What Does My 401k Cost?

Hidden 401k Fees

Millions of Americans believe they pay nothing for their 401k retirement accounts. Unfortunately, this is only a misperception fostered by the financial industry. In reality, the average 401k costs its owner almost $1000 per year! Fortunately, it takes only minutes to find the true cost of 401k accounts.

So what does my 401k cost?

The Average 401k Costs Almost $1000 Per Year!

Most Americans have no idea what they pay for their 401k. According to a 2011 survey by the American Association of Retired Persons, 71% of 401k owners believe they pay nothing. Even among owners who know they pay 401k fees, two-thirds don't t know how much they pay.

In reality, the average 401k costs its owner almost $1000 annually! A study by Fidelity Investments at the end of the third quarter of 2012 found that the average balance of 401k accounts was $75,900. Since the expense ratio of the average mutual fund in 401k accounts is about 1.27%, the average 401k owner paid $963.93!

Thus, the typical 401k investor is almost completely unaware that he or she spends nearly $1000 per year for his 401k! It'd be difficult to imagine any other four-digit annual expense that is so effectively hidden!

How to Reduce 401k Fees

There are a number of ways to effectively reduce 401k fees, including:

- Choose low-cost index funds;

- Steer clear of insurance products;

- Avoid paying sales charges, 12b-1 fees and surrender fees;

- Consider an IRA;

- Don't borrow from your 401k;

- Don't trade excessively; and

- Ask your employer to add lower-cost investment options.

Click here for a detailed description of these strategies for reducing 401k fees.

How to Calculate 401k Cost

In 2012, the Labor Department issued new regulations requiring greater transparency of 401k fees.

Under these regulations, fee disclosures were to be sent to plan sponsors (i.e., your employer) by July 1, 2012, and to plan participants (i.e., you) by August 30, 2012. The fee disclosures were required to offer information about any fees charged in connection with 401k accounts.

Specifically, the August 30, 2012 statements were required to describe how the plan works and the types of expenses that may be deducted from the accounts. The statements were also required to include a chart listing all of the investment options, their performance history, their comparison to investment benchmarks (e.g., the S&P 500), and the operating expenses for each investment.

The new regulations also require more information about 401k fees on your quarterly and annual statements for your actual account. This information should include a detailed accounting of any transaction fees charged to your account (e.g., a $75 fee to set up a loan from your account) and any fees for administrative services. This information should further include the expense ratio for each investment option offered by your plan, expressed as a dollar amount per $1000 investment.

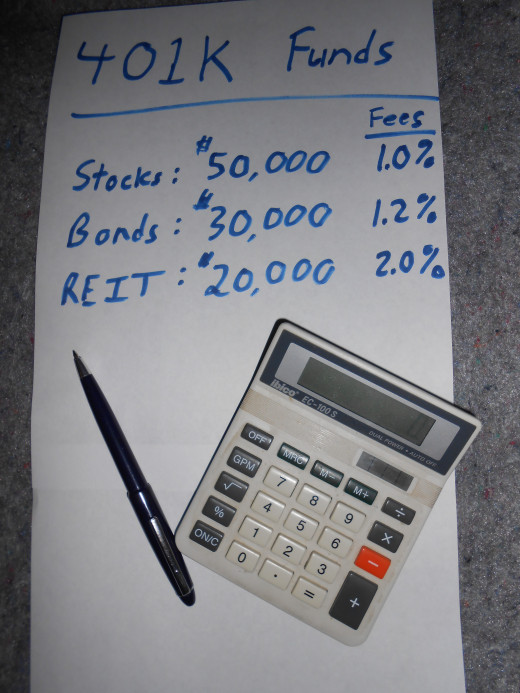

To calculate the cost of your 401k, you first need to calculate three amounts: (1) the sum of any transaction fees charged to your account, which should be listed in your account statement; (2) the sum of any administrative fees charged to your account, which should also be listed in your account statement; and (3) the sum of the investment expenses for your investments, which you can find by multiplying the expense ratio for each investment by the amount of that investment.

Then, to determine the total cost of your 401k, simply add together (1) your transaction fees, (2) your administrative fees, and (3) your investment expenses. To determine if your costs are higher or lower than average, take the total cost of your 401k, divide by your account balance, and multiply by 100 to express the result as a percentage. Typical investors with typical 401k plans will find the total annual cost of their 401k represents about 1.25% - 1.50% of their account balance.

If the cost of your 401k is more than this, you should definitely look for ways to reduce your 401k costs. Helpful suggestions are provided in the sidebar entitled "How to Reduce 401k Fees".

However, even low-cost 401k plans can be improved and made more efficient. Thus, even if the cost of your 401k is less than 1.25%, you should still look for ways to reduce your 401k costs. Even small decreases in this cost can add up to many thousands of dollars by the time you retire.

Other Retirement Advice

- How to Find Retirement Money and Pensions from Past Employers

You may be entitled to thousands of dollars from old retirement plans with former employers. You only need to follow a few simple steps to claim this money.

- How Much Do You Need to Retire?

The commonly accepted rule says a retiree needs to replace a percentage of his pre-retirement income to retire comfortably. This rule is likely to lead savers to delay retirement beyond the point where they could retire comfortably.

- Retire Early by Living Below Your Means

Virtually anyone can retire early by following only one simple rule: "Live well below your means".