What Every Canadian, and Every Investor, Needs To Know

Executive Summary

Originally published on January 20, 2017

This report was completed for Canadian Minister of Public Safety Ralph Goodale after the opportunity to send correspondence to him was presented by Shawna Dittburner, a parliamentary assistant.

Extensive evidence is presented with regard to incorrect stock data currently being shown by chart providers on the internet, how this misleads investors, and how it appears to be a symptom of a situation that creates motive for other nefarious acts, in addition to seeming fraud, including extortion and murder, among others.

The matters at hand were discovered while the author of the study was researching a suspicious death and noticed that charts of stock of companies connected to the person who suffered the untimely death contained significant errors. Further investigation led to the discovery that at least 5 percent of stocks on the TSX Venture Exchange have charts with apparent missing consolidation adjustment errors with at least one provider. Another serious problem with the presentation of data was observed: the apparent cutting off of unfavourable data.

An argument for how entering precise definitions for stock, equity, speck, and speculity into Canadian or provincial legislation would save lives and provide a more transparent marketplace, with a higher level of “full, true and plain” disclosure than presently enjoyed, leading ultimately to increased business activity, and a greater level of trust among all involved, potentially improving Canada’s image internationally and establishing the country as a leader in financial engineering, is also presented.

Table of Contents

Report to Honourable Ralph Goodale, Minister of Public Safety

Are missing TSX Venture consolidation adjustments a symptom of a serious, bigger problem that is possibly easily solved?

- Background -- New definitions to save lives, life savings -- Those who deceive for financial gain carry motive to commit other crimes

- Different groups

- Different methods

- Why are so many TSX Venture companies’ charts missing consolidation adjustments?

- Risks

- Flow-through shares not helping situation any

- Recommendations

Appendix One: Images of seemingly erroneous charts from BigCharts and Stockhouse

Appendix Two: Screenshots of conversations from the Stockhouse “bullboard” for RT Minerals

1. Background

There are two immediate matters of concern being presented to the Minister in this report: the urgent need for a rename of the equity of companies with no revenues to speculity, and of their shares to shyres, and stock to speck, as well as the current preponderance of missing consolidation adjustments on charts and in historical data for shares listed on the TSX Venture Exchange, seemingly leading to the potential of many investors being misled.

At present, a legal definition of the terms “stock” and “share” is elusive, as I discuss in my writing with Blasting News. The Ontario Securities Act uses the term stock to define the term “security,” but provides no further explanation. The U.S. Securities Act of 1933 gives the matter a similar treatment. Seeking a more definitive answer, this writer undertook learning the nature of the very first stock ever issued, perhaps the most true definition.

The first stock was issued by the Dutch East India Company in 1602. The company not only generated revenue, it was profitable, and its shares paid dividends with yields ranging from 12 to 63 percent over its first years. Comparatively, the shares of a company with no revenue, such as Goldstar Minerals Inc. (TSXV: GDM), are a joke. Stock in companies without profits, or at least revenues, is absurd.

What a share in a revenue-less company represents is an option on equity in future profits or earnings, as I have discussed extensively with the Inquisitr. However, this term is problematic, as there are already many types of options in use. Alternative terms that serve exactly the same purpose are speck, shyre, and speculity, as I have defined and given example usage of with Blasting News.

The reason that this is of utmost importance is that the average Canadian has become accustomed to the word stock and the notion that stocks are a reasonable thing for people to buy if planning for a goal, such as retirement or a child’s education. There is such a wide divide between the shares of a company like profitable Dollarama, Inc. (TSE: DOL) and revenue-less King’s Bay Gold Corp. (TSXV: KBG) that calling the equity of each by the same name is a true disservice to the Canadian public, entirely misleading, and inconsistent with “full, true and plain disclosure,” which this writer has been taught is paramount.

Stock distributors, issuers, and their associates, carry motive when they induce retail investors to buy shares, both through investment adviser (IA)-client relationships and on their own accord in the open market. King’s Bay Gold stock has done nothing but lose value; there are hundreds of similar examples; at least some of the people involved in distributing these stocks knew that they were going to lose value and that whoever was buying them was getting ripped off.

It is this secret that they hold that brings forward the potential for a wide range of nefarious acts. The actions a stock distributor might take to stop one of his targets from learning about the deception behind an investment would not take much of an imagination to conjure. Family members and children, anyone connected to someone holding a secret like this become potential victims. I know of a dead family member of a board member of two TSX Venture Exchange stocks down over 90 percent. As I have previously explained to the Minister, there is a publication ban in place that prevents me from revealing further details of this matter. Once the ban is lifted, I plan on publishing full and extensive reports.

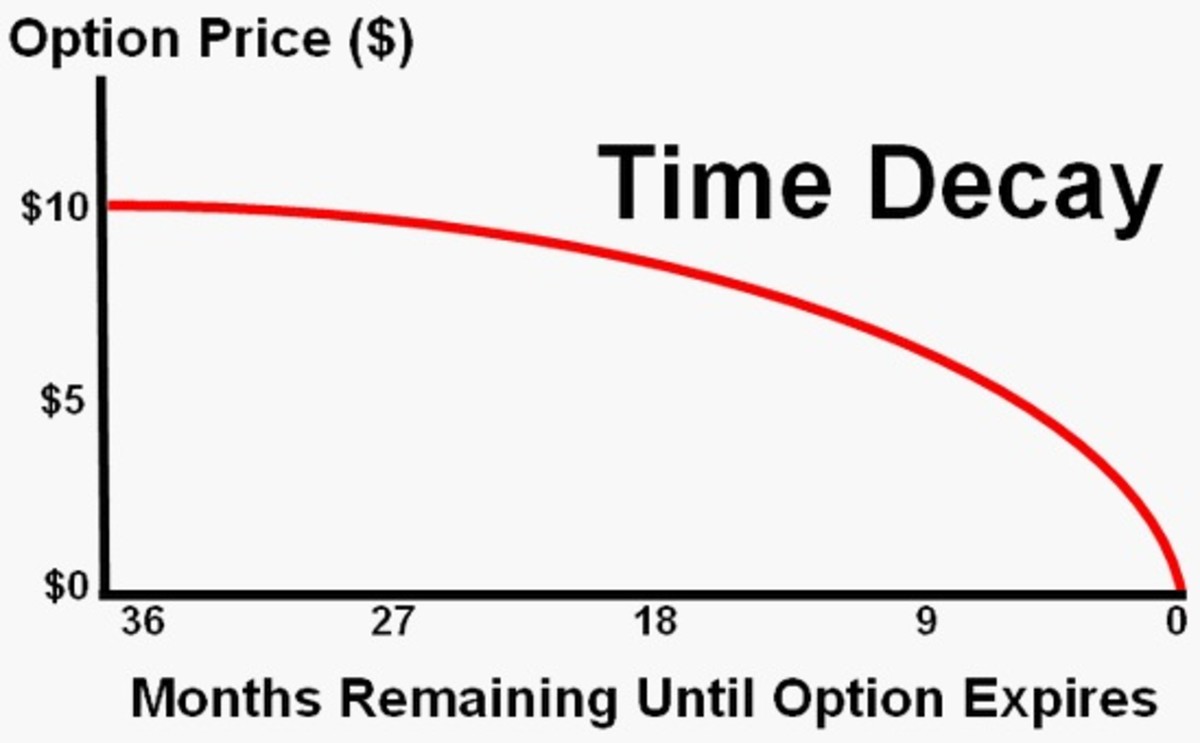

I fully believe that if this person’s death is connected to concealing knowledge of future losses and that if the securities had been called specks or shyres instead of stocks or shares that this person would be alive now. The ability of the seeming perpetrators of fraud to deceive is at least partially removed with a name change to speck, shyre, and speculation. Everyone would know up front that specks go to zero, or close to it. To buy a speck, clients, especially those opening self-directed accounts, must be shown this chart, or something similar.

Penny Stock Time-Value Decay

Before trading specks, retail traders must understand that they are much different than stocks, with some characteristics comparable to options, particularly the way many tend to lose most of their value, most of the time. The above chart of King’s Bay Gold versus the Dow Jones Industrial Average illustrates this perfectly. The comparable chart that options investors must understand before they are allowed to trade is this:

Option Time-Value Decay

The plan to rename stock in revenue-less companies to speck and shares to shyres will not only save lives, it will lead to an increased level of transparency. Transparency instills increased confidence, which is something that investors, issuers, and regulators hold a longing for. This plan allows all parties to continue business as usual, only more honestly. No more sleepless nights worrying for issuers and distributors. This plan hinders none, but those who would deceive, cheat, steal, and murder. Anyone wishing to complete transactions like mergers and acquisitions would be able to do so. Voting rights can be attached. Financial ratios can be redefined to loss per shyre or shyres outstanding. Specks serve all the same functions that stocks do, with the additional benefit of warning elderly couples that it is a completely different investment.

2. Different Groups

Judging by the number of TSX Venture Exchange-listed stocks with charts missing apparent consolidation adjustments, there could be dozens of organizations involved with questionable stock distribution methods, of shares that routinely lose most of their value. In the Kirkland Lake, Ontario-area alone there appear to be several, as I have discussed in the ongoing series with Blasting News.

In 2014, Investment Executive reported on a $200,000 order against Joe Dwek of MineralFields, among several other firms. Of Dwek and his companies the Ontario Securities Commission “alleged that its compliance reviews of the firms uncovered a number of deficiencies and compliance issues, including inadequate supervision of personal trading, inappropriate personal trading, and insufficient supervision.”

Even before Mr. Dwek’s heyday on the TSX Venture, there appeared to have been a shift away from centralized underwriters, of the type traditionally thought of, first to less-conventional operators like Mr. Dwek and perhaps Jordan Belfort, to even smaller operators, via channels like Stockhouse.com and Frontier MCG, who appear to facilitate private placements between issuers and smaller private placement buyers.

The set up would seem comparable to a turn-key boiler room enterprise. It has been explained how an individual could buy a quantity of stock through a private placement and induce someone else to buy it on the open market, while at the same time selling their own. Many times, these stocks continue to lose value and a victim could be unaware that they were even the target of a scam.

The name of the 1973 film, The Sting, takes its meaning from a confidence game that results in its target losing their money, but believing that they have fallen victim to bad luck, rather than a scam. Similar operations are described in the 1923 series Reminiscences of a Stock Operator, as well as the 2000 film Boiler Room and 2013 film The Wolf of Wall Street, inspired by the life of Jordan Belfort.

As Adrian du Plessis explained in the 1990s, distributors of fraudulent stock will morph and change to adapt to what current conditions dictate. Methods distributors of stock may try to use to induce others to buy include paying for hyped-up research with firms like Small Cap Network, who received “$2,000 per month by Frontier MCG for market awareness and other advertising,” to write about CobalTech Mining (TSXV: CSK) shares, which are down by about 25 percent since dubious “analysis” was published. Kirkland Lake community newspaper the Northern News is notorious for printing press releases of a seeming flam-flam nature of firms with no revenues with shares that go onto lose most of their value: Northern Gold Mining, Inc. and Orefinders Resources Inc. (TSXV: ORX) are just two examples, among many. Northern Gold Mining has also been featured with QualityStocks.net, as have other companies featured here.

This writer has seen too many hyped-up, flim flam articles accompanying private placements and subsequent slides in share price to believe that many of these examples are anything but cash grabs by shady groups. Whether there is actually legitimate business activity underneath some is irrelevant. The financing and the distribution of the stock is a disgrace and an embarrassment to Canada. However, speck, shyre, and speculity immediately eliminate this problem. CobalTech can continue to offer private placements, only it would be ensured that investors understood that the company has no revenues, and that the “speck” has lost most of its value and that other “specks” like it usually lose most of their value too.

3. Different Methods

Today’s small private placement buyer and stock distributor have a number of methods at their disposal to induce others to place orders on the TSX Venture Exchange (and others) to buy their stock.

- Paid-for analysis and news coverage, possibly in community and other newspapers disguised as news

- Paying for or otherwise causing inaccurate historical data to be displayed by providers

- Fake technical signals

- Internet message board posters

- Email lists

- Social engineering – targets like the elderly, intellectually disabled, and other marginalized people.

- Cold calling on the telephone and even door to door.

- It has been described how a family member could easily use a private placement to deceive an elderly parent or other loved one into parting with a significant amount of a capital, while potentially being unaware that they were a victim of a scam. Almost any social situation would seem a potential way for someone skilled enough to distribute stock in this manner.

- Many “sales” or “inducements” to buy speck appear to be occurring outside of IA-client relationships that more stringent regulations may fail to adequately address.

Those engaged in the business of distributing worthless stock must be adept at understanding the motivations of the targets of their scams, which can conceivably range from strangers to close friends, coworkers, and family members. Many stock traders, both amateur and professional, use technical analysis. It is possible, through the use of intentionally omitting consolidation adjustments from charts and historical prices, to create the appearance of technical buy signals that depend on a stock’s all-time high. Small investors can be induced into buying a false breakout, creating a market for a private placement owner, or others, to distribute stock into.

Options are analysed differently than stock. While the charts of exchange-traded equity stock options are relevant, most traders depend more upon the price and chart of the underlying stock than the option itself. An option breaking out to a new price high is much less relevant than a stock breaking out to a new price high. In the same way, a speck or shyre breaking out to a new price high is less relevant than a stock breaking out to a new price high. The current consolidation errors would be much less critical for small mom-and-pop investors if the product was named and commonly described as speck, in part, because of its option-like pricing characteristics and that all market participants have been made aware of the true nature of the investment.

In short, solving the serious problem we have with missing consolidation adjustments would be much, much simpler by renaming these securities specks than attempting to track down what appear to be multiple sources of error, ensuring that all data has been properly corrected, and monitoring the situation in the future. Specks and shyres cut through all of these problems like a laser. Speck charts don’t matter. The S&P/TSX Venture Composite Index is a long-term, perpetual option. It could be read in a manner comparable with the CBOE VIX volatility index, but with the understanding that it will continue to lose value. It is a joke to have the Standard & Poor’s 500 and TSX Venture Composite as competing equity indices.

Perpetrators of stock fraud will stop at nothing to distribute their worthless shares. Any method that can be imagined to create the impression of false demand has likely been employed by, if not invented by, those distributing stock in revenue-less companies.

4. Why are so many TSX Venture companies’ charts missing consolidation adjustments?

As has been proposed, there appear to be a number, perhaps dozens, of groups involved with distributing stocks that routinely lose most of their value in Canada. As experts, such as Adrian du Plessis, have suggested, operators have a number of methods at their disposal and are capable of redesigning strategies in an attempt to continue to deceive. Charts from official-looking, recognizable providers like Stockhouse.com and BigCharts.com, among others, could be used to mislead a wide range of potential targets of scams, including strangers on the internet reading paid-for, hyped-up research or an elderly parent, grandparent, aunt, or uncle. Creating the impression of demand and an active market in thinly traded TSX Venture names is not a difficult or complicated proposition. It is reasonable to suspect that some of these missing adjustments are a result of this motivation, felt by seemingly hundreds, if not thousands of Canadians connected to these companies. Renaming the stock of revenue- less companies to speck improves all of their lives, instantly. A collective sigh of relief will be heard through the nation.

This investigation was conducted over the first 20 days of January 2017. The author used the listed company directory with the TSX Venture Exchange website and compared the charts of every company listed with BigCharts and Stockcharts, about 1,769 in total. The TSX Venture lists some companies twice, for example, Oceanic Iron Ore Corp. (TSXV: FEO), appears under both listings for the letter O and the letter F. The author has attempted to omit duplicates. However, some may remain.

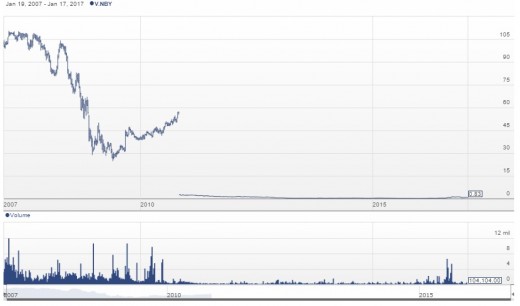

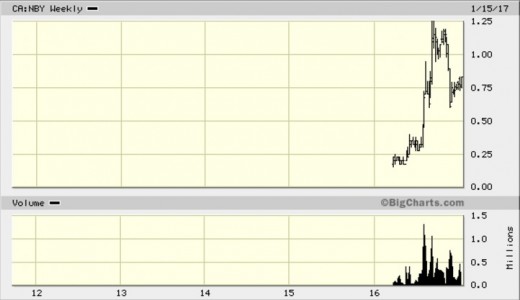

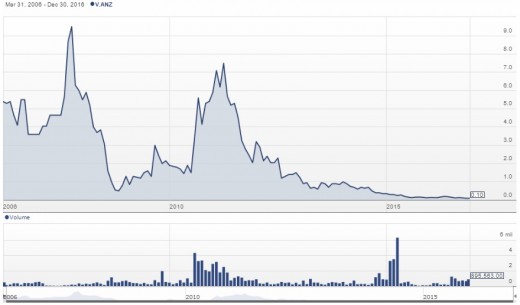

Further, this investigation only lists companies with charts that appear to be in absolute disagreement. There are a much larger number of charts where data unfavorable to those distributing stock is simply cut off, with that of Niobay Metals Inc. (TSXV: NBY) standing out as a notable example. Data with Stockhouse shows Niobay stock near $100 in 2008, while BigCharts only looks backs as far as mid-2016.

From Stockhouse

From BigCharts

Further, there may be examples where both BigCharts and Stockhouse are in agreement and both are erroneously or intentionally omitting consolidation adjustments that the methodology used here may have missed. That Stockhouse is involved in the business of facilitating private placements, combined with message boards, and charts that are, at the very least, extremely error-prone, prompts the question “Could Stockhouse or some other entity accept payments to display erroneous data?”

As an example of the type of information that is being shared on Stockhouse message boards, this author has compiled a complete archive of screenshots of messages for the RT Minerals Corp. (TSXV: RTM) Stockhouse “bullboard.” The author notes that RT Minerals is included in the list of firms whose charts for shares appear with apparent missing-consolidation errors with Stockhouse.

At this point, the author is only able to find one example of stock with an apparent missing split, as opposed to consolidation (or reverse split), adjustment with BigCharts and Stockhouse. The motive behind such an omission remains unclear. The company with share data with an apparent missing split adjustment is Shaw Communications Inc. (TSXV: SJR.A). The charts are included with attached image files. The split that appears to be missing from the Stockhouse chart was reported by MarketWired, in 2007.

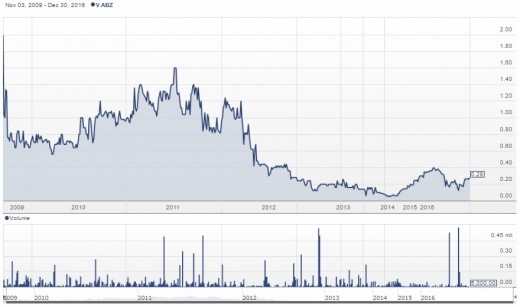

Here is a list of 95 TSX Venture Exchange-listed stocks with charts that appear to be missing consolidation adjustments with BigCharts or Stockhouse where the providers appear to be in outright contradiction. Images are attached, including additional images for companies whose charts had interesting features, such as being cut off, but were not in outright contradiction; a number of charts for firms falling into this category remain uninvestigated.

- Air IQ Inc. (IQ)

- 88 Capital Corp. (EEC)

- 92 Resources Corp. (NTY)

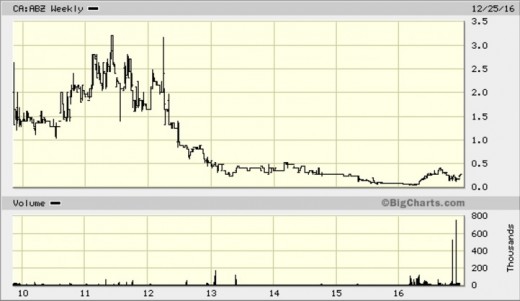

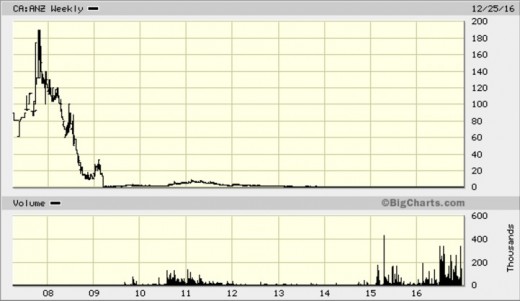

- Alianza Minerals Ltd. (ANZ)

- Ango-Canadian Mining Corp. (URA)

- Argentina Lithium & Energy Corp. (LIT)

- Arrowstar Resources Ltd. (AWS)

- AsiaBaseMetals Inc. (ABZ)

- BC Moly Ltd. (BM)

- Black Isle Resources Corp. (BIT)

- Blue Sky Energy Inc. (BSI)

- Canadian International Minerals Inc. (CIN)

- Canamex Resources Corp. (CSQ)

- Caza Gold Corp. (CZY)

- Clarocity Corp. (CLY)

- CobalTech Mining Inc. (CSK)

- Copper North Mining Corp. (COL)

- Cyprium Mining Corp. (CUG)

- Darelle Online Solutions Inc. (DAR)

- Desert Gold Ventures Inc. (DAU)

- Dunnedin Ventures Inc. (DVI)

- Essex Angel Capital Inc. (EXC)

- Everton Resources Inc. (EVR)

- Goldcliff Resources Corp. (GCN)

- Golden Predator Mining Corp. (GPY)

- Goldstar Minerals Inc. (GDM)

- Goldstrike Resources Ltd. (GSR)

- Great Bear Resources Ltd. (GBR)

- Grenville Gold Corp. (GVG)

- Gungnir Resources Inc. (GUG)

- H2O Innovation Inc. (HEO)

- Hamilton Thorne Ltd. (HTL)

- Inca One Gold Corp. (IO)

- Inform Resources Corp. (IRR)

- Japan Gold Corp. (JG)

- Jaxon Minerals Inc. (JAX)

- K2 Gold Corp. (KTO)

- Kaizen Discovery Inc. (KZD)

- King's Bay Gold Corp. (KBG)

- Legend Gold Corp. (LGN)

- Legend Power Systems Inc. (LPS)

- Logan Resources Ltd. (LGR)

- Lomiko Metals Inc. (LMR)

- Lumina Gold Corp. (LUM)

- Marlin Gold Mining Ltd. (MLN)

- Marquee Energy Ltd. (MQX)

- Mint Corp. (MIT)

- Medgold Resources Corp. (MED)

- Metallic Minerals Corp. (MMG)

- Millennial Lithium Corp. (ML)

- Minecorp Energy Ltd. (MCE)

- New Destiny Mining Corp. (NED)

- Nicola Mining Inc. (NIM)

- Oceanic Iron Ore Corp. (FEO)

- Opawica Explorations Inc. (OPW)

- Orex Minerals Inc. (REX)

- OrganiGram Holdings Inc. (OGI)

- Orofino Minerals Inc. (ORR)

- Pacific Bay Minerals Ltd. (PBM)

- Pacific Iron Ore Corp. (POC)

- Pacific North West Capital Corp. (PFN)

- Pancontinental Gold Corp. (PUC)

- Panorama Petroleum Inc. (PPA)

- Parallel Mining Corp. (PAL)

- Parkit Enterprise Inc. (PKT)

- Parlane Resource Corp. (PPP)

- Philippine Metals Inc. (PHI)

- Plateau Uranium Inc. (PLU)

- Prospero Silver Corp. (PSL)

- Q-Gold Resources Ltd. (QGR)

- Quizam Media Corp. (QQ)

- RockBridge Resources Inc. (RBE)

- RT Minerals Corp. (RTM)

- RYU Apparel Inc. (RYU)

- Saint Jean Carbon Inc. (SJL)

- Sandspring Resources Ltd. (SSP)

- Saville Resources Inc. (SRE)

- Seaway Energy Services Inc. (SEW)

- Sienna Resources Inc. (SIE)

- Silver Pursuit Resources Ltd. (SPF)

- ScoZinc Mining Ltd. (SZM)

- Stratton Resources Inc. (SI)

- Sokoman Iron Corp. (SIC)

- Sandspring Resources Ltd. (SSP)

- Strata-X Energy Ltd. (SXE)

- Tajiri Resources Corp. (TAJ)

- Terraco Gold Corp. (TEN)

- theScore Inc. (SCR)

- TrackX Holdings Inc. (TKX)

- Trigon Metals Inc. (TM)

- Unity Energy Corp. (UTY)

- Virginia Hills Oil Corp. (VHO)

- Xiana Mining Inc. (XIA)

- Xtierra Inc. (XAG)

- Zenith Energy Ltd. (ZEE)

5. Risks

There is a chance that the author’s outlook and view of the market could be wrong. That, despite the fact that oil and gold sit multiples above where they did in 2000, and that the TSX Venture Composite is much lower, he could be wrong. That, despite the fact that the Vancouver Stock Exchange, objectively, failed ten years after the introduction of the internet, when all market participants more-or-less gained equal access to information, and that since being revamped into the TSX Venture, the operation, as a stock exchange, has failed miserably again, I could be wrong.

If the federal or provincial governments were to adopt legislation defining share, stock, equity, corporation, shyre, speck, speculity, and speculation as I suggest, there appears to be almost no risk. There is widespread consensus among professionals that the TSX Venture Exchange is deeply troubled. Many articles ponder its continued existence. The pricing and valuation of the securities of revenue-less companies currently referred to as stock would prevail after a rename to speck. Allowing retail investors to short speck with less stringent capital requirements would seem only fair.

If commodity prices were to gain in value by 10,000 percent, the function of the speck/stock line, if adopted, would remain, rewarding successful speculations that generate revenue with the badge of honour: becoming a corporation, rightfully permitted to issue equity, the definition of which is rooted in the notion of people coming together to share a common good. What common good is there without revenues or profits? Businesses without revenues and profits that raise capital by selling publicly traded securities may be fairly described as speculations, more accurately than as corporations.

Other risks to the plan to rename revenue-less corporations to speculations may exist that the author is unaware of.

6. Flow-through shares not helping situation any

The author has made note of the “flow-through share” program offered by the federal government. The intent of the program, is, no doubt, borne of goodwill. The capital raised by some of the most questionable firms listed in this report, with no doubt, goes to benefit small communities in Canada and around the world. The motivation for politicians like MP Charlie Angus, as reported by the Timmins Press, to wish to encourage equity deals and support flow-through shares as a result is plain to see and also borne of goodwill. What politician doesn’t want to see financing that may result in jobs and increased economic activity? A change to specks and shyres does not challenge this status quo in any way. In fact, it provides another, new and innovative avenue for legitimate business operators to raise capital, perhaps allowing those previously barred from doing so to participate for the first time.

Instead of flow-through shares, revenue-less issuers could sell “flow-through shyres” or “flow-through specks.” Even with the tax savings these investments offer, as explained by Young and Thrifty, the loss in value many go onto experience equate to them making a questionable proposition as an investment, from any reasonable standpoint. Offering tax incentives of a similar nature on speck is a much less morally onerous proposition and business for the government to be in, simply because of the increased level of transparency and disclosure.

Currently, a case can be made that the flow-through share program is incentivizing operations capable of fleecing little old ladies of their life savings. This is what the Canadian government is subsidizing; Jordan Belfort, Boiler Room-style, pump-and-dump operations. We can do better Mr. Goodale. We must do better as a nation.

7. Recommendations

As this writer has made abundantly clear, the only reasonable course of action for the Government of Canada to pursue is to introduce precise definitions for stock, share, equity, corporation, speck, shyre, speculity, and speculation into legislation. I believe the line dividing stock from speck should be companies that have more than zero revenues. However, this is certainly open for debate.

Penalties should be imposed for companies that represent their speck as stock, as well as for writers producing paid analysis and other stock promotors who do. Independent journalists should be encouraged to learn the difference between stock and speck, but suffer no consequences for misidentifying a speck, though corrections should be expected. IAs could be banned from selling specks. However, what IA might suggest to their client that they purchase a speck, unless, perhaps, they had truly compelling information and not just flim flam? Specks serve as an invisible hand might.

The proposed name change warns all those who might be unaware, while allowing those with altruistic intentions to continue to perform the important work they do, including the resulting consequences of capital being distributed more equitably throughout Canada and the rest of the world. The proposal will also save an unknowable number of lives and is the only right thing to do.

Examples of charts included in the appendices of the report to Minister Goodale are included here. See the report for the full list, and screenshots of RT Minerals Stockhouse "bullboard" posts.

From Stockhouse

From BigCharts

From Stockhouse

From BigCharts

May 2019 Update

It appears that Stockhouse has finally, silently corrected their charts. Note how this writer acknowledges this, while Stockhouse appears to pretend nothing was ever amiss, with no explanation and no apology. How many investors were misled in the interim?

© 2017 Stephen Sinclair