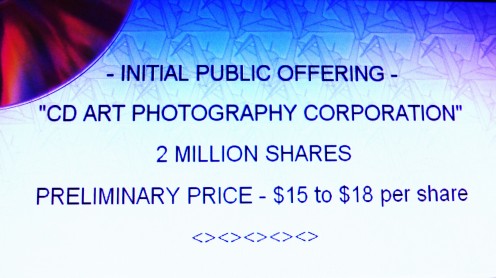

What Is an Initial Public Offering? IPO of Common Stock Explained

The advice and exclusive tips contained within the following entry will help the novice investor understand and fully comprehend the basic fundamental concept of an "Initial Public Offering". Important aspects covered will include an explanation as to why this working capitol generating strategy is an integral and in some cases critical aspect of sustaining a generous supply of venture cash infusion into our economy, thereby potentially inducing new job creation, a brief foray highlighting buyer eligibility requirements related to purchasing new issues and subsequent selling of IPO's , and finally, a condensed introduction pertaining to "Flipping" shares immediately after the new issue begins trading on the respective exchange in the after market. The preceding will be covered in detail along with a few other invaluable insights and expert perspectives designed to provide the reader with a solid foundation of knowledge regarding this highly speculative segment of the stock market. Please read on, and always consult a financial professional before investing -

>> WHY IPO's?

When an existing privately held company reaches a crossroads in regard to the availability of working capitol for essential research, product manufacturing, brick and mortar expansion, or any other necessity to ensure the venture maintains a viable path toward growth and profitability, there are several potential financing avenues the owners(s) can pursue. One plausible way to secure the needed funds is to convert and or transfer all or a portion of the company from private to public ownership by offering and ultimately issuing to participating investors and investment companies, undivided and equal units of equity called "Common Stock", or "Common Shares", or just simply "Shares". The issuance of initial stock in a privately held company, which is subject to applicable registration procedure prior to distribution, typically results in the termination of absolute and unimpeded control by current ownership, and transfers these responsibilities into the hands of a new group of vested parties called "Shareholders" who have purchased common stock and the attached inherent voting rights.

The issuance of initial stock in a privately held company, which is subject to applicable registration procedure prior to distribution, typically results in the termination of absolute and unimpeded control by current ownership, and effectively transfers these responsibilities into the hands of a new group of vested parties called "Shareholders" who have purchased common stock and the attached inherent voting rights.

Unless the float is considered extremely light or thin, as can be the case with certain penny stocks or struggling pink sheet issues, stocks in general are typically considered liquid investments and shares constantly exchange hands via consummated trades on the tangible open out cry or computerized "Virtual" exchanges, so the demographic makeup of owners at any given point in time is fluid and subject to continuous change. Depending upon a company's overall performance, which ultimately dictates the long term price trend of underlying stocks, the original founders may indeed continue to run the day to day operations and manage the venture like many successful Silicon Valley entrepreneurs of the 1980s and 1990s have done, and continue to do so. However, once company equity is transferred to the public, the management team must then perform their duties under a new dynamic, the atmosphere of intense scrutiny and watchful eyes of several thousand individual co owners (Shareholders) who have the future right to cast one vote for every share of common stock they own.

This new voting process can diminish a founders control and or authority while empowering shareholders with leverage to regularly select the B.O.D. (Board of Directors) and all other executives based upon their specific criteria. Consequences of this new corporate structure dictate all future voting may indeed be influenced primarily by evaluating an individuals past job performance, and not necessarily by taking into consideration the loyalty of an individual and or longstanding history with the company. Essentially, the management team is now responsible for producing a profitable venture and ultimately must report to, and satisfy not only themselves, but a virtual army of individuals and institutions who have a vested interest in the company's overall success. Moreover, once the conversion from private to public company is complete, several "Wall Street" entities will then have an innate obligation to analyze underlying fundamentals and report specific accounting facts and figures to the public via respective publications. A subject which will be covered extensively in future articles.

As you can clearly ascertain upon initial study, the process of raising substantial working capitol to potentially rejuvenate, jump start, and grow a fledgling or chronically stagnating privately held company via IPO can be a viable option, but it does come with a unique set of inherent circumstances and risks which need to be thoroughly researched, considered, and addressed prior to shopping the idea to potential underwriters.

>> TAKING A COMPANY PUBLIC

- There are a multitude of critically important steps that must be successfully completed prior to the actual selling of shares to the public and or financial institutions - The table below illustrates the basic procedure in chronological order. Generally speaking, every prospective IPO must adhere to the following guidelines and basic principles to ensure compliance with regulations, and thereafter maximize IPO marketing effectiveness:

"ROAD TO IPO"

|

|---|

Shop the company idea & concept to brokerage / underwriting firms and present the "Story" i.e. product or service, initial goals, projected short, mid, and long term sales & revenue potential etc.

|

Sign on with "Underwriting Firm"

|

"Underwriting Firm" analyzes & evaluates pertinent company data

|

IPO Plan is registered with all appropriate regulatory bodies

|

"Preliminary Prospectus" which includes flexible share price is issued, published & delivered to potential investors

|

"Road Show" begins, i.e. introduction & promotion of new company

|

- Always consult your "Financial Advisor" or "Planner" regarding the risk & potential reward prior to investing in the highly volatile IPO market -

>> WHO CAN BUY IPO's?

Anyone who has the means can purchase an equity interest in an IPO via "Shares" ("Pre Market Shares" are usually subject to availability). Shares can be purchased with the assistance of a full service or discount brokerage firm if they have access to the new issue. Traditionally, the IPO has been a much sought after and enticing investment or "Trading" vehicle for the savvy risk tolerant high net worth Wall Street participant due to short term price "POP" and long term sustained market value appreciation potential. Three important factors that can drive higher market price adjustments or lack there of, are the following:

- Underlying Fundamental Strength

- Product / Service Demand

- "Sizzle"

In the past, IPO's were typically set aside and reserved for "Wealthy" or "A-List" clientele, however, this limited, pinpoint focused marketing strategy has been evolving in sync with the popularity and increased usage of online discount brokerages. The Internet now, as it has for decades, provides individual investors with convenient fingertip access to perform their own research which enables them to make their own financial decisions before each transaction is executed. Recent studies and reports suggest the average investor continues to spend an increasing amount of time perusing the Internet, which as we all know is plugged into a vast, spacious, highly complicated communications network that can provide easier access to relevant information potentially resulting in the successful procurement of new issues or "IPO's". Inevitably, with new conveniences ultimately comes new responsibilities and exclusive ownership for the decisions we make. Should a novice investor rely solely upon his/her due diligence and research to determine legitimate, suitable investment choices? Is scouring the Internet without the assistance of a knowledgeable, reputable financial consultant really the most prudent way for the inexperienced to buy and sell securities? Presumably, the jury is still deliberating these tantalizing questions and it's certainly an interesting subject which deserves to be re-visited and more deeply probed in future articles.

As it stands today, if you have the financial resources and access to the IPO shares, a buy transaction is just seconds away.

>> "FLIPPING SHARES"

"Flipping" can indeed result in a very profitable strategy for the IPO shareholder, but not so beneficial for short term stock price stabilization. Maintaining an even and orderly trading flow in an effort to prevent the proverbial "Bottom" from dropping out of this fledgling new issue, is a top priority for the underwriting firm. And although "Flipping" is a legitimate, potential money making strategy, it's a somewhat derogatory term used to describe any owner of common stock who immediately, or shortly after the IPO begins initial trading in the after market, sells or "Unloads" all or a portion of his/her shares for short term profit or loss. IPO participants are usually discouraged by the underwriting Broker/Dealer from implementing this kind of swift ownership exodus and if short term "Unloading" is deemed to be a developing pattern, participants may risk being scratched from future new issue "Marketing Lists". Regardless of stock price at the time of sale, either higher or lower than the original cost, results are still the same for a newborn company, potential instability. An uncertain situation which can lead to even more selling pressure in the short term depending upon trading volume and a few other underlying factors. A rapid price discounting effect snowballing in the wrong direction is one of the worst case scenarios for a fragile, newborn public entity in the short term.

- Thanks For Visiting - My primary goal within the context of this educational module is to help the novice gain a basic fundamental understanding of the speculative, exceedingly volatile, & high risk nature of the "IPO" market - As always, consult a professional Financial Advisor or Planner before investing - I sincerely appreciate the continuous positive feedback from a growing online international audience of First Time Readers, Knowledge Seekers, Internet Surfers, Peers, New and Established Friends & Associates - Please feel free to explore & discover my vast & continuously expanding collection of online articles - A . P.

About the Author -

<> Alternative Prime is a former "Personal Finance Professional" - Broker - Life Agent - Series 7 & 63 Registered Representative & NASD Member Licensed in 5 States - Stock & Options Researcher/Consultant/Trader/Investor - Contract Quality Check Supervisor - Regional Manager/Trainer and Formally Educated in a multitude of diverse subjects including Business Law Aspects <>

<> Conceived, Designed, Developed, Written, & Created By Alternative Prime <>

|

|---|

<> Exclusive Custom Images Created By Alternative Prime <>

|

|---|