What is VALUE Investing

If you are looking to understand what Value Investing is, then you are very close to uncovering the SECRET to becoming Ultra Super Rich in the long term.

Don’t believe me?

What if I were to tell you one of the richest people in the world uses this method?

Now, would you believe me?

There are only two types of people who get rich on Wall Street in the long term. One is the Stock Broker and other is the Value Investor.

The rest of the Greedy Monkeys who want to get rich QUICK lose all of their money eventually.

But didn’t the people who lost all their money take advice from the Stock Analysts?

Yes, they did! Relying on the advice of these analysts is the fastest way to lose money. And this is one of the principles of Value Investing.

Why shouldn’t you listen to an ‘Expert Stock Analyst’?

Brief History

Value Investing Method has been used ever since stock markets began. Most successful investors used the philosophy without even realising that is was Value Investing. However the term and its philosophy was made famous by Benjamin Graham and David Dodd when they started teaching it at Colombia Business School in 1928 and publishing a book Security Analysis in 1934.

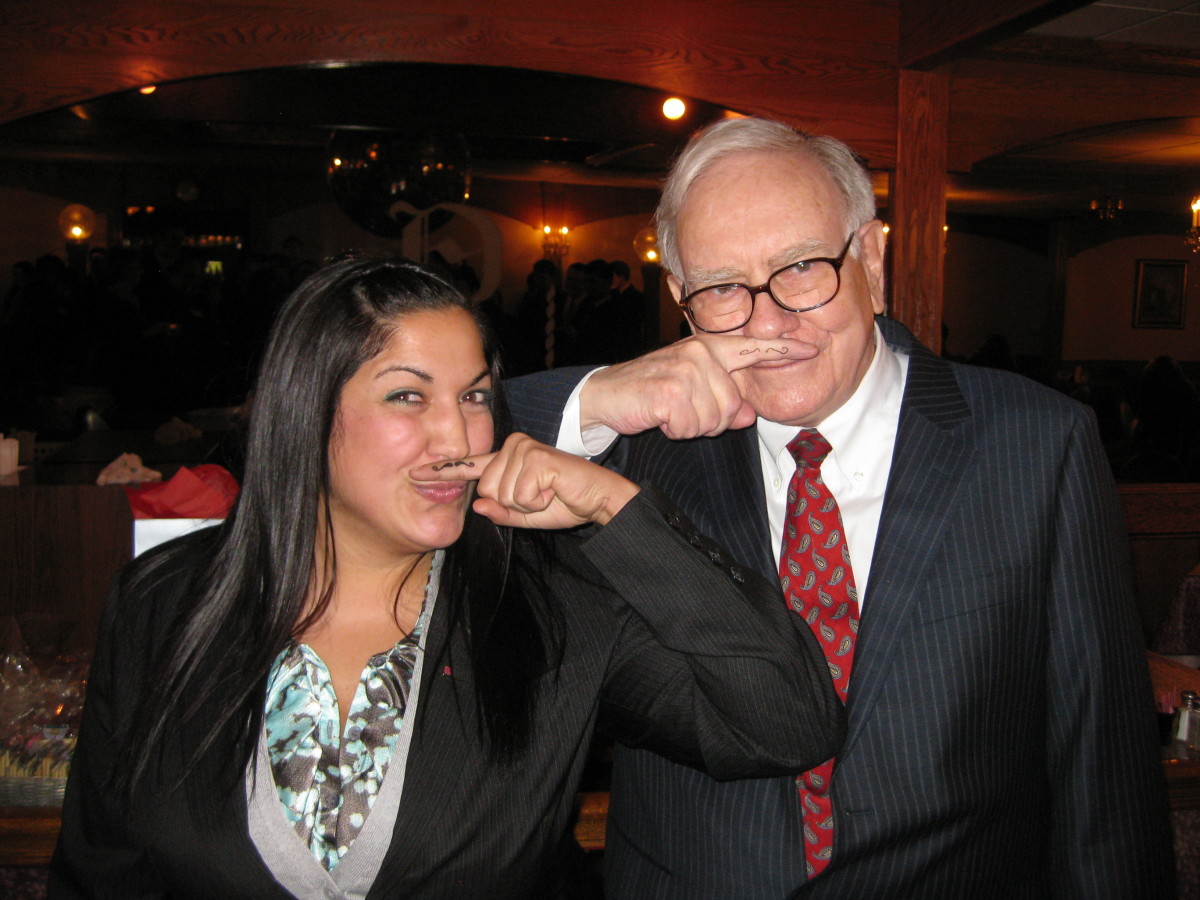

Benjamin Graham through his writings and teaching inspired a number of students to become successful at stock market investing. One of his students was Warren Buffet.

Did Warren Buffet become RICH by applying his philosophy? You BET!

The FIRST principle of Value Investing

If you are thinking about getting rich by practice Value Investing in the future then you should not write this principle out on a paper, neither in your notebook but carve it out in your mind. It goes out like this.

“Buy a stock of a company that is trading for a lesser value than what it is intrinsically worth”

e.g. Buying Exon Mobile if its stocks were to sell now at 15$ even though you know its intrinsic worth is around 40$.

The real key to becoming successful at value investing is KNOWING what the intrinsic value of a company is.

The intrinsic value of a company is not what the value of its shares is. It is different.

Almost 99% of companies at stock market sell at way higher than their intrinsic value most of the time.

The 1% of the companies whose stocks sell below their intrinsic value is where the true GOLD lies.

Even though Warren Buffett has shared this SECRET principle openly with the world since the past 31 years, almost nobody is following it to become super RICH like him.

“I can only tell you that the secret has been out for 50 years…yet I have seen no trend toward value investing in the 35 years I’ve practiced it.” –Warren Buffett

Why isn’t everyone following his secret and becoming SUPER RICH?

Because knowing the intrinsic value of a company requires time, effort, going through a lot of failures, patience and a whole lot of control over the self.

Everyone wants a GET RICH QUICK way to becoming a Billionaire on Wall Street. So no one goes into the practice of finding out the intrinsic value of the company.

The single BIGGEST habit of successful value investors

This habit easily distinguishes Value Investors from others.

“Value Investors rarely look at the stock market and they never take the advice of a stock analyst”

Most other kind of investors will jump on to the T.V. like crazy at 9.00 a.m. keep on listening to the Financial News. Their emotions are tied to the stock. If it goes up in a second, they jump around doing Hoopla. If it doesn’t, they feel sad and depressed. They are on an emotional roller coaster.

Benjamin Graham has a name for such people. They are not true investors. They are SPECULATORS. Their practice cannot be called investing, it is gambling.

Value investors are busy either doing the financial analysis of a company, learning about the board of directors or reading a book. They hardly ever check the stocks. They aren’t bothered if there is a bull market or a bare, or there is a political effect on the stocks or even if stock market shuts down and never opens up for the next 5 years.

“I never attempt to make money on the stock market. I buy on the assumption that they could close the market the next day and not reopen it for five years.” –Warren Buffett

Becoming a Value Investor

“At age 19, I read a book [The Intelligent Investor] and what I'm doing today, at age 76, is running things through the same thought process I learned from the book I read at 19.” – Warren Buffett

If you want to become a Value Investor, then reading The Intelligent Investor’ by Benjamin Graham is the BEST place to start. It is the beginners guide to Value Investing. Graham lays out his entire philosophy in this book. Once you read this book you will know whether Value Investing is for you or not. If you find it is, then you will also realise what step to take next in the world of Value Investing.

Practicing self-control

All of human unhappiness comes from one single thing: not knowing how to remain at rest in a room. –Blaise Pascal

Value Investing is all about self-control; not giving into the temptation of investing in already a highly successful company with over valued stocks. Or, investing in a company that everyone is investing in (following the herd), or listening to an expert analyst and giving into your GREED just because he says a stock is HOT!

This is speculating

Example of speculating

Investing in Facebook just because it is highly successful today or Investing in Tesla because you heard about Elton Musk describing the future of his company and how bright it was going to be.

In order to practice self-control you must become a student of psychology.

Psychology not only helps you control the greedy monkey inside yourself but also help you to not listen to other greedy monkeys around you- the stock analyst, your mutual fund manager, stock broker, 99% of stock market investors.

Summary

- Value Investing is a philosophy that is based on the principle of buying a good stock at a fair price i.e. buying an undervalued stock of a good company.

- In order to practice Value Investing philosophy you need to become counter-intuitive; not listen to experts, analysts, your family, friends when deciding which stock to buy.