What is Windstorm Insurance?

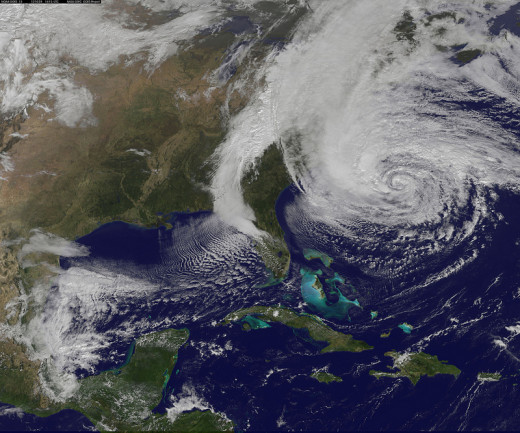

Windstorm Coverage for Superstorm Sandy

The National Hurricane Center downgraded Superstorm Sandy from a tropical storm to a post-tropical cyclone just before Sandy slammed into the New Jersey coast and damaged or destroyed thousands of homes.

While the downgrade in Sandy's classification may seem academic, it will help the Mid-Atlantic region recover more quickly by saving the impacted homeowners thousands of dollars on their windstorm insurance claims. This experience highlights the importance of having windstorm insurance--and of the specific language used in the insurance policies that include it.

Definition of Windstorm Insurance

Windstorm insurance is a special type of property-casualty insurance that protects policyholders from damage caused by windstorms. Many standard homeowners insurance policies do not cover damage caused by high winds, but windstorm coverage is often offered as a separate rider to such policies for an additional cost. It is essential that homeowners living in areas at risk of high winds--such as from hurricanes or tornadoes--purchase windstorm insurance to adequately protect their homes from wind damage.

Higher Deductible

Windstorm insurance policies or riders typically carry higher deductibles than standard homeowners insurance policies. Some windstorm policies have deductibles for wind damage that are a higher dollar amount than the deductibles for other types of damage. For example, a standard homeowners policy with a normal deductible of $500 for most types of damage might have a deductible of $5000 for wind damage.

Other windstorm policies have deductibles that are a percentage of the insurance coverage. For example, the Texas Windstorm Insurance Association has deductibles of between 1% and 5%. If a home insured for $500,000 is completely destroyed by a tornado, then a windstorm deductible of $25,000 would apply if the windstorm deductible was 5%.

Homeowners with a windstorm policy carrying a high deductible should plan for its impact in the event their home suffers severe windstorm damage. The best way to do this is to keep a higher emergency fund than they would normally keep. For example, instead of an emergency fund of $12,000 sufficient to fund 3 months of ordinary living expenses, a homeowner with a 3% windstorm deductible on a $200,000 house should keep an emergency fund of perhaps $15,000. The extra $3000 would help the homeowner cover the $6000 wind storm deductible if the need arises. The other $3000 needed to cover the deductible could come out of the remainder of the emergency fund.

Specific Language is Critical

The specific language used by the windstorm insurance policy or rider is critical. For example, the language used in many windstorm policies in the Mid-Atlantic states impacted by Superstorm Sandy (including New York, New Jersey, Maryland, Connecticut) refers to a "hurricane deductible" triggered only in the event the damage is caused by a hurricane as classified by the National Hurricane Center. Thus, since the National Hurricane Center did not classify Sandy as a hurricane when it hit the New Jersey coast, the "hurricane deductible" was not triggered, and the impacted homeowners saved thousands of dollars by not being subject to their hurricane deductibles.

In contrast, insurers in states such as Louisiana are allowed to write their windstorm policies so they are triggered by "named storms". As a result, homeowners with these policies would have been forced to pay higher windstorm deductibles if they had been hit in a situation analogous to Sandy since Sandy kept its name even after coming ashore.

Thus, homeowners need to examine the specific language of the insurance policy to see what they are buying for their insurance premium. In some states, they may be able to shop around for better windstorm coverage, or at least be in a better position to compare the policies offered by competing insurers on an apples-to-apples basis. In other states where the windstorm coverage is dictated by state law, homeowners should at least understand the amount of risk they are taking with respect to windstorm damage so they can plan appropriately.