiming for deductible expenses and a proportion of

your household bills if you work from home. If you play it right you might be able

to include a big proportion of your mortgage, heating, electricity and

water bills as deductible expenses.

Did you know that if you provide entertainment for staff or clients, some of these business entertainment expenses are tax deductible? I like this; to support your claims for business entertainment expenses make sure that you keep invoices and receipts. I’ll remember to ask for a receipt next time I rent a boy for my entertainment.

If you have any tax efficient advice or just tips to pay less tax, don’t forget to share them in the comments box. The Best advice I can give you is to employ an accountant to do your accounts, and provide advice and assistance or better even, date your accountant and make the most out of it!