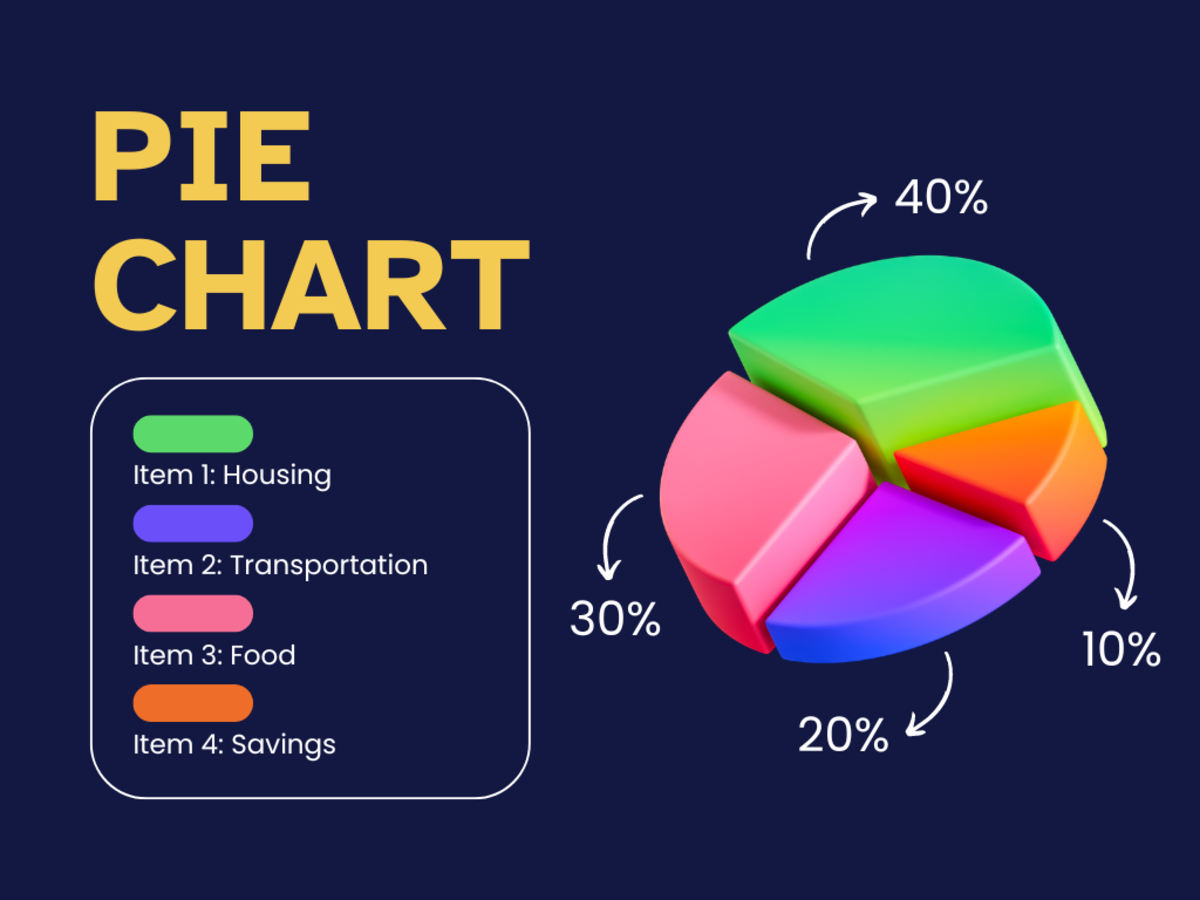

What Is an Emergency Fund?

Save money for an emergency

What is an emergency fund?

What happens if the transmission goes out on your car? Most people get mad, panic, take their car to the repair shop and charge the repair on a credit card. Then they struggle to pay off the credit card.

If you have an emergency fund, this could be a much better scenario. It is never good to have the transmission go out on your car, but if you have $10,000 in an emergency fund, while you would be a little irritated at the inconvenience, you could easily take your car in , get it fixed and pay cash!

You should have an emergency fund set up in either a savings account, money market account or an interest bearing checking account. It should be fairly easy to get to, but not too easy. You don't want to be tempted to use the money to buy some new shoes or a set of golf clubs. This should be an EMERGENCY FUND which means it should only be used for EMERGENCIES! If you car breaks down, your washer goes out or your roof starts leaking. Something serious like that.

How do I get money for the emergency fund?

So you are probably thinking, where do I get $10,000 for an Emergency Fund? First of all, you don't get it all at once. You have to save. Start out and try to save $1,000. Then gradually build that up to $10,000.

We are fortunate today with all of the technology we have. It is easy to simply set up a payroll deduction directly to a savings account in a bank. You would be surprised how quickly $5 per week would add up. This can be especially true if you sneak a little extra in here and there. For example, keep a jar for spare coins. Whenever you get change from some where, put it in the coin jar. Once a year or every 6 months, take it to the bank and have them count it and put it into your savings account. It's pretty easy to get $50-$100 in a year.

Another idea is to sell stuff. Everyone has stuff they don't really need. Have a rummage sale or sell it on e-bay or something. There are also garage sales online where you can list stuff. Again, with the technology today it can be pretty easy to sell something.

Another way to get some extra money for the emergency fund is to pick up a part-time job. This would only be temporary until the emergency fund is built up to the point where you are comfortable with it.

You could also offer your services. This is something that you could continue to do after the emergency fund is built up. If you have a hobby or find something you like to do, keep doing it on the side. You don't have to do a lot of it, just basically as a hobby. A good example is to mow yards. Maybe you mow multiple yards until your emergency fund is built up and then you cut down to 1 or 2 yards or you simply find an empty lot to mow every other week. You can bring in an extra $50-$100 per month to help with expenses or simply money for your entertainment.

Most experts suggest to have 3-6 months expense setting in an emergency fund. Obviously the larger emergency fund you have, the better. Even if all you can afford is $1,000-$2,000 that will certainly help. Having an emergency fund will make your life much easier.

- How much will I need in my emergency fund?

Most experts agree that you should have 3-6 months expenses set aside in an emergency fund. But exactly how do you figure what is considered an expense? Do you use your normal expense or do you cut back...

Other ideas to get money for your emergency fund

You could also pick up a temporary second job in order to obtain some extra money for your emergency fund. I know this isn't for everyone because some people are working 60 hours a week just to make ends meet. But for those who are fortunate enough to only be working 40 hours per week, they could pick up a second job until they get their emergency fund in a more comfortable position. They would really have to get a job at a regular place of employment.

You could also offer services like start mowing yards, rake leaves, do handy man work. There are options out there if you look. In fact, you could continue to do some of these things on occasion to get extra money for your entertainment, vacations or to rebuild your emergency fund if necessary.

Most experts suggest to have 3-6 months expense setting in an emergency fund. Obviously the larger emergency fund you have, the better. Even if all you can afford is $1,000-$2,000 that will certainly help. Having an emergency fund will make your life much easier.